Property Tax Exempt Form Texas

Property Tax Exempt Form Texas - Web to receive this exemption, the purchaser must complete the title application tax/affidavit form, available from the texas comptroller of public accounts. Web this year, the texas legislature increased the tax exemption from $40,000 to $100,000, lawmakers' partial response to a statewide increase in property taxes. Web most counties have the homestead exemption form online. Applying for the homestead exemption is free and easy. The available texas homeowner exemptions are listed. Do not pay anyone to fill up and/or file your. Learn how to claim a homestead exemption. Request for replacement refund check: Web the legislature's $18 billion omnibus plan to lower property taxes is done by compressing the school property maintenance and operations tax rate and by raising. Web 7 hours agotexas voters will have to vote on raising the homestead exemption form $40,000 to $100,000 on the november ballot.

Web a homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the state or adopted by a local taxing unit. Web application for property tax refund: Web exemptions from property tax require applications in most circumstances. Learn how to claim a homestead exemption. Web raising the homestead exemption from $40,000 to $100,000; Applications for property tax exemptions are filed with the appraisal district in which the property is. Web property tax application for residence homestead exemption. Web 2 — property tax exemptions owner’s qualifications /& ˘ ˆ + ˇ ˘ !˜! Web property tax exemptions are one of the most effective and straightforward ways to reduce your property tax bill and save money. Applying for the homestead exemption is free and easy.

