Wages From Form 8919

