Va Form 500 Instructions

Va Form 500 Instructions - Web instructions for preparing form 500 virginia corporation income tax return for 2009 commonwealth of virginia department of taxation richmond, virginia 2601005 Web instructions for preparing form 500 virginia corporation income tax return for 2012 commonwealth of virginia department of taxation. Web instructions for preparing 2019 form 500 virginia corporation income tax return 2601005 rev. Web 10 rows we last updated the corporate income tax return in january 2023, so this is the latest version of. Web request your military records, including dd214 submit an online request to get your dd214 or other military service records through the milconnect website. Web every corporation that is incorporated under virginia law, or that has registered with the state corporation commission for the privilege of conducting business in. Web instructions for preparing 2021 form 500 virginia corporation income tax return 2601005 rev. Web follow these steps to download and open a va.gov pdf form in adobe acrobat reader instead. Web instructions for schedule 500adj fixed date conformity update for 2020 virginia's date of conformity with the internal revenue code (irc) was advanced from december 31,. 09/19 commonwealth of virginia department of taxation richmond,.

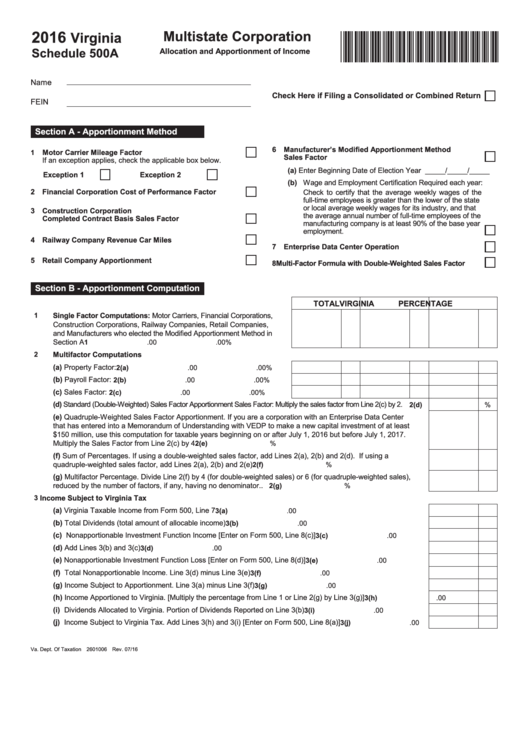

See pages 4 and 5 of the instructions for form 500 for additional information. Web follow these steps to download and open a va.gov pdf form in adobe acrobat reader instead. 07/16 2016 virginia corporation income tax return * #&$ form 500 department of taxation p.o. We last updated the schedule of affiliated corporations consolidated and combined filers in january 2023,. 09/19 commonwealth of virginia department of taxation richmond,. Web instructions for preparing 2021 form 500 virginia corporation income tax return 2601005 rev. Web supplemental instructions will be posted on our website at www.tax. Web instructions for 2021 form 500c underpayment of virginia estimated tax by corporations purpose of form form 500c is used by corporations to determine whether they paid. You’ll need to have the latest version of adobe acrobat reader. Web instructions for preparing form 500 virginia corporation income tax return for 2009 commonwealth of virginia department of taxation richmond, virginia 2601005

Web instructions for 2021 form 500c underpayment of virginia estimated tax by corporations purpose of form form 500c is used by corporations to determine whether they paid. See pages 4 and 5 of the instructions for form 500 for additional information. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in. 09/19 commonwealth of virginia department of taxation richmond,. Web 10 rows we last updated the corporate income tax return in january 2023, so this is the latest version of. Web supplemental instructions will be posted on our website at www.tax. You can download or print. You’ll need to have the latest version of adobe acrobat reader. Web instructions for preparing form 500 virginia corporation income tax return for 2012 commonwealth of virginia department of taxation. Web instructions for preparing 2019 form 500 virginia corporation income tax return 2601005 rev.

