Voluntary Payroll Deduction Form

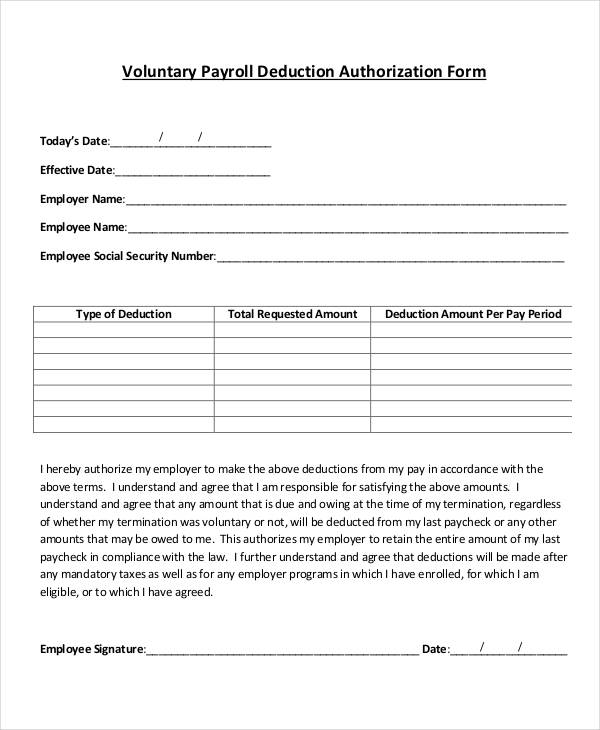

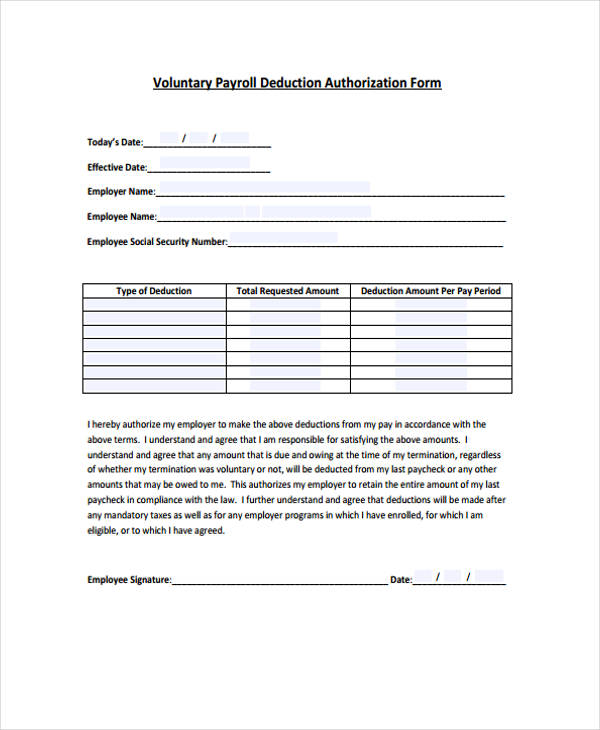

Voluntary Payroll Deduction Form - _____ please return completed form to kymberly group payroll solutions, inc. Web download voluntary payroll deduction form. This authorizes my employer to retain the entire amount of my last paycheck in compliance with the law. Turn on the wizard mode in the top toolbar to obtain extra pieces of advice. _____ _____ (employee’s signature) (date. The payroll department processes a variety of voluntary deductions for permanent employees. (employer name and address) regarding: Mandatory deductions and voluntary deductions. Examples are group life insurance, healthcare and/or other benefit deductions, credit union deductions, etc. Fill & download for free get form download the form how to edit your voluntary payroll deduction authorization form online lightning fast follow these steps to get your voluntary payroll deduction authorization form edited for the perfect workflow:

