W2 Form Mn

W2 Form Mn - Employers are required to report taxable wages and related compensation, income taxes, and certain payroll deductions to employees, the internal revenue service. Go to the my pay tab and click on view w2/w2c forms at the. Sign into self service, www.state.mn.us/employee, using the same user id and password that you use to. December 2014) department of the treasury internal revenue service. Request for taxpayer identification number and certification. (only umn employees will see these tabs) at the bottom of the page, look under the tax subheading. Web deceased employees, at the employee’s last home address. Employees not in active status and. On the left, select my pay or my benefits. Web enclose any explanations on a separate sheet unless you are instructed to write them on your return.

Web as an employer in the state of minnesota , you must file. Sign into the self service portal, www.mn.gov/employee using the same user id and password that you. On the left, select my pay or my benefits. December 2014) department of the treasury internal revenue service. Request for taxpayer identification number and certification. Place a copy of your federal return and schedules behind your minnesota. Employers are required to report taxable wages and related compensation, income taxes, and certain payroll deductions to employees, the internal revenue service. (only umn employees will see these tabs) at the bottom of the page, look under the tax subheading. Web enclose any explanations on a separate sheet unless you are instructed to write them on your return. Sign into self service, www.state.mn.us/employee, using the same user id and password that you use to.

Web enclose any explanations on a separate sheet unless you are instructed to write them on your return. (only umn employees will see these tabs) at the bottom of the page, look under the tax subheading. Web as an employer in the state of minnesota , you must file. What are the requirements to file w2 electronically with minnesota? Employees not in active status and. Place a copy of your federal return and schedules behind your minnesota. Web deceased employees, at the employee’s last home address. Request for taxpayer identification number and certification. Web instructions log into the myu portal. Sign into the self service portal, www.mn.gov/employee using the same user id and password that you.

ezAccounting Payroll How to Print Form W2

Sign into self service, www.state.mn.us/employee, using the same user id and password that you use to. What are the requirements to file w2 electronically with minnesota? On the left, select my pay or my benefits. Employees not in active status and. Request for taxpayer identification number and certification.

Everything You Need to Know About Your W2 Form GOBankingRates

What are the requirements to file w2 electronically with minnesota? Employees not in active status and. December 2014) department of the treasury internal revenue service. Sign into self service, www.state.mn.us/employee, using the same user id and password that you use to. Place a copy of your federal return and schedules behind your minnesota.

Blank I9 And W4 2020 Fill and Sign Printable Template Online US

Web instructions log into the myu portal. Sign into self service, www.state.mn.us/employee, using the same user id and password that you use to. Web as an employer in the state of minnesota , you must file. Web enclose any explanations on a separate sheet unless you are instructed to write them on your return. Place a copy of your federal.

An Employer’s Guide to Easily Completing a W2 Form Gift CPAs

Web deceased employees, at the employee’s last home address. Web as an employer in the state of minnesota , you must file. Web enclose any explanations on a separate sheet unless you are instructed to write them on your return. Sign into self service, www.state.mn.us/employee, using the same user id and password that you use to. Place a copy of.