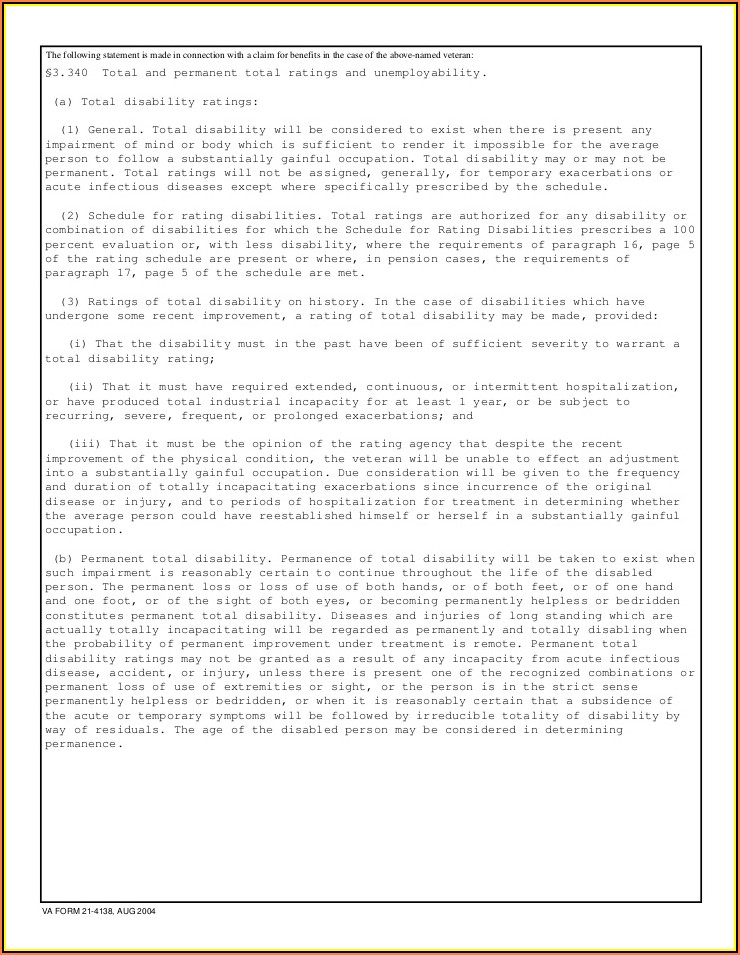

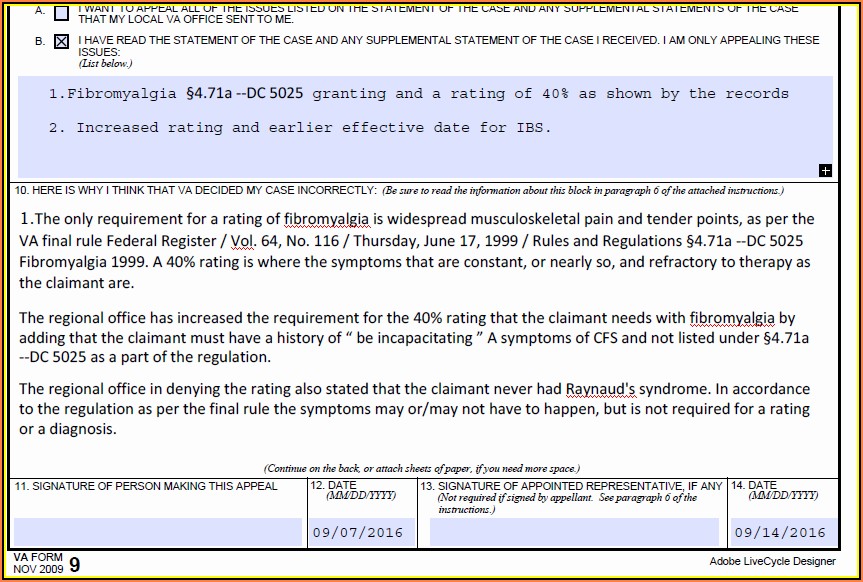

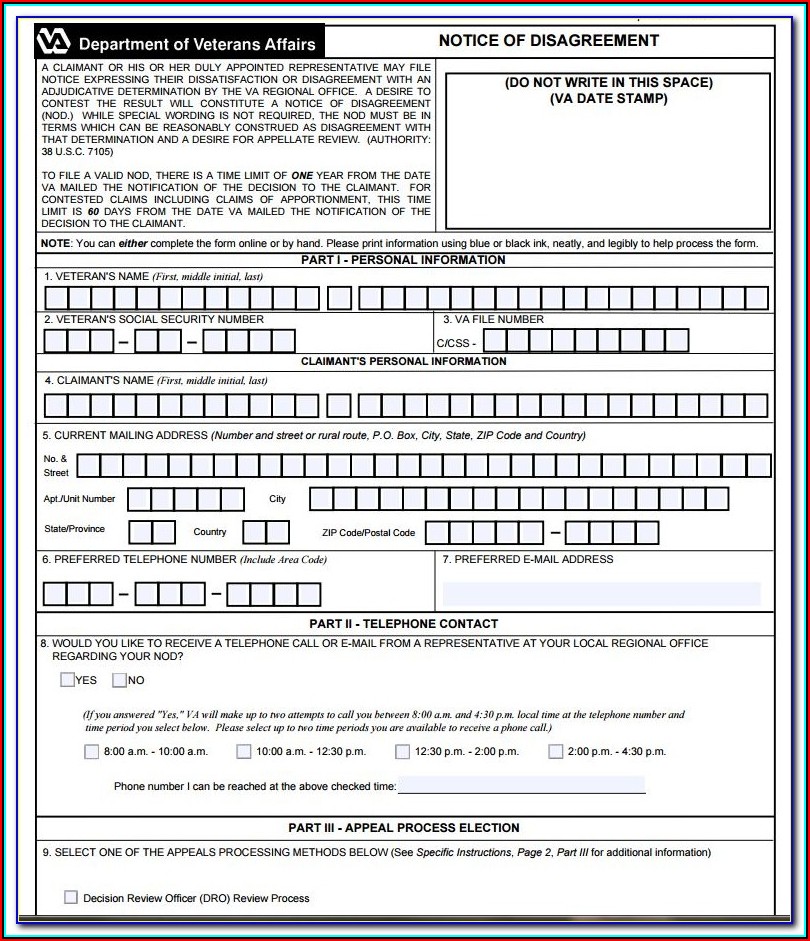

Va Form 21 4138 Instructions Form Resume Examples GM9Ow6k9DL

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in. Web instructions for preparing form 500 virginia corporation income tax return for 2009 commonwealth of virginia department of taxation richmond, virginia 2601005 Web request your military records, including dd214 submit an.

Fillable Schedule 500a Multistate Corporation Virginia 2016

See pages 4 and 5 of the instructions for form 500 for additional information. Web instructions for preparing form 500 virginia corporation income tax return for 2009 commonwealth of virginia department of taxation richmond, virginia 2601005 Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue.

