Vermont Estimated Tax Payment Form 2023

Vermont Estimated Tax Payment Form 2023 - Your average tax rate is 11.67% and your marginal tax rate is. And you are filing a form. Web 2023 individual income estimated tax payment voucher: Vermont credit for income tax. And you are not enclosing a payment, then use this address. Web when are estimated income tax payments due? Estimated income tax payments are made in four equal amounts by the due dates shown below: Web tax day for the 2022 tax year falls on tuesday, april 18th, 2023. Use myvtax, the department's online portal, to electronically pay your estimated income tax. You can pay all of your estimated tax by april 18, 2023, or in four equal amounts by the dates shown below.

Web the final due date for your last 2023 estimated tax payment will be january 15th, 2024. And you are filing a form. Web deadlines for estimated tax payments. If you make $70,000 a year living in california you will be taxed $11,221. Web you should make estimated payments if your estimated ohio tax liability (total tax minus total credits) less ohio withholding is more than $500. Estimated income tax payments are made in four equal amounts by the due dates shown below: This form is for income earned in tax year 2022, with tax returns due in april. Web 2023 individual income estimated tax payment voucher: And you are not enclosing a payment, then use this address. 2022 vermont income tax return booklet.

This deadline applies to any individual or small business seeking to file their taxes with the. This form is for income earned in tax year 2022, with tax returns due in april. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example,. And you are not enclosing a payment, then use this address. If you make $70,000 a year living in california you will be taxed $11,221. Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100 million to the. Web when are estimated income tax payments due? Web tax day for the 2022 tax year falls on tuesday, april 18th, 2023. This booklet includes forms and instructions for: Use myvtax, the department's online portal, to electronically pay your estimated income tax.

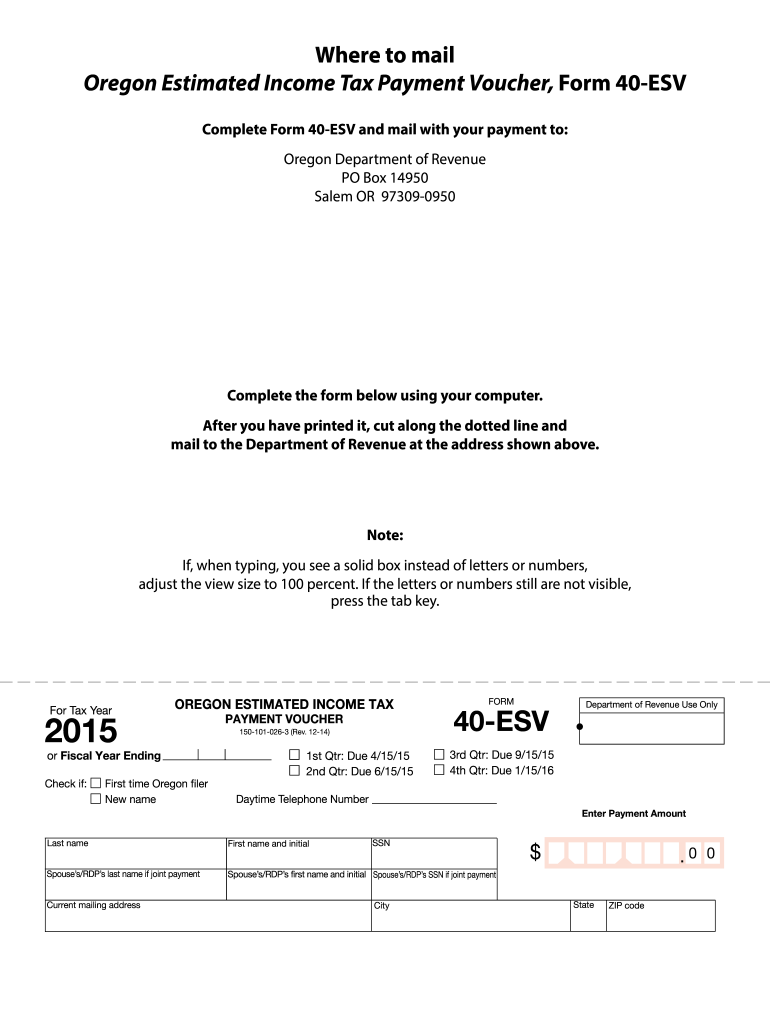

Oregon Estimated Tax Payment Voucher 2022 Fill Out and Sign Printable

Web you should make estimated payments if your estimated ohio tax liability (total tax minus total credits) less ohio withholding is more than $500. This form is for income earned in tax year 2022, with tax returns due in april. Additional forms and schedules may be required. You can make your estimated income tax payment online using ach debit or.

