Texas Sales Tax Calendar

Texas Sales Tax Calendar - Do you need to collect and remit sales tax in texas? Web in 2024, the texas sales tax holidays will be held on the following dates: Web your texas sales tax filing frequency & due dates. As a business operating in texas, it’s important to know the specific sales tax rate for the areas you operate in. Filing your texas sales tax returns online Web our free online guide for business owners covers texas sales tax registration,. File a sales tax return. Web businesses that cross the texas economic nexus threshold must register. Web the state sales tax in texas is 6.25%. When it comes time to file sales tax in texas you must do three things:

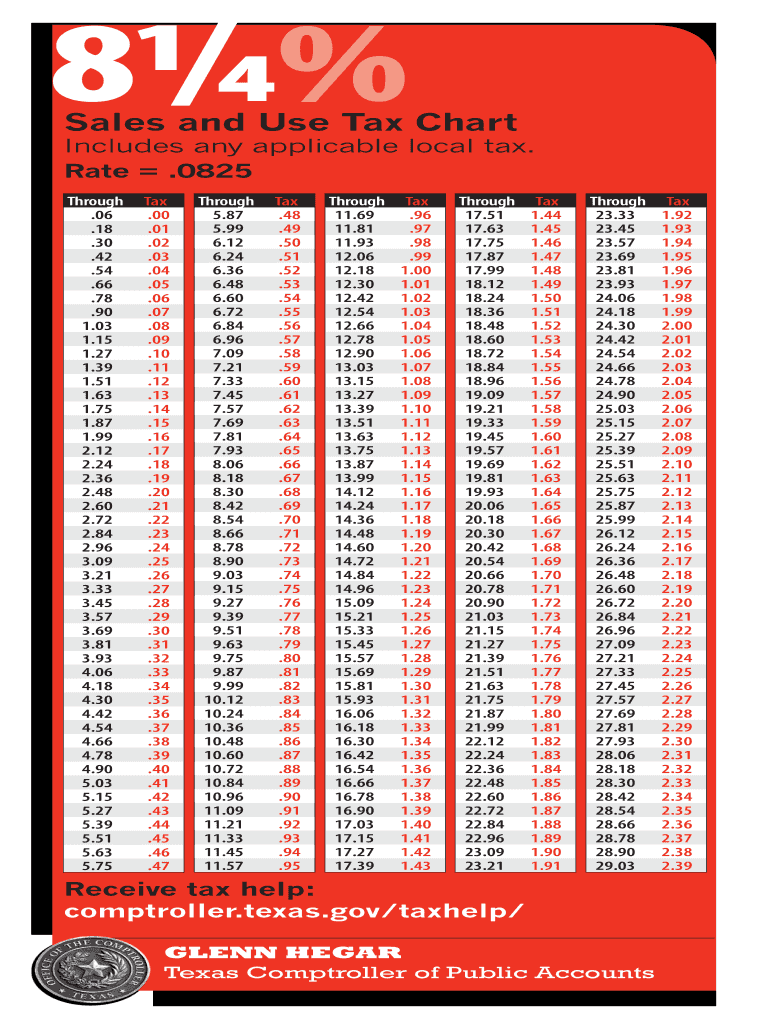

Top where to file your texas sales tax return: Filing your texas sales tax returns online Your business's sales tax return must be filed by the 20th of the month following reporting period. Calculate how much sales tax you owe; Web texas sales tax returns are always due the 20th of the month following the reporting period. List of sales tax holidays. Local tax can’t exceed 2%, which. Web texas sales and use tax faqs about prepayment discounts, extensions and amendments. However, these rates increase to 8.25% in almost every texas jurisdiction as cities, counties, special districts, and transit authorities can each impose up to a 2% sales tax. Sales tax on cars & vehicles.

Your business's sales tax return must be filed by the 20th of the month following reporting period. Web your texas sales tax filing frequency & due dates. Web in 2024, the texas sales tax holidays will be held on the following dates: Web texas sales tax returns are always due the 20th of the month following the reporting period. Sales tax on cars & vehicles. Top where to file your texas sales tax return: Web do i need to be collecting texas sales tax? However, these rates increase to 8.25% in almost every texas jurisdiction as cities, counties, special districts, and transit authorities can each impose up to a 2% sales tax. Contact the department of revenue. Web texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and.

Sales Tax Calculator 2024 Texas Chere Deeanne

Web our free online guide for business owners covers texas sales tax registration,. Web texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and. Web businesses that cross the texas economic nexus threshold must register. Due dates on this chart are adjusted for saturdays, sundays and 2024 federal legal holidays. When it comes time.