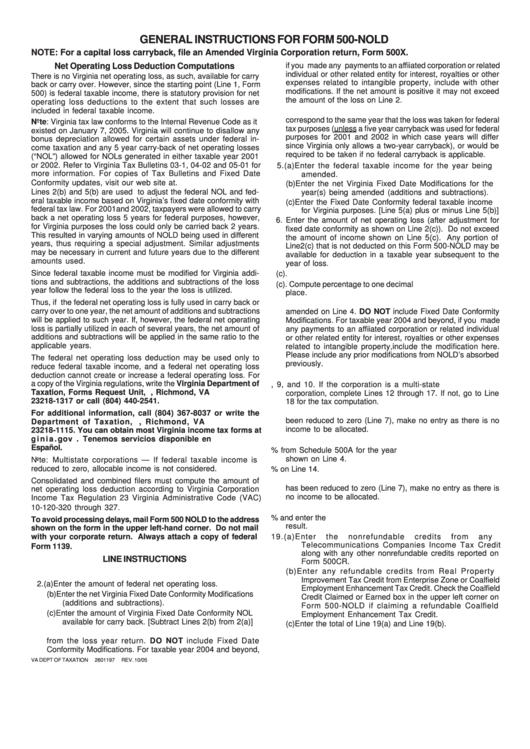

General Instructions For Form 500Nold printable pdf download

Web instructions for preparing 2019 form 500 virginia corporation income tax return 2601005 rev. 09/19 commonwealth of virginia department of taxation richmond,. 08/21 commonwealth of virginia department of taxation. Web instructions for preparing form 500 virginia corporation income tax return for 2012 commonwealth of virginia department of taxation. Web all home service contract providers must submit form 500hs, home service.

