S Corporation Extension Form

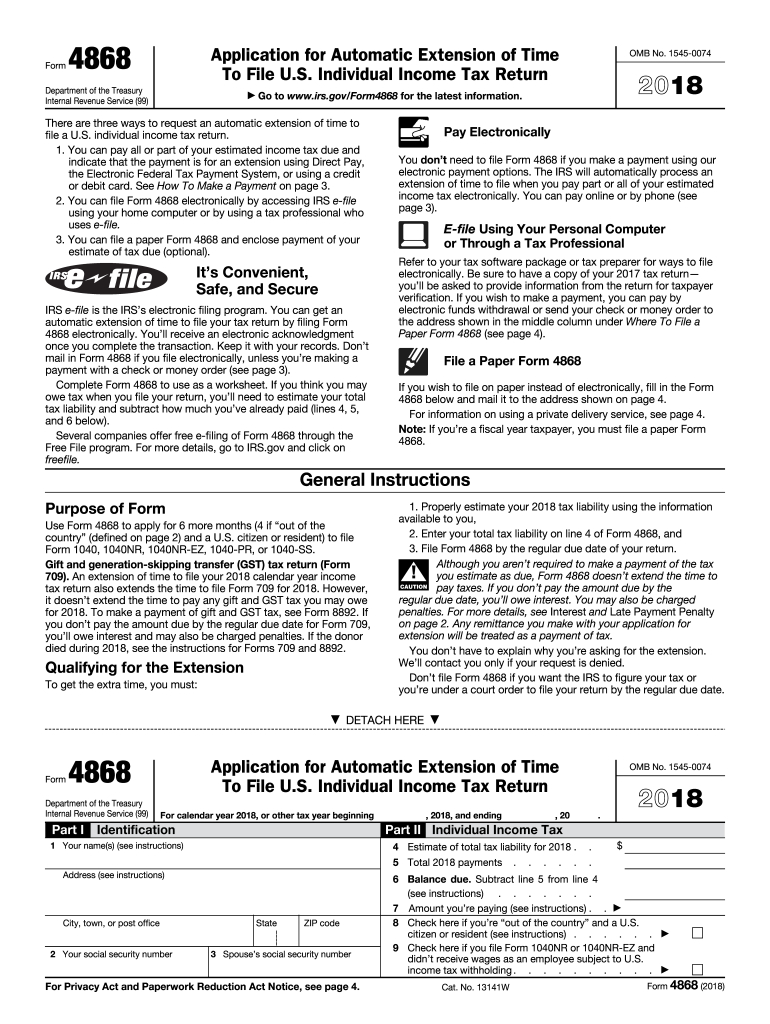

S Corporation Extension Form - Web helpful forms and publications what is an s corporation? And the total assets at the end of the tax year are: Extension of time to file. Web extension forms by filing status individuals form 4868, application for automatic extension of time to file u.s. If the irs grants an extension. Web the llc or lp satisfies the statutory requirements to be an s corporation. For calendar year corporations, the due date is march 15, 2023. Ad filing your tax extension just became easier! Request your extension to file by paying your balance due on our free online tax portal, mydorway,. Use the following irs center address:.

Web both the income tax and license fee are reported on form sc1120s. Ad filing your tax extension just became easier! Extension of time to file. No matter what your tax situation is, turbotax® has you covered. If an s corporation cannot file its california tax return by the 15th day of. Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business. Individual income tax return special rules. Payments due april 18, june 15, september. Web the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, cigarette tax, financial. Ad create legal forms instantly.

Web the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, cigarette tax, financial. Individual income tax return special rules. Extension of time to file. Web helpful forms and publications what is an s corporation? File an extension for free today and extend your tax return through october 16th. Please use the form listed under the current tax year if it is not listed under the year you are. Payments due april 18, june 15, september. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. For calendar year corporations, the due date is march 15, 2023. Ad get access to the largest online library of legal forms for any state.