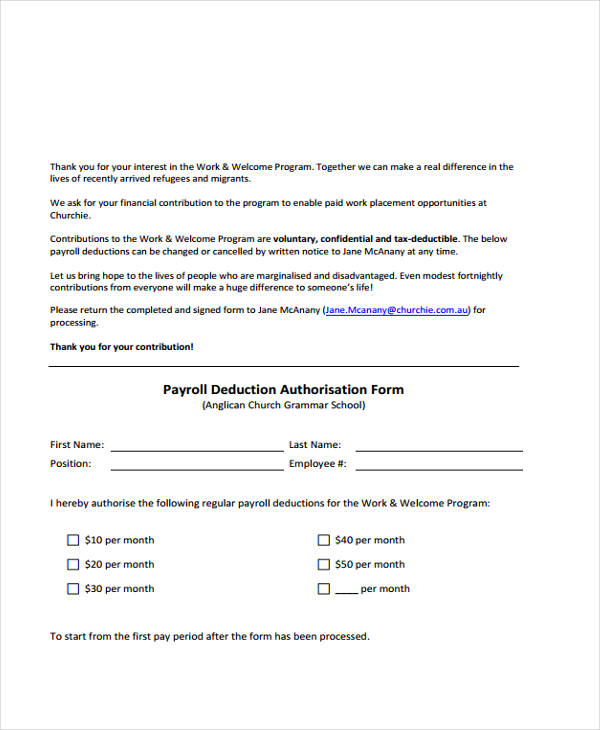

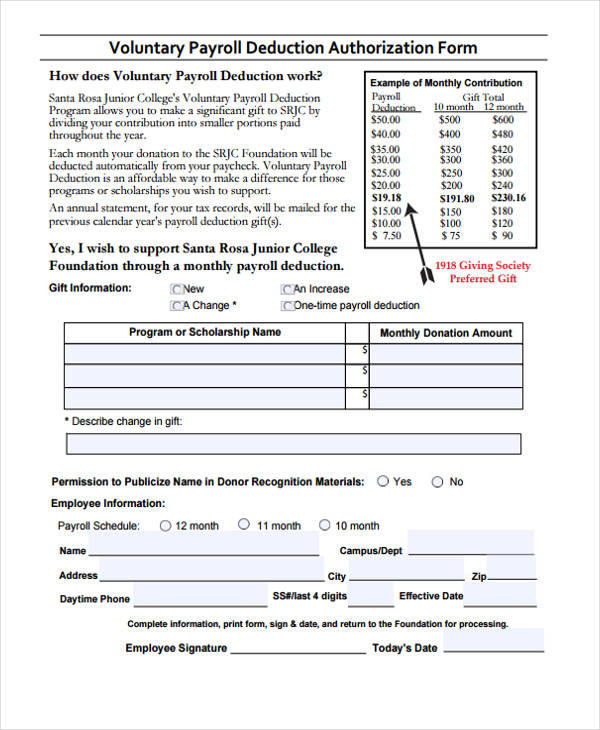

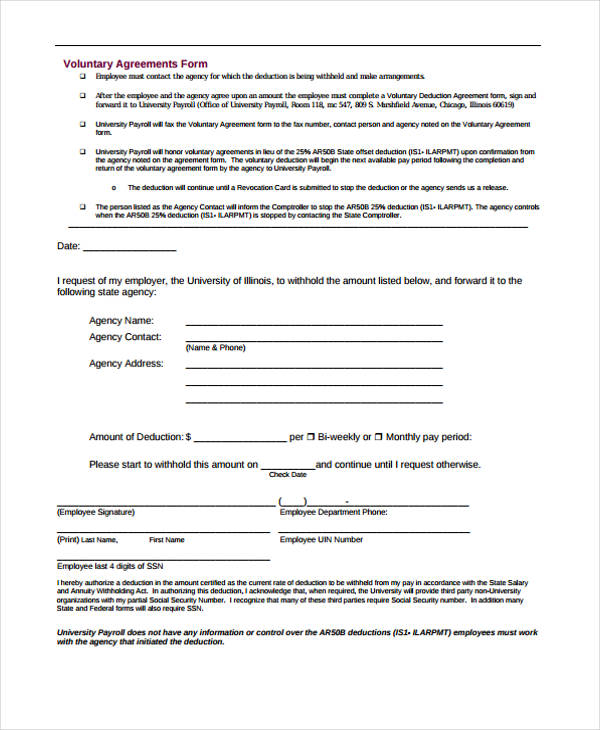

Web how to file a voluntary deduction agreement form step 1. Alert groups resources contact last modified on may 02, 2023 back to top back to top Web voluntary deductions charitable contributions credit union deductions deferred compensation plans employee organization membership fees insurance plans permanent life insurance premium deductions purchasing retirement service credit savings bonds purchases supplemental optional benefits programs texas prepaid higher education. Click the get form button to begin editing. Payroll tax deduction form dornc.com details file format pdf size: Web download voluntary payroll deduction form. Mandatory deductions and voluntary deductions. They agree that they have given you the right to reduce their payment by a certain amount. This authorizes my employer to retain the entire amount of my last paycheck in compliance with the law. Web the voluntary payroll deduction (vpd) program is a benefit offered to state and some educational employees so they may request payroll deductions from their paychecks to automatically be paid.