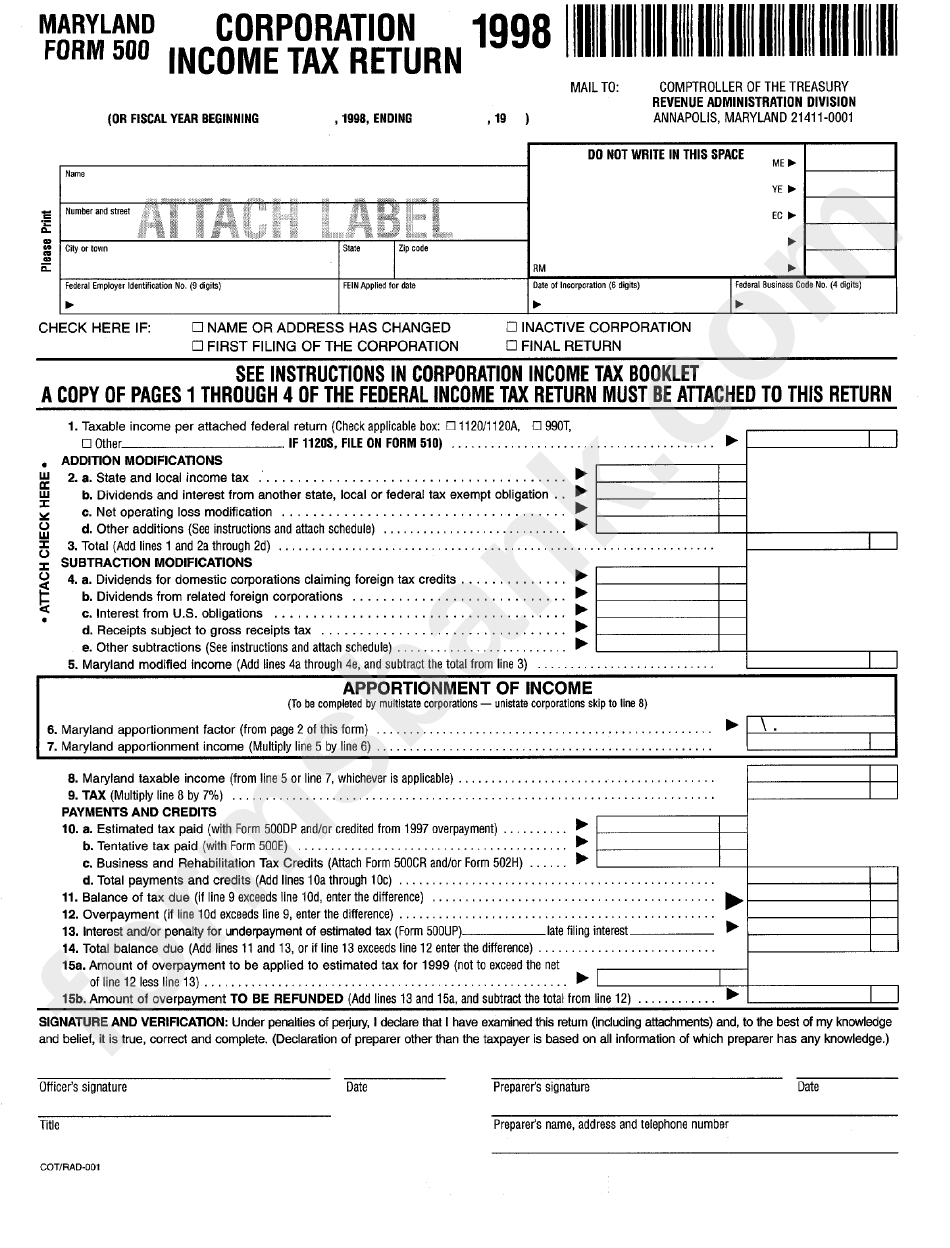

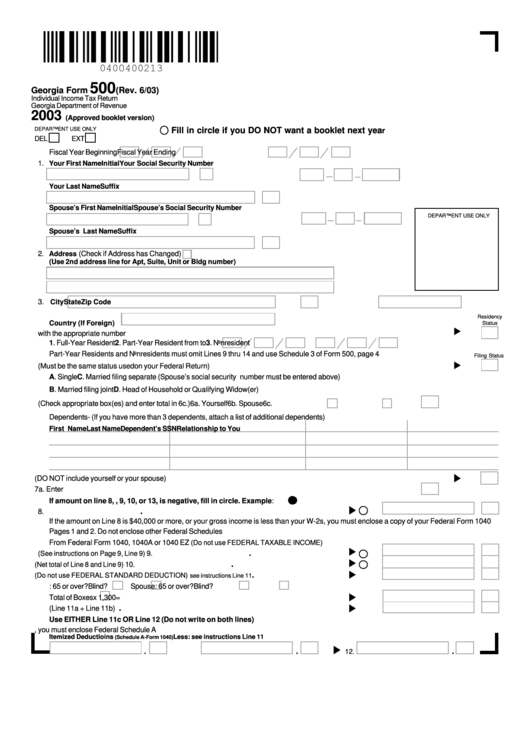

Fillable Form 500 Corporation Tax Return Maryland 1998

We last updated the schedule of affiliated corporations consolidated and combined filers in january 2023,. Web all home service contract providers must submit form 500hs, home service contract provider minimum tax computation, with their form 500, virginia corporation. Web follow these steps to download and open a va.gov pdf form in adobe acrobat reader instead. Web instructions for preparing 2021.

