Sample Completed 1023 Ez Form

Sample Completed 1023 Ez Form - Signnow combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. Web after you complete the five steps, you’ll download the form. Small organizations may be eligible to apply. You must apply on form 1023. Then you’ll need to download and save the. The data is based on approved closures and is extracted quarterly to annual summary documents as of august 6, 2014. The advanced tools of the editor will lead you through the editable pdf template. This form is for income earned in tax year 2022, with tax returns due in april 2023. Application for reinstatement of exempt status and retroactive reinstatement requesting expedited review A complete application will include one or more documents in addition to form 1023.

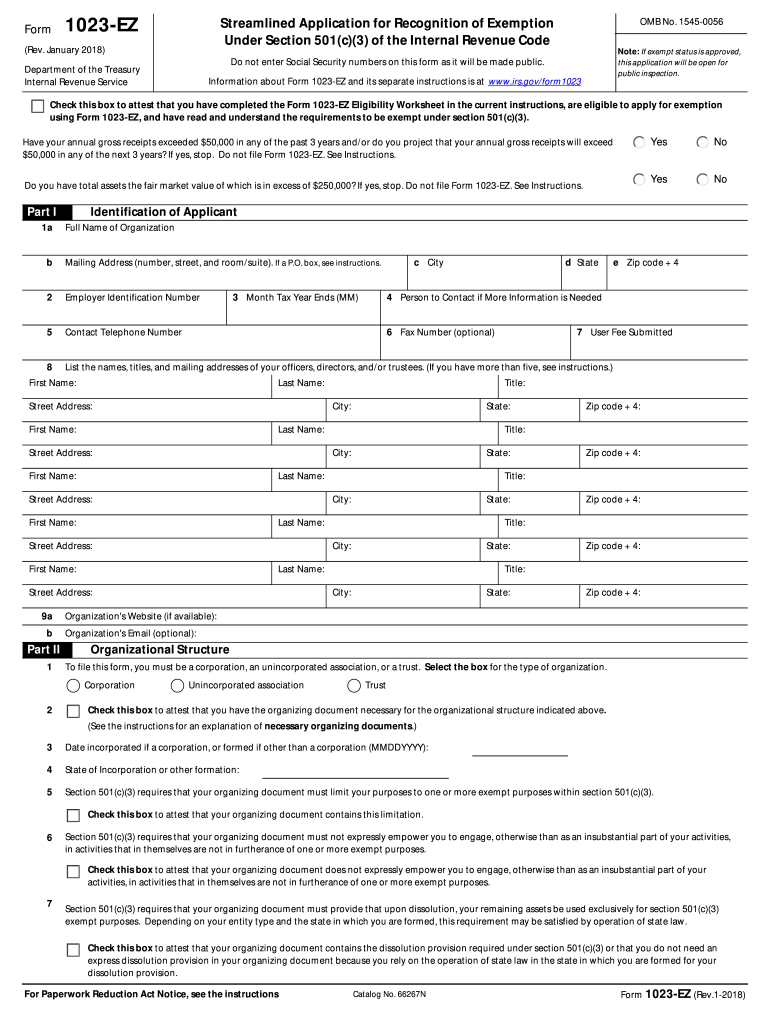

Then you’ll need to download and save the. 2 to qualify for exemption as a section 501(c)(3) organization, you must be organized and operated exclusively to further one or more of the following purposes. Utilize a check mark to indicate the answer. Sign online button or tick the preview image of the form. The data is based on approved closures and is extracted quarterly to annual summary documents as of august 6, 2014. If you answer “no” to all of the worksheet questions, you may apply Small organizations may be eligible to apply. Pdf file to your computer. Application for reinstatement of exempt status and retroactive reinstatement requesting expedited review Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501 (c) (3).

You must apply on form 1023. This is an important step toward establishing a nonprofit in any state. 2 to qualify for exemption as a section 501(c)(3) organization, you must be organized and operated exclusively to further one or more of the following purposes. To start the blank, utilize the fill camp; 9 a organization's website (if available): The data is based on approved closures and is extracted quarterly to annual summary documents as of august 6, 2014. If you answer “no” to all of the worksheet questions, you may apply Part ii organizational structure 1 to file this form, you must be a corporation, an unincorporated association, or a trust. Pay.gov can accommodate only one uploaded file. Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501 (c) (3).

