Transfer On Death Deed California Form

Transfer On Death Deed California Form - Web transfer on death deed i/we, (owner/owners), hereby convey to (grantee beneficiary), effective on my/our death the following described real property: Web effective january 1, 2022 by california senate bill 315 a revocation of a revocable transfer on death deed shall be signed by two persons who are both present at the. Web for a complete list, see california probate code section 13050. If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer. This document is exempt from. The following must be submitted: Web this revocation form only affects a transfer on death deed that you made. This document is exempt from documentary. A revocable transfer on death deed shall be substantially in the following form. Web revocable transfer on death (tod) deed (california probate code section 5642) assessor’s parcel number:

Web you must send a “notice of revocable transfer on death deed” to all legal heirs. Web this revocation form only affects a transfer on death deed that you made. Drawing up this template will cost you. Upload, modify or create forms. The transfer on death deed is considered a nonprobate method for transferring property to a named beneficiary. Property in living trusts can be transferred without going to. Web use this deed to transfer the residential property described below directly to your named beneficiaries when you die. This document is exempt from documentary. Ad ca revocable tod deed & more fillable forms, register and subscribe now! Web revocable transfer on death (tod) deed (california probate code section 5642) assessor’s parcel number:

(a) the first page of the form. Web transfer of ownership to beneficiary—upon the death of the registered owner, ownership may be transferred to the tod beneficiary. Web you must send a “notice of revocable transfer on death deed” to all legal heirs. Try it for free now! The following must be submitted: Web revocable transfer on death (tod) deed (california probate code section 5642) assessor’s parcel number: You must include a copy of the recorded transfer on death deed and of the death certificate. This document is exempt from documentary. If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer. (a) this part applies to a revocable transfer on death deed made by a transferor who dies on or after january 1, 2016, whether the deed was executed or recorded before, on,.