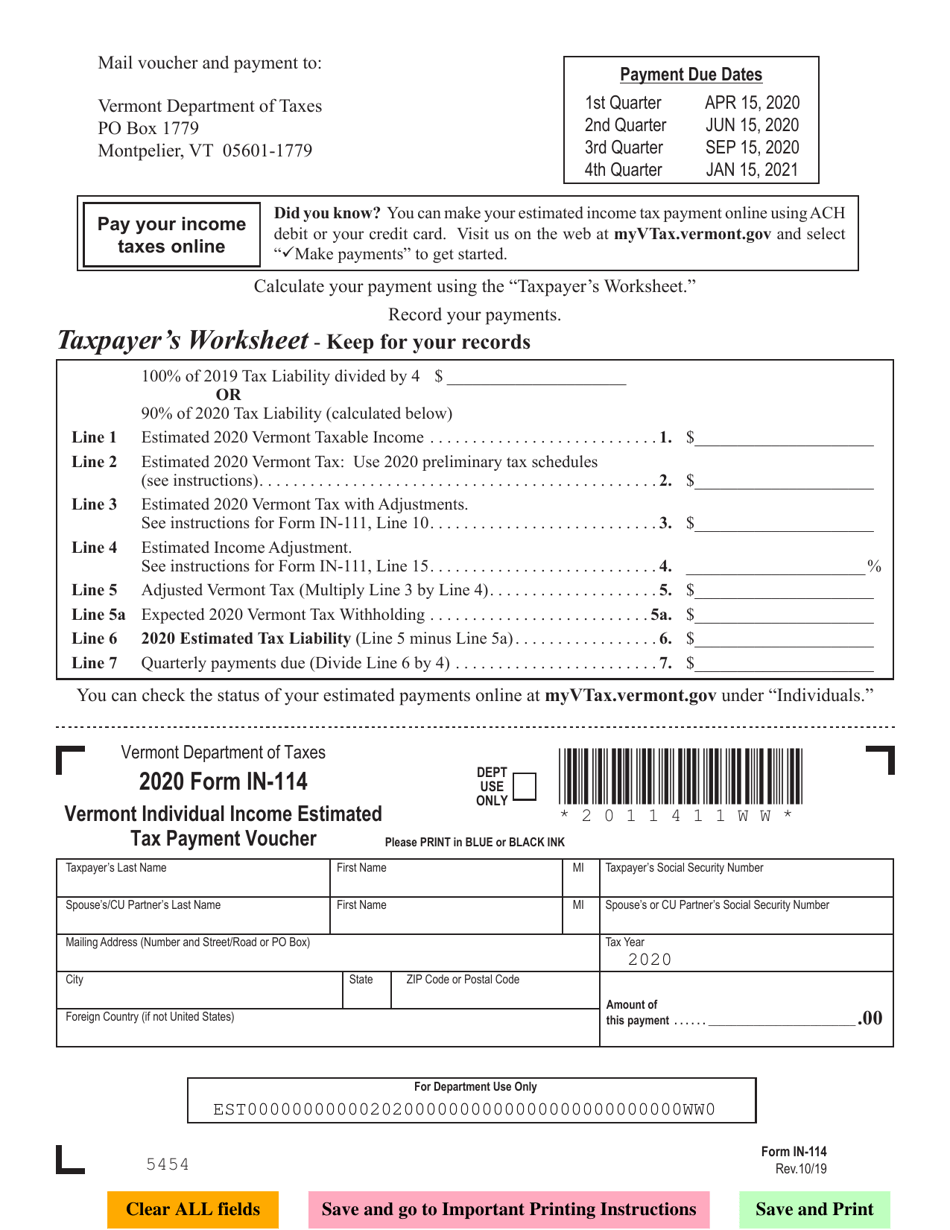

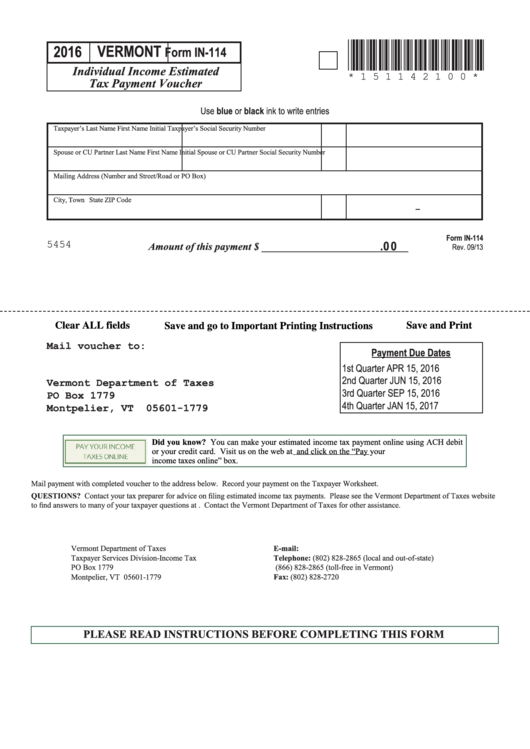

Form IN114 Download Fillable PDF or Fill Online Vermont Individual

2022 vermont income tax return booklet. If you make $70,000 a year living in california you will be taxed $11,221. Estimated income tax payments are made in four equal amounts by the due dates shown below: This form is for income earned in tax year 2022, with tax returns due in april. Vermont credit for income tax.

Fillable Form In114 Vermont Individual Estimated Tax Payment

This deadline applies to any individual or small business seeking to file their taxes with the. And you are filing a form. Web if you live in vermont. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example,. You can pay all of your estimated tax by april 18, 2023, or in.

301 Moved Permanently

Web when are estimated income tax payments due? Web deadlines for estimated tax payments. Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100 million to the. I think rates are likely to. Web pay estimated income tax by voucher;

Estimated Tax Payment Worksheet 2023

Your average tax rate is 11.67% and your marginal tax rate is. And you are enclosing a payment, then. Web january 17, 2023 can i file annualized estimated payments for vermont? Web deadlines for estimated tax payments. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example,.

Vermont Department Of Taxes Collection Irs Notice Cp17 Refund Of Excess

Web pay your income taxesonline did you know? This is the date that the irs and. You can make your estimated income tax payment online using ach debit or your credit card.visit us on the web at. It is important to make this final payment on time (along with the rest of the payments, of. This booklet includes forms and.