Form 1023 Example Glendale Community

Small organizations may be eligible to apply. Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501 (c) (3). You must apply on form 1023. Application for reinstatement of exempt status and retroactive reinstatement requesting expedited review If you answer “no” to all of the worksheet questions, you may apply

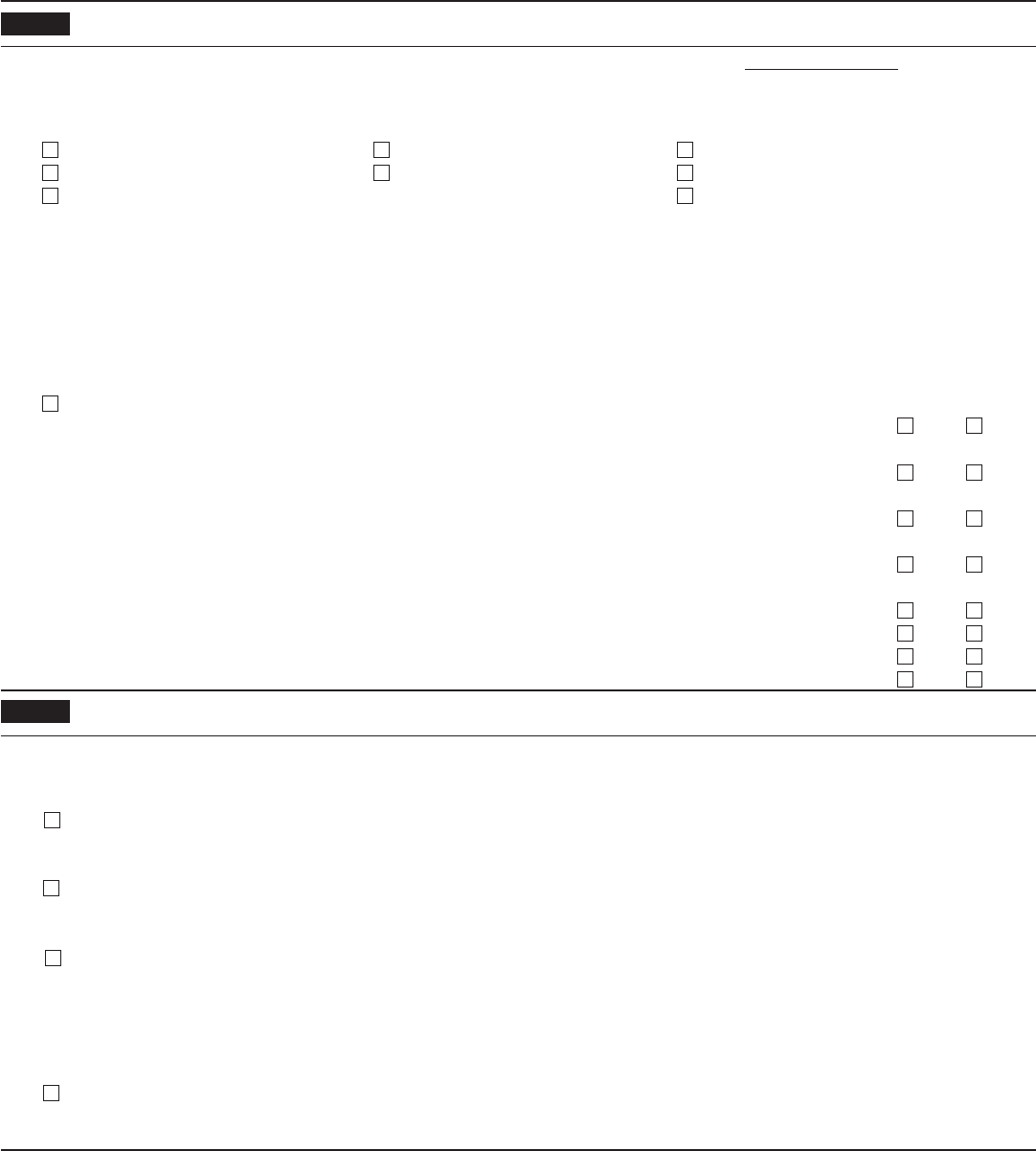