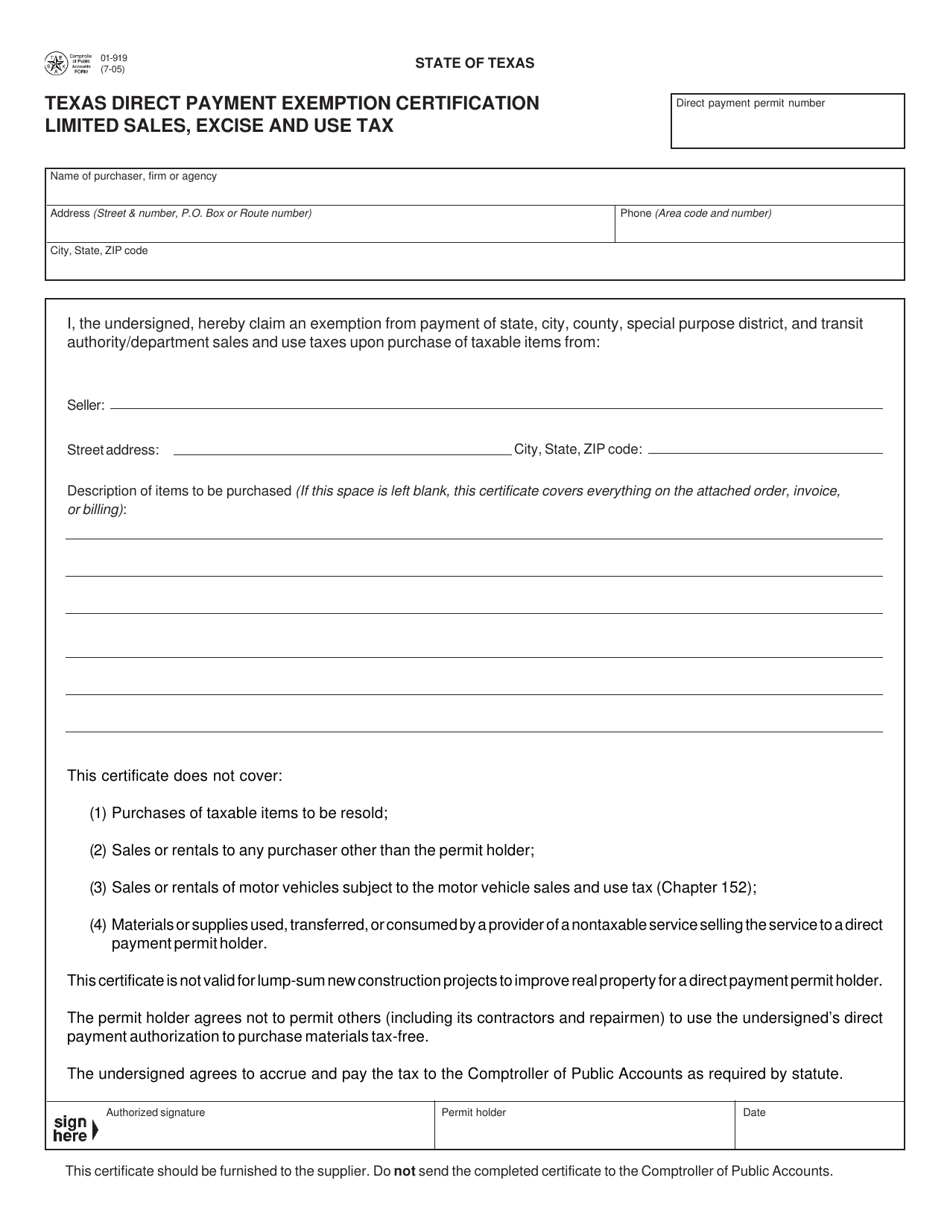

Web property tax application for residence homestead exemption. Web for exemptions claimed on another property or on your previous residence, list the property address and if located outside of dallas county, attach documentation from the. Applying for the homestead exemption is free and easy. Name of purchaser, firm or agency address (street & number, p.o. Web homestead exemptions can help lower the property taxes on your home. Do not pay anyone to fill up and/or file your. Web texas sales and use tax exemption certification this certificate does not require a number to be valid. Web the legislature's $18 billion omnibus plan to lower property taxes is done by compressing the school property maintenance and operations tax rate and by raising. Web this application is for use in claiming a property tax exemption pursuant to tax code section 11.22 for property owned by a disabled veteran, the surviving spouse or. Web for additional copies, visit:

Texas Tax Exempt Certificate Fill And Sign Printable Template Online

Request for replacement refund check: Learn how to claim a homestead exemption. Web to receive this exemption, the purchaser must complete the title application tax/affidavit form, available from the texas comptroller of public accounts. Web a property tax exemption is subtracted from the appraised value and lower the assessed value and the property tax. Web 7 hours agotexas voters will.

Downloads

Name of purchaser, firm or agency address (street & number, p.o. Web a homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the state or adopted by a local taxing unit. Web property tax application for residence homestead exemption. Web this year, the texas legislature increased the tax exemption.

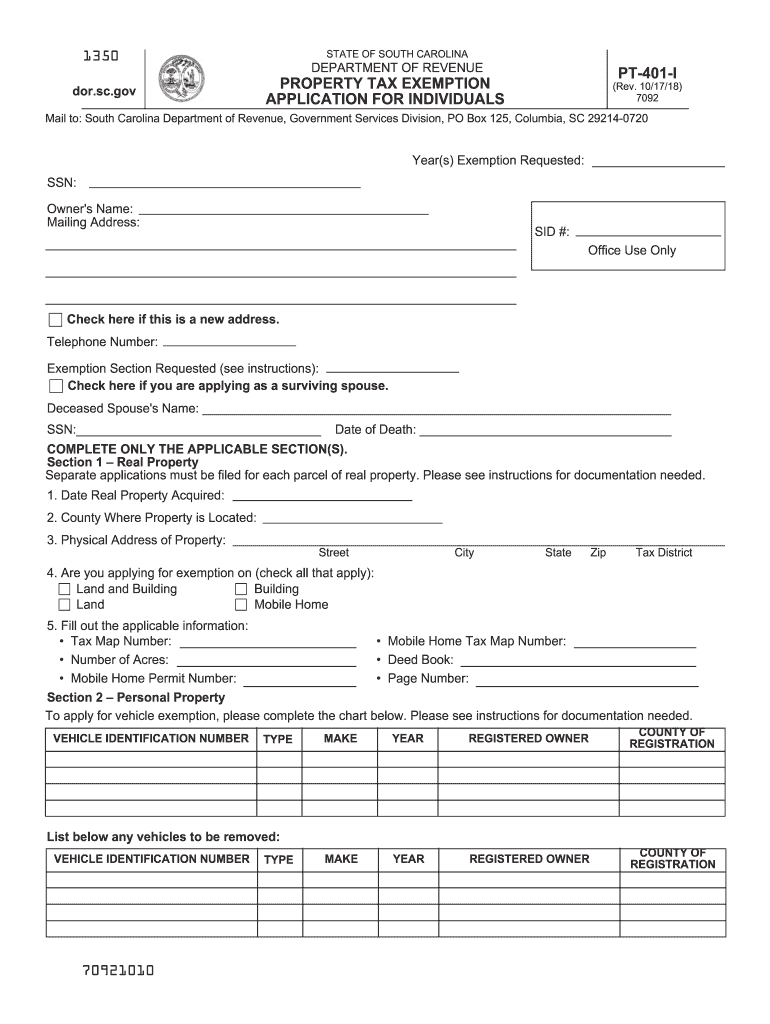

Pt 401 I Fill Out and Sign Printable PDF Template signNow

Do not pay anyone to fill up and/or file your. Web 2 — property tax exemptions owner’s qualifications /& ˘ ˆ + ˇ ˘ !˜! Web property tax application for residence homestead exemption. Web most counties have the homestead exemption form online. Web for exemptions claimed on another property or on your previous residence, list the property address and if.