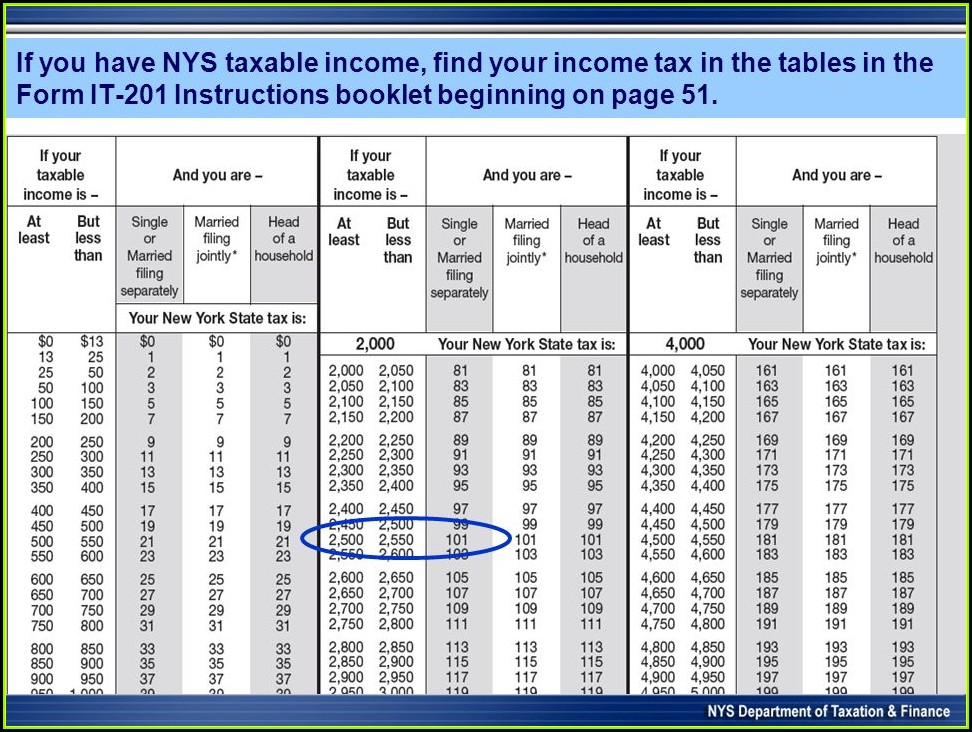

Ny State Tax Extension Form It 201 Form Resume Examples MW9pX8Z9AJ

Free information and preview, prepared forms for you, trusted by legal professionals Web helpful forms and publications what is an s corporation? Please use the form listed under the current tax year if it is not listed under the year you are. Individual income tax return special rules. Web the missouri department of revenue administers missouri's business tax laws, and.

Corporation return due date is March 16, 2015Cary NC CPA

Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. For calendar year corporations, the due date is march 15, 2023. Web helpful forms and publications what is an s corporation? And the total assets at the end of the tax year are: Ad create.

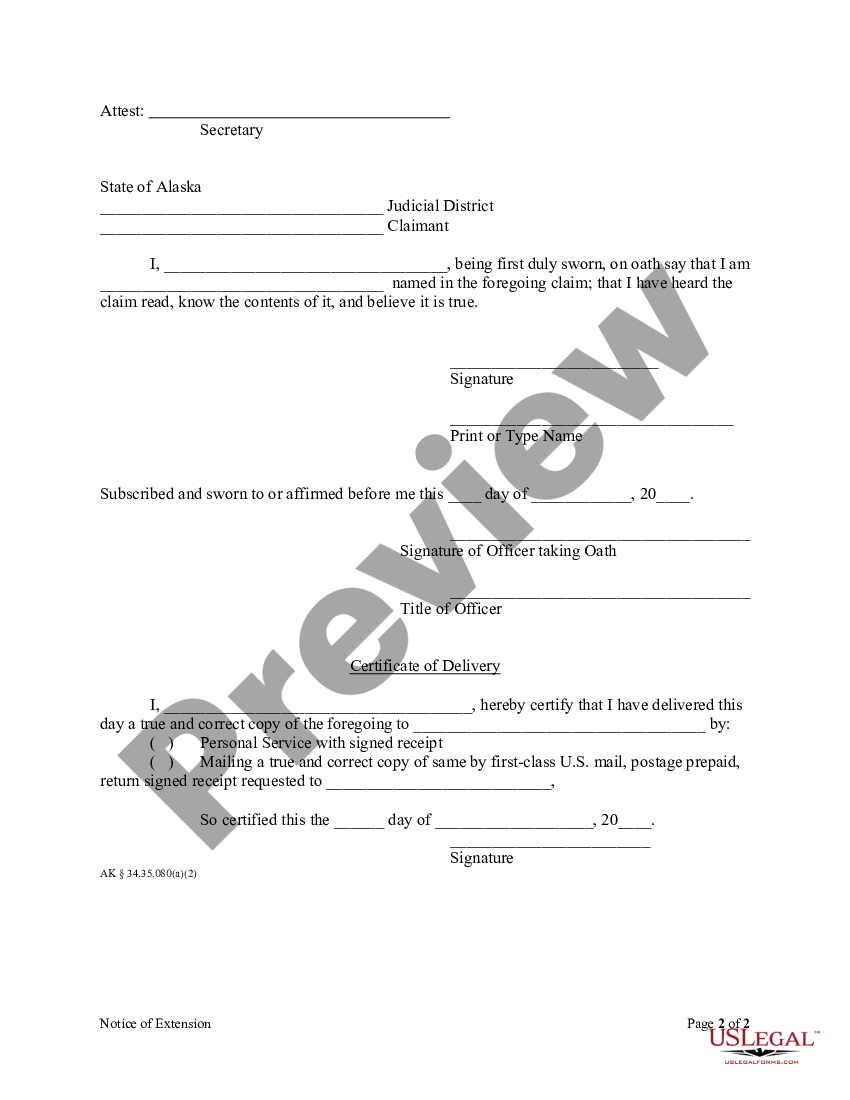

Alaska Notice of Extension Corporation or LLC US Legal Forms

Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business. Ad get access to the largest online library of legal forms for any state. File an extension for free today and extend your tax return through october 16th. Request your extension to file.