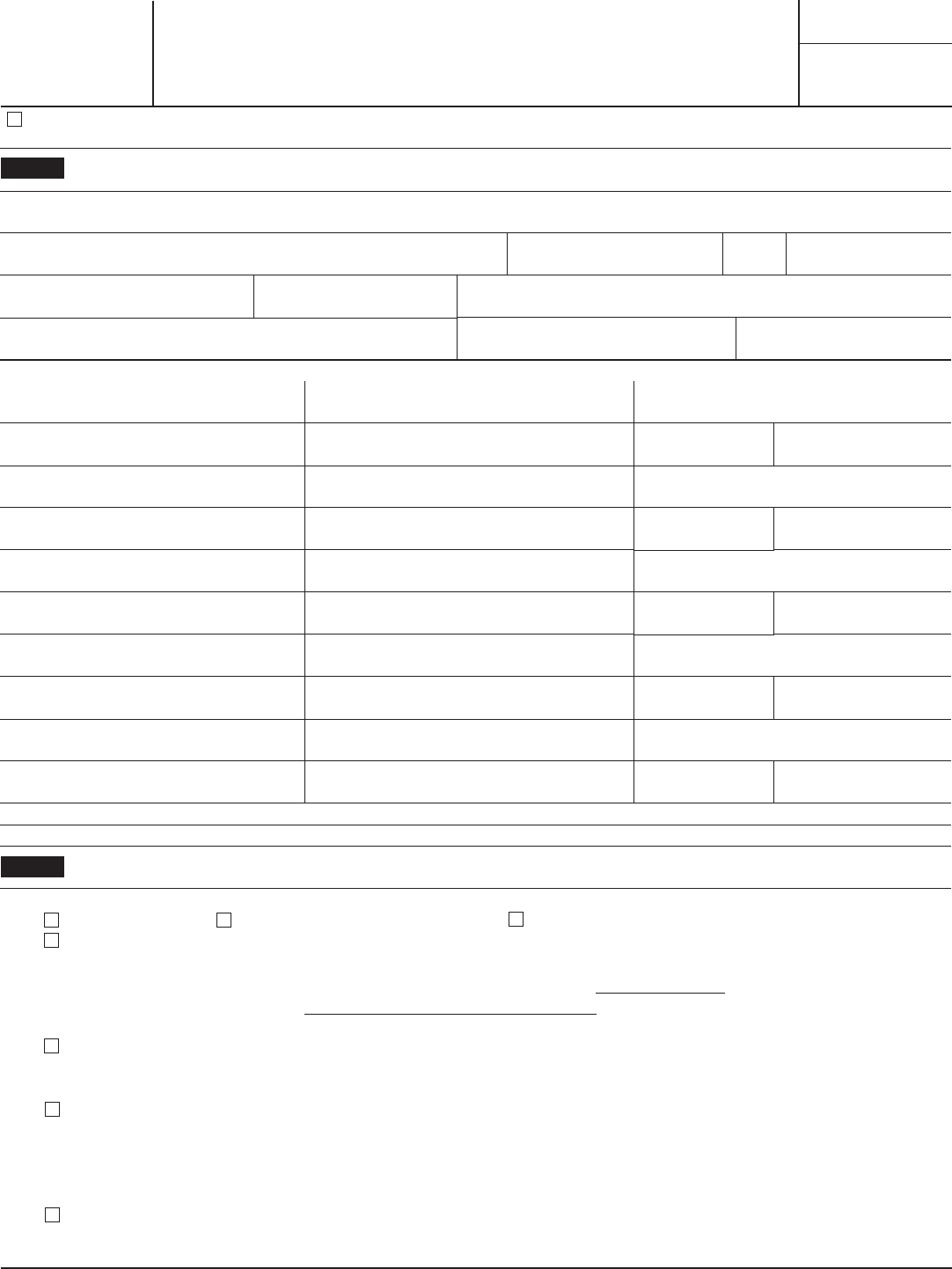

Form 1023EZ Streamlined Application for Recognition of Exemption

If you answer “no” to all of the worksheet questions, you may apply Past, present, and planned activities. Utilize a check mark to indicate the answer. Sign online button or tick the preview image of the form. The advanced tools of the editor will lead you through the editable pdf template.

