Spx Options Calendar Spread

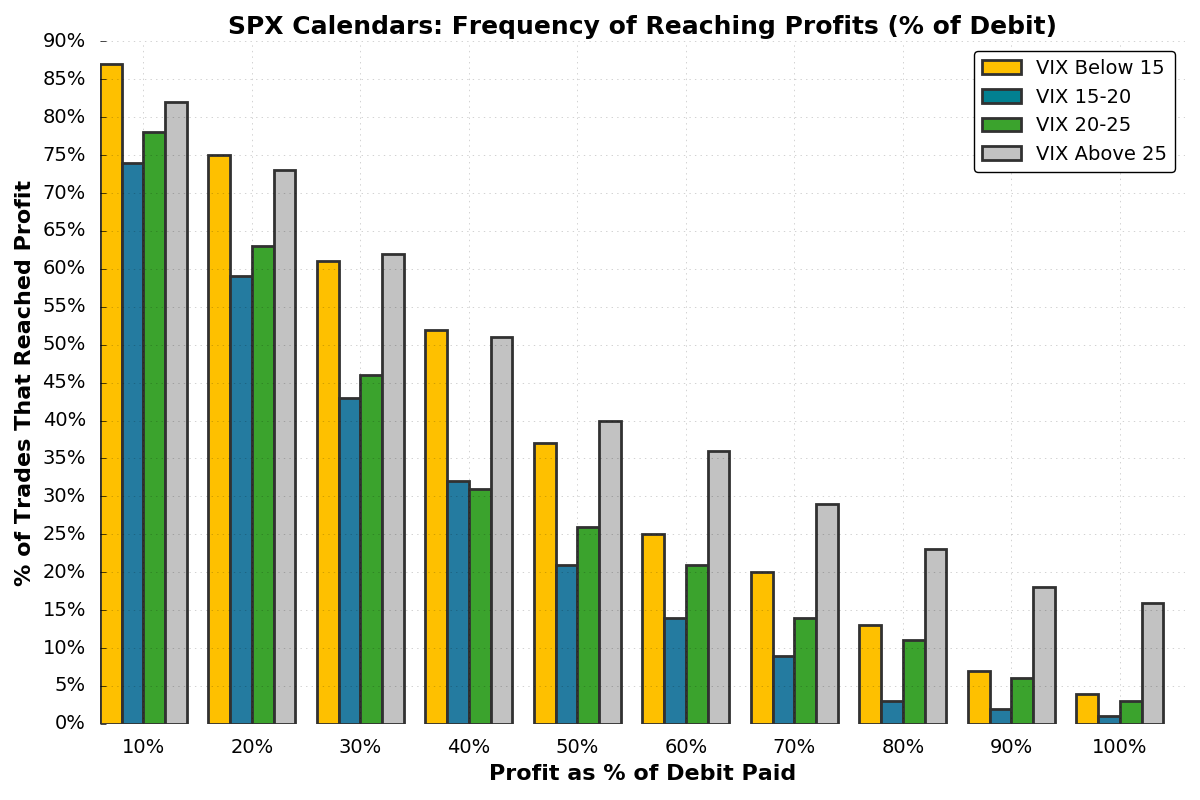

Spx Options Calendar Spread - Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index with. Web use the options expiration calendar, on marketwatch, to view options expiration. Web i trade a lot of calendar spreads, and was looking to build a trade setup using 0dte calendar spreads in spx for daily trades. Web it is a double calendar.paired with an iron condor. Calendars tend to be long vega and that can be augmented (or buffered) with a short vega iron condor. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with. Web a calendar spread, also known as a time spread, involves simultaneously buying and selling two options with the same strike price but different expiration dates. Still determining things like strikes and the dte for the. Web s&p 500 index options capture u.s. Investors will see option contracts tied to more.

Web 158 rows view the basic ^spx option chain and compare options of s&p 500 index on yahoo finance. We all would like all our trades to be winners, but we know this. Stock market exposure with ease utilizing spx suite of options with a variety of contract sizes, settlements, and expirations. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with. Web by joseph adinolfi. Experienced traders know that nothing teaches you more than losing trades. Web 1.) buying puts or calls. Web a bull call spread is used when a moderate rise in the price of the underlying asset is expected. Theta is the changes to options value with. Web the benefits of index options let you trade right up to market close on expiration day.

