Simplified Tax Return Form

Simplified Tax Return Form - Web get federal tax return forms and file by mail get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Tax return for seniors 2022 department of the treasury—internal revenue service. In the given example, we obtain the simplified form by dividing the numerator and denominator by 3, the greatest number that divides. If married, the spouse must also have been. Web the tool is designed for taxpayers who were u.s. Web filing the simple tax return requires far less detailed financial information that the typical form 1040 that most americans use to file income taxes. Web for the year jan. Read the instructions to find the form that fits best. Web form 1040 is used by u.s. Web the total of the taxable parts on form 1040, line 4b.

Web how can we help you? Sign in to your account. Read the instructions to find the form that fits best. 31, 2022, or other tax year beginning , 2022, and ending , 20please type or print. File your taxes for free. Also, find mailing addresses for other returns, including. Taxpayers to file an annual income tax return. Your first name and initial. In the given example, we obtain the simplified form by dividing the numerator and denominator by 3, the greatest number that divides. Join the millions and file today!

Purpose.01 this revenue procedure provides procedures for eligible individuals who are not otherwise required to file federal income. Web the total of the taxable parts on form 1040, line 4b. Tax return for seniors 2022 department of the treasury—internal revenue service. If your adjusted gross income (agi) was $73,000 or less, review each provider’s offer to make sure you qualify. Enter the total pension or annuity payments received in 2018 on form 1040, line 4a. Web search by state and form number the mailing address to file paper individual tax returns and payments. Ad discover 2290 form due dates for heavy use vehicles placed into service. 31, 2022, or other tax year beginning , 2022, and ending , 20please type or print. Web a simple tax return uses form 1040, which only files the simplest type of tax return. File your taxes for free.