Ultimate Texas Sales Tax Guide Zamp

Texas' sales tax by the numbers: Web our free online guide for business owners covers texas sales tax registration,. For applicable taxes, quarterly reports are due in april, july, october and january. Web the sales tax rate for texas sales is 6.25 percent for 2022. Web the state sales tax in texas is 6.25%.

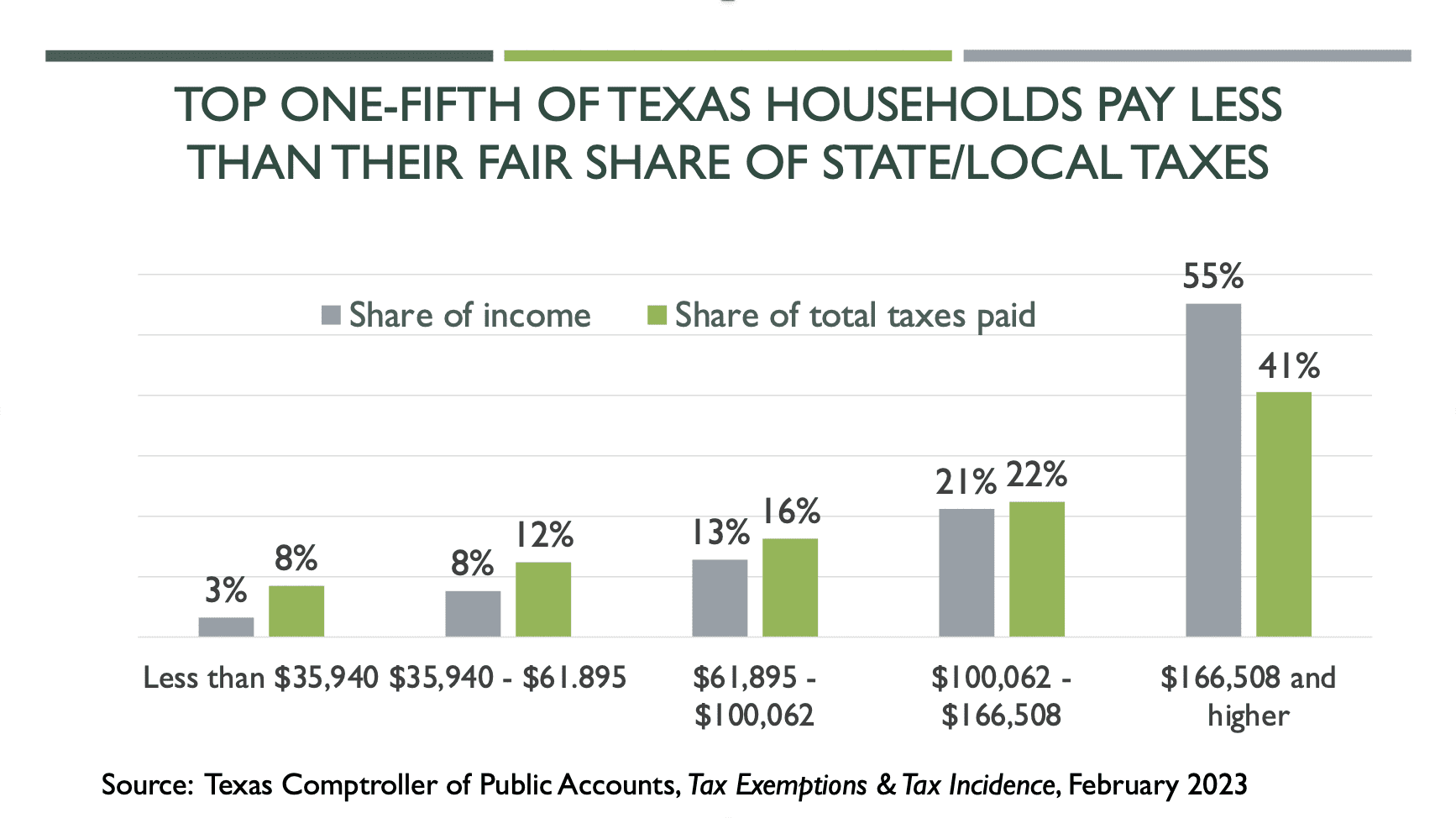

Who Pays Texas Taxes? (2023) Every Texan

Top where to file your texas sales tax return: Web the state sales tax in texas is 6.25%. Web calendar of texas sales tax filing dates. Web your texas sales tax filing frequency & due dates. Web texas sales and use tax faqs about prepayment discounts, extensions and amendments.

