Rita Tax Exemption Form

Rita Tax Exemption Form - Web exempt from filing form 37. When you file a form 10a, the tax withheld from section a, columns 2 or 3 ofform 37 must be reduced by the amount claimed on the refund request. Rita applies to taxable reimbursements received in the previous year. Web if you have already filed form 37 or are not required to file. Employer federal id # 1. Web if you have municipal taxable income and do not meet other exemptions below, your income is not exempt and you must file a rita form 37. In order for the certificate to be accepted in good. Web if you have not received an exemption letter from the irs, you can obtain an application for recognition of exemption (form 1023) by visiting. For age exemption qualifications, visit ritaohio.com, select the rita municipality in which you worked and review the special notes section. Web if you had no taxable income, complete a declaration of exemption form, available at www.ritaohio.com.

File form 37 by april 15, 2019. Web completing the exemption portion of the notice indicating why you have not filed a return for the tax year(s) listed. Select this line to file an individual declaration of exemption. Web exempt organization types. For age exemption qualifications, visit ritaohio.com, select the rita municipality in which you worked and review the special notes section. Web exempt from filing form 37. Web if you have municipal taxable income and do not meet other exemptions below, your income is not exempt and you must file a rita form 37. Web if you have already filed form 37 or are not required to file. Rita applies to taxable reimbursements received in the previous year. If filing the ohio tax return mfj, select either taxpayer or spouse to indicate whose.

When you file a form 10a, the tax withheld from section a, columns 2 or 3 ofform 37 must be reduced by the amount claimed on the refund request. Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary,. Web if you have municipal taxable income and do not meet other exemptions below, your income is not exempt and you must file a rita form 37. Web exempt from filing form 37. If you were a resident of a rita municipality during any part of the year, you must either file a form 37 return with rita or, if eligible, declaration of. Web applying for tax exempt status. For age exemption qualifications, visit ritaohio.com, select the rita municipality in which you worked and review the special notes section. Individual forms f orm 37 individual municipal income tax return form 37 instructions form 75. If you file after this date, you. If you did not file a return for any of the reasons listed on the.

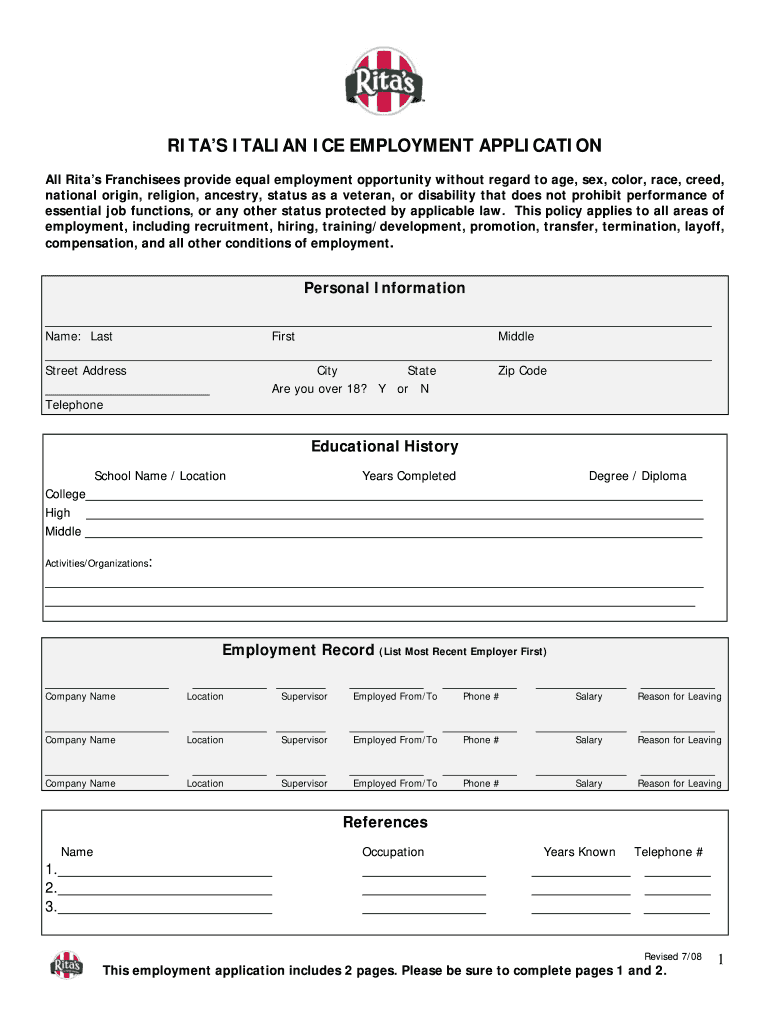

Rita's Application Form Fill Out and Sign Printable PDF Template

Web under 18 years of age exemption exist. File form 37 by april 15, 2019. Employer federal id # 1. Employer certification is not required. If you did not file a return for any of the reasons listed on the.