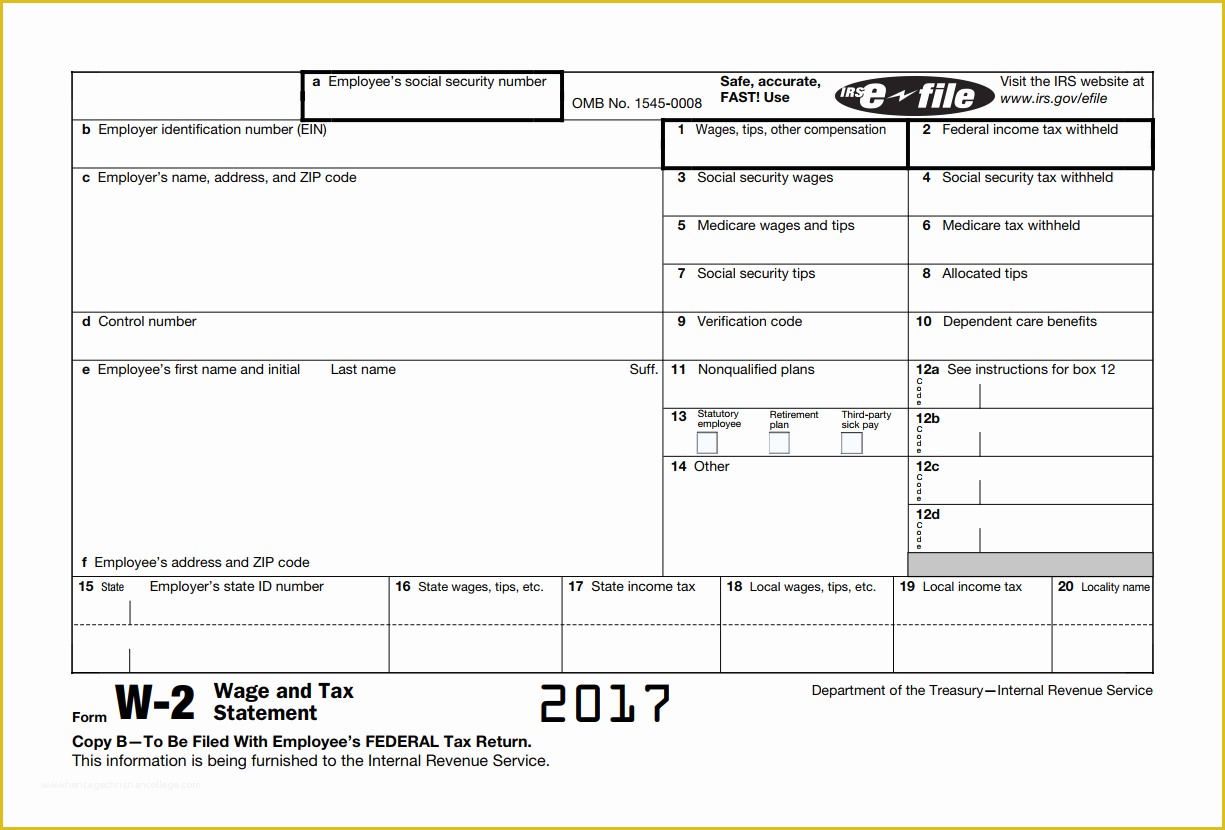

Sample W2 Tax Forms

Sign into self service, www.state.mn.us/employee, using the same user id and password that you use to. Web as an employer in the state of minnesota , you must file. Employers are required to report taxable wages and related compensation, income taxes, and certain payroll deductions to employees, the internal revenue service. Place a copy of your federal return and schedules.

So You Have Stock Compensation And Your Form W2 Just Arrived Now What

Web instructions log into the myu portal. Employers are required to report taxable wages and related compensation, income taxes, and certain payroll deductions to employees, the internal revenue service. Employees not in active status and. What are the requirements to file w2 electronically with minnesota? Web as an employer in the state of minnesota , you must file.

