Tax Form 5564

Tax Form 5564 - Web where and how to mail your federal tax return. Request for copy of tax return. If you are making a. Web sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. Web follow the simple instructions below: Web up to $40 cash back get the free irs form 5564 pdf. If you have no objections to the information on the. Individual tax return form 1040 instructions; You should determine if you agree with the proposed changes or wish to file a petition with. It’s getting down to the wire to mail in your tax returns on time.

This policy includes forms printed from. Your return must be postmarked by april 15, have the. Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of deficiency. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). If you are making a. Web you should review the complete audit report enclosed with your letter. Irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Web it indicates your consent with the proposed decrease or increase in tax payments. Checking the documents you receive from your employer,. Keeping accurate and full records.

5564 notice of deficiency waiver free ebay auction templatesvictoria secret coupons 2012 ×10. It’s getting down to the wire to mail in your tax returns on time. Web you should review the complete audit report enclosed with your letter. Web to reduce the amount of interest further, you may send a check for the tax due along with form 5564. Web up to $40 cash back get the free irs form 5564 pdf. If you are unable to pay the balance due, the irs offers. However, with our preconfigured web templates, things get simpler. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). The form is known as a notice of deficiency. If you are making a.

Tax Form 5564 Fill Online, Printable, Fillable, Blank pdfFiller

If you have no objections to the information on the. If you agree with the information on your notice,. Web what is irs form 5564? Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of deficiency. Web you do.

Contact data vehicle transportation and shipping, EURO WAYS LOGISTIC

If you have no objections to the information on the. Web sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. If you are making a. Web to reduce the amount of interest further, you may send a check for the tax due along with form 5564. Checking the documents.

Where do you mail IRS Form 5564 and a payment?

Web follow the simple instructions below: Web up to $40 cash back get the free irs form 5564 pdf. Your return must be postmarked by april 15, have the. If you have no objections to the information on the. Waiting until you get all your income statements before filing your tax return.

2011 Form CA DMV INF 40 Fill Online, Printable, Fillable, Blank pdfFiller

The form is known as a notice of deficiency. You can avoid future problems by: How to fill out form 5564. This policy includes forms printed from. However, with our preconfigured web templates, things get simpler.

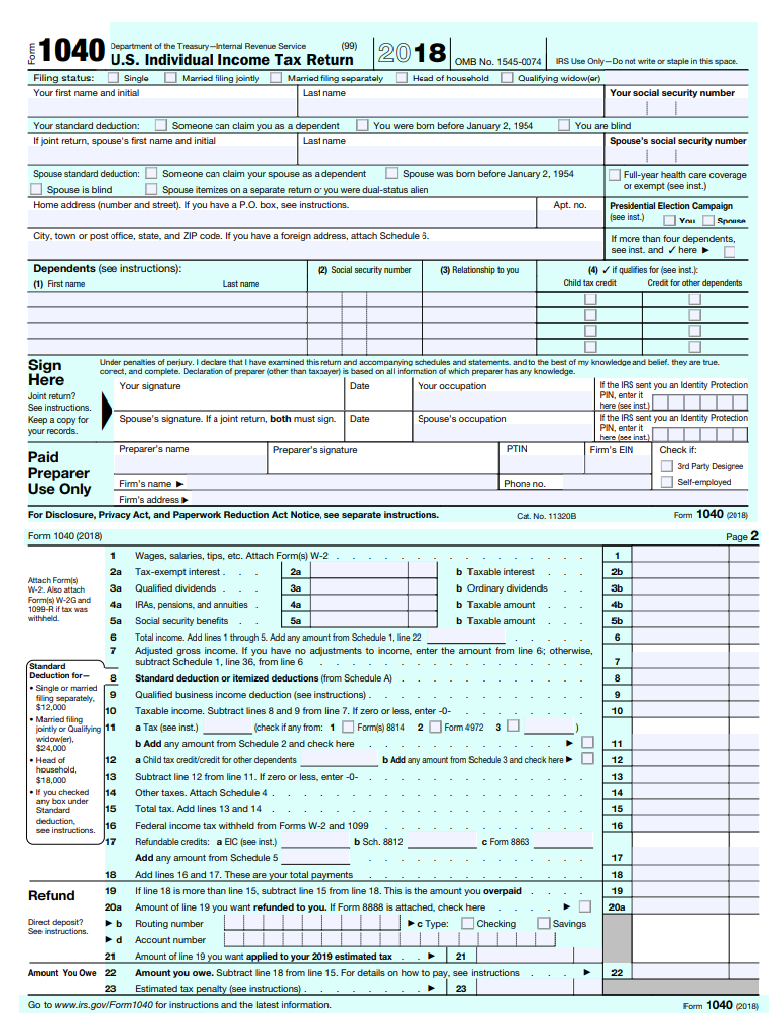

Form1040allpages PriorTax Blog

Checking the documents you receive from your employer,. You can avoid future problems by: Web up to $40 cash back get the free irs form 5564 pdf. Irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Your return must be postmarked by april 15, have the.