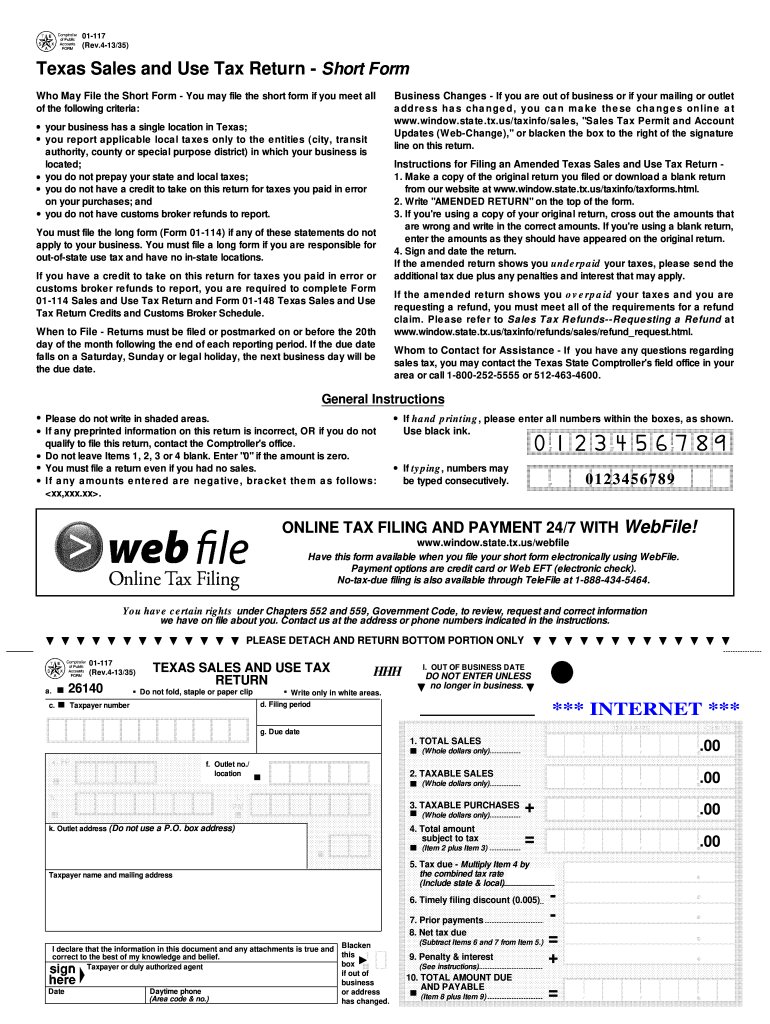

TX Sales Tax Return Monthly Form Denver City & County Fill out Tax

Filing your texas sales tax returns online Web view our complete guide to texas sales tax, with information about texas sales tax. Calculate how much sales tax you owe; Due dates on this chart are adjusted for saturdays, sundays and 2024 federal legal holidays. Web your texas sales tax filing frequency & due dates.

Texas Tax Rate 20152024 Form Fill Out and Sign Printable PDF

Sales tax on cars & vehicles. However, these rates increase to 8.25% in almost every texas jurisdiction as cities, counties, special districts, and transit authorities can each impose up to a 2% sales tax. List of sales tax holidays. Web in 2024, the texas sales tax holidays will be held on the following dates: In the tabs below, discover new.

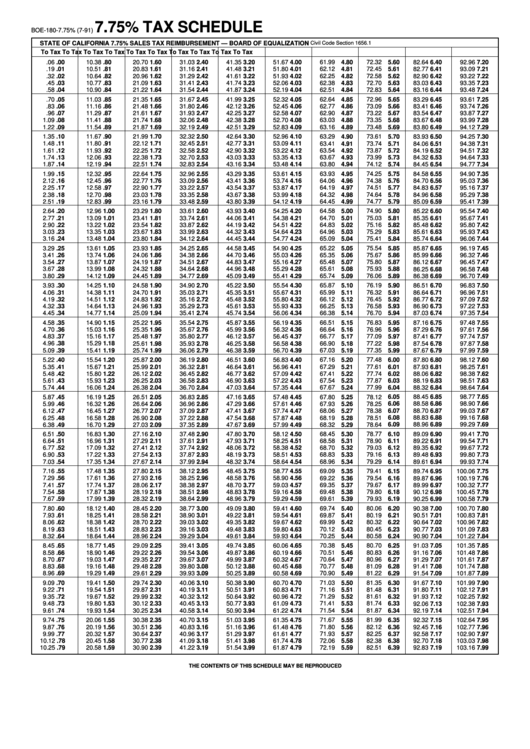

Printable Sales Tax Chart A Visual Reference of Charts Chart Master

In the tabs below, discover new map and. When it comes time to file sales tax in texas you must do three things: For applicable taxes, quarterly reports are due in april, july, october and january. Web 2024 reporting due dates for taxes, fees and reports. State sales tax rate table.