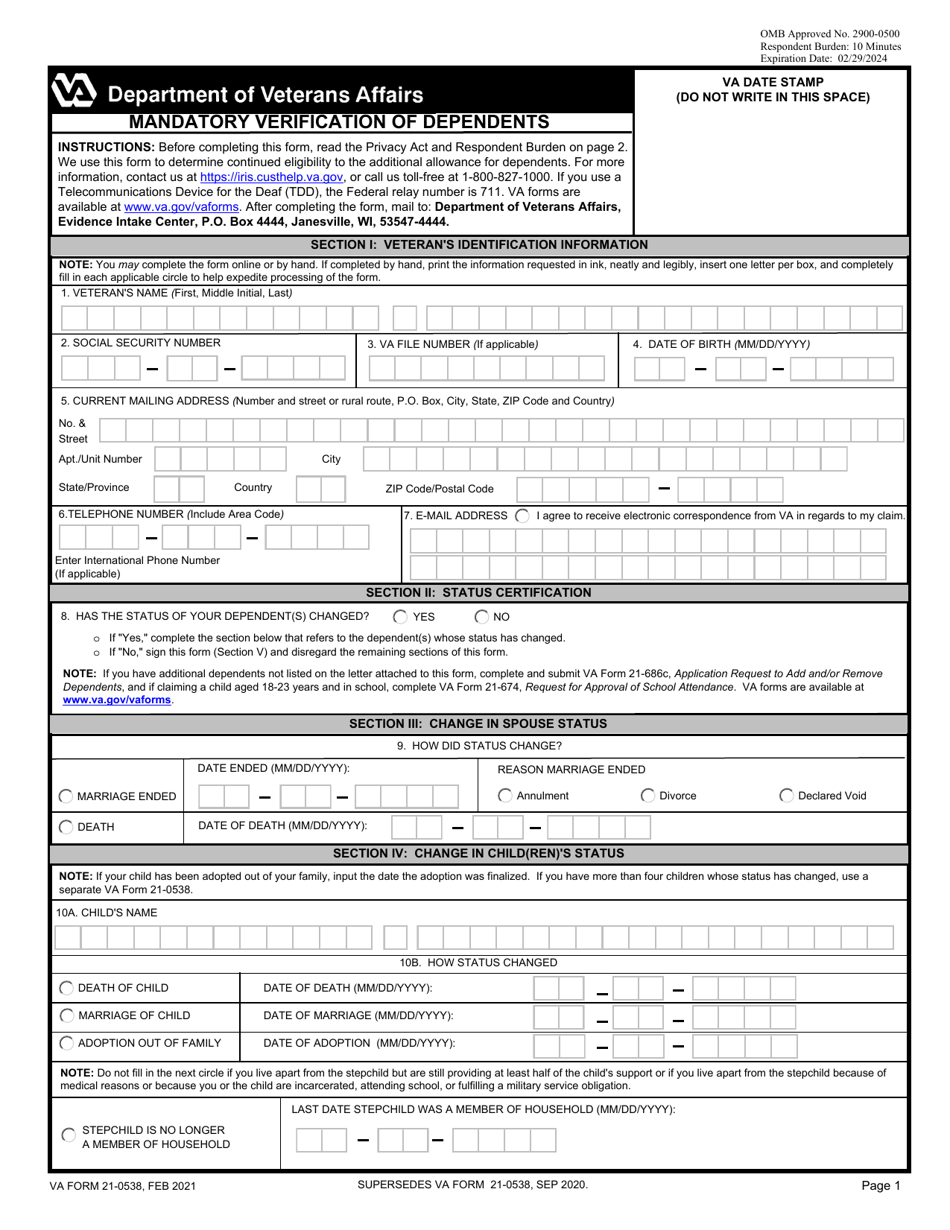

VA Form 210538 Download Fillable PDF or Fill Online Mandatory

Web instructions for preparing 2019 form 500 virginia corporation income tax return 2601005 rev. We last updated the schedule of affiliated corporations consolidated and combined filers in january 2023,. Web instructions for preparing 2021 form 500 virginia corporation income tax return 2601005 rev. Web all home service contract providers must submit form 500hs, home service contract provider minimum tax computation,.

State Tax Form 500ez bestkup

See pages 4 and 5 of the instructions for form 500 for additional information. You can download or print. Web instructions for preparing 2019 form 500 virginia corporation income tax return 2601005 rev. 09/19 commonwealth of virginia department of taxation richmond,. Web every corporation that is incorporated under virginia law, or that has registered with the state corporation commission for.

Va Claim Form 21 4138 Form Resume Examples gq96xwxVOR

See pages 4 and 5 of the instructions for form 500 for additional information. Web instructions for preparing 2021 form 500 virginia corporation income tax return 2601005 rev. Web instructions for schedule 500adj fixed date conformity update for 2020 virginia's date of conformity with the internal revenue code (irc) was advanced from december 31,. Web supplemental instructions will be posted.

Va Form 21 4138 Instructions Form Resume Examples GM9Ow6k9DL

07/16 2016 virginia corporation income tax return * #&$ form 500 department of taxation p.o. Web follow these steps to download and open a va.gov pdf form in adobe acrobat reader instead. Web request your military records, including dd214 submit an online request to get your dd214 or other military service records through the milconnect website. Web instructions for preparing.

