Sc Form 1065

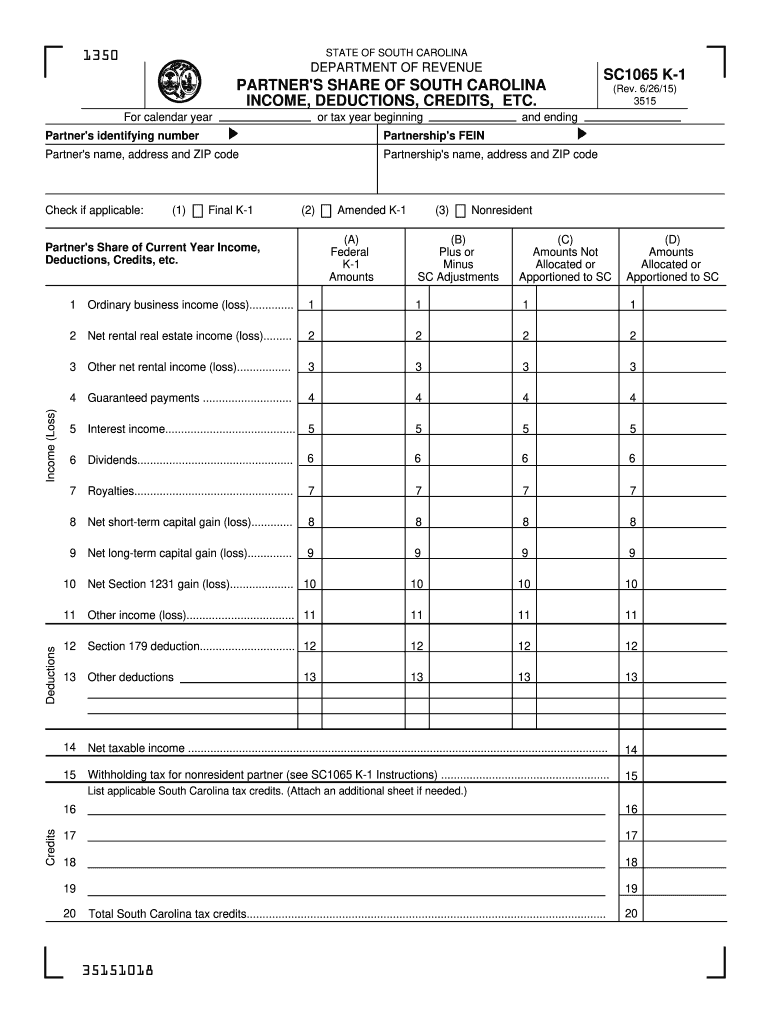

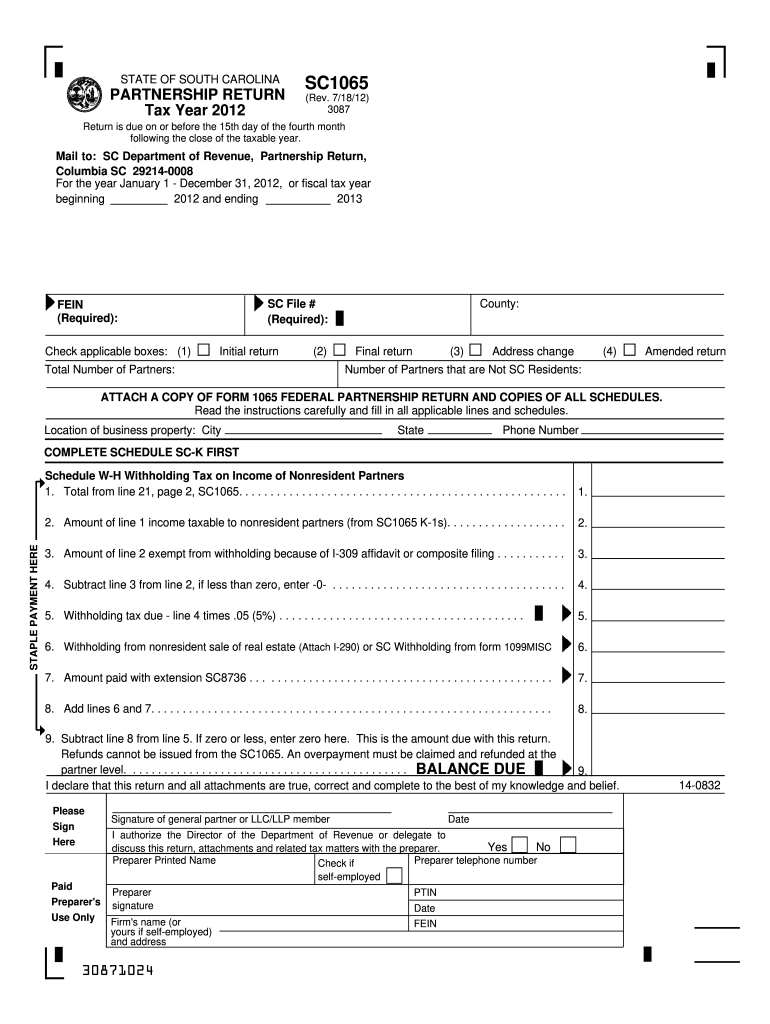

Sc Form 1065 - Or getting income from u.s. 7/23/14) 3087 return is due on or before the 15th day of the fourth month following the close of the taxable year. Amend your sc1065 whenever the irs adjusts your federal 1065. They expect to owe an active trade or business income tax liability of $100 or more with the filing of their sc1065, partnership tax return. Web we last updated the partner's share of south carolina income, deduction, credits, etc. Electronic filing options > page footer content Signnow allows users to edit, sign, fill and share all type of documents online. Web sc 1065 dor.sc.gov state of south carolina 2020 partnership return due by the 15th day of the third month following the close of the taxable year. Web if you file your sc1065 by paper and have a balance due, submit your payment with the return. A qualifying partnership, including an llc taxed as a partnership, can elect to have its active trade or business income taxed at the entity level instead of the partner level.

Or getting income from u.s. Return of partnership income, including recent updates, related forms and instructions on how to file. Web if you file your sc1065 by paper and have a balance due, submit your payment with the return. They expect to owe an active trade or business income tax liability of $100 or more with the filing of their sc1065, partnership tax return. Ad irs inst 1065 & more fillable forms, register and subscribe now! Signnow allows users to edit, sign, fill and share all type of documents online. Find current and past year sc1065 partnership tax forms at dor.sc.gov/forms. Electronic filing options > page footer content Web health and human services forms and applications. File the sc1065 and include all taxes due to the scdor by the 15th day of the third month following the end of the partnership's taxable year.

They choose to pay their active trade or business income tax at the entity level, and. Signnow allows users to edit, sign, fill and share all type of documents online. Or getting income from u.s. Partnerships must file a declaration of estimated tax if: Find current and past year sc1065 partnership tax forms at dor.sc.gov/forms. Web health and human services forms and applications. File the sc1065 and include all taxes due to the scdor by the 15th day of the third month following the end of the partnership's taxable year. Web sc 1065 dor.sc.gov state of south carolina 2020 partnership return due by the 15th day of the third month following the close of the taxable year. Amend your sc1065 whenever the irs adjusts your federal 1065. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s.

