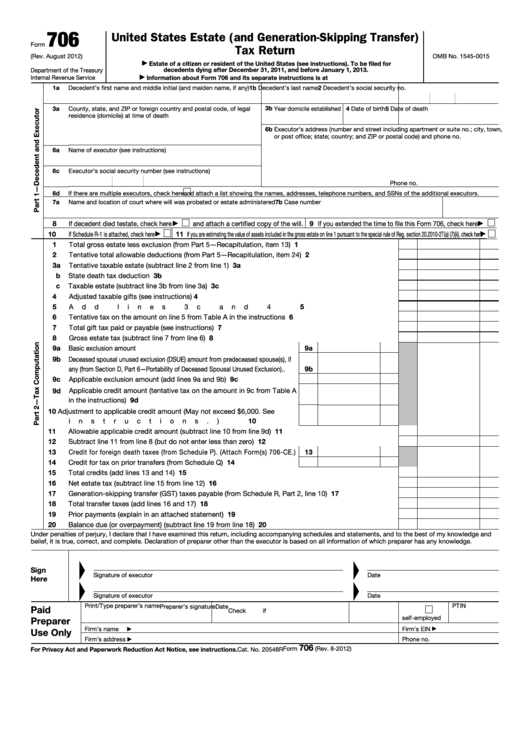

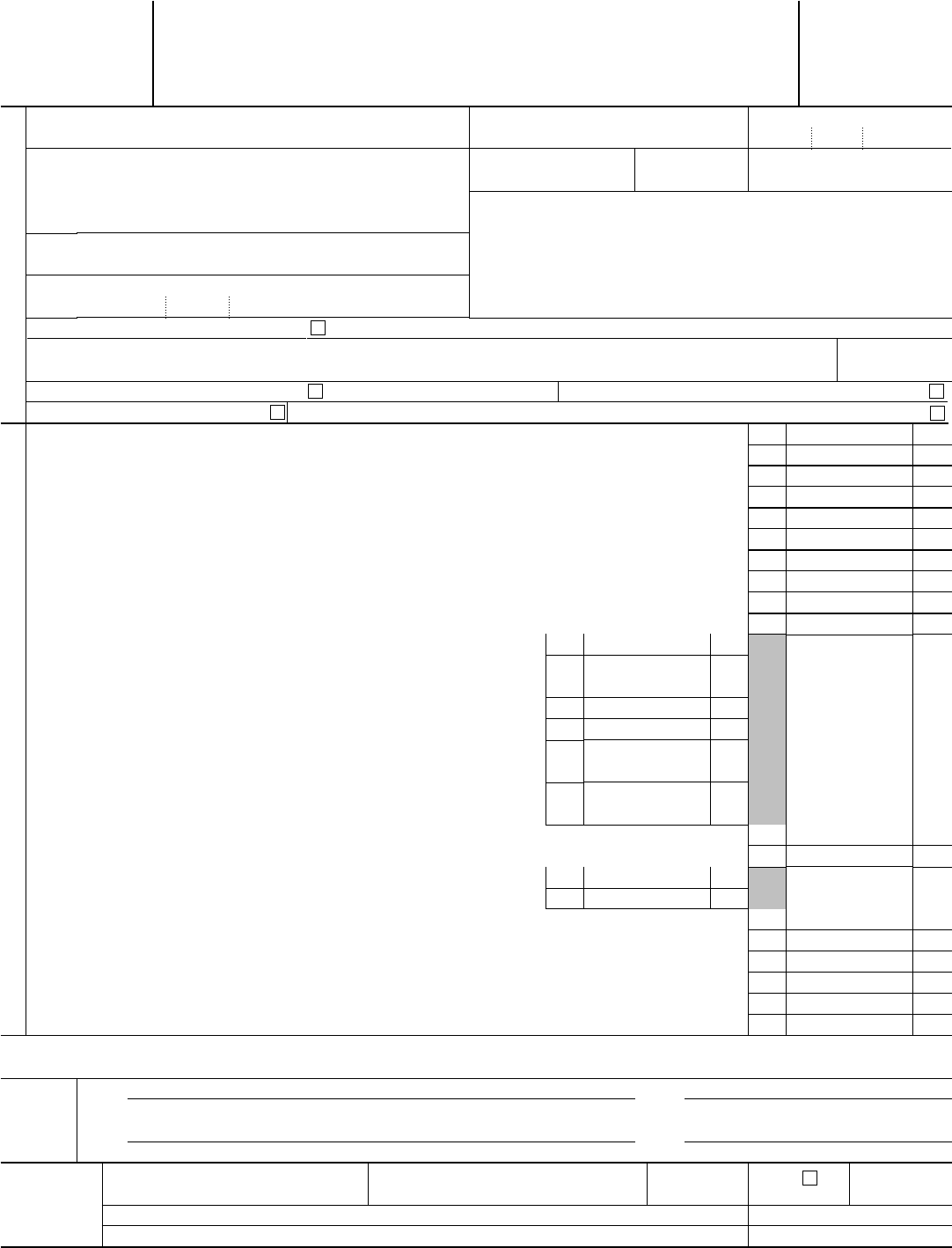

Sample Form 706 Completed

Sample Form 706 Completed - To be filed for decedents dying after december 31, 2018. A taxpayer is allowed a higher annual exclusion for gifts to a noncitizen spouse ($152,000 in 2018). Web form 706 is used by an executor of an estate to calculate the amount of tax owed on estates valued at more than $12.06 million if the decedent died in 2022 ($12.92 million in 2023). The amount of the payment does not normally affect the tax balance you must pay to the federal government. The federal gift tax return form 709, and the decedent’s final federal income tax return, form 1040. In addition, there are 11 states that have an estate tax as well. On line 6a, list the executor you want contacted by the irs; Web part 6 of form 706 is where you elect portability of deceased spousal unused exclusion (dsue) for the estate. City, town, or post office; Cpe credits available 8 total cpe 8 taxes macpa columbia center

This list details what do for each section of part 6: Web how to complete schedule c for estate form 706 updated: List any additional executors on an. On line 6a, list the executor you want contacted by the irs; Part 6—portability of deceased spousal unused exclusion (dsue) was added to form 706. Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Web estate tax (form 706) noncitizen spouses gifts to a spouse who is not a u.s. Edit your sample form 706 completed online type text, add images, blackout confidential details, add comments, highlights and more. City, town, or post office; Current revision form 706 pdf instructions for form 706 ( print version pdf) recent developments

On the face of the form 706, fill in the decedent’s name, address, social security number, year domicile (residence) was established in the decedent’s state of residence, date of birth, and date of death. This estate tax is levied on the entire taxable estate and not just the beneficiary’s specific share. And zip or foreign postal code) and phone no. Web form 706 is used by an executor of an estate to calculate the amount of tax owed on estates valued at more than $12.06 million if the decedent died in 2022 ($12.92 million in 2023). List any additional executors on an. The federal gift tax return form 709, and the decedent’s final federal income tax return, form 1040. Use form 4768, application for extension of time to file a return and/or pay u.s. The amount of the payment does not normally affect the tax balance you must pay to the federal government. We will also look at a simplified election example. Web filing a completed form 2848 with this return may expedite processing of the form 706.