Application Affidavit Emissions Extension Pdf Fill Online, Printable

Web helpful forms and publications what is an s corporation? The original due date for this. Web the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, cigarette tax, financial. Extension of time to file. Ad get access to the largest online library of legal forms for any state.

Form 12 Extension Why You Should Not Go To Form 12 Extension AH

The original due date for this. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. No matter what your tax situation is, turbotax® has you covered..

Form DR0158F Download Fillable PDF or Fill Online Payment for

Web s corp extension. Web helpful forms and publications what is an s corporation? Ad filing your tax extension just became easier! And the total assets at the end of the tax year are: Ad turbotax has the tax solutions to help, whether you file an extension or not.

Are you a Corporate or SCorp? Know your Extension Form Type in Form

Free information and preview, prepared forms for you, trusted by legal professionals Web the llc or lp satisfies the statutory requirements to be an s corporation. If an s corporation cannot file its california tax return by the 15th day of. The best legal forms website, free for all! An s corporation is similar to a partnership, in that the.

1120S

Use the following irs center address:. Web extension forms by filing status individuals form 4868, application for automatic extension of time to file u.s. Web this is a reminder that the extended due date to file form 100s, california s corporation franchise or income tax return, is september 15, 2021. If the irs grants an extension. Please use the form.

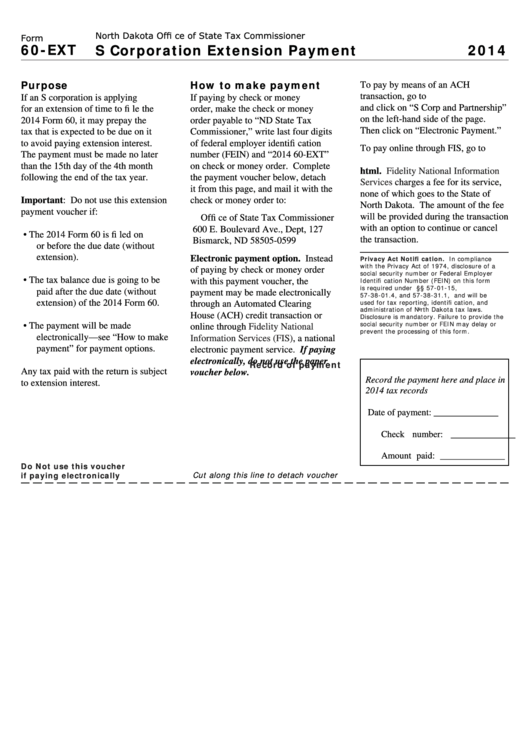

Form 60Ext Instructions S Corporation Extension Payment 2014

Ad turbotax has the tax solutions to help, whether you file an extension or not. Extension of time to file. Ad get access to the largest online library of legal forms for any state. Web extension forms by filing status individuals form 4868, application for automatic extension of time to file u.s. Web the llc or lp satisfies the statutory.

Print Irs Extension Form 4868 2021 Calendar Printables Free Blank

Please use the form listed under the current tax year if it is not listed under the year you are. Ad turbotax has the tax solutions to help, whether you file an extension or not. Web extension forms by filing status individuals form 4868, application for automatic extension of time to file u.s. And the total assets at the end.

No Matter What Your Tax Situation Is, Turbotax® Has You Covered.

Ad get access to the largest online library of legal forms for any state. Get free access to the best forms today! Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. And the total assets at the end of the tax year are:

1) A Shareholder That Is A.

Ad turbotax has the tax solutions to help, whether you file an extension or not. Request your extension to file by paying your balance due on our free online tax portal, mydorway,. If an s corporation cannot file its california tax return by the 15th day of. File an extension for free today and extend your tax return through october 16th.

Ad Filing Your Tax Extension Just Became Easier!

Web both the income tax and license fee are reported on form sc1120s. Web s corp extension. Ad create legal forms instantly. Use the following irs center address:.

If The Irs Grants An Extension.

For calendar year corporations, the due date is march 15, 2023. Web extension forms by filing status individuals form 4868, application for automatic extension of time to file u.s. The original due date for this. Web the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, cigarette tax, financial.