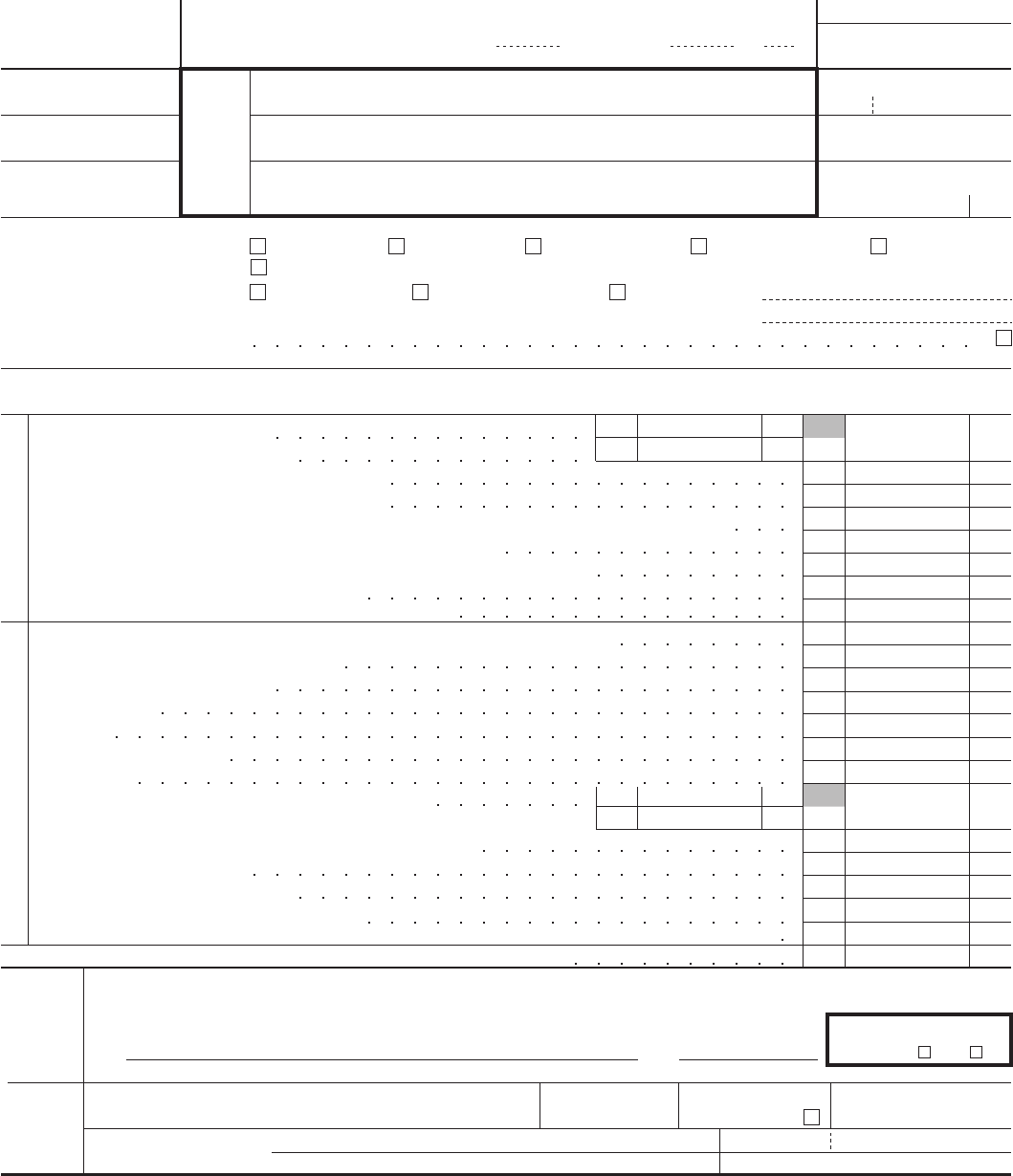

2014 form 1065 instructions

Web we last updated the partner's share of south carolina income, deduction, credits, etc. 7/23/14) 3087 return is due on or before the 15th day of the fourth month following the close of the taxable year. Electronic filing options > page footer content Web sc 1065 dor.sc.gov state of south carolina 2020 partnership return due by the 15th day of.

Easily File Form 1065 Online YouTube

Web we last updated the partner's share of south carolina income, deduction, credits, etc. Electronic filing options > page footer content Signnow allows users to edit, sign, fill and share all type of documents online. A qualifying partnership is one whose owners are all: Web new for 2022 tax year.