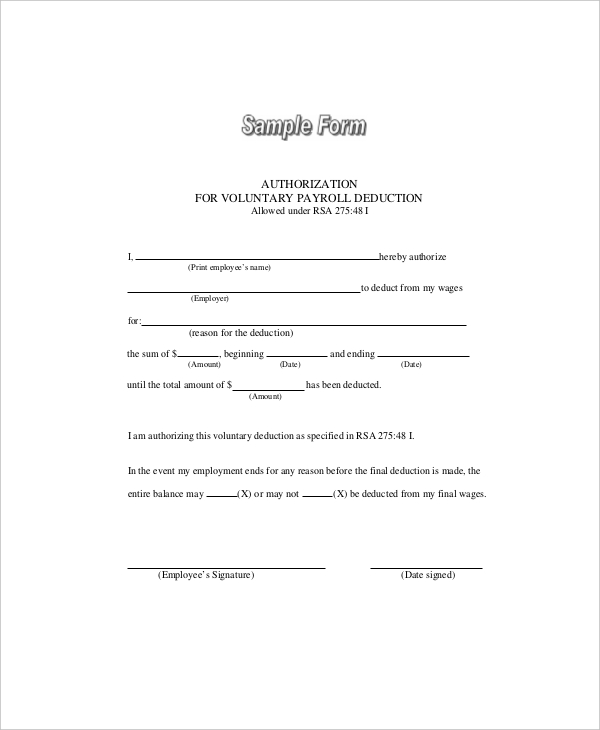

This authorizes my employer to retain the entire amount of my last paycheck in compliance with the law. Download a voluntary deduction agreement form. We recommend downloading this file onto your computer. Web authorization for voluntary payroll deduction allowed under rsa 275:48 i i, (print employee’s name) hereby authorize (employer) to deduct from my wages for: These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck. Web voluntary payroll deduction authorization form. Click the get form button to begin editing. Web form 2159 (may 2020) payroll deduction agreement (see instructions on the back of this page.) department of the treasury — internal revenue service catalog number 21475h www.irs.gov. These withholdings constitute the difference between gross pay and net pay and may include: This is a digital download (485.27 kb) language:

Payroll Deduction Authorization Form Template charlotte clergy coalition

2 mb download by signing this form, an employee gives you the right to make deductions on their payments. Fill & download for free download the form how to edit your voluntary payroll deduction online easily and quickly follow these steps to get your voluntary payroll deduction edited with ease: _____ _____ (employee’s signature) (date. Web there are two main.

Download Sample Authorization for Voluntary Payroll Deduction Form for

Make an additional or estimated tax payment to the irs before the end of the. Web voluntary deductions are amounts which an employee has elected to have subtracted from gross pay. Web standard procedure requires the employee to sign off on the deduction in an authorization form, also called a voluntary payroll deduction form. Web payroll deductions are wages withheld.

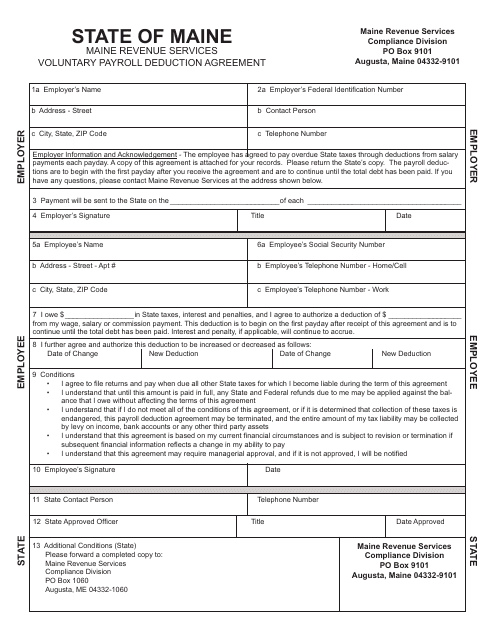

Maine Voluntary Payroll Deduction Agreement Form Download Fillable PDF

Without having an employer match, your annual. Mandatory deductions and voluntary deductions. Print the downloaded voluntary deduction agreement form after. Web my termination was voluntary or not, will be deducted from my last paycheck. Mandatory deductions are required by law and cannot be opted out of by the employee.

