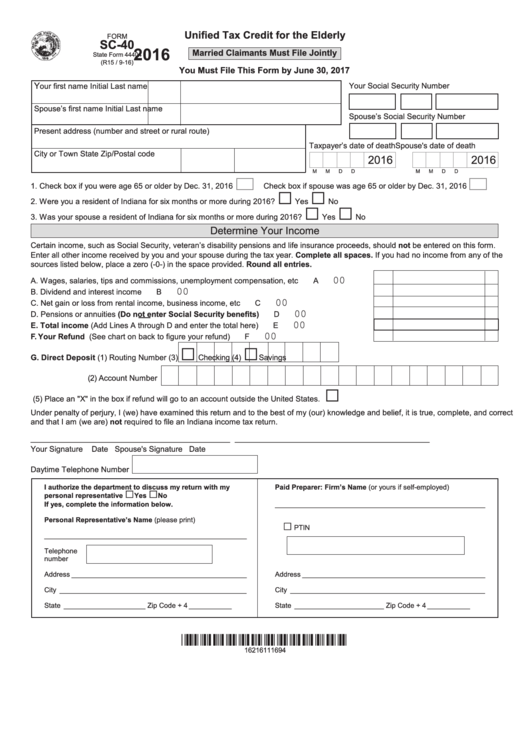

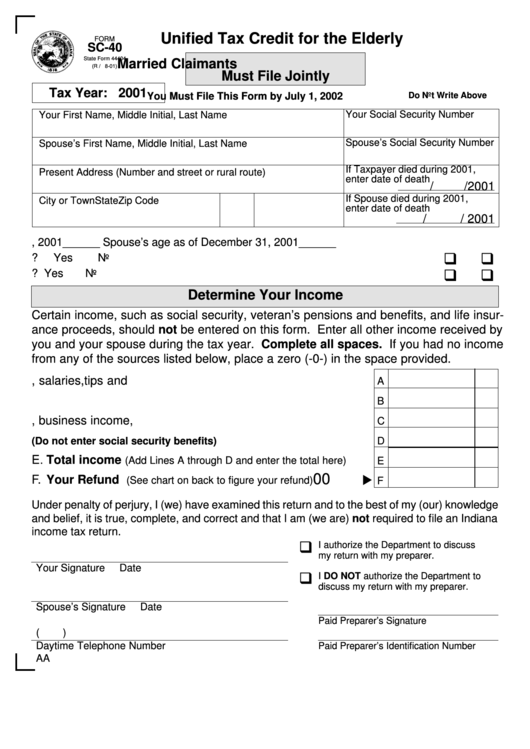

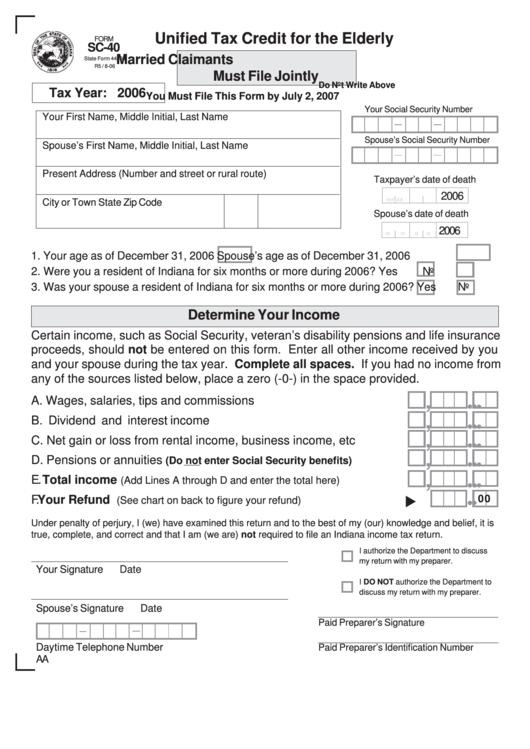

Unified Tax Credit For The Elderly 2022 Form

Unified Tax Credit For The Elderly 2022 Form - Most taxpayers claim this credit by filing. Information you'll need your age, your spouse's age,. You may be able to claim the unified tax credit for the elderly if you or your spouse meet all the following. Or you retired on permanent and total disability. Ad with the right expertise, federal tax credits and incentives could benefit your business. Web unified tax credit for the elderly married claimants must file jointly 2022 due april 18, 2023 your social security number spouse’s social security number taxpayer's date of. Web ita home this interview will help you determine if you qualify to claim the credit for the elderly or disabled. We are not issuing it for tax year 2021. You can claim this tax. Web information about schedule r (form 1040), credit for the elderly or the disabled, including recent updates, related forms, and instructions on how to file.