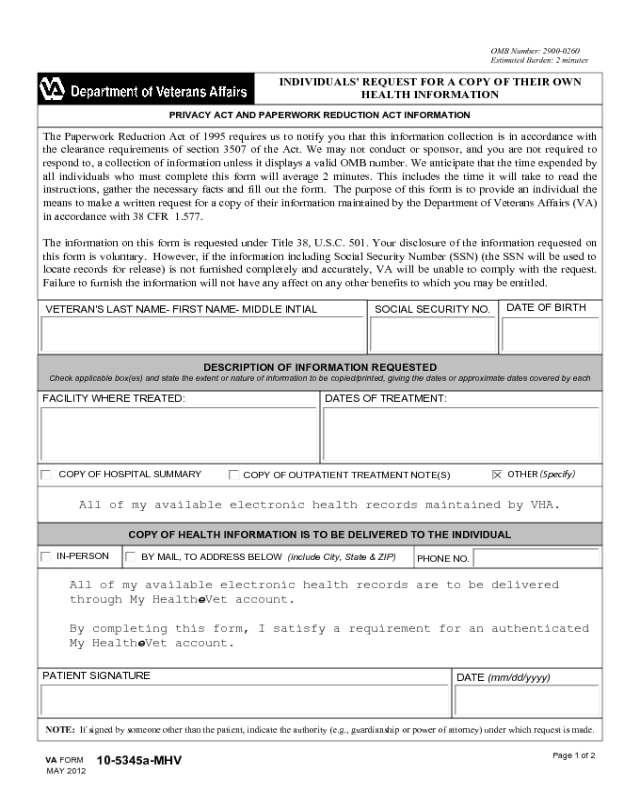

VA Form 105345aMHV Edit, Fill, Sign Online Handypdf

Web instructions for schedule 500adj fixed date conformity update for 2020 virginia's date of conformity with the internal revenue code (irc) was advanced from december 31,. 08/21 commonwealth of virginia department of taxation. Web request your military records, including dd214 submit an online request to get your dd214 or other military service records through the milconnect website. 07/16 2016 virginia.