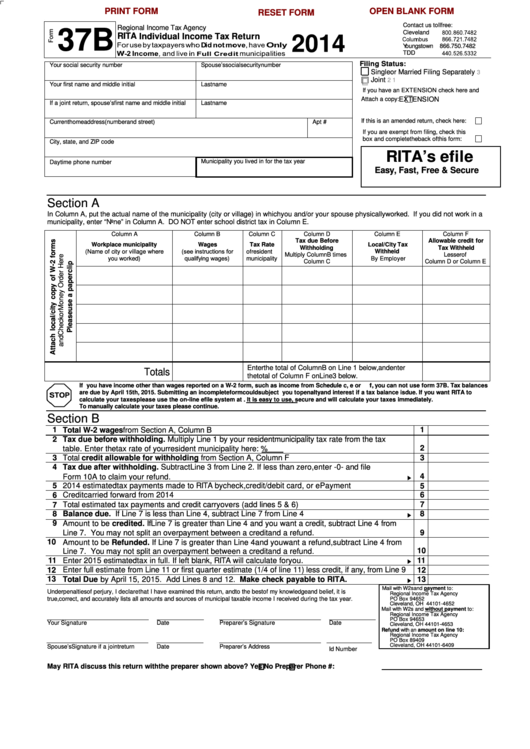

Fillable Form 37b Rita Individual Tax Return 2014 printable

If filing the ohio tax return mfj, select either taxpayer or spouse to indicate whose. Individual forms f orm 37 individual municipal income tax return form 37 instructions form 75. Web if you had no taxable income, complete a declaration of exemption form, available at ritaohio.com. File form 37 by april 17, 2018. File form 37 by april 15, 2019.

OH RITA 10A Fill out Tax Template Online US Legal Forms

If you file after this date,. If you file after this date, you. Web if you have already filed form 37 or are not required to file. Web if you had no taxable income, complete a declaration of exemption form, available at ritaohio.com. Web under 18 years of age exemption exist.

RITA tax filers can claim a refund for working at home during

File form 37 by april 17, 2018. Employer federal id # 1. Web exempt organization types. Web if you have municipal taxable income and do not meet other exemptions below, your income is not exempt and you must file a rita form 37. Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary,.

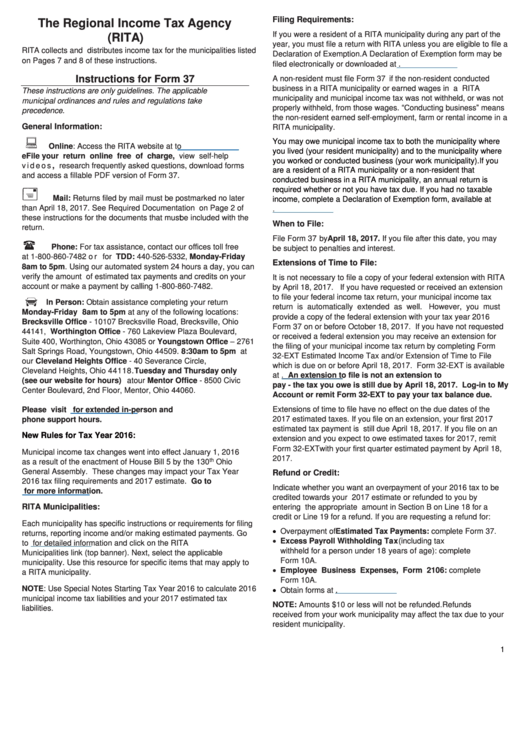

Instructions For Form 37 The Regional Tax Agency (Rita

Web if you have not received an exemption letter from the irs, you can obtain an application for recognition of exemption (form 1023) by visiting. If you were a resident of a rita municipality during any part of the year, you must either file a form 37 return with rita or, if eligible, declaration of. Web exempt from filing form.