Form 1023, Page 1

Enter your official contact and identification details. 2 to qualify for exemption as a section 501(c)(3) organization, you must be organized and operated exclusively to further one or more of the following purposes. Application for reinstatement of exempt status and retroactive reinstatement requesting expedited review Then you’ll need to download and save the. Sign online button or tick the preview.

Form 1023EZ Edit, Fill, Sign Online Handypdf

The data is based on approved closures and is extracted quarterly to annual summary documents as of august 6, 2014. The advanced tools of the editor will lead you through the editable pdf template. Sign online button or tick the preview image of the form. Pdf file to your computer. A complete application will include one or more documents in.

1023 ez form Fill out & sign online DocHub

If you answer “no” to all of the worksheet questions, you may apply Pdf file to your computer. Small organizations may be eligible to apply. Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501 (c) (3). Sign online button or tick the preview image of the form.

Sample 1023 by Ida Mae Campbell Wellness & Resource Center Issuu

Web after you complete the five steps, you’ll download the form. Enter your official contact and identification details. You must apply on form 1023. 2 to qualify for exemption as a section 501(c)(3) organization, you must be organized and operated exclusively to further one or more of the following purposes. A complete application will include one or more documents in.

Sample Completed 1023 Ez Form Fill Out and Sign Printable PDF

If you answer “no” to all of the worksheet questions, you may apply Part ii organizational structure 1 to file this form, you must be a corporation, an unincorporated association, or a trust. Utilize a check mark to indicate the answer. A complete application will include one or more documents in addition to form 1023. Pay.gov can accommodate only one.

Form 1023EZ Edit, Fill, Sign Online Handypdf

Sign online button or tick the preview image of the form. Part ii organizational structure 1 to file this form, you must be a corporation, an unincorporated association, or a trust. Web after you complete the five steps, you’ll download the form. Pay.gov can accommodate only one uploaded file. This is an important step toward establishing a nonprofit in any.

36 1023 Ez Eligibility Worksheet support worksheet

Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501 (c) (3). Part ii organizational structure 1 to file this form, you must be a corporation, an unincorporated association, or a trust. Web how to make an electronic signature for the 1023 ez form download in the online mode. The advanced.

IRS Proposes Form 1023EZ

Web how to make an electronic signature for the 1023 ez form download in the online mode. Small organizations may be eligible to apply. Past, present, and planned activities. A complete application will include one or more documents in addition to form 1023. 2 to qualify for exemption as a section 501(c)(3) organization, you must be organized and operated exclusively.

We Are Not Affiliated With Any Brand Or Entity On This Form.

A complete application will include one or more documents in addition to form 1023. Then you’ll need to download and save the. This form is for income earned in tax year 2022, with tax returns due in april 2023. Past, present, and planned activities.

If You Answer “No” To All Of The Worksheet Questions, You May Apply

Part ii organizational structure 1 to file this form, you must be a corporation, an unincorporated association, or a trust. Web how to make an electronic signature for the 1023 ez form download in the online mode. Enter your official contact and identification details. Sign online button or tick the preview image of the form.

Required Attachment To Form 1023 Does The Organization Need To Submit Any Documents With The Form 1023 Application?

Pdf file to your computer. Purpose of form completed form 1023 required to apply for recognition of section 501 (c) (3) exemption. 2 to qualify for exemption as a section 501(c)(3) organization, you must be organized and operated exclusively to further one or more of the following purposes. This is an important step toward establishing a nonprofit in any state.

Application For Reinstatement Of Exempt Status And Retroactive Reinstatement Requesting Expedited Review

To start the blank, utilize the fill camp; Web form 1023 ez streamlined reinstatement instructions national pta pta. Signnow combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. Utilize a check mark to indicate the answer.