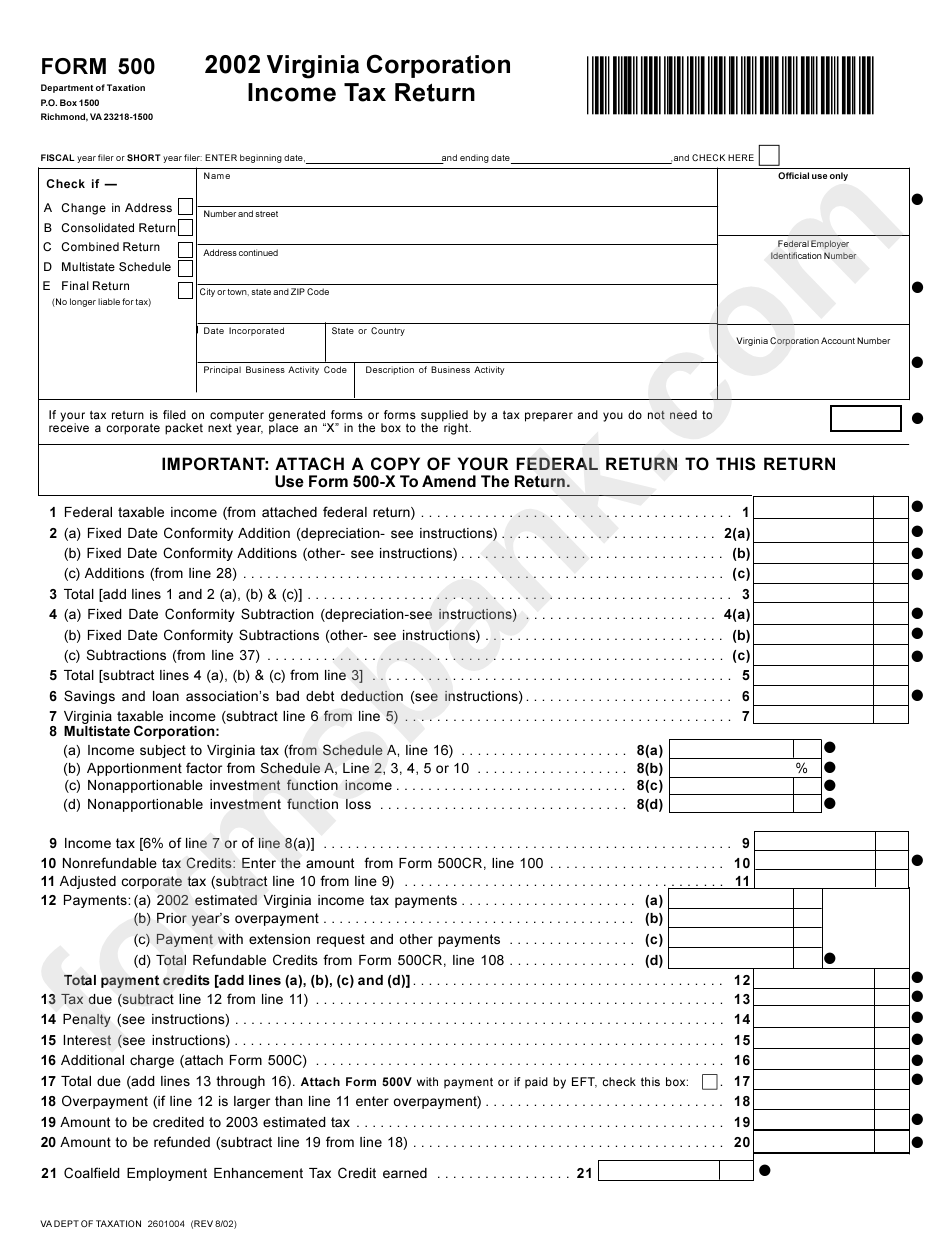

Form 500 Virginia Corporation Tax Return 2002 printable pdf

Web every corporation that is incorporated under virginia law, or that has registered with the state corporation commission for the privilege of conducting business in. 07/16 2016 virginia corporation income tax return * #&$ form 500 department of taxation p.o. Web instructions for preparing form 500 virginia corporation income tax return for 2012 commonwealth of virginia department of taxation. You.

Web Instructions For Schedule 500Adj Fixed Date Conformity Update For 2020 Virginia's Date Of Conformity With The Internal Revenue Code (Irc) Was Advanced From December 31,.

09/19 commonwealth of virginia department of taxation richmond,. You’ll need to have the latest version of adobe acrobat reader. Web request your military records, including dd214 submit an online request to get your dd214 or other military service records through the milconnect website. You can download or print.

Web Instructions For Preparing 2019 Form 500 Virginia Corporation Income Tax Return 2601005 Rev.

We last updated the schedule of affiliated corporations consolidated and combined filers in january 2023,. Web all home service contract providers must submit form 500hs, home service contract provider minimum tax computation, with their form 500, virginia corporation. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in. Web supplemental instructions will be posted on our website at www.tax.

Web Instructions For Preparing Form 500 Virginia Corporation Income Tax Return For 2012 Commonwealth Of Virginia Department Of Taxation.

Web every corporation that is incorporated under virginia law, or that has registered with the state corporation commission for the privilege of conducting business in. Web more about the virginia form 500ac corporate income tax ty 2022. Web instructions for preparing form 500 virginia corporation income tax return for 2009 commonwealth of virginia department of taxation richmond, virginia 2601005 Web instructions for preparing 2021 form 500 virginia corporation income tax return 2601005 rev.

Web 10 Rows We Last Updated The Corporate Income Tax Return In January 2023, So This Is The Latest Version Of.

Fill out as much information as. Web instructions for 2021 form 500c underpayment of virginia estimated tax by corporations purpose of form form 500c is used by corporations to determine whether they paid. Web follow these steps to download and open a va.gov pdf form in adobe acrobat reader instead. 07/16 2016 virginia corporation income tax return * #&$ form 500 department of taxation p.o.