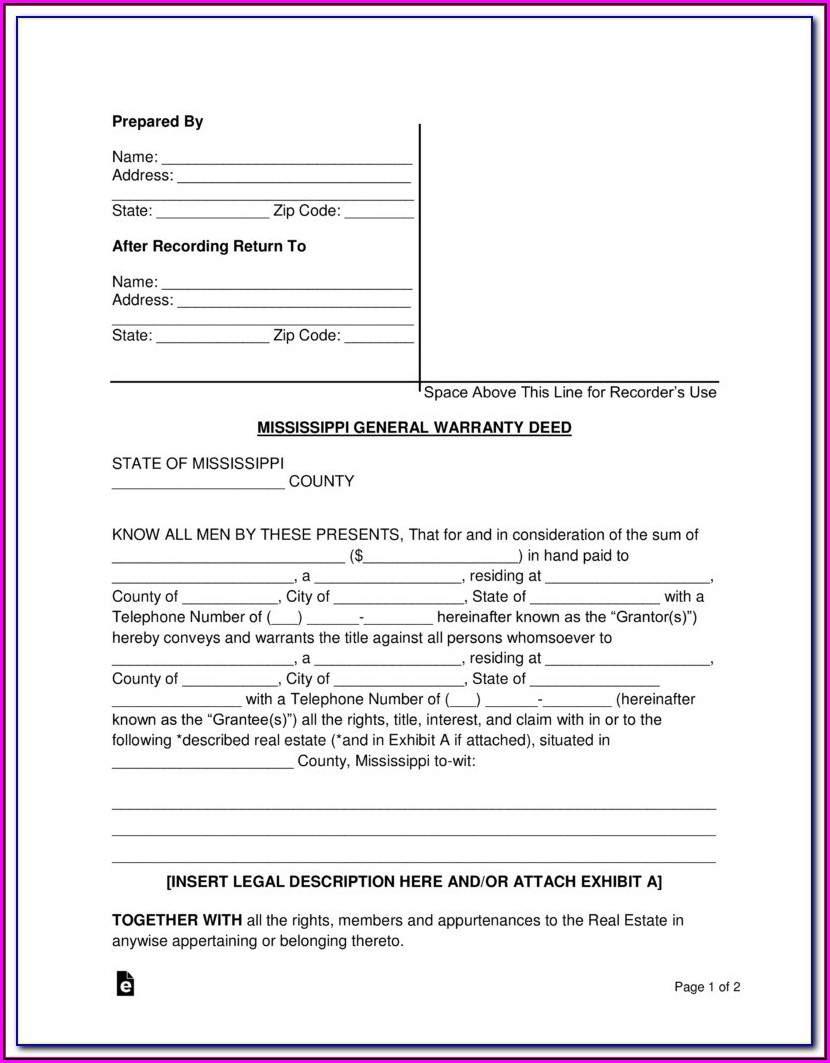

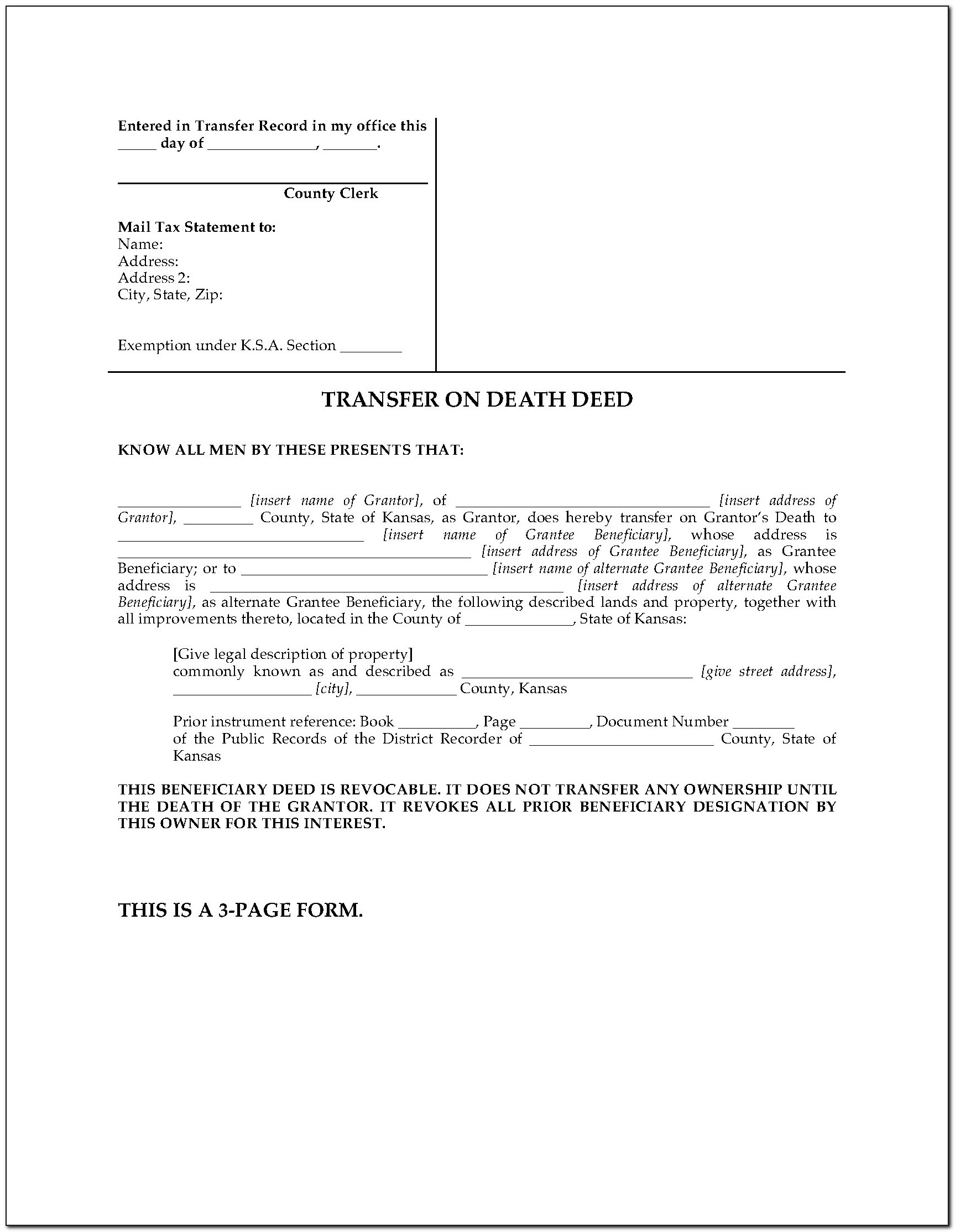

Nebraska Transfer On Death Deed Form Form Resume Examples gzOeVpMkWq

Web transfer of ownership to beneficiary—upon the death of the registered owner, ownership may be transferred to the tod beneficiary. Web this revocation form only affects a transfer on death deed that you made. Web a california tod deed is a legal document that conveys real estate to a designated beneficiary when the current owner dies. Web use this deed.

