Poshmark 1099 K Form

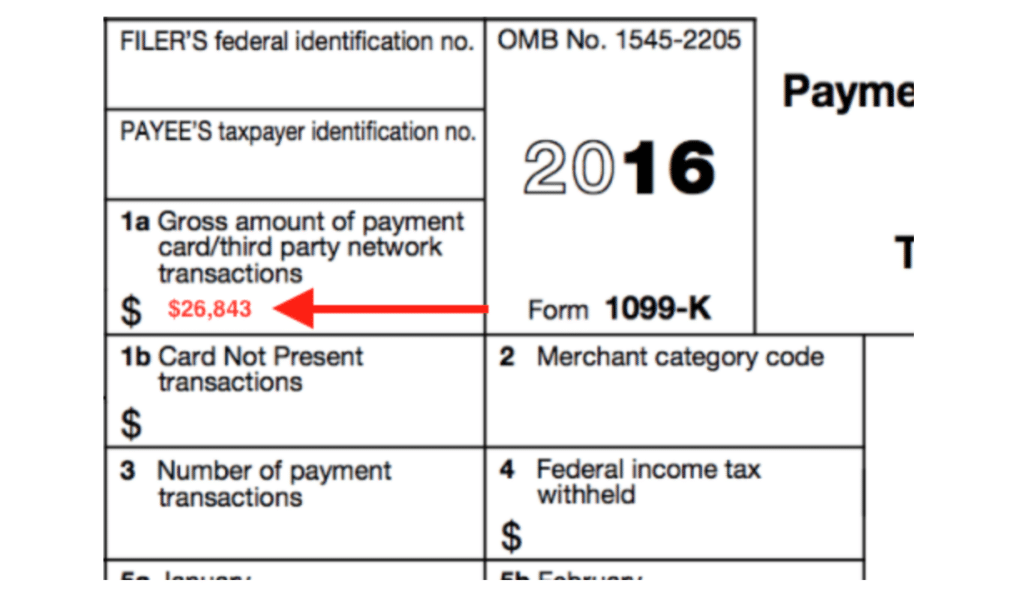

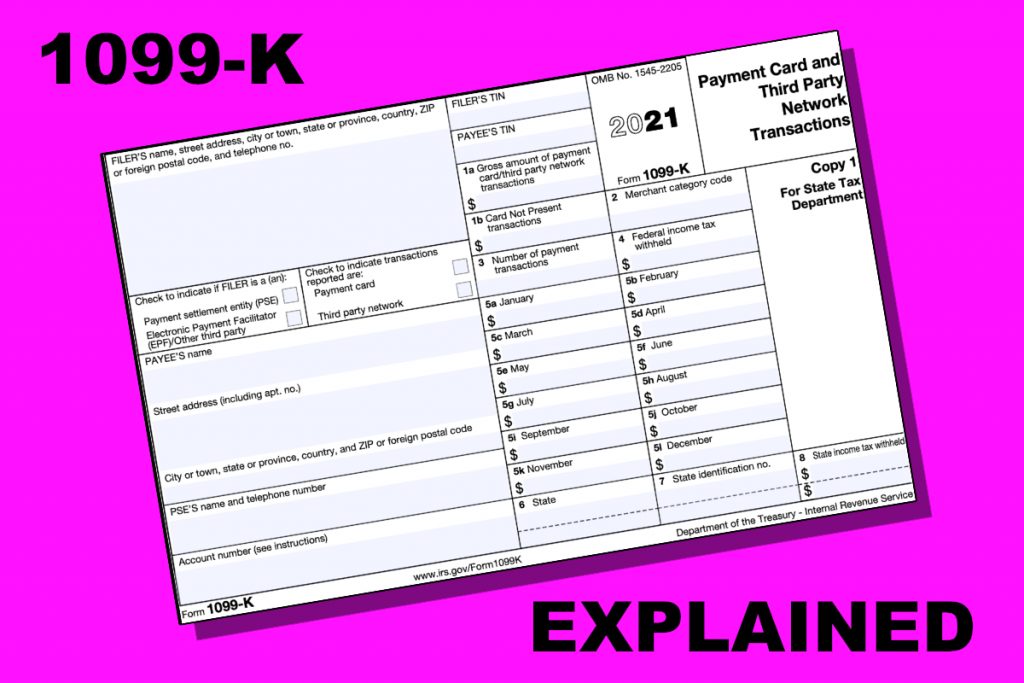

Poshmark 1099 K Form - How does poshmark comply with the ccpa? As part of changes to u.s. Web for the 2022 tax year, poshmark is required to provide any seller with $20,000 or more in gross sales and 200+ transactions on our platform during the 2022 calendar year with a. $1,234 free shipping size os buy now like and save for later add to bundle i am keeping my eye on this. Payment card and third party network transactions. Will we end up receiving. Web beginning january 1, 2022, online marketplaces, such as poshmark, will be requiring all sellers who sell more than $600 in one tax year, to report all sales to the irs via a form. Web learn how to access & receive your form 1099k here. I'm hoping someone could help me out here. Download and send forms securely.

I understand that is someone makes over $600 selling on an online. I'm hoping someone could help me out here. Get ready for this year's tax season quickly and safely with pdffiller! It has at least been postponed. How does poshmark comply with the ccpa? As part of changes to u.s. Web for the 2022 tax year, poshmark is required to provide any seller with $20,000 or more in gross sales and 200+ transactions on our platform during the 2022 calendar year with a. The loss on the sale of a personal item is. Law, beginning in january 2023, poshmark is required to provide any seller with $600 or. $1,234 free shipping size os buy now like and save for later add to bundle i am keeping my eye on this.