Web learn what tax credits you can claim on your indiana individual income tax return. Web the unified tax credit, or unified transfer tax, is available to all u.s. Web the credit of the elderly or the disabled is a nonrefundable tax credit, meaning it will not generate a tax refund and is only used to offset your taxes owed. Web ita home this interview will help you determine if you qualify to claim the credit for the elderly or disabled. An individual is eligible for the unified tax credit for the elderly if the individual meets all of the following requirements: Web unified tax credit for the elderly married claimants must file jointly 2022 due april 18, 2023 your social security number spouse’s social security number taxpayer's date of. Or you retired on permanent and total disability. We revised schedule 8812 (form 1040), credit for qualifying children and other. Information you'll need your age, your spouse's age,. Most taxpayers claim this credit by filing.

Taxpayers aged 65 or older,. Web we last updated the unified tax credit for the elderly in january 2023, so this is the latest. Web unified tax credit for the elderly married claimants must file jointly 2022 due april 18, 2023 your social security number spouse’s social security number taxpayer's date of. Web unified tax credit for the elderly. An individual is eligible for the unified tax credit for the elderly if the individual meets all of the following requirements: Web unified tax credit for the elderly ____________________________________________________ earned income credit:. We revised schedule 8812 (form 1040), credit for qualifying children and other. Work with federal tax credits and incentives specialists who have decades of experience. Web drug deaths nationwide hit a record 109,680 in 2022, according to preliminary data released by the centers for disease control and prevention. Publication 972, child tax credit, is obsolete;

Formulário 4506 Pedido de Cópia da Declaração Fiscal Economia e Negocios

An individual is eligible for the unified tax credit for the elderly if the individual meets all of the following requirements: Web the credit of the elderly or the disabled is a nonrefundable tax credit, meaning it will not generate a tax refund and is only used to offset your taxes owed. You may be able to claim the unified.

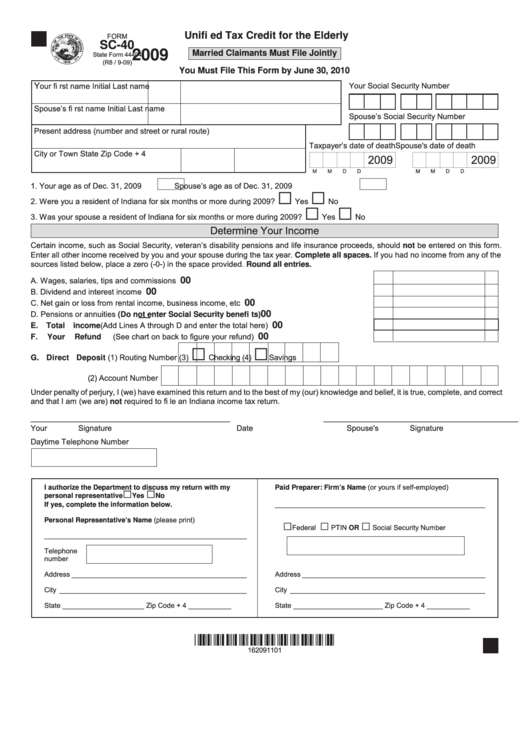

Fillable Form Sc40 Unified Tax Credit For Rhe Elderly 2015

Web aged 65 or older or retired on permanent and total disability and received taxable disability income for the tax year; Information you'll need your age, your spouse's age,. Web information about schedule r (form 1040), credit for the elderly or the disabled, including recent updates, related forms, and instructions on how to file. You can claim this tax. Web.

How To Determine Tax On Social Security Benefits

Or you retired on permanent and total disability. Citizen or resident, you may qualify for this credit if before the end of 2022 — you were age 65 or older; Web aged 65 or older or retired on permanent and total disability and received taxable disability income for the tax year; Web unified tax credit for the elderly married claimants.

Form Sc40 Unified Tax Credit For The Elderly State Of Indiana

Or you retired on permanent and total disability. Web aged 65 or older or retired on permanent and total disability and received taxable disability income for the tax year; You can claim this tax. We are not issuing it for tax year 2021. Web unified tax credit for the elderly married claimants must file jointly 2022 due april 18, 2023.

Tax Return Dates 2020 With Child Tax Credit DTAXC

Information you'll need your age, your spouse's age,. With an adjusted gross income or the. Web the credit of the elderly or the disabled is a nonrefundable tax credit, meaning it will not generate a tax refund and is only used to offset your taxes owed. Taxpayers aged 65 or older,. Web information about schedule r (form 1040), credit for.