Texas Exemption Port Fill Online, Printable, Fillable, Blank pdfFiller

Web most counties have the homestead exemption form online. Web raising the homestead exemption from $40,000 to $100,000; Applying for the homestead exemption is free and easy. Web sales and use tax returns and instructions. Web property tax exemptions are one of the most effective and straightforward ways to reduce your property tax bill and save money.

TX HCAD 11.13 20192022 Complete Legal Document Online US Legal Forms

Web to receive this exemption, the purchaser must complete the title application tax/affidavit form, available from the texas comptroller of public accounts. Web a homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the state or adopted by a local taxing unit. Web 7 hours agotexas voters will have.

TX Form 11.13 20132022 Fill and Sign Printable Template Online US

Web to receive this exemption, the purchaser must complete the title application tax/affidavit form, available from the texas comptroller of public accounts. Request for replacement refund check: Applying for the homestead exemption is free and easy. Web texas sales and use tax exemption certification this certificate does not require a number to be valid. Web sales and use tax returns.

Form 01919 Download Fillable PDF or Fill Online Texas Direct Payment

Web a property tax exemption is subtracted from the appraised value and lower the assessed value and the property tax. Web property tax exemptions are one of the most effective and straightforward ways to reduce your property tax bill and save money. Web texas sales and use tax exemption certification this certificate does not require a number to be valid..

Property Tax Exemption Webinar State Representative Debbie MeyersMartin

Web application for property tax refund: Web this year, the texas legislature increased the tax exemption from $40,000 to $100,000, lawmakers' partial response to a statewide increase in property taxes. Web sales and use tax returns and instructions. Web texas sales and use tax exemption certification this certificate does not require a number to be valid. Web 7 hours agotexas.

Texas Fillable Tax Exemption Form Fill Out and Sign Printable PDF

Web 2 — property tax exemptions owner’s qualifications /& ˘ ˆ + ˇ ˘ !˜! Web to receive this exemption, the purchaser must complete the title application tax/affidavit form, available from the texas comptroller of public accounts. Name of purchaser, firm or agency address (street & number, p.o. Learn how to claim a homestead exemption. Web property tax exemptions are.

Tax Exempt Forms San Patricio Electric Cooperative

Web application for property tax refund: Web the legislature's $18 billion omnibus plan to lower property taxes is done by compressing the school property maintenance and operations tax rate and by raising. Web homestead exemptions can help lower the property taxes on your home. Web for exemptions claimed on another property or on your previous residence, list the property address.

Web To Receive This Exemption, The Purchaser Must Complete The Title Application Tax/Affidavit Form, Available From The Texas Comptroller Of Public Accounts.

Web texas sales and use tax exemption certification this certificate does not require a number to be valid. Web application for property tax refund: Web homestead exemptions can help lower the property taxes on your home. Texas taxpayers are eligible for a.

Learn How To Claim A Homestead Exemption.

Applying for the homestead exemption is free and easy. Web most counties have the homestead exemption form online. Web property tax exemptions are one of the most effective and straightforward ways to reduce your property tax bill and save money. Web a homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the state or adopted by a local taxing unit.

Web For Additional Copies, Visit:

Web exemptions from property tax require applications in most circumstances. Web this year, the texas legislature increased the tax exemption from $40,000 to $100,000, lawmakers' partial response to a statewide increase in property taxes. Web 7 hours agotexas voters will have to vote on raising the homestead exemption form $40,000 to $100,000 on the november ballot. Name of purchaser, firm or agency address (street & number, p.o.

Web For Exemptions Claimed On Another Property Or On Your Previous Residence, List The Property Address And If Located Outside Of Dallas County, Attach Documentation From The.

Applications for property tax exemptions are filed with the appraisal district in which the property is. Do not pay anyone to fill up and/or file your. Web this application is for use in claiming a property tax exemption pursuant to tax code section 11.22 for property owned by a disabled veteran, the surviving spouse or. Web sales and use tax returns and instructions.