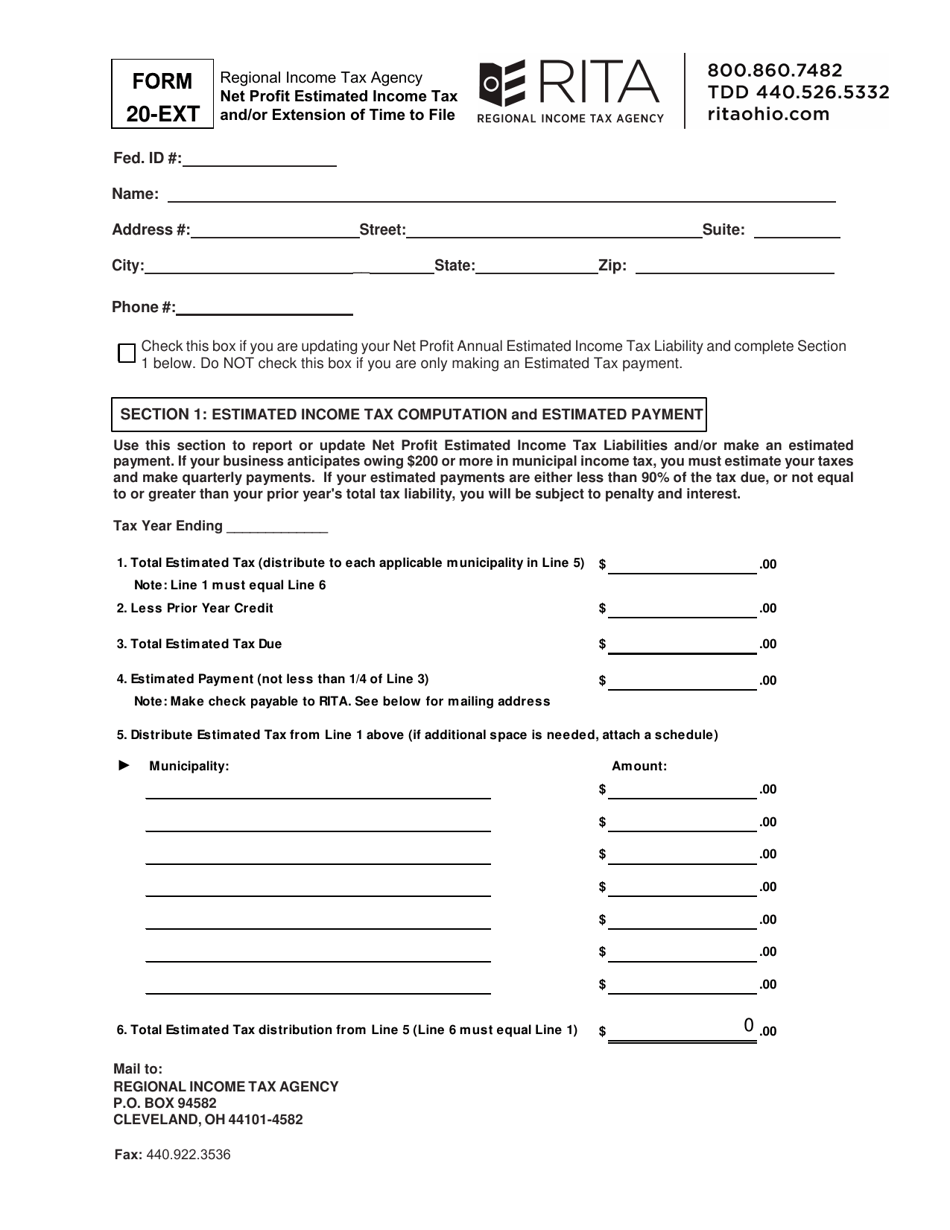

Form 20EXT Download Fillable PDF or Fill Online Net Profit Estimated

In order for the certificate to be accepted in good. Web if you have not received an exemption letter from the irs, you can obtain an application for recognition of exemption (form 1023) by visiting. Web exempt from filing form 37. Web completing the exemption portion of the notice indicating why you have not filed a return for the tax.