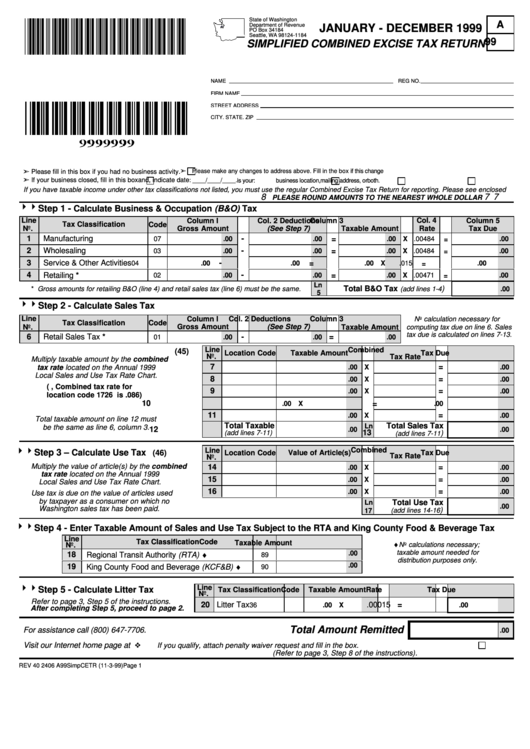

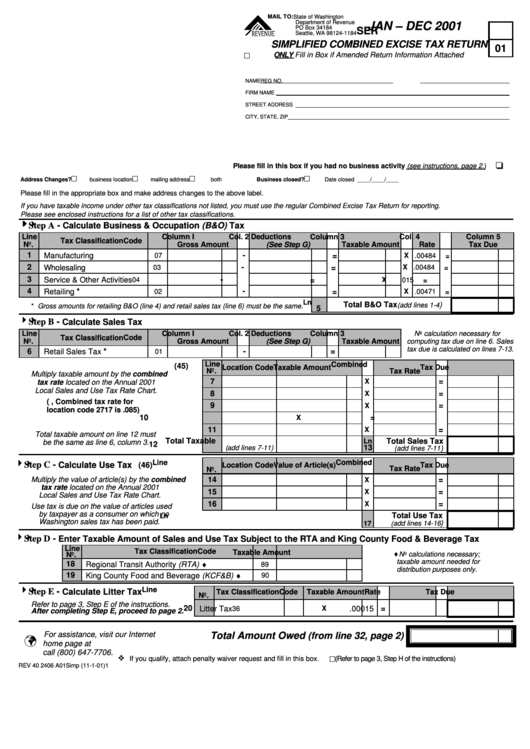

Form A99 Simplified Combined Excise Tax Return 1999 printable pdf

Taxpayers to file an annual income tax return. Citizens or resident aliens for the entire tax year for which they're inquiring. Web how can we help you? Form 1040, 1120, 941, etc. Fill out your tax forms • complete the main form and.

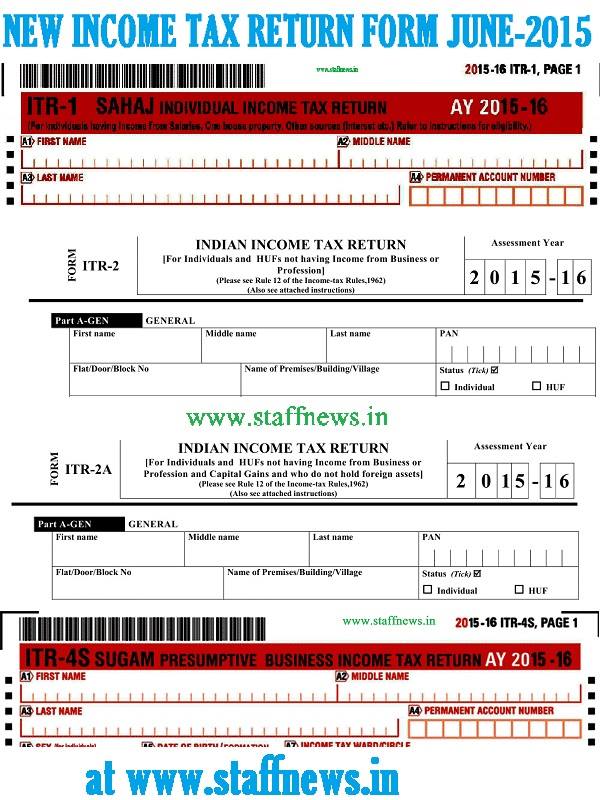

See what the new and simplified Tax Return form looks like

Tax return for seniors 2022 department of the treasury—internal revenue service. Turbotax® helps you get your tax returns done right. Form 1040, 1120, 941, etc. Purpose.01 this revenue procedure provides procedures for eligible individuals who are not otherwise required to file federal income. Join the millions and file today!