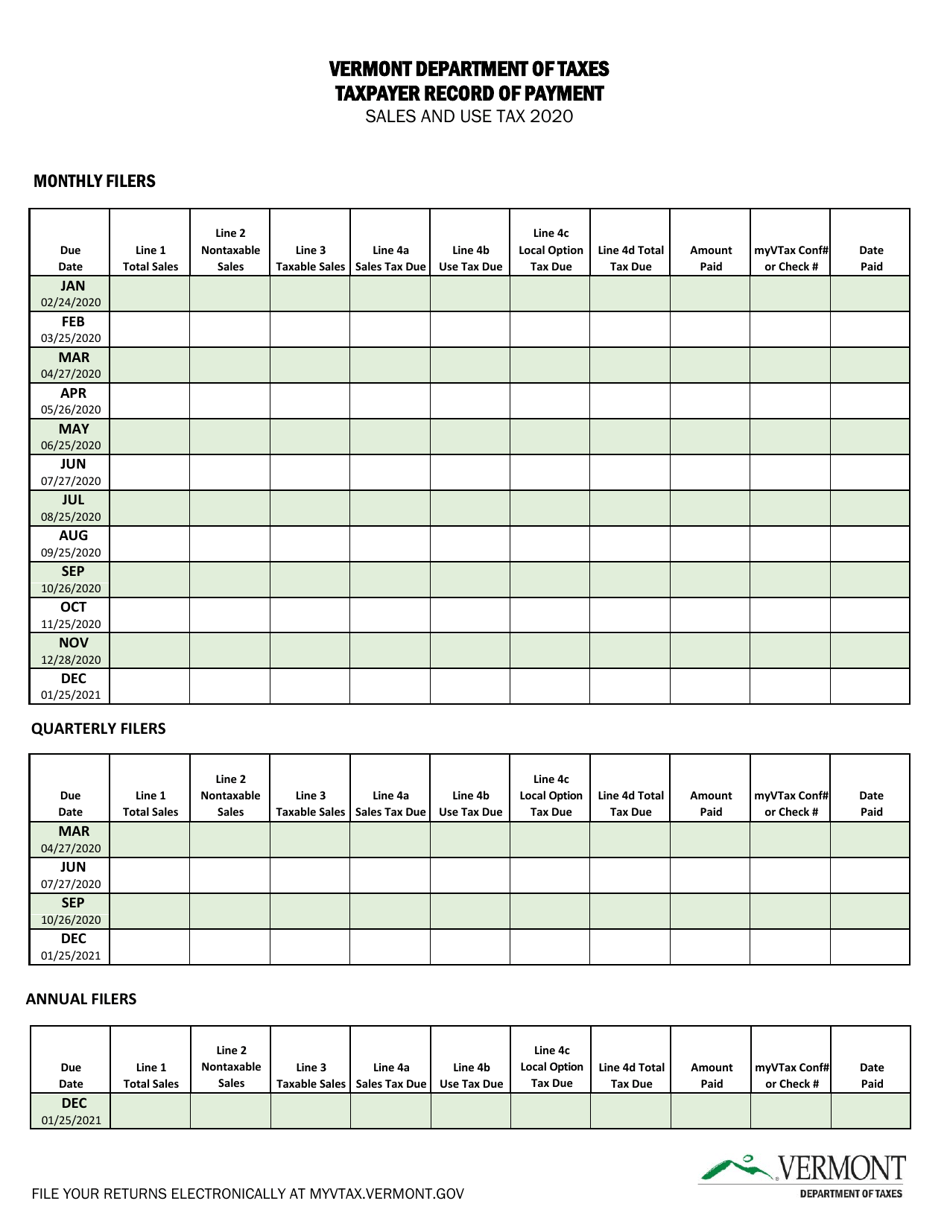

2020 Vermont Sales and Use Tax Record of Payment Download Printable PDF

Web when are estimated income tax payments due? And you are filing a form. Individuals who make annualized estimated tax payments with the irs may also make annualized. I think rates are likely to. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

2018 Form OR OR40V Fill Online, Printable, Fillable, Blank pdfFiller

Individuals who make annualized estimated tax payments with the irs may also make annualized. And you are not enclosing a payment, then use this address. Web pay estimated income tax | vermont.gov. Web income tax forms for vermont. This form is for income earned in tax year 2022, with tax returns due in april.