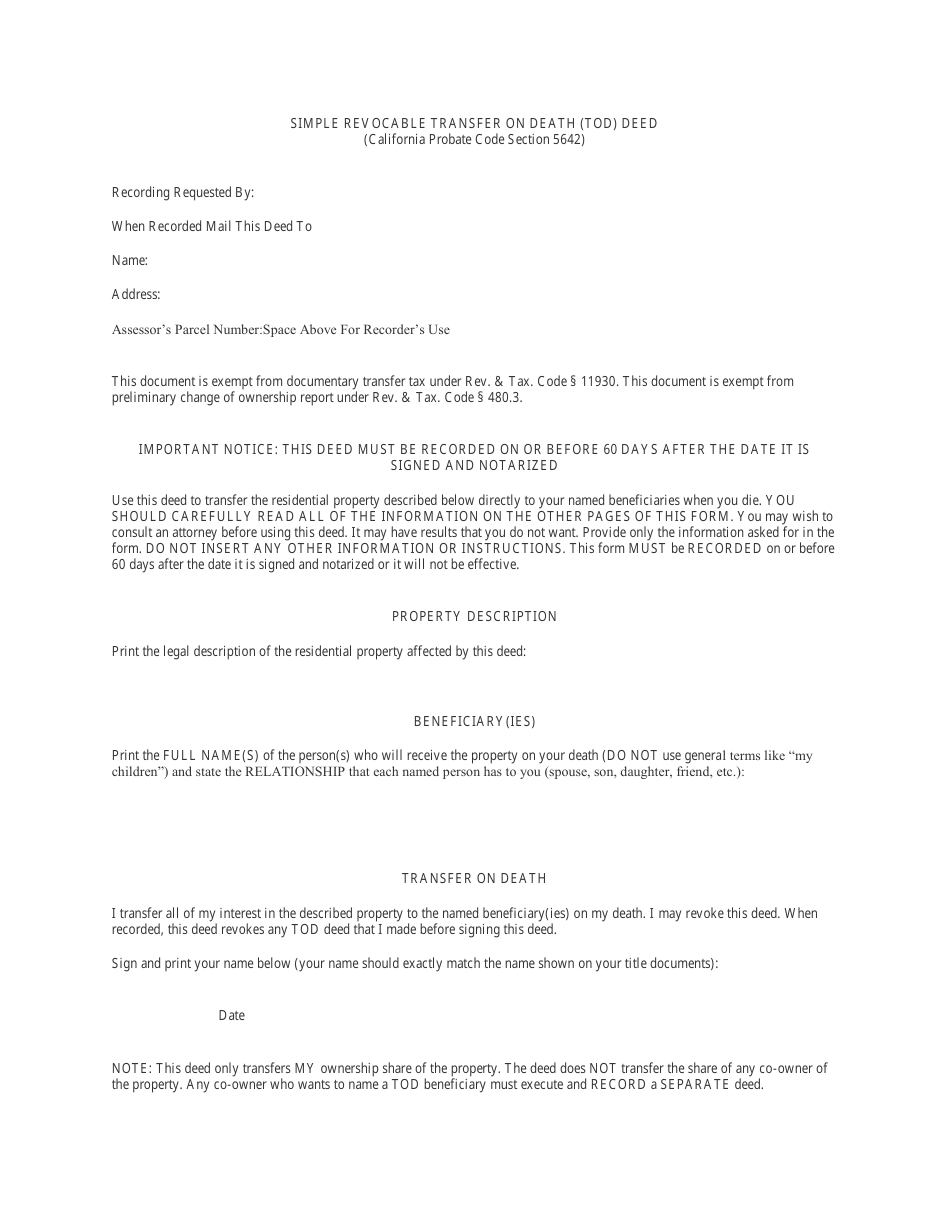

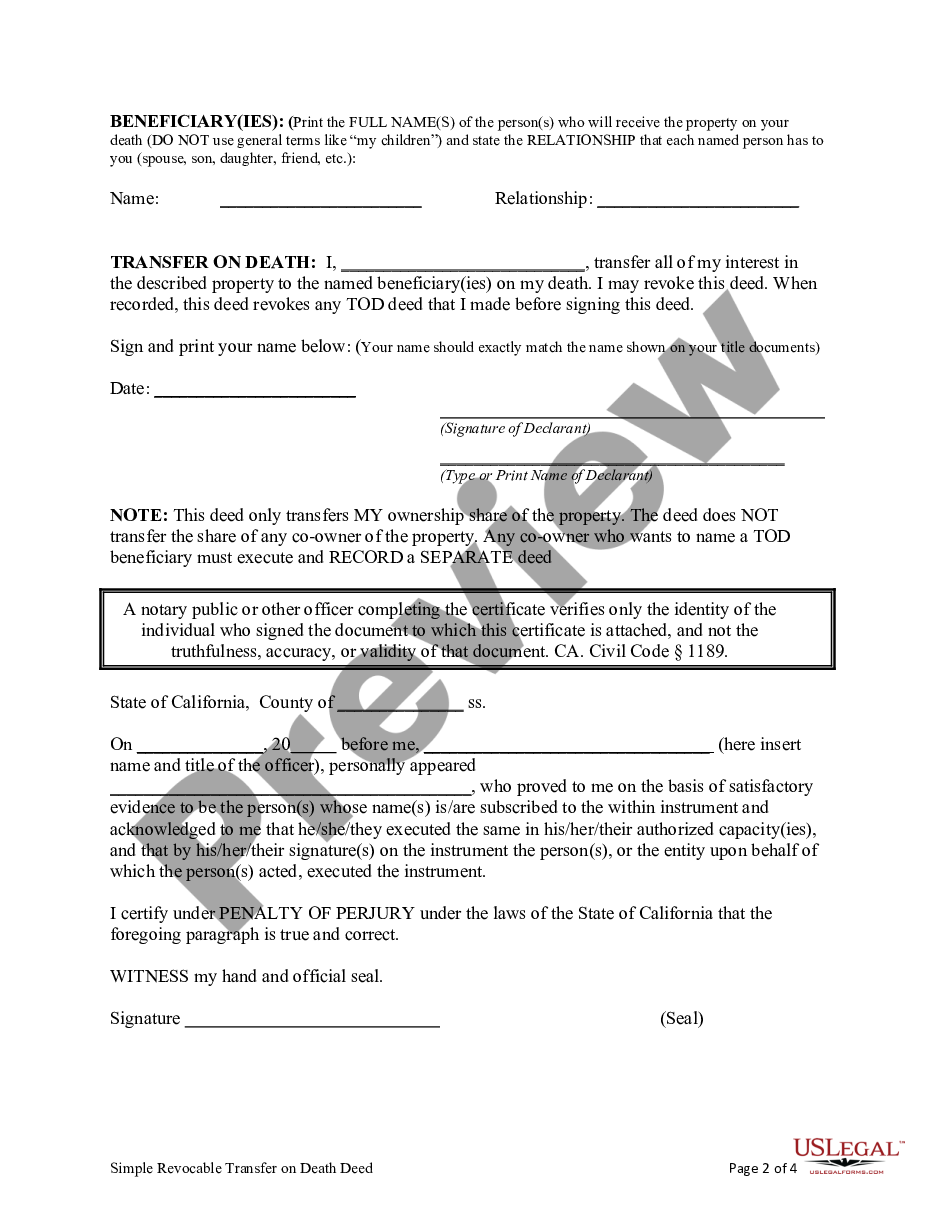

California Simple Revocable Transfer on Death Deed Form Download

Web a california tod deed is a legal document that conveys real estate to a designated beneficiary when the current owner dies. Web this revocation form only affects a transfer on death deed that you made. Web use this deed to transfer the residential property described below directly to your named beneficiaries when you die. This document is exempt from..