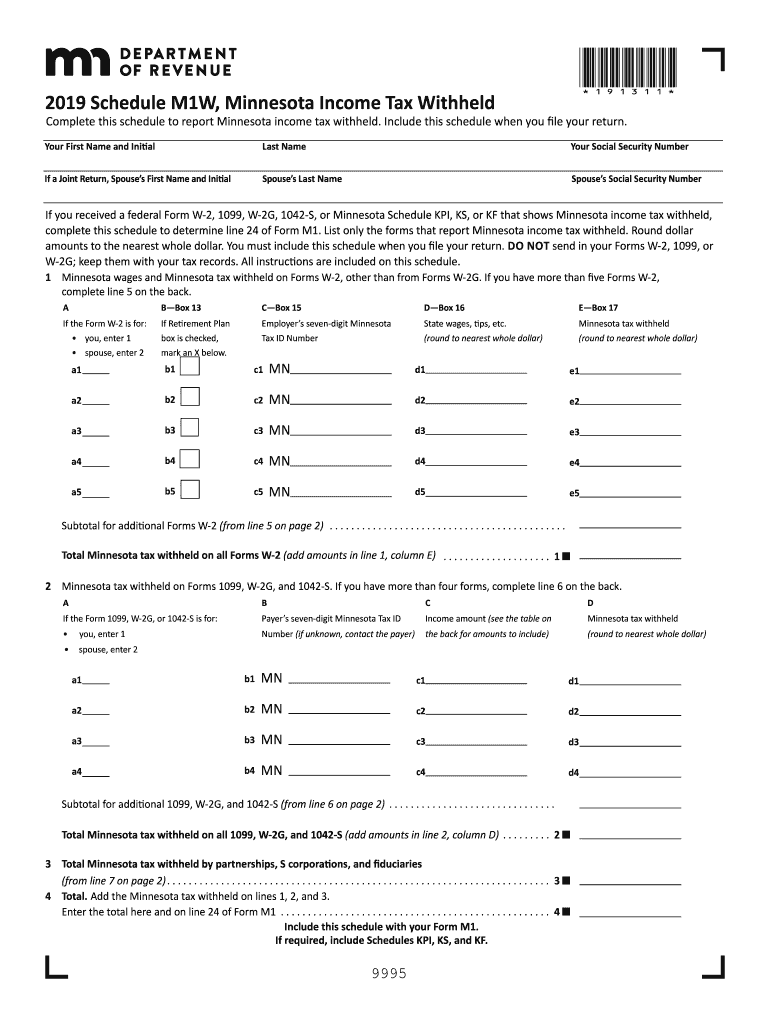

2020 Minnesota Tax Fill Out and Sign Printable PDF Template signNow

Place a copy of your federal return and schedules behind your minnesota. Sign into self service, www.state.mn.us/employee, using the same user id and password that you use to. Web deceased employees, at the employee’s last home address. Sign into the self service portal, www.mn.gov/employee using the same user id and password that you. Request for taxpayer identification number and certification.

How to Print Multipe W2 Forms on the Sheet for Employees

Employers are required to report taxable wages and related compensation, income taxes, and certain payroll deductions to employees, the internal revenue service. Web enclose any explanations on a separate sheet unless you are instructed to write them on your return. (only umn employees will see these tabs) at the bottom of the page, look under the tax subheading. Sign into.

IRS Urged to Move Up W2 Filing Deadline

On the left, select my pay or my benefits. Employees not in active status and. What are the requirements to file w2 electronically with minnesota? December 2014) department of the treasury internal revenue service. Sign into self service, www.state.mn.us/employee, using the same user id and password that you use to.

Free W2 Template Of W 2 Wage Taxable Irs and State In E form W2

Web deceased employees, at the employee’s last home address. Web as an employer in the state of minnesota , you must file. On the left, select my pay or my benefits. Web enclose any explanations on a separate sheet unless you are instructed to write them on your return. Employers are required to report taxable wages and related compensation, income.

Web Enclose Any Explanations On A Separate Sheet Unless You Are Instructed To Write Them On Your Return.

Web instructions log into the myu portal. Go to the my pay tab and click on view w2/w2c forms at the. December 2014) department of the treasury internal revenue service. (only umn employees will see these tabs) at the bottom of the page, look under the tax subheading.

On The Left, Select My Pay Or My Benefits.

Employers are required to report taxable wages and related compensation, income taxes, and certain payroll deductions to employees, the internal revenue service. Employees not in active status and. Web as an employer in the state of minnesota , you must file. Web deceased employees, at the employee’s last home address.

Place A Copy Of Your Federal Return And Schedules Behind Your Minnesota.

Request for taxpayer identification number and certification. Sign into the self service portal, www.mn.gov/employee using the same user id and password that you. Sign into self service, www.state.mn.us/employee, using the same user id and password that you use to. What are the requirements to file w2 electronically with minnesota?