Form 1065 Corporate

Health care power of attorney [pdf] living will [pdf] certified copy of birth certificate [pdf] certified copy of death certificate [pdf] certified copy of marriage license [pdf] certified copy of report of divorce [pdf] child support forms. They choose to pay their active trade or business income tax at the entity level, and. Electronic filing options > page footer content.

2008 Form 1065 Edit, Fill, Sign Online Handypdf

Beginning with the 2021 tax year: Web new for 2022 tax year. Web sc 1065 dor.sc.gov state of south carolina 2020 partnership return due by the 15th day of the third month following the close of the taxable year. File the sc1065 and include all taxes due to the scdor by the 15th day of the third month following the.

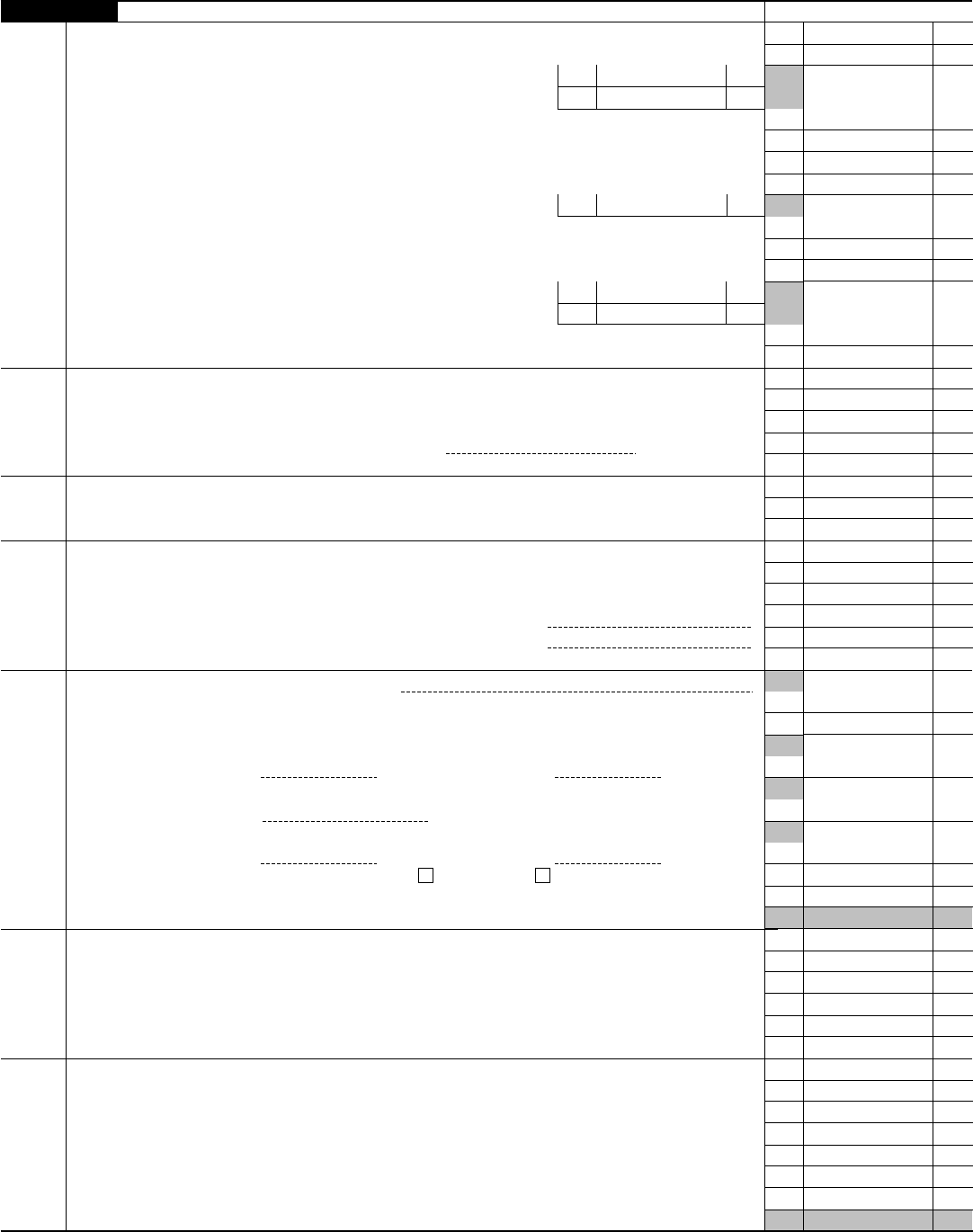

Download Form 1065 for Free Page 2 FormTemplate

They choose to pay their active trade or business income tax at the entity level, and. Or getting income from u.s. They expect to owe an active trade or business income tax liability of $100 or more with the filing of their sc1065, partnership tax return. A qualifying partnership, including an llc taxed as a partnership, can elect to have.

2014 Form 1065 Edit, Fill, Sign Online Handypdf

File the sc1065 and include all taxes due to the scdor by the 15th day of the third month following the end of the partnership's taxable year. A qualifying partnership is one whose owners are all: Web sc 1065 dor.sc.gov state of south carolina 2020 partnership return due by the 15th day of the third month following the close of.

2008 Form 1065 Edit, Fill, Sign Online Handypdf

Web information about form 1065, u.s. Signnow allows users to edit, sign, fill and share all type of documents online. Health care power of attorney [pdf] living will [pdf] certified copy of birth certificate [pdf] certified copy of death certificate [pdf] certified copy of marriage license [pdf] certified copy of report of divorce [pdf] child support forms. Web taxpayers whose.

2008 Form 1065 Edit, Fill, Sign Online Handypdf

Web health and human services forms and applications. Web sc 1065 dor.sc.gov state of south carolina 2020 partnership return due by the 15th day of the third month following the close of the taxable year. Web taxpayers whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically. Web information about form 1065, u.s..