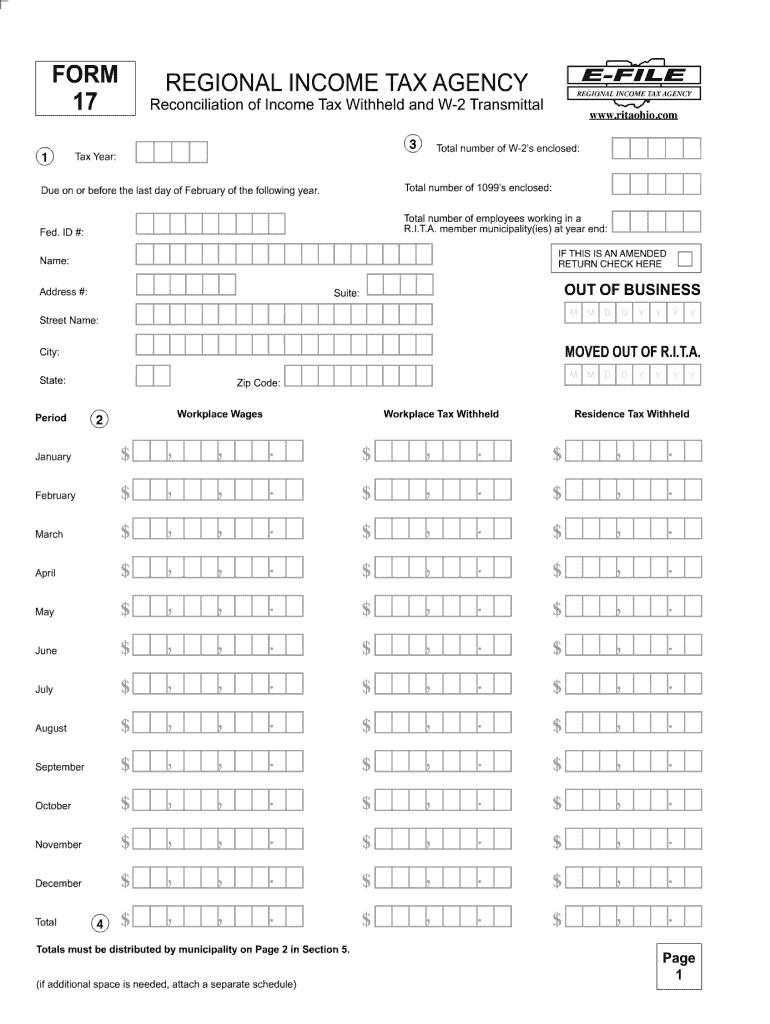

OH RITA 17 2012 Fill out Tax Template Online US Legal Forms

Irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Individual tax return form 1040 instructions; However, with our preconfigured web templates, things get simpler. Review the changes and compare them to your tax return. You should determine if you agree with the proposed changes or wish to file a petition with.

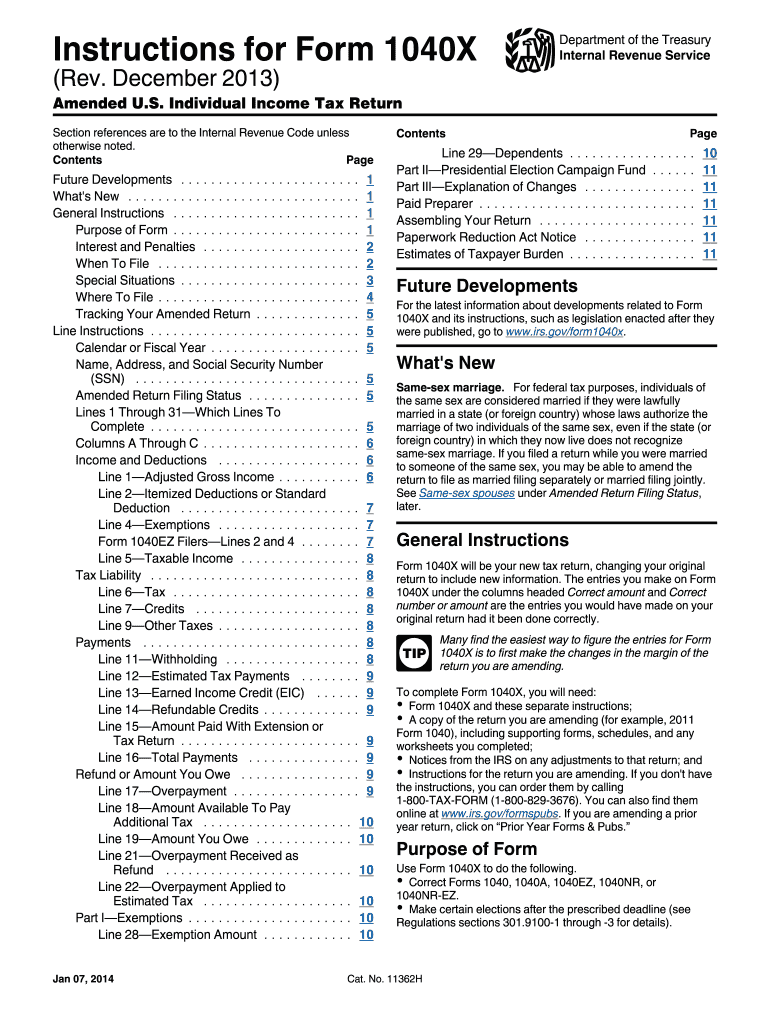

1040x Instructions Form Fill Out and Sign Printable PDF Template

Checking the documents you receive from your employer,. Web it indicates your consent with the proposed decrease or increase in tax payments. Your return must be postmarked by april 15, have the. If you are unable to pay the balance due, the irs offers. This policy includes forms printed from.