Free Printable Beneficiary Deed Free Printable

This document is exempt from documentary. Ca prob code § 5642 (2020) 5642. Try it for free now! (a) the first page of the form. Property in living trusts can be transferred without going to.

Free Oregon Transfer On Death Deed Form Form Resume Examples

Ad ca revocable tod deed & more fillable forms, register and subscribe now! Web revocable transfer on death (tod) deed (california probate code section 5642) this document is exempt from documentary transfer tax under revenue &. If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer. Web simple.

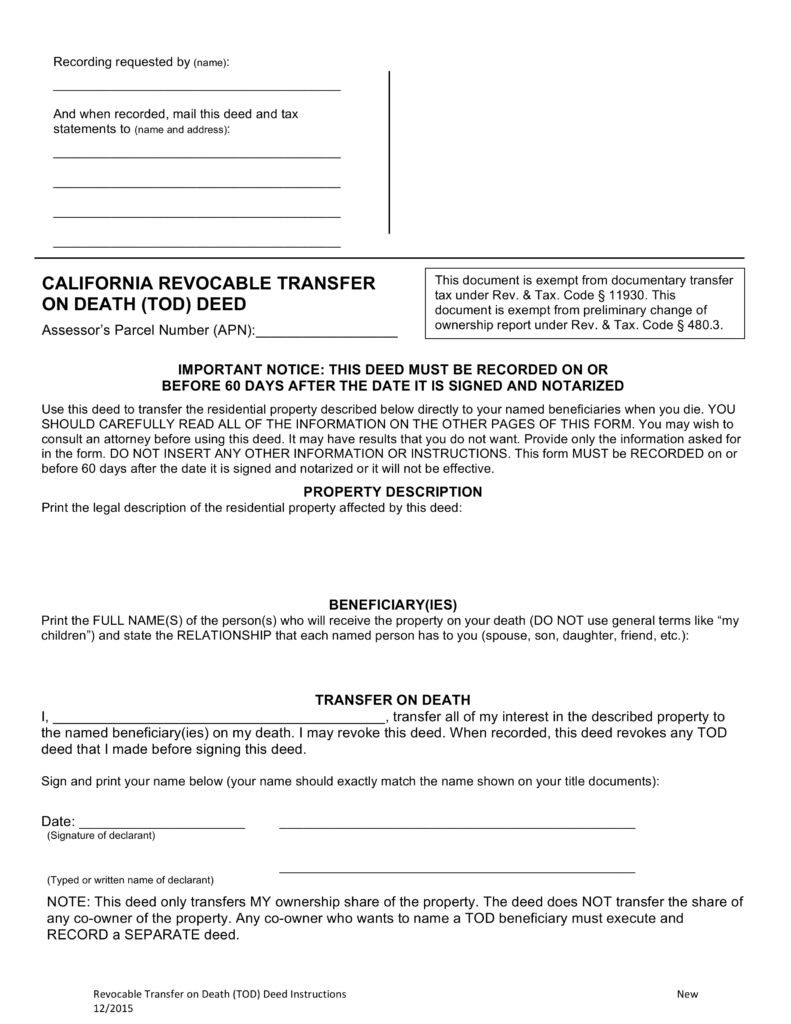

California Revocable Transfer on Death Deed Individual to Individual

Ca prob code § 5642 (2020) 5642. Try it for free now! You should carefully read all of the. The transfer on death deed is considered a nonprobate method for transferring property to a named beneficiary. Web you must send a “notice of revocable transfer on death deed” to all legal heirs.

CA Simple Revocable TOD Deed Complete Legal Document Online US

Web use this deed to transfer the residential property described below directly to your named beneficiaries when you die. Upload, modify or create forms. If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer. Web for a complete list, see california probate code section 13050. Ad answer simple.