Texas Sales Tax Chart

Due dates on this chart are adjusted for saturdays, sundays and 2024 federal legal holidays. Calculate how much sales tax you owe; Contact the department of revenue. Web view our complete guide to texas sales tax, with information about texas sales tax. Filing your texas sales tax returns online

Texas State Sales Tax 2024 Kathe Maurine

File a sales tax return. Sales tax on cars & vehicles. If the filing due date falls on a weekend or holiday, sales tax is generally due the next business day. Filing your texas sales tax returns online Do you need to collect and remit sales tax in texas?

Texas Sales Use Tax 20192024 Form Fill Out and Sign Printable PDF

How to file and pay sales tax in texas in 2024. Depending on the volume of sales taxes you. Web our free online guide for business owners covers texas sales tax registration,. Web view our complete guide to texas sales tax, with information about texas sales tax. Top where to file your texas sales tax return:

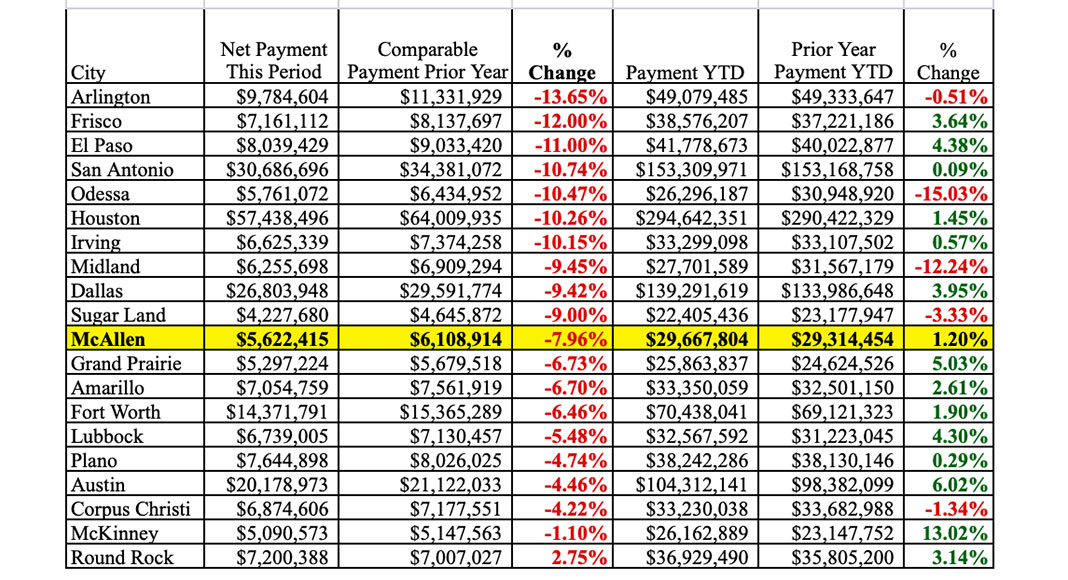

May 2020 Sales Tax Info Texas Border Business

Local tax can’t exceed 2%, which. Web do i need to be collecting texas sales tax? In the tabs below, discover new map and. Depending on the volume of sales taxes you. Web texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and.

If The Filing Due Date Falls On A Weekend Or Holiday, Sales Tax Is Generally Due The Next Business Day.

Web our free online guide for business owners covers texas sales tax registration,. Depending on the volume of sales taxes you. Web texas sales tax returns are always due the 20th of the month following the reporting period. Web in 2024, the texas sales tax holidays will be held on the following dates:

Web Texas Imposes A 6.25 Percent State Sales And Use Tax On All Retail Sales, Leases And.

How to file and pay sales tax in texas in 2024. Calculate how much sales tax you owe; Web the state sales tax in texas is 6.25%. There are two types of sales tax designations in texas:

However, These Rates Increase To 8.25% In Almost Every Texas Jurisdiction As Cities, Counties, Special Districts, And Transit Authorities Can Each Impose Up To A 2% Sales Tax.

Web your texas sales tax filing frequency & due dates. Web 2024 reporting due dates for taxes, fees and reports. When it comes time to file sales tax in texas you must do three things: Do you need to collect and remit sales tax in texas?

As A Business Operating In Texas, It’s Important To Know The Specific Sales Tax Rate For The Areas You Operate In.

Web a sales tax holiday is an annual event during which the texas comptroller of public. Web calendar of texas sales tax filing dates. State sales tax rate table. Web the sales tax rate for texas sales is 6.25 percent for 2022.