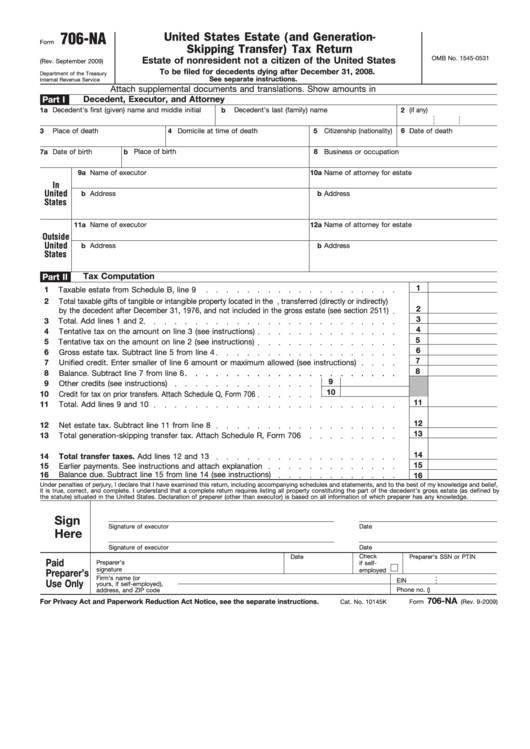

706 Na Tax Blank Sample to Fill out Online in PDF

Form 706 can be used for several purposes. Web filing a completed form 2848 with this return may expedite processing of the form 706. Web current developments in estate planning and taxation, representing a client with potential capacity issues, whether a supplemental 706 is required, inter‐vivos qtip planning, prenuptial agreements for the estate planner and the. Cpe credits available 8.

Form 706A United States Additional Estate Tax Return (2013) Free

Web estate tax (form 706) noncitizen spouses gifts to a spouse who is not a u.s. August 2013) to be filed for decedents dying after december 31, 2012. Web filing a completed form 2848 with this return may expedite processing of the form 706. The original due date of the form 706 is 9 months from the decedent’s date of.

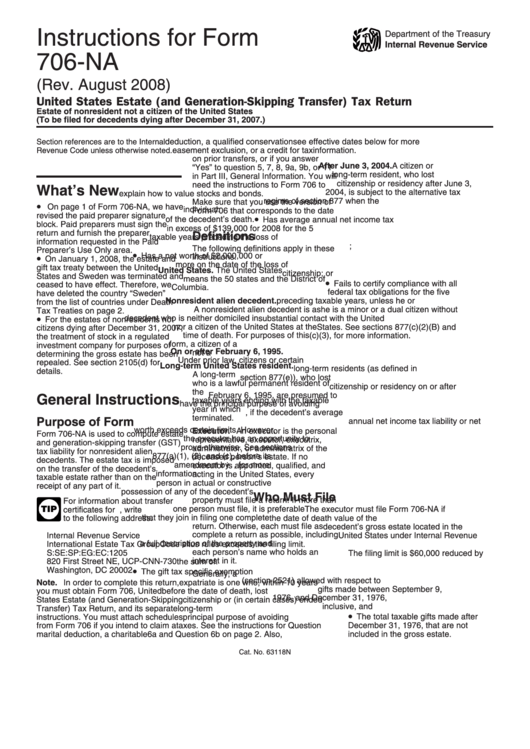

Instructions For Form 706Na United States Estate (And Generation

If you are unable to file form 706 by the due date, you may receive an extension of time to file. We will also look at a simplified election example. The original due date of the form 706 is 9 months from the decedent’s date of death. The federal gift tax return form 709, and the decedent’s final federal income.

Fillable Form 706Na 2009 United States Estate (And

If you wish only to authorize someone to inspect and/or receive confidential tax information (but not to represent you before the irs), complete and file form 8821. The federal gift tax return form 709, and the decedent’s final federal income tax return, form 1040. Web nationally renowned tax expert, robert s. Section a, opting out of portability: Sign it in.

for How to Fill in IRS Form 706

August 2013) to be filed for decedents dying after december 31, 2012. Web nationally renowned tax expert, robert s. Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. A taxpayer is allowed a higher annual exclusion for gifts to a noncitizen spouse ($152,000 in 2018). August 2019).

Form 706A United States Additional Estate Tax Return (2013) Free

August 2019) department of the treasury internal revenue service. The amount of the payment does not normally affect the tax balance you must pay to the federal government. On the face of the form 706, fill in the decedent’s name, address, social security number, year domicile (residence) was established in the decedent’s state of residence, date of birth, and date.