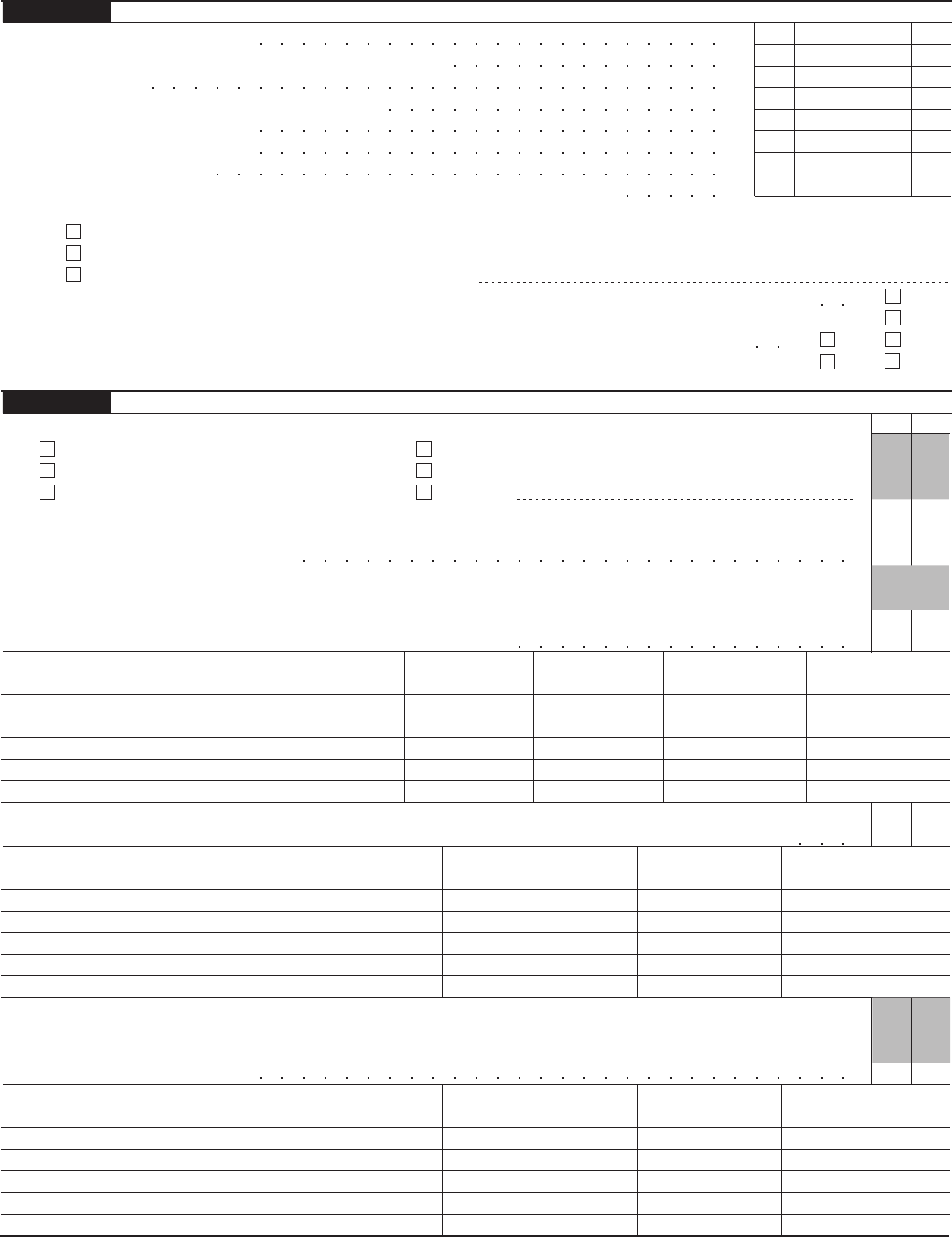

2015 Form SC SC1065 K1 Fill Online, Printable, Fillable, Blank pdfFiller

Electronic filing options > page footer content Beginning with the 2021 tax year: Signnow allows users to edit, sign, fill and share all type of documents online. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web health and human services forms and applications.

Is There A Fillable Sc1065 Form Fill Online, Printable, Fillable

Web if you file your sc1065 by paper and have a balance due, submit your payment with the return. Health care power of attorney [pdf] living will [pdf] certified copy of birth certificate [pdf] certified copy of death certificate [pdf] certified copy of marriage license [pdf] certified copy of report of divorce [pdf] child support forms. Web taxpayers whose south.

Web Health And Human Services Forms And Applications.

