Sole Proprietorship Michigan Form

Sole Proprietorship Michigan Form - A sole proprietor is someone who owns an unincorporated business by himself or herself. Web sole proprietorships, like michigan corporations, don’t have to pay these taxes as well. File for a assumed name. Web proof that the sole proprietorship is paid by the job and an irs 1099 form is given to the sole proprietorship by the general contractor at the end of the year. Web come up with a business name. Separate application forms are listed below for use to update or correct deficient forms. Web sole proprietor forms are for sole proprietors, i.e. There are also no fees involved with forming or maintaining this business type. • the name under which the sole proprietorship or partnership will do business • name and business address of the. Please see our section on choosing and checking the availability of a name for your small.

Web when it comes to being a sole proprietor in the state of michigan, there is no formal setup process. Open a business bank account. There are also no fees involved with forming or maintaining this business type. Web sole proprietorships, like michigan corporations, don’t have to pay these taxes as well. Web business taxes new business registration most commonly used forms registration forms the michigan department of treasury offers an online new business. However, you may be required to pay some taxes depending on the type of business you. Web michigan business tax registration, online & form 518 the online registration eliminates the need to complete and mail in the ‘form 518, michigan business tax registration'. This form is used to exclude certain individuals from insurance coverage as permitted by statute and is not available online. Choose a business name for your sole proprietorship and check for availability. The forms cannot be signed by owners of limited liability companies (llcs) or corporations.

Come up with a business. This process is easy, fast, secure and convenient. The forms cannot be signed by owners of limited liability companies (llcs) or corporations. Separate application forms are listed below for use to update or correct deficient forms. Web proof that the sole proprietorship is paid by the job and an irs 1099 form is given to the sole proprietorship by the general contractor at the end of the year. • the name under which the sole proprietorship or partnership will do business • name and business address of the. Again, just by taking actions that may lead to making money. Web sole proprietor forms are for sole proprietors, i.e. However, you may be required to pay some taxes depending on the type of business you. Please see our section on choosing and checking the availability of a name for your small.

Limited Company Or Sole Proprietorship? Choice Of Incorporation Top

Sole proprietorships and copartnerships file their names with the county clerk in the county in which their business is located, and also in any other county in which. However, you may be required to pay some taxes depending on the type of business you. Web the only thing you must do to start a sole proprietorship in michigan is simply.

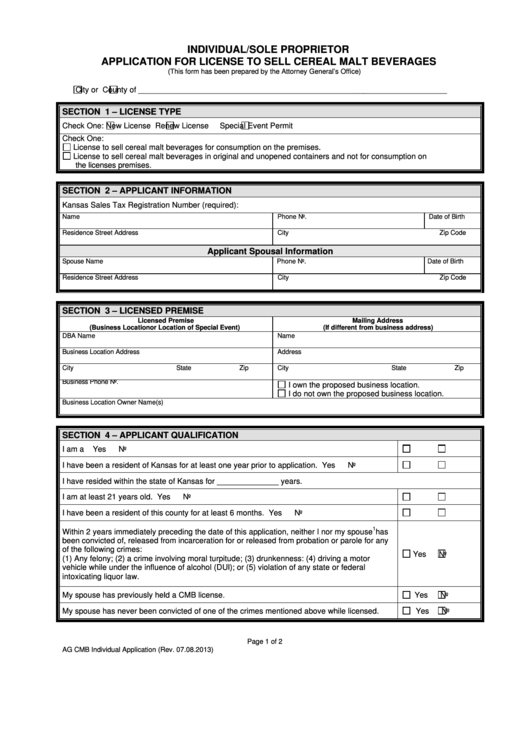

Fillable Individual/sole Proprietor Application For License To Sell

Web the michigan department of treasury offers an online new business registration process. Web come up with a business name. Separate application forms are listed below for use to update or correct deficient forms. Web sole proprietorships, like michigan corporations, don’t have to pay these taxes as well. Web sole proprietor forms are for sole proprietors, i.e.

Sole Proprietorship Advantages (Some Will Surprise You)

There are also no fees involved with forming or maintaining this business type. However, you may be required to pay some taxes depending on the type of business you. Web the michigan department of treasury offers an online new business registration process. Open a business bank account. Web when it comes to being a sole proprietor in the state of.

How to a Michigan Sole Proprietorship in 2022

The forms cannot be signed by owners of limited liability companies (llcs) or corporations. A sole proprietor is someone who owns an unincorporated business by himself or herself. Web the only thing you must do to start a sole proprietorship in michigan is simply decide to start. Again, just by taking actions that may lead to making money. Web sole.