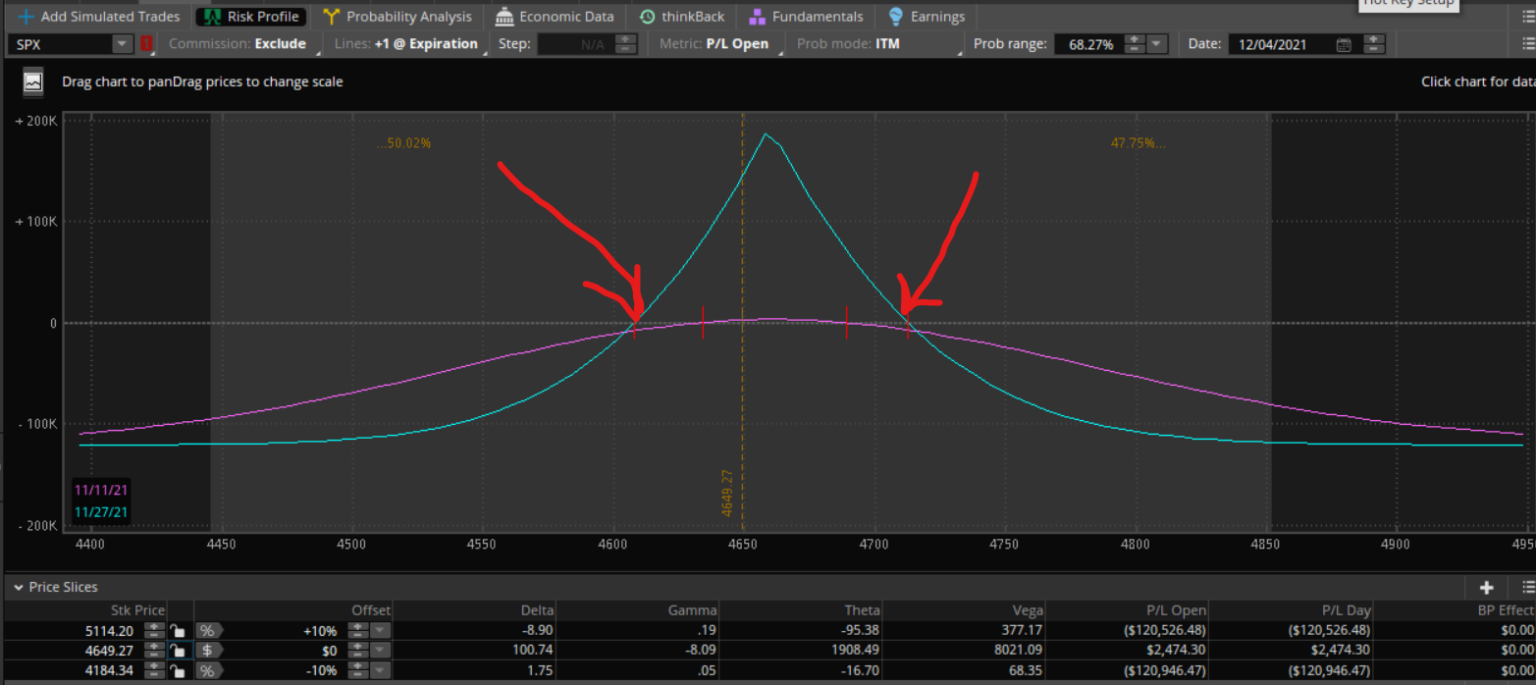

Web the benefits of index options let you trade right up to market close on expiration day. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index with. Web 1.) buying puts or calls. We seemingly have been discussing the potential outcomes for this afternoon’s. Web i trade a lot of calendar spreads, and was looking to build a trade setup using 0dte calendar spreads in spx for daily trades. Experienced traders know that nothing teaches you more than losing trades. It's not the biggest quarterly expiration on record, but it's still pretty large. Web it is a double calendar.paired with an iron condor. Theta is the changes to options value with. Web by joseph adinolfi.

How to Trade SPX Options SPX Calendar Spread Example

Still determining things like strikes and the dte for the. Web a calendar spread uses the different option expiration dates to create a difference in theta to increase our leverage. Experienced traders know that nothing teaches you more than losing trades. The maximum profit in this strategy is the difference between the strike prices. It's not the biggest quarterly expiration.

How Calendar Spreads Work (Best Explanation) projectoption

Still determining things like strikes and the dte for the. Calendars tend to be long vega and that can be augmented (or buffered) with a short vega iron condor. Web a calendar spread, also known as a time spread, involves simultaneously buying and selling two options with the same strike price but different expiration dates. The maximum profit in this.