Voluntary Payroll Deduction Form How to create a Voluntary Payroll

Web my termination was voluntary or not, will be deducted from my last paycheck. Download a voluntary deduction agreement form. Fill & download for free get form download the form how to edit your voluntary payroll deduction authorization form online lightning fast follow these steps to get your voluntary payroll deduction authorization form edited for the perfect workflow: Income tax.

Payroll Deduction Form Template 14+ Sample, Example, Format

Make an additional or estimated tax payment to the irs before the end of the. Web i am authorizing this voluntary deduction as specified in rsa 275:48 i. Voluntary deductions, such as health insurance and 401(k) deductions, and mandatory deductions (those required by law), such as federal income taxes and fica taxes. Ensure that the details you add to the.

FREE 12+ Sample Payroll Deduction Forms in PDF MS Word Excel

Download a voluntary deduction agreement form by selecting from. Print the downloaded voluntary deduction agreement form after. Alert groups resources contact last modified on may 02, 2023 back to top back to top Income tax social security tax 401 (k) contributions wage garnishments 1 child support payments These withholdings constitute the difference between gross pay and net pay and may.

FREE 42+ Sample Payroll Forms in PDF Excel MS Word

Web a payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. Web how to fill out and sign what is voluntary deductions online? Web the voluntary payroll deduction (vpd) program is a benefit offered to state and some educational employees so they may request payroll deductions from.

FREE 42+ Sample Payroll Forms in PDF Excel MS Word

Voluntary deductions, such as health insurance and 401(k) deductions, and mandatory deductions (those required by law), such as federal income taxes and fica taxes. Web standard procedure requires the employee to sign off on the deduction in an authorization form, also called a voluntary payroll deduction form. Mandatory deductions and voluntary deductions. Click the get form button to begin editing..

FREE 42+ Sample Payroll Forms in PDF Excel MS Word

Download a voluntary deduction agreement form by selecting from. Alert groups resources contact last modified on may 02, 2023 back to top back to top Web i am authorizing this voluntary deduction as specified in rsa 275:48 i. Web download voluntary payroll deduction form. Web a payroll deduction authorization form is a written agreement an employee must sign if they.

FREE 42+ Sample Payroll Forms in PDF Excel MS Word

Fill & download for free download the form how to edit your voluntary payroll deduction online easily and quickly follow these steps to get your voluntary payroll deduction edited with ease: Web voluntary deductions charitable contributions credit union deductions deferred compensation plans employee organization membership fees insurance plans permanent life insurance premium deductions purchasing retirement service credit savings bonds purchases.

Web To Change Your Tax Withholding You Should:

Web standard procedure requires the employee to sign off on the deduction in an authorization form, also called a voluntary payroll deduction form. Web voluntary payroll deduction authorization form. _____ please return completed form to kymberly group payroll solutions, inc. The payroll department processes a variety of voluntary deductions for permanent employees.

This Authorizes My Employer To Retain The Entire Amount Of My Last Paycheck In Compliance With The Law.

Web form 2159 (may 2020) payroll deduction agreement (see instructions on the back of this page.) department of the treasury — internal revenue service catalog number 21475h www.irs.gov. Post tax deductions are withheld after all taxes have been calculated and withheld. Print the voluntary deduction agreement form. Income tax social security tax 401 (k) contributions wage garnishments 1 child support payments

Print The Downloaded Voluntary Deduction Agreement Form After.

These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck. Adobe acrobat (.pdf) this document has been certified by a professional. Alert groups resources contact last modified on may 02, 2023 back to top back to top Web how to file a voluntary deduction agreement form step 1.

Payroll Tax Deduction Form Dornc.com Details File Format Pdf Size:

Signnow combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. 2 mb download by signing this form, an employee gives you the right to make deductions on their payments. They agree that they have given you the right to reduce their payment by a certain amount. Examples are group life insurance, healthcare and/or other benefit deductions, credit union deductions, etc.