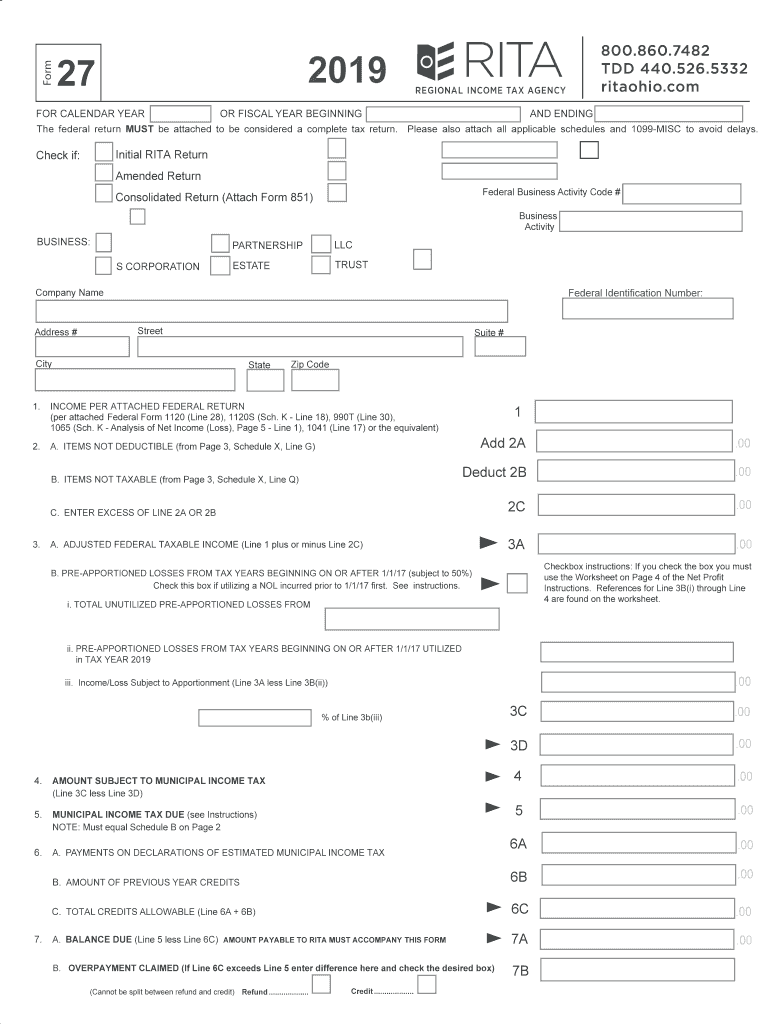

Rita Form 27 Fill Out and Sign Printable PDF Template signNow

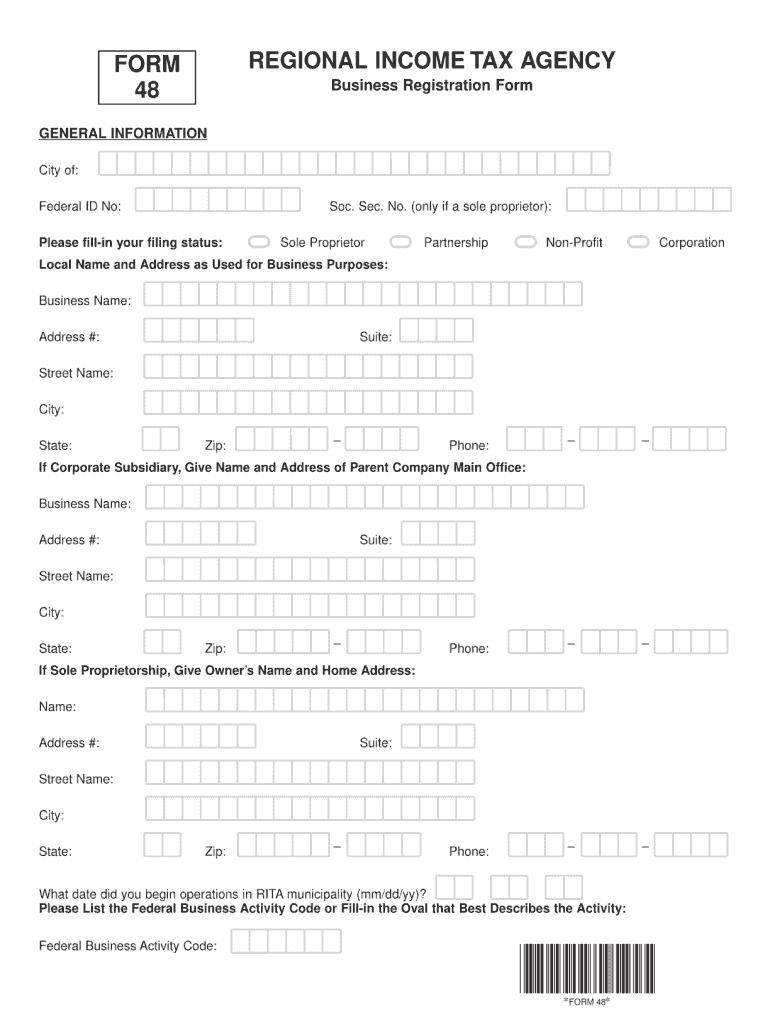

Web if you had no taxable income, complete a declaration of exemption form, available at www.ritaohio.com. Web taxes rita forms the following forms can be found on the rita website: File form 37 by april 15, 2019. Rita applies to taxable reimbursements received in the previous year. For age exemption qualifications, visit ritaohio.com, select the rita municipality in which you.

20202022 Form OH RITA 27 Fill Online, Printable, Fillable, Blank

If you file after this date, you. Web if you had no taxable income, complete a declaration of exemption form, available at ritaohio.com. If filing the ohio tax return mfj, select either taxpayer or spouse to indicate whose. If you were a resident of a rita municipality during any part of the year, you must either file a form 37.

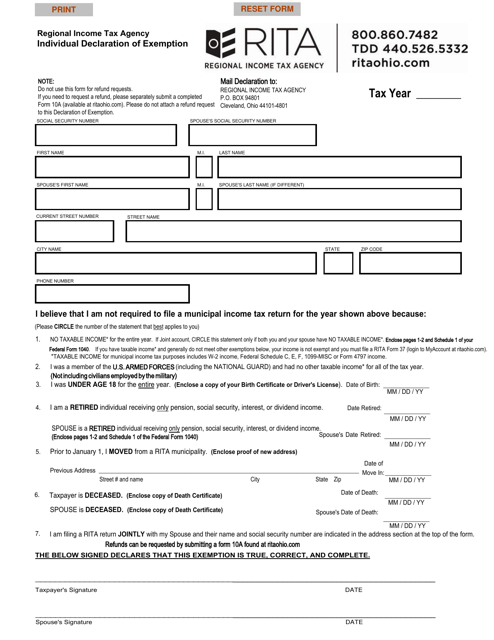

Ohio Individual Declaration of Exemption Download Fillable PDF

Web exempt organization types. Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary,. Rita applies to taxable reimbursements received in the previous year. Web exempt from filing form 37. If you did not file a return for any of the reasons listed on the.

Web If You Have Municipal Taxable Income And Do Not Meet Other Exemptions Below, Your Income Is Not Exempt And You Must File A Rita Form 37.

File form 37 by april 17, 2018. Rita applies to taxable reimbursements received in the previous year. Use this form if you are exempt from filing an individual municipal. In order for the certificate to be accepted in good.

Web If You Have Not Received An Exemption Letter From The Irs, You Can Obtain An Application For Recognition Of Exemption (Form 1023) By Visiting.

Web describe product or services purchased exempt from tax telephone number type of business. If you were a resident of a rita municipality during any part of the year, you must either file a form 37 return with rita or, if eligible, declaration of. When you file a form 10a, the tax withheld from section a, columns 2 or 3 ofform 37 must be reduced by the amount claimed on the refund request. If you file after this date,.

Select This Line To File An Individual Declaration Of Exemption.

Individual forms f orm 37 individual municipal income tax return form 37 instructions form 75. Employer certification is not required. Web if you have already filed form 37 or are not required to file. Web if you had no taxable income, complete a declaration of exemption form, available at www.ritaohio.com.

Quarterly Payroll And Excise Tax Returns Normally Due On May 1.

Web exempt from filing form 37. For age exemption qualifications, visit ritaohio.com, select the rita municipality in which you worked and review the special notes section. Employer federal id # 1. Web exempt organization types.