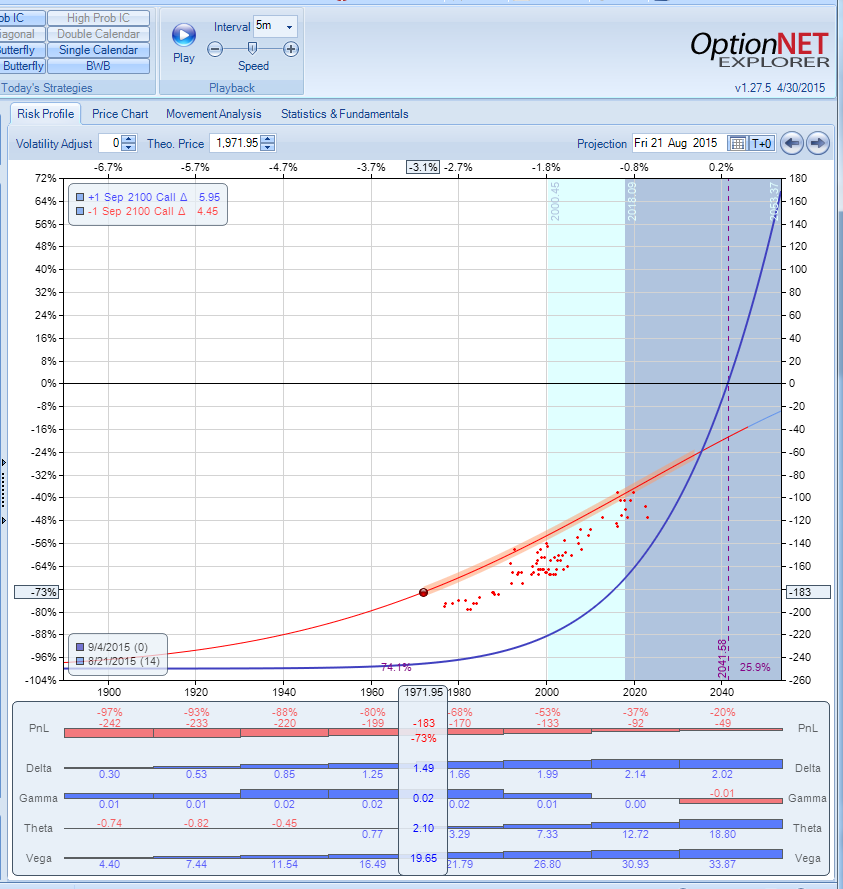

SPX Calendar Spread Calendar Spread Profit and Loss

In this post we will focus on. Still determining things like strikes and the dte for the. It's not the biggest quarterly expiration on record, but it's still pretty large. Web i trade a lot of calendar spreads, and was looking to build a trade setup using 0dte calendar spreads in spx for daily trades. Web by joseph adinolfi.

SPX Calendar Spread How I Made a 540 Profit with Options Trading

Theta is the changes to options value with. Web options market expectations from the fomc. Web a calendar spread is what we call the options trade structure where you are buying and selling the same strike option across 2 different expirations. Say you have a portfulio of several. It's not the biggest quarterly expiration on record, but it's still pretty.