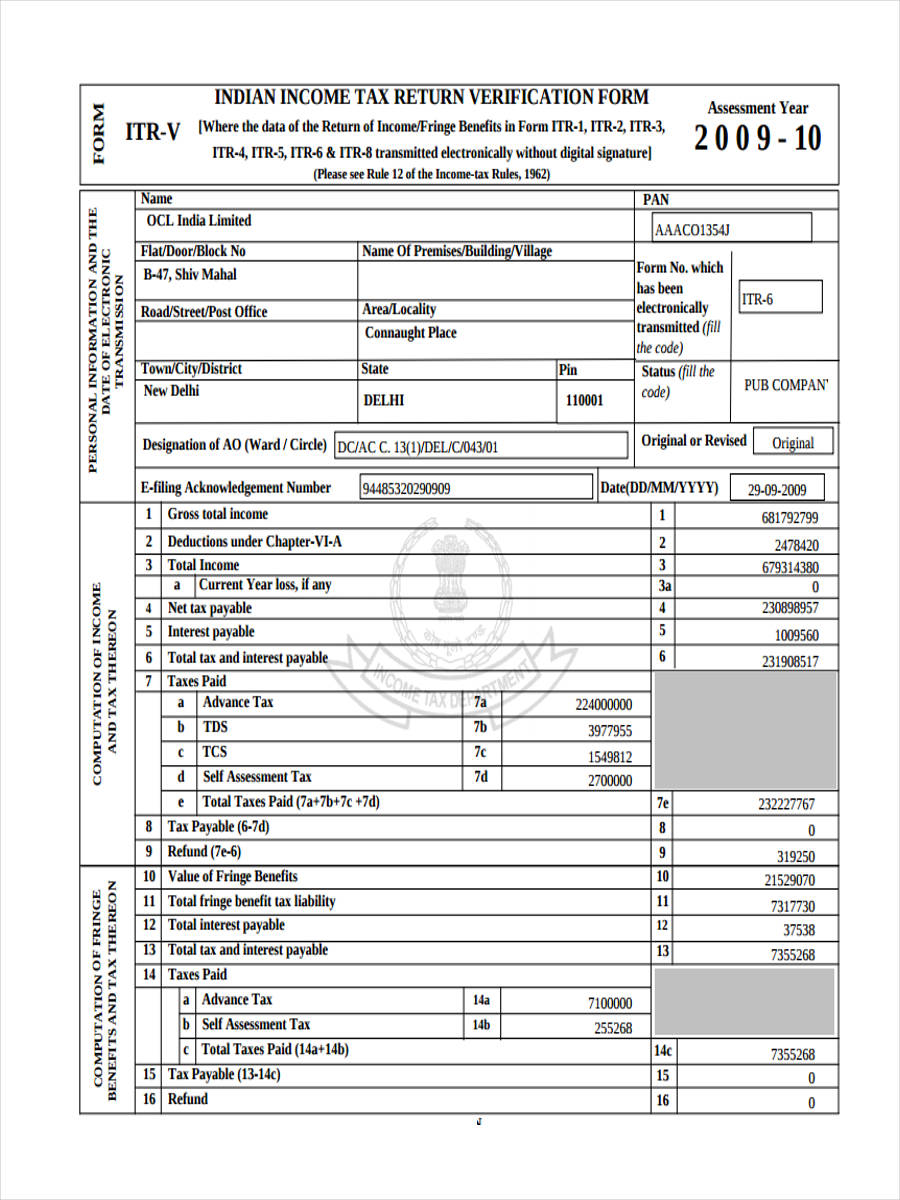

1 Page Tax Return Form BD 202122 (PDF, Excel format)

Fill out your tax forms • complete the main form and. Ad your taxes done right. File your taxes for free. Also, find mailing addresses for other returns, including. Citizens or resident aliens for the entire tax year for which they're inquiring.

1040 (2020) Internal Revenue Service

Also, find mailing addresses for other returns, including. Web the newly released 1040 form is intended to simplify the standard filing process for all households. Ad discover 2290 form due dates for heavy use vehicles placed into service. Web the tool is designed for taxpayers who were u.s. Taxpayers to file an annual income tax return.

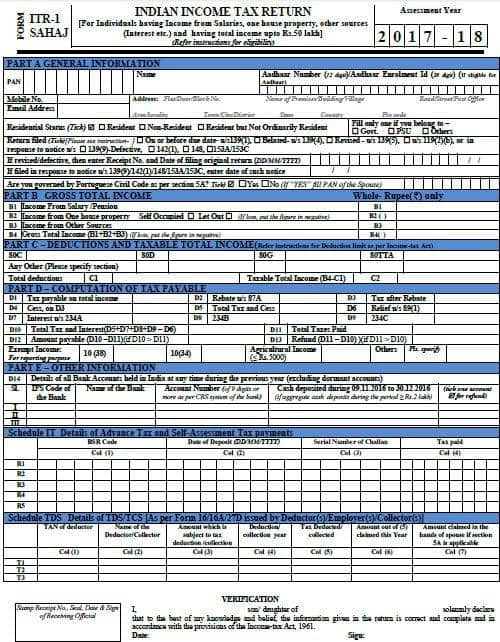

Simplified Tax Return Form Sahaj ITR1, ITR2, ITR2A & Sugam

Purpose.01 this revenue procedure provides procedures for eligible individuals who are not otherwise required to file federal income. Web a simple tax return uses form 1040, which only files the simplest type of tax return. In the given example, we obtain the simplified form by dividing the numerator and denominator by 3, the greatest number that divides. Also, find mailing.