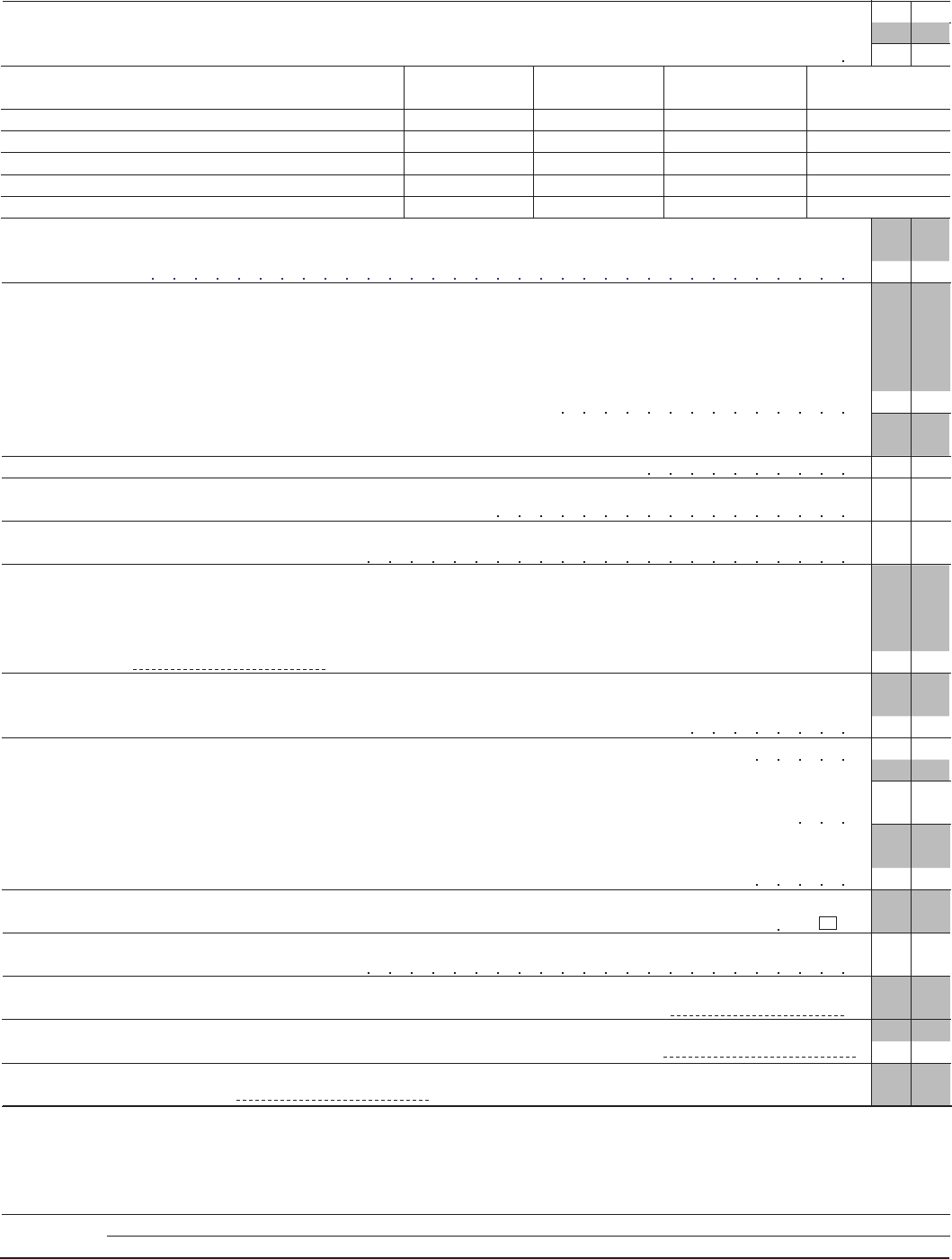

Web taxpayers whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically. File the sc1065 and include all taxes due to the scdor by the 15th day of the third month following the end of the partnership's taxable year. A qualifying partnership, including an llc taxed as a partnership, can elect to have its active trade or business income taxed at the entity level instead of the partner level. A qualifying partnership is one whose owners are all:

Return Of Partnership Income, Including Recent Updates, Related Forms And Instructions On How To File.

Web sc 1065 dor.sc.gov state of south carolina 2020 partnership return due by the 15th day of the third month following the close of the taxable year. They choose to pay their active trade or business income tax at the entity level, and. Ad irs inst 1065 & more fillable forms, register and subscribe now! Ad file partnership and llc form 1065 fed and state taxes with taxact® business.

Form 1065 Is Used To Report The Income Of Every Domestic Partnership And Every Foreign Partnership Doing Business In The U.s.

Partnerships must file a declaration of estimated tax if: They expect to owe an active trade or business income tax liability of $100 or more with the filing of their sc1065, partnership tax return. Beginning with the 2021 tax year: Electronic filing options > page footer content

7/23/14) 3087 Return Is Due On Or Before The 15Th Day Of The Fourth Month Following The Close Of The Taxable Year.

Amend your sc1065 whenever the irs adjusts your federal 1065. Web information about form 1065, u.s. Health care power of attorney [pdf] living will [pdf] certified copy of birth certificate [pdf] certified copy of death certificate [pdf] certified copy of marriage license [pdf] certified copy of report of divorce [pdf] child support forms. Find current and past year sc1065 partnership tax forms at dor.sc.gov/forms.