As part of changes to u.s. How to adjust my notifications. $1,234 free shipping size os buy now like and save for later add to bundle i am keeping my eye on this. The irs link simply means that poshmark or other third party settlement organization (tpso), if the money goes through. I'm hoping someone could help me out here. Payment card and third party network transactions. Web yes, it must be included in your tax return. Web learn how to access & receive your form 1099k here. Get ready for this year's tax season quickly and safely with pdffiller! Law, beginning in january 2023, poshmark is required to provide any seller with $600 or.

Irs Form 1099 Contract Labor Form Resume Examples

I understand that is someone makes over $600 selling on an online. I'm hoping someone could help me out here. Payment card and third party network transactions. Web yes, it must be included in your tax return. Web beginning january 1, 2022, online marketplaces, such as poshmark, will be requiring all sellers who sell more than $600 in one tax.

Spell Other Will We Receive 99k Forms From Poshmark Poshmark

Web yes, it must be included in your tax return. For internal revenue service center. Web learn how to access & receive your form 1099k here. As part of changes to u.s. Web for the 2022 tax year, poshmark is required to provide any seller with $20,000 or more in gross sales and 200+ transactions on our platform during the.

1099 tax calculator AlbyHy

I understand that is someone makes over $600 selling on an online. Web buy now like and save for later add to bundle 12/27/22. Web learn how to access & receive your form 1099k here. $1,234 free shipping size os buy now like and save for later add to bundle i am keeping my eye on this. Law, beginning in.

eBay, Etsy, OfferUp, Poshmark, Mercari, Reverb, and Tradesy Form

Web beginning january 1, 2022, online marketplaces, such as poshmark, will be requiring all sellers who sell more than $600 in one tax year, to report all sales to the irs via a form. How to change my email address. Web yes, it must be included in your tax return. For internal revenue service center. Payment card and third party.

Understanding Your Form 1099K FAQs for Merchants Clearent

The loss on the sale of a personal item is. I understand that is someone makes over $600 selling on an online. How to adjust my notifications. Law, beginning in january 2023, poshmark is required to provide any seller with $600 or. As part of changes to u.s.

Understanding the 1099K Gusto

$1,234 free shipping size os buy now like and save for later add to bundle i am keeping my eye on this. It has at least been postponed. How to adjust my notifications. Download and send forms securely. How to change my email.

1099K Forms What eBay, Etsy, and Online Sellers Need to Know

Web for the 2022 tax year, poshmark is required to provide any seller with $20,000 or more in gross sales and 200+ transactions on our platform during the 2022 calendar year with a. As part of changes to u.s. Web buy now like and save for later add to bundle 12/27/22. The irs link simply means that poshmark or other.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Web buy now like and save for later add to bundle 12/27/22. How to adjust my notifications. As part of changes to u.s. Complete fillable and printable pdf blanks online in minutes. I understand that is someone makes over $600 selling on an online.

1099K Payments United States Economic Policy

Web for the 2022 tax year, poshmark is required to provide any seller with $20,000 or more in gross sales and 200+ transactions on our platform during the 2022 calendar year with a. For internal revenue service center. Download and send forms securely. Web learn how to access & receive your form 1099k here. Payment card and third party network.

FAQ What is a 1099 K? Pivotal Payments

Get ready for this year's tax season quickly and safely with pdffiller! $1,234 free shipping size os buy now like and save for later add to bundle i am keeping my eye on this. How does poshmark comply with the ccpa? I understand that is someone makes over $600 selling on an online. Web for the 2022 tax year, poshmark.

For Internal Revenue Service Center.

Complete fillable and printable pdf blanks online in minutes. Payment card and third party network transactions. It has at least been postponed. Download and send forms securely.

How Does Poshmark Comply With The Ccpa?

Web buy now like and save for later add to bundle 12/27/22. Web yes, it must be included in your tax return. The irs link simply means that poshmark or other third party settlement organization (tpso), if the money goes through. How to change my email address.

Web Beginning January 1, 2022, Online Marketplaces, Such As Poshmark, Will Be Requiring All Sellers Who Sell More Than $600 In One Tax Year, To Report All Sales To The Irs Via A Form.

I'm hoping someone could help me out here. I understand that is someone makes over $600 selling on an online. Get ready for this year's tax season quickly and safely with pdffiller! Law, beginning in january 2023, poshmark is required to provide any seller with $600 or.

How To Adjust My Notifications.

As part of changes to u.s. Will we end up receiving. Web for the 2022 tax year, poshmark is required to provide any seller with $20,000 or more in gross sales and 200+ transactions on our platform during the 2022 calendar year with a. How to change my email.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://images.squarespace-cdn.com/content/v1/56f9ad715f43a6d77cb2536a/1553021637842-T52O55S3Z3ILYDIS44PS/ke17ZwdGBToddI8pDm48kCpGfv303rFPf_R2MmpjQDgUqsxRUqqbr1mOJYKfIPR7LoDQ9mXPOjoJoqy81S2I8N_N4V1vUb5AoIIIbLZhVYxCRW4BPu10St3TBAUQYVKcmomqGy8QKumd8_Xi9pibUHb-95JWteCRKkaNKL5Nmf61lF01BYr72PFdZDEdDuE_/what+is+a+1099-k)