Combining Calendar Spreads with Butterfly Spreads SPX Options YouTube

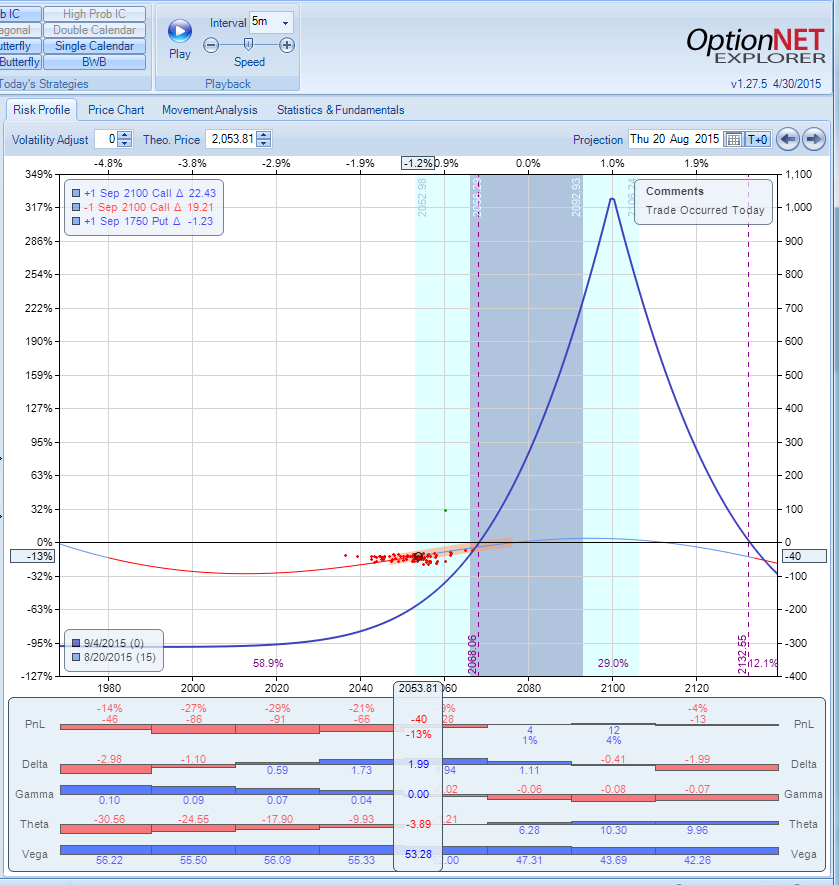

Web it is a double calendar.paired with an iron condor. Calendars tend to be long vega and that can be augmented (or buffered) with a short vega iron condor. Web i trade a lot of calendar spreads, and was looking to build a trade setup using 0dte calendar spreads in spx for daily trades. Web the benefits of index options.

SPX 15 Day Calendar Spread Calm Hedge

Web use the options expiration calendar, on marketwatch, to view options expiration. Stock market exposure with ease utilizing spx suite of options with a variety of contract sizes, settlements, and expirations. Say you have a portfulio of several. Still determining things like strikes and the dte for the. Web options market expectations from the fomc.

How to Trade SPX Options with a Small Account (Part 2) YouTube

Web 158 rows view the basic ^spx option chain and compare options of s&p 500 index on yahoo finance. Still determining things like strikes and the dte for the. Web use the options expiration calendar, on marketwatch, to view options expiration. Stock market exposure with ease utilizing spx suite of options with a variety of contract sizes, settlements, and expirations..

Calendar Call Option Spread [SPX] YouTube

Web it is a double calendar.paired with an iron condor. Investors will see option contracts tied to more. Stock market exposure with ease utilizing spx suite of options with a variety of contract sizes, settlements, and expirations. Calendars tend to be long vega and that can be augmented (or buffered) with a short vega iron condor. Web a calendar spread,.

How to Trade SPX Options SPX Calendar Spread Example

The maximum profit in this strategy is the difference between the strike prices. Investors will see option contracts tied to more. We seemingly have been discussing the potential outcomes for this afternoon’s. Web s&p 500 index options capture u.s. Web a calendar spread uses the different option expiration dates to create a difference in theta to increase our leverage.

Double Calendar Spread in SPX YouTube

It's not the biggest quarterly expiration on record, but it's still pretty large. Web a calendar spread uses the different option expiration dates to create a difference in theta to increase our leverage. Web it is a double calendar.paired with an iron condor. Web a calendar spread is what we call the options trade structure where you are buying and.

The Maximum Profit In This Strategy Is The Difference Between The Strike Prices.

Web it is a double calendar.paired with an iron condor. Web use the options expiration calendar, on marketwatch, to view options expiration. Web the benefits of index options let you trade right up to market close on expiration day. Web 1.) buying puts or calls.

Say You Have A Portfulio Of Several.

We seemingly have been discussing the potential outcomes for this afternoon’s. Web a calendar spread, also known as a time spread, involves simultaneously buying and selling two options with the same strike price but different expiration dates. It's not the biggest quarterly expiration on record, but it's still pretty large. Theta is the changes to options value with.

Web S&P 500 Index Options Capture U.s.

Web by joseph adinolfi. Web i trade a lot of calendar spreads, and was looking to build a trade setup using 0dte calendar spreads in spx for daily trades. Web a calendar spread uses the different option expiration dates to create a difference in theta to increase our leverage. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index with.

Web A Calendar Spread Is An Options Or Futures Strategy Where An Investor Simultaneously Enters Long And Short Positions On The Same Underlying Asset But With.

Web 158 rows view the basic ^spx option chain and compare options of s&p 500 index on yahoo finance. In this post we will focus on. Web options market expectations from the fomc. Investors will see option contracts tied to more.

![Calendar Call Option Spread [SPX] YouTube](https://i.ytimg.com/vi/em03gM2jnxs/maxresdefault.jpg)