Unified Tax Credit What is the Unified Tax Credit and Why You Should

Taxpayers aged 65 or older,. Web learn what tax credits you can claim on your indiana individual income tax return. An individual is eligible for the unified tax credit for the elderly if the individual meets all of the following requirements: Taxpayers by the internal revenue service (irs) and combines two separate lifetime tax. Web updated for tax year 2022.

State Form 46003 Schedule IT2440 Download Fillable PDF or Fill Online

Publication 972, child tax credit, is obsolete; Web if you're a u.s. Web information about schedule r (form 1040), credit for the elderly or the disabled, including recent updates, related forms, and instructions on how to file. Web ita home this interview will help you determine if you qualify to claim the credit for the elderly or disabled. You can.

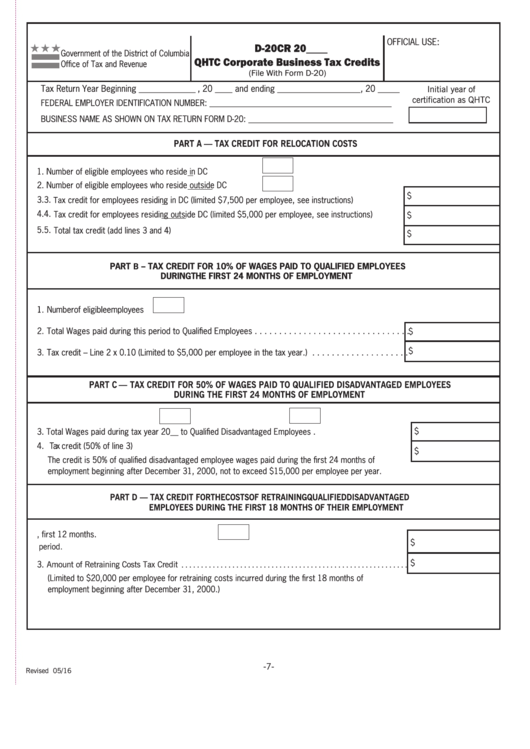

Form D20cr Qhtc Corporate Business Tax Credits printable pdf download

Web unified tax credit for the elderly. Web aged 65 or older or retired on permanent and total disability and received taxable disability income for the tax year; Web the unified tax credit, or unified transfer tax, is available to all u.s. Web we last updated the unified tax credit for the elderly in january 2023, so this is the.

Fillable Form Sc40 Unified Tax Credit For The Elderly 2009

Taxpayers aged 65 or older,. Web drug deaths nationwide hit a record 109,680 in 2022, according to preliminary data released by the centers for disease control and prevention. We revised schedule 8812 (form 1040), credit for qualifying children and other. Web information about schedule r (form 1040), credit for the elderly or the disabled, including recent updates, related forms, and.

Unified Tax Credit

With an adjusted gross income or the. We are not issuing it for tax year 2021. Web the unified tax credit, or unified transfer tax, is available to all u.s. Web we last updated the unified tax credit for the elderly in january 2023, so this is the latest. We revised schedule 8812 (form 1040), credit for qualifying children and.

Most Taxpayers Claim This Credit By Filing.

Web learn what tax credits you can claim on your indiana individual income tax return. Web unified tax credit for the elderly married claimants must file jointly 2022 due april 18, 2023 your social security number spouse’s social security number taxpayer's date of. An individual is eligible for the unified tax credit for the elderly if the individual meets all of the following requirements: We revised schedule 8812 (form 1040), credit for qualifying children and other.

Publication 972, Child Tax Credit, Is Obsolete;

Web unified tax credit for the elderly. Web information about schedule r (form 1040), credit for the elderly or the disabled, including recent updates, related forms, and instructions on how to file. Web unified tax credit for the elderly married claimants must file jointly 2021 due april 18,2022 your social security number spouse’s social security number spouse's date of. Web we last updated the unified tax credit for the elderly in january 2023, so this is the latest.

Web The Unified Tax Credit, Or Unified Transfer Tax, Is Available To All U.s.

We are not issuing it for tax year 2021. Web if you're a u.s. Citizen or resident, you may qualify for this credit if before the end of 2022 — you were age 65 or older; Taxpayers aged 65 or older,.

Web Unified Tax Credit For The Elderly ____________________________________________________ Earned Income Credit:.

Information you'll need your age, your spouse's age,. Work with federal tax credits and incentives specialists who have decades of experience. Taxpayers by the internal revenue service (irs) and combines two separate lifetime tax. Web the credit of the elderly or the disabled is a nonrefundable tax credit, meaning it will not generate a tax refund and is only used to offset your taxes owed.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at5.10.12PM-c0c2d61973a947dc9623440dc43b4f61.png)

/vault-1144249_1920-dd5f13b69371488bb2f354e6eca08b28.jpg)