Free Arizona Transfer On Death Deed Form Form Resume Examples

If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer. Web for a complete list, see california probate code section 13050. Ad answer simple questions to make a transfer on death deed on any device in minutes. The following must be submitted: There are several conditions governing the.

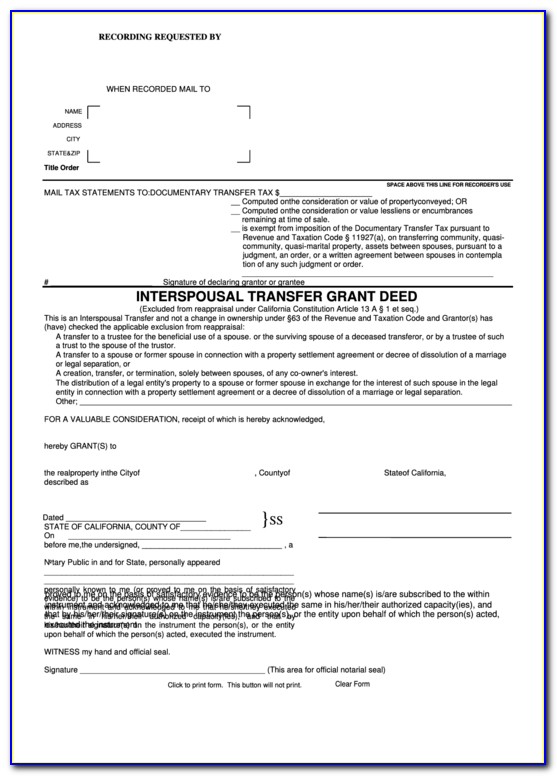

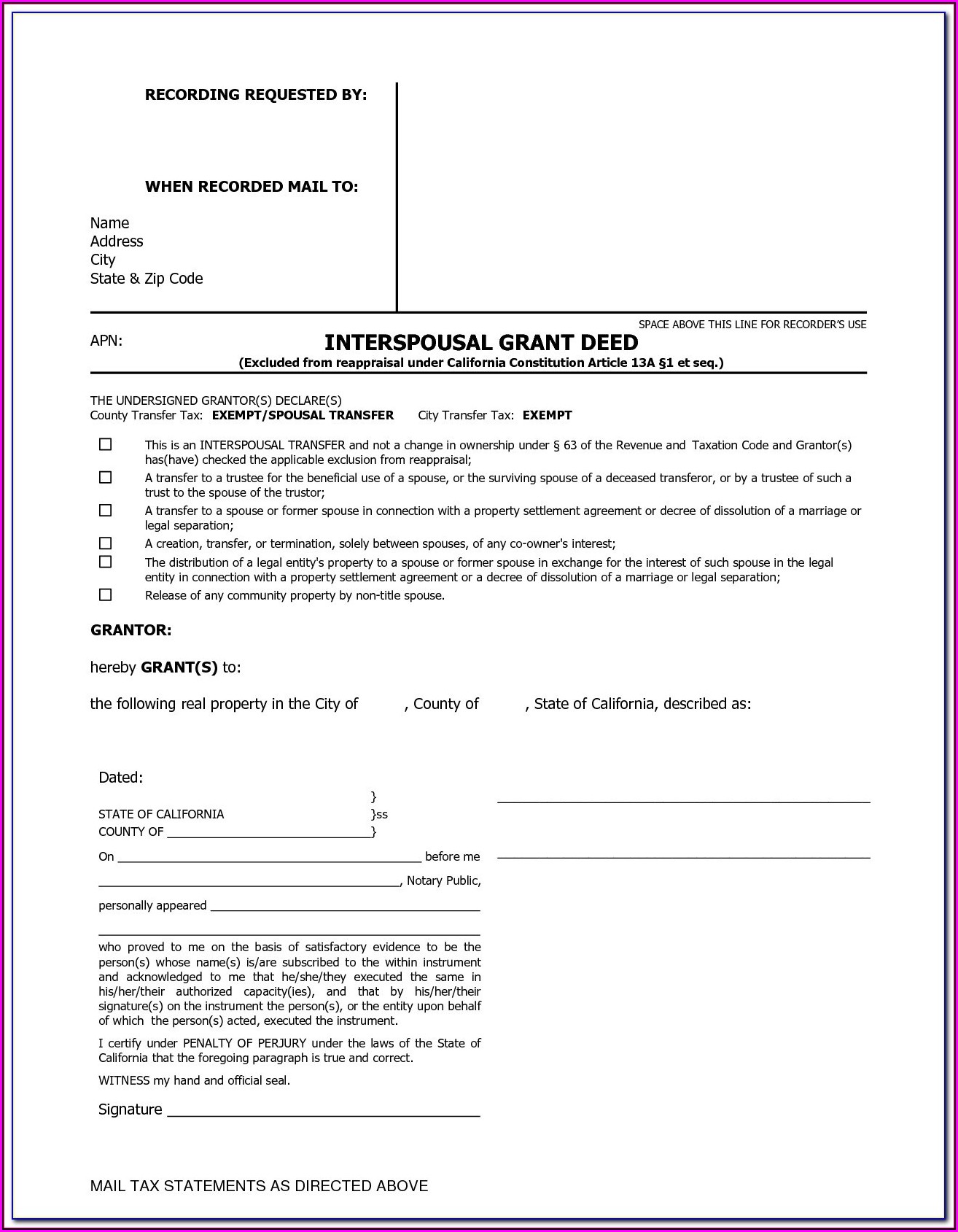

Free Interspousal Transfer Deed California Form Form Resume

This document is exempt from. Ca prob code § 5642 (2020) 5642. Easily customize your transfer on death deed. Web you must send a “notice of revocable transfer on death deed” to all legal heirs. The transfer on death deed is considered a nonprobate method for transferring property to a named beneficiary.