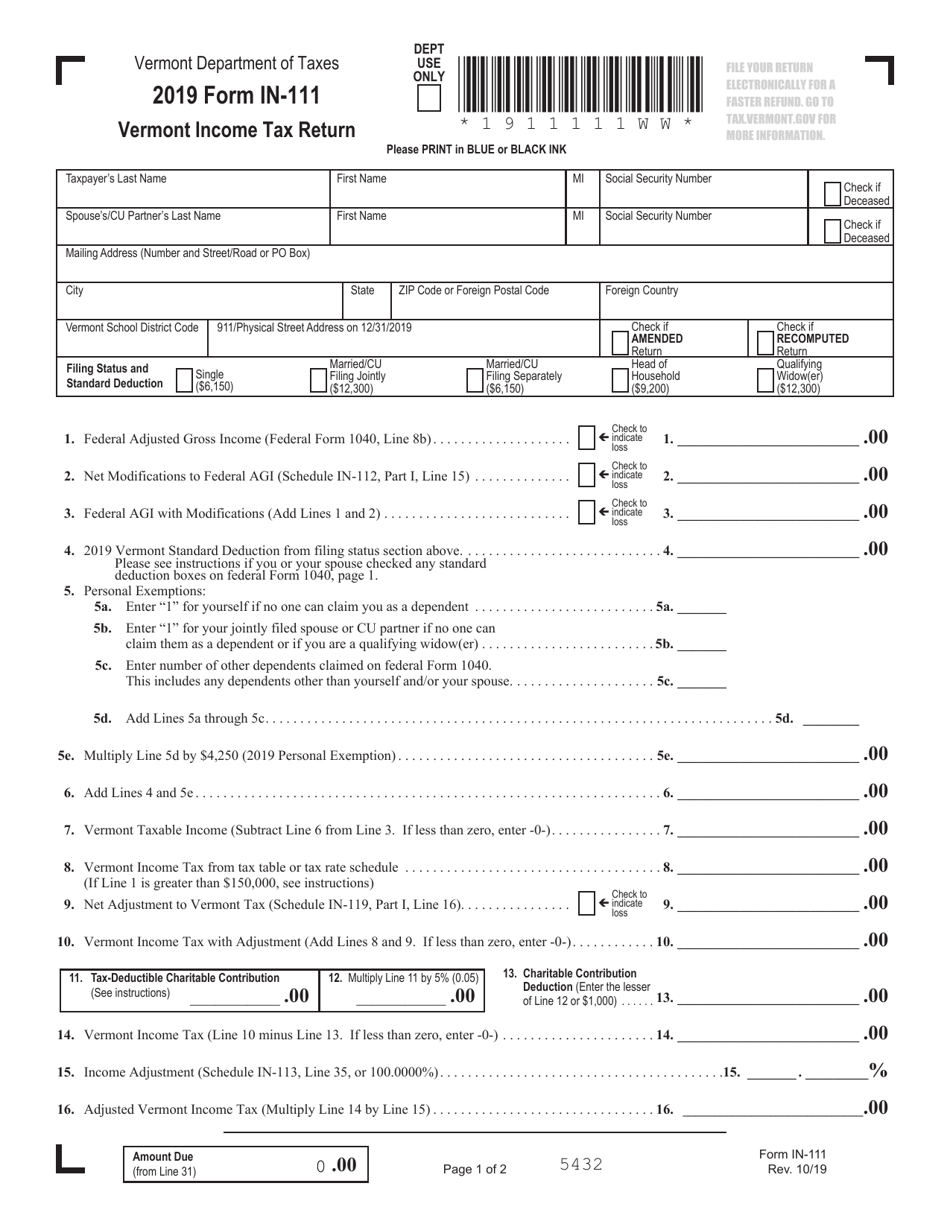

Form IN111 Download Fillable PDF or Fill Online Vermont Tax

And you are not enclosing a payment, then use this address. Individuals who make annualized estimated tax payments with the irs may also make annualized. You can make your estimated income tax payment online using ach debit or your credit card.visit us on the web at. Web you should make estimated payments if your estimated ohio tax liability (total tax.