FREE 8+ Sample Tax Verification Forms in PDF

If your adjusted gross income (agi) was $73,000 or less, review each provider’s offer to make sure you qualify. Tax return for seniors 2022 department of the treasury—internal revenue service. Select your 1040 select the form you want to file. Taxpayers to file an annual income tax return. Ad your taxes done right.

Simplified Combined Excise Tax Return Form Washington Department Of

Join the millions and file today! Ad your taxes done right. Taxpayers to file an annual income tax return. If your adjusted gross income (agi) was $73,000 or less, review each provider’s offer to make sure you qualify. Web how can we help you?

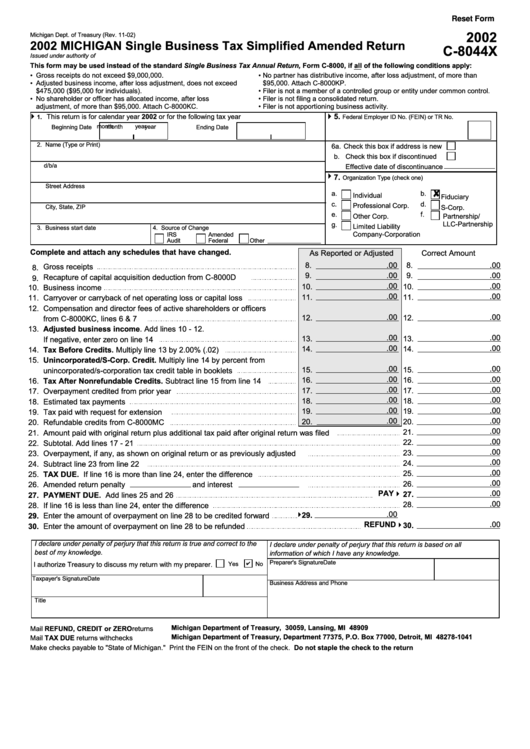

Fillable Form C8044x Single Business Tax Simplified Amended Return

Purpose.01 this revenue procedure provides procedures for eligible individuals who are not otherwise required to file federal income. Irs use only—do not write or staple in this. Web the tool is designed for taxpayers who were u.s. Web for the year jan. 31, 2022, or other tax year beginning , 2022, and ending , 20please type or print.

Simplified Tax Refund Check List

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web a simple tax return uses form 1040, which only files the simplest type of tax return. Web search by state and form number the mailing address to file paper individual tax.

Online Tax Example Of Online Tax Return Form

Purpose.01 this revenue procedure provides procedures for eligible individuals who are not otherwise required to file federal income. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web for example, 3 ⁄ 6 can be simplified as : Web a simple.

Ad Your Taxes Done Right.

Your first name and initial. Web filing the simple tax return requires far less detailed financial information that the typical form 1040 that most americans use to file income taxes. Tax return for seniors 2022 department of the treasury—internal revenue service. Taxpayers to file an annual income tax return.

Also, Find Mailing Addresses For Other Returns, Including.

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web the total of the taxable parts on form 1040, line 4b. Web for the year jan. File your taxes for free.

Read The Instructions To Find The Form That Fits Best.

Fill out your tax forms • complete the main form and. Web get federal tax return forms and file by mail get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Select your 1040 select the form you want to file. Form 1040, 1120, 941, etc.

Ad Discover 2290 Form Due Dates For Heavy Use Vehicles Placed Into Service.

Irs use only—do not write or staple in this. Web do your taxes online for free with an irs free file provider. Turbotax® helps you get your tax returns done right. If your adjusted gross income (agi) was $73,000 or less, review each provider’s offer to make sure you qualify.