Transfer On Death Deed Form Colorado Form Resume Examples 12O8v3gDr8

Web effective january 1, 2022 by california senate bill 315 a revocation of a revocable transfer on death deed shall be signed by two persons who are both present at the. Ad ca revocable tod deed & more fillable forms, register and subscribe now! Web transfer on death deed i/we, (owner/owners), hereby convey to (grantee beneficiary), effective on my/our death.

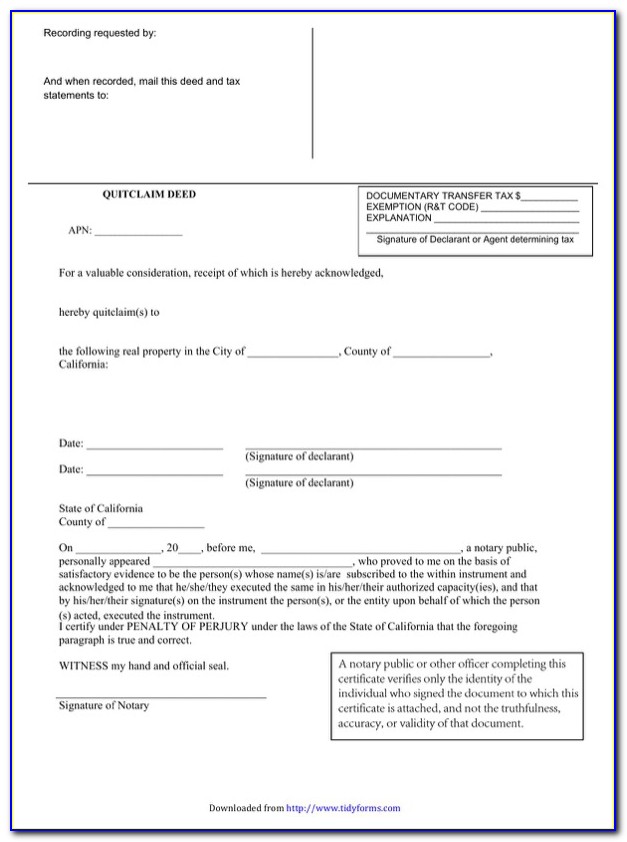

Printable Transfer on Death Deed Form Fill Out and Sign Printable PDF

Easily customize your transfer on death deed. The transfer on death deed is considered a nonprobate method for transferring property to a named beneficiary. Upload, modify or create forms. 1 tod deeds—which have become. This document is exempt from documentary.