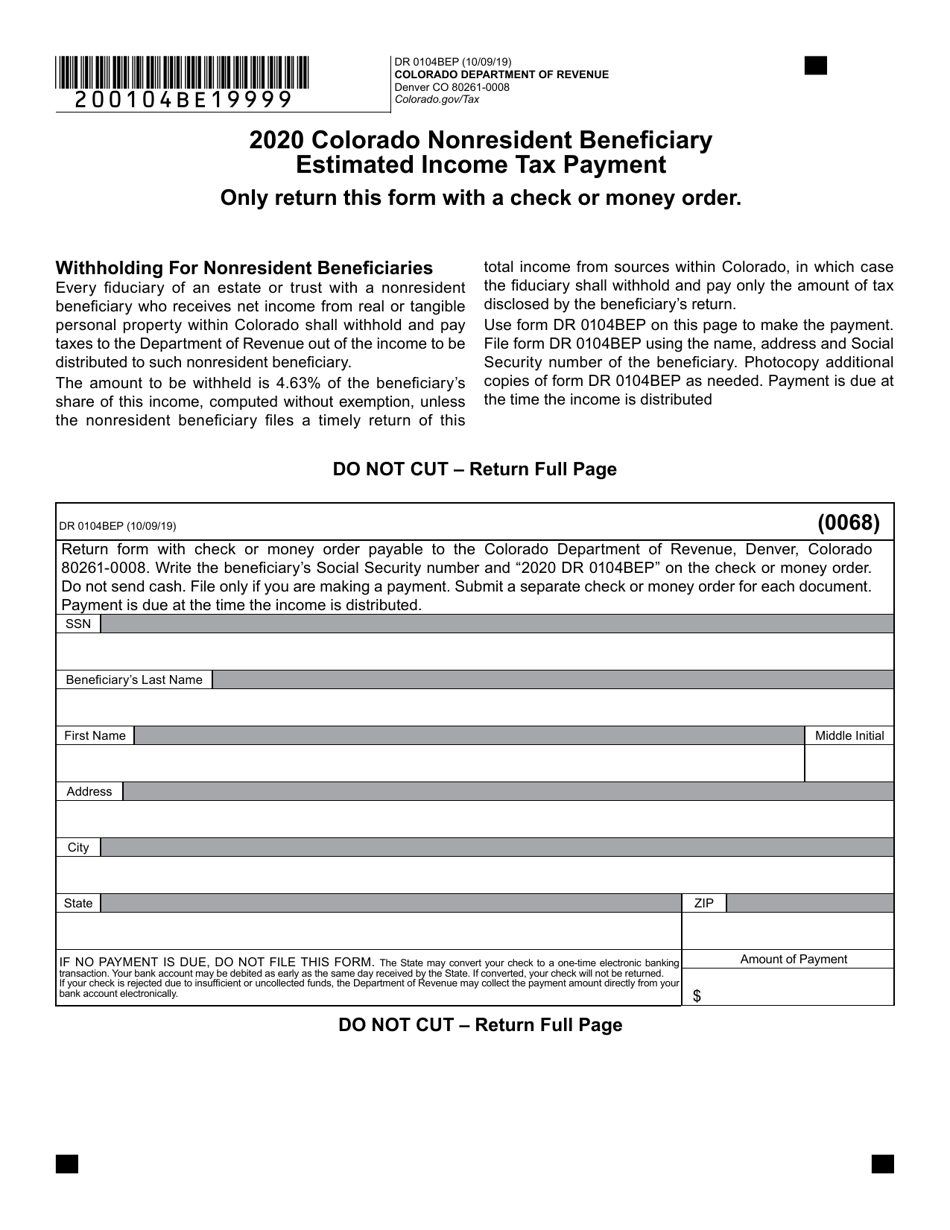

Form DR0104BEP Download Fillable PDF or Fill Online Colorado

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. You can make your estimated income tax payment online using ach debit or your credit card.visit us on the web at. You can pay all of your estimated tax by april 18, 2023, or in four equal amounts by the dates shown.

Web Pay Estimated Income Tax | Vermont.gov.

This deadline applies to any individual or small business seeking to file their taxes with the. Web january 17, 2023 can i file annualized estimated payments for vermont? Web 2023 individual income estimated tax payment voucher: Vermont credit for income tax paid.

Web Pay Estimated Income Tax By Voucher;

Individuals who make annualized estimated tax payments with the irs may also make annualized. Web income tax forms for vermont. Web deadlines for estimated tax payments. And you are filing a form.

Web If You Live In Vermont.

Vermont credit for income tax. Web 2023 individual income estimated tax payment voucher: Processing time and refund information; Estimated income tax payments are made in four equal amounts by the due dates shown below:

Web Watch Newsmax Live For The Latest News And Analysis On Today's Top Stories, Right Here On Facebook.

You can pay all of your estimated tax by april 18, 2023, or in four equal amounts by the dates shown below. I think rates are likely to. Your average tax rate is 11.67% and your marginal tax rate is. If you make $70,000 a year living in california you will be taxed $11,221.