IRS Audit Letter CP3219A Sample 1

Individual tax return form 1040 instructions; Web popular forms & instructions; The form is known as a notice of deficiency. Along with notice cp3219a, you should receive form 5564. You can avoid future problems by:

FIA Historic Database

Web this letter is your notice of deficiency, as required by law. Web what is irs form 5564? Along with notice cp3219a, you should receive form 5564. If you are making a. Web to reduce the amount of interest further, you may send a check for the tax due along with form 5564.

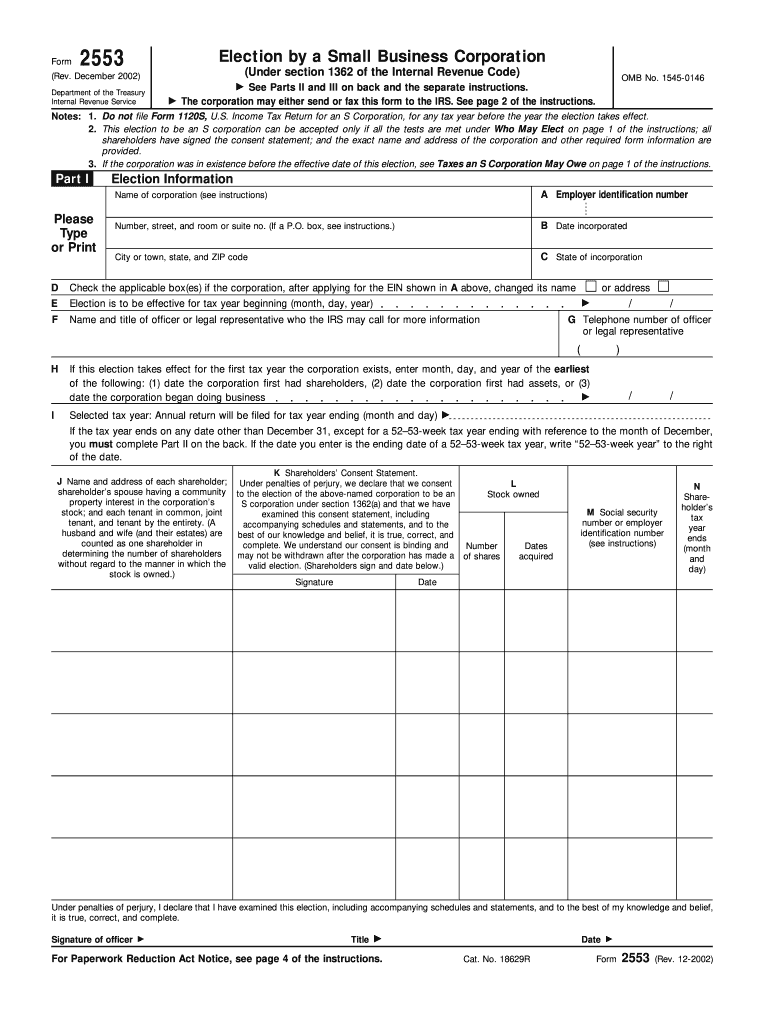

Irs Form 2553 Fill in Fill Out and Sign Printable PDF Template signNow

If you are making a. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. It’s getting down to the wire to mail in your tax returns on time. If you are unable to pay the balance due, the irs offers. You should determine if you agree with the proposed changes or wish to file a petition with.

Web It Indicates Your Consent With The Proposed Decrease Or Increase In Tax Payments.

Request for copy of tax return. Irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. If you disagree you have the right to challenge this determination in u.s. Web popular forms & instructions;

Your Return Must Be Postmarked By April 15, Have The.

Web what is irs form 5564? Web up to $40 cash back form 564 is an oklahoma sales tax return form, used by businesses to report and remit sales and use taxes collected within the state of oklahoma. Waiting until you get all your income statements before filing your tax return. It’s getting down to the wire to mail in your tax returns on time.

How To Fill Out Form 5564.

If you are unable to pay the balance due, the irs offers. Web sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. Web you should review the complete audit report enclosed with your letter. If you agree with the information on your notice,.

Web This Letter Explains The Changes And Your Right To Challenge The Increase In Tax Court.

You should determine if you agree with the proposed changes or wish to file a petition with. Checking the documents you receive from your employer,. Web to reduce the amount of interest further, you may send a check for the tax due along with form 5564. Web form 4506 (novmeber 2021) department of the treasury internal revenue service.