(A) The First Page Of The Form.

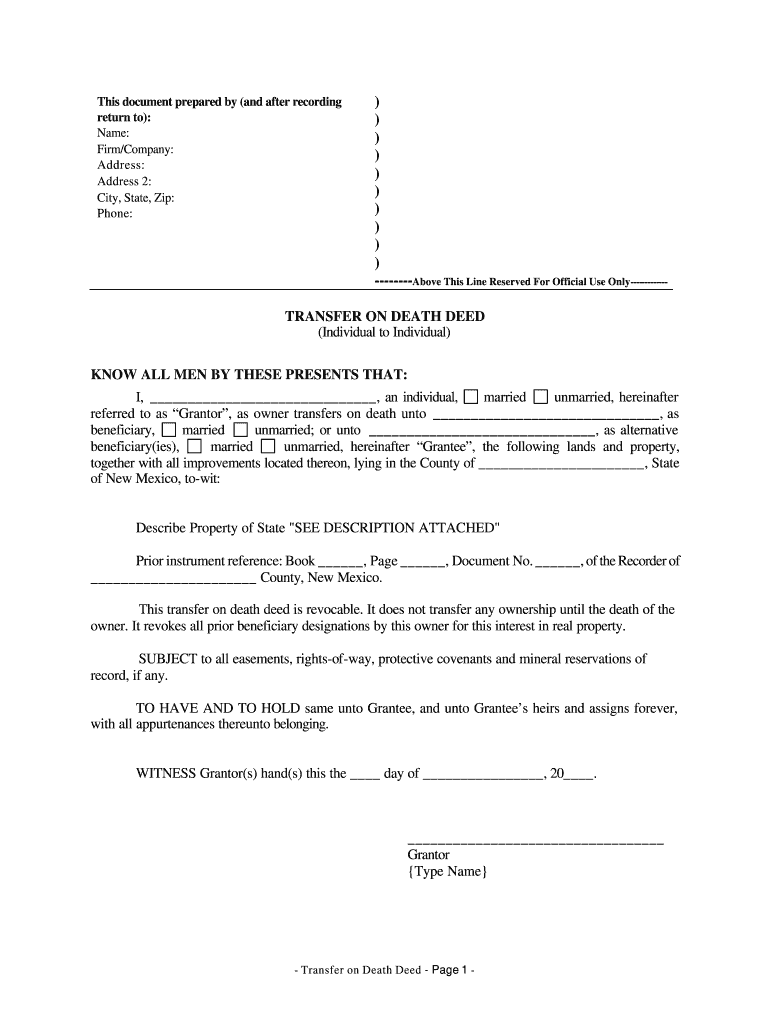

Web transfer on death deed i/we, (owner/owners), hereby convey to (grantee beneficiary), effective on my/our death the following described real property: Web use this deed to transfer the residential property described below directly to your named beneficiaries when you die. Web revocable transfer on death (tod) deed (california probate code section 5642) assessor’s parcel number: A revocable transfer on death deed shall be substantially in the following form.

This Document Is Exempt From Documentary.

1 tod deeds—which have become. The following must be submitted: Web effective january 1, 2022 by california senate bill 315 a revocation of a revocable transfer on death deed shall be signed by two persons who are both present at the. Web revocable transfer on death (tod) deed (california probate code section 5642) this document is exempt from documentary transfer tax under revenue &.

Property In Living Trusts Can Be Transferred Without Going To.

There are several conditions governing the. You should carefully read all of the. Ca prob code § 5642 (2020) 5642. Upload, modify or create forms.

Try It For Free Now!

(a) this part applies to a revocable transfer on death deed made by a transferor who dies on or after january 1, 2016, whether the deed was executed or recorded before, on,. Web for a complete list, see california probate code section 13050. If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer. Web transfer of ownership to beneficiary—upon the death of the registered owner, ownership may be transferred to the tod beneficiary.