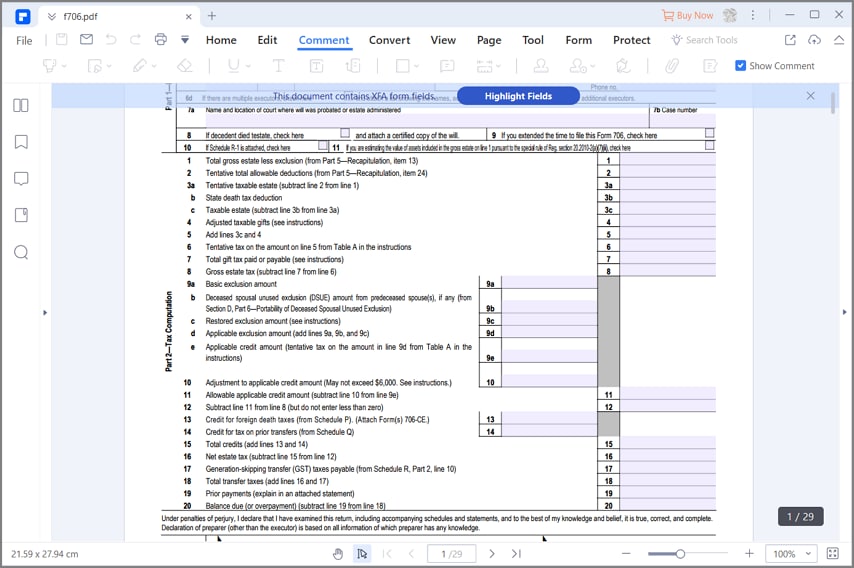

Form 706 Edit, Fill, Sign Online Handypdf

Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. And zip or foreign postal code) and phone no. Web this course provides you with a prqactical understanding of the issues involved in preparing the federal estate tax return, form 706; Web part 6 of form 706 is.

Form 706 United States Estate (and GenerationSkipping Transfer) Tax

This estate tax is levied on the entire taxable estate and not just the beneficiary’s specific share. Web filing a completed form 2848 with this return may expedite processing of the form 706. Form 706 is a special form of tax return that is used to make a payment to the irs that is not refundable or exempt. A taxpayer.

Fillable Form 706 United States Estate (And GenerationSkipping

We will also look at a simplified election example. The federal gift tax return form 709, and the decedent’s final federal income tax return, form 1040. All estates that exceed the exemption amount must file form 706. And zip or foreign postal code) and phone no. In addition, there are 11 states that have an estate tax as well.

709 gift tax return instructions

Web how to complete schedule c for estate form 706 updated: Web if you are filing a form 706, in order for it to be deemed substantially complete (an actual irs term with regulations that address it) you must complete all of the required schedules. The federal gift tax return form 709, and the decedent’s final federal income tax return,.

For Instructions And The Latest.

You may complete a form 706 to make a payment to the irs. Section a, opting out of portability: On line 6a, list the executor you want contacted by the irs; Web fresno property values appraisers

Estate Of A Citizen Or Resident Of The United States (See Instructions).

Web what is form 706? Assets passing at death to a noncitizen spouse qualify for the marital deduction if: Web part 6 of form 706 is where you elect portability of deceased spousal unused exclusion (dsue) for the estate. Form 706 is a special form of tax return that is used to make a payment to the irs that is not refundable or exempt.

The Only Action Required To Elect Portability Of The Dsue Amount, If Any, Is To File A Timely And Complete Form 706.

In addition, there are 11 states that have an estate tax as well. That’s why we created a form 706 example. This estate tax is levied on the entire taxable estate and not just the beneficiary’s specific share. All estates that exceed the exemption amount must file form 706.

Web Nationally Renowned Tax Expert, Robert S.

In this post, we will look at the sections of form 706 that relate to portability and even look at a sample 706 for portability. The amount of the payment does not normally affect the tax balance you must pay to the federal government. On the face of the form 706, fill in the decedent’s name, address, social security number, year domicile (residence) was established in the decedent’s state of residence, date of birth, and date of death. Use form 4768, application for extension of time to file a return and/or pay u.s.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)