Sole Proprietorship Definition, Advantages, Examples, Features

Again, just by taking actions that may lead to making money. Web sole proprietorships, like michigan corporations, don’t have to pay these taxes as well. Obtain business licenses and permits. Web come up with a business name. Open a business bank account.

Assumed Name Certificate Texas Sole Proprietorship Form champion

File for a assumed name. There are also no fees involved with forming or maintaining this business type. Web michigan business tax registration, online & form 518 the online registration eliminates the need to complete and mail in the ‘form 518, michigan business tax registration'. Please see our section on choosing and checking the availability of a name for your.

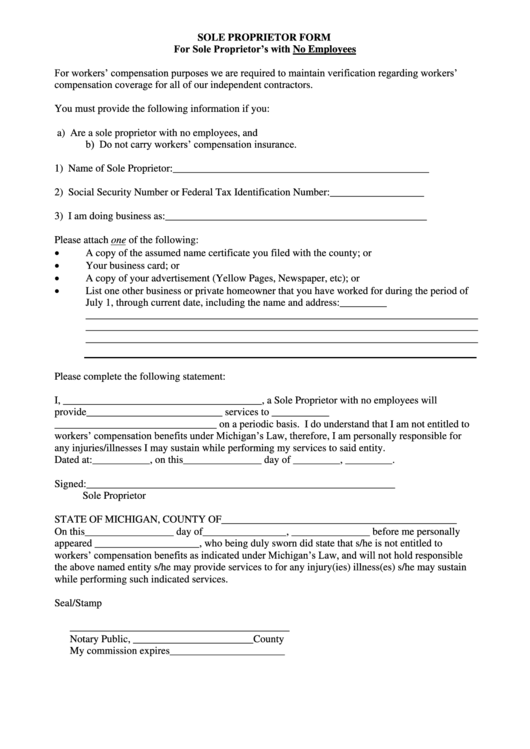

Sole Proprietor Form printable pdf download

Web sole proprietorships, like michigan corporations, don’t have to pay these taxes as well. Web sole proprietor prequalification application checklist application packet. Obtain business licenses and permits. Web when it comes to being a sole proprietor in the state of michigan, there is no formal setup process. This form is used to exclude certain individuals from insurance coverage as permitted.

Sole Proprietorship Features, Advantages, Disadvantages with Examples

Obtain business licenses and permits. Choose a business name for your sole proprietorship and check for availability. Web the only thing you must do to start a sole proprietorship in michigan is simply decide to start. Again, just by taking actions that may lead to making money. Web information to include on the form:

What is Sole Proprietorship? Explained Along With Examples

Web michigan business tax registration, online & form 518 the online registration eliminates the need to complete and mail in the ‘form 518, michigan business tax registration'. The forms cannot be signed by owners of limited liability companies (llcs) or corporations. Come up with a business. This form is used to exclude certain individuals from insurance coverage as permitted by.

Sole Proprietorship In Delhi Process Documents Require

However, if you are the sole member of a. This process is easy, fast, secure and convenient. Web come up with a business name. Separate application forms are listed below for use to update or correct deficient forms. Web sole proprietor prequalification application checklist application packet.

Come Up With A Business.

Separate application forms are listed below for use to update or correct deficient forms. Again, just by taking actions that may lead to making money. This form is used to exclude certain individuals from insurance coverage as permitted by statute and is not available online. However, if you are the sole member of a.

Web The Michigan Department Of Treasury Offers An Online New Business Registration Process.

Web come up with a business name. Web proof that the sole proprietorship is paid by the job and an irs 1099 form is given to the sole proprietorship by the general contractor at the end of the year. However, you may be required to pay some taxes depending on the type of business you. Choose a business name for your sole proprietorship and check for availability.

Web When It Comes To Being A Sole Proprietor In The State Of Michigan, There Is No Formal Setup Process.

Web sole proprietorships, like michigan corporations, don’t have to pay these taxes as well. Open a business bank account. Web the only thing you must do to start a sole proprietorship in michigan is simply decide to start. • the name under which the sole proprietorship or partnership will do business • name and business address of the.

Web Business Taxes New Business Registration Most Commonly Used Forms Registration Forms The Michigan Department Of Treasury Offers An Online New Business.

The forms cannot be signed by owners of limited liability companies (llcs) or corporations. A sole proprietor is someone who owns an unincorporated business by himself or herself. Web information to include on the form: Web sole proprietor exclusion form (for sole proprietor subcontractors without regular employees) for workers’ compensation purposes our company is required to.