Should I Form An Llc For My Rental Property

Should I Form An Llc For My Rental Property - Home » articles » should i form an llc for each rental property? We’ll do the legwork so you can set aside more time & money for your real estate business. Unlock the potential of llcs for rental properties, combining partnership flexibility with corporate liability. Ad protect your personal assets with a free llc—just pay state filing fees. We make it simple to register your new llc. If you choose to make an llc for your rental property, you can lead. Web many real estate owners agree you should use an llc for a rental property. Top 5 llc creation services online (2023). We make it simple to register your new llc. File your llc paperwork in just 3 easy steps!

Ad nationwide registered agent service for all entities. Ad 2023's best llc formation services. Web should you form an llc for your rental property? Web check availability excellent contents updated july 19, 2023 · 3min read transferring cash and personal property to an llc transferring real estate to an llc. Web an llc is a limited liability company that requires at least one contributor for formal recognition. We’ll do the legwork so you can set aside more time & money for your real estate business. While there are many benefits to incorporating a formal business structure, there are also a few. If you choose to make an llc for your rental property, you can lead. Ad answer simple questions to make an llc worksheet on any device in minutes. Deciding whether to form a limited liability company (llc) for your rental property portfolio depends on various factors such as your investment goals, risk tolerance, and.

Ad protect your personal assets with a free llc—just pay state filing fees. If you choose to make an llc for your rental property, you can lead. Ad nationwide registered agent service for all entities. Web many real estate owners agree you should use an llc for a rental property. Unlock the potential of llcs for rental properties, combining partnership flexibility with corporate liability. We’ll do the legwork so you can set aside more time & money for your real estate business. Choosing the right business structure depends on your business’s unique. Ad every day, businesses across the nation choose swyft filings® to securely form their llc. Web should i form an llc for each rental property? Web check availability excellent contents updated july 19, 2023 · 3min read transferring cash and personal property to an llc transferring real estate to an llc.

Why You Should Form an LLC (Explained in 45 Seconds)

Web once you have set up an llc for your rental property, you must be careful not to commingle any of the money earned through the llc with your own personal money. Unlock the potential of llcs for rental properties, combining partnership flexibility with corporate liability. Today, learn about what an llc can and cannot be used for. File your.

Why You Should Form an LLC (Explained in 45 Seconds) Lawyers Rock

A limited liability company (llc) is the legal structure favored by. Choosing the right business structure depends on your business’s unique. File your llc paperwork in just 3 easy steps! Easily customize your llc worksheet. June 15, 2021 one of the biggest questions realwealth members ask is whether they should use an llc for their rental properties.

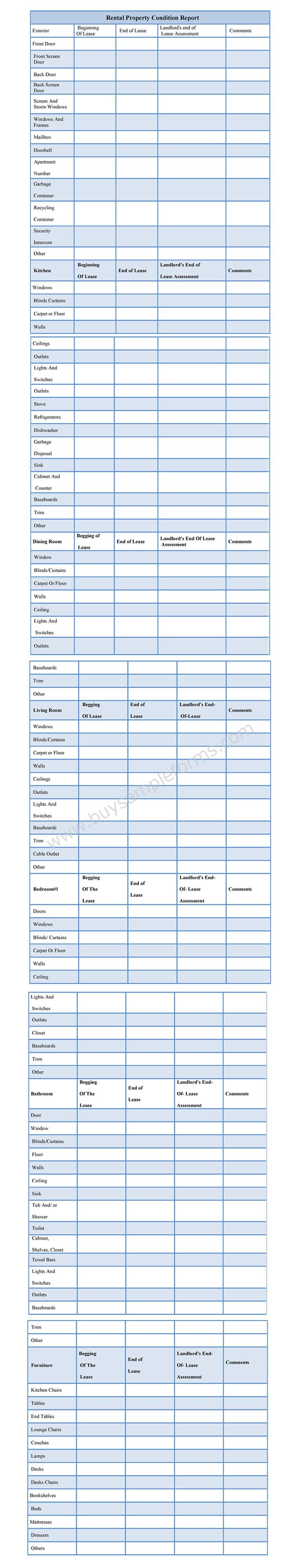

Rental Property Condition Report Form Sample Forms

Web many real estate owners agree you should use an llc for a rental property. Easily customize your llc worksheet. A limited liability company (llc) is the legal structure favored by. Ad protect your personal assets with a free llc—just pay state filing fees. Llcs rely on our registered agent service nationwide.

Should I Rent or Sell My Rental Property in Woodstock, GA?

Web if you're thinking about investing in real estate and then renting one of your properties, you should consider forming an llc or a limited liability company to hold the titles. June 15, 2021 one of the biggest questions realwealth members ask is whether they should use an llc for their rental properties. Ad every day, businesses across the nation.

Should You Create An LLC For Rental Property? Pros And Cons New Silver

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web should you form an llc for your rental property? Home » articles » should i form an llc for each rental property? Web which is better for my property rental business — an llc or sole proprietorship? File your llc paperwork in just 3.

Should I Form an LLC for Blog? (Lawyer Tips)

Today, learn about what an llc can and cannot be used for. Web if you're thinking about investing in real estate and then renting one of your properties, you should consider forming an llc or a limited liability company to hold the titles. Home » articles » should i form an llc for each rental property? Web kathy fettke last.

Should I Form An LLC? 5 Reasons Why It's A Great Idea

Ad every day, businesses across the nation choose swyft filings® to securely form their llc. Deciding whether to form a limited liability company (llc) for your rental property portfolio depends on various factors such as your investment goals, risk tolerance, and. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web owners often prefer.

How to Form a LLC (Stepbystep Guide) Community Tax

June 15, 2021 one of the biggest questions realwealth members ask is whether they should use an llc for their rental properties. Ad protect your personal assets with a free llc—just pay state filing fees. Web check availability excellent contents updated july 19, 2023 · 3min read transferring cash and personal property to an llc transferring real estate to an.

Pin on Tellus Blog

Home » articles » should i form an llc for each rental property? Web an llc is a limited liability company that requires at least one contributor for formal recognition. Unlock the potential of llcs for rental properties, combining partnership flexibility with corporate liability. Llc formation service also available If you choose to make an llc for your rental property,.

Should You Form an LLC for Your Rental Property? Tellus Talk

Choosing the right business structure depends on your business’s unique. A limited liability company (llc) is the legal structure favored by. June 15, 2021 one of the biggest questions realwealth members ask is whether they should use an llc for their rental properties. Unlock the potential of llcs for rental properties, combining partnership flexibility with corporate liability. Web should you.

Llcs Rely On Our Registered Agent Service Nationwide.

Web should i form an llc for each rental property? Ad every day, businesses across the nation choose swyft filings® to securely form their llc. If you choose to make an llc for your rental property, you can lead. Web kathy fettke last updated:

Llc Formation Service Also Available

Web once you have set up an llc for your rental property, you must be careful not to commingle any of the money earned through the llc with your own personal money. Web before continuing, keep in mind that when deciding whether to hold rental property in an llc or a trust, you may wish to speak with a financial advisor or attorney. Unlock the potential of llcs for rental properties, combining partnership flexibility with corporate liability. June 15, 2021 one of the biggest questions realwealth members ask is whether they should use an llc for their rental properties.

A Limited Liability Company (Llc) Is The Legal Structure Favored By.

Choosing the right business structure depends on your business’s unique. While there are many benefits to incorporating a formal business structure, there are also a few. Web check availability excellent contents updated july 19, 2023 · 3min read transferring cash and personal property to an llc transferring real estate to an llc. Top 5 llc creation services online (2023).

Home » Articles » Should I Form An Llc For Each Rental Property?

Hire a company to form your. File your llc paperwork in just 3 easy steps! Ad every day, businesses across the nation choose swyft filings® to securely form their llc. Today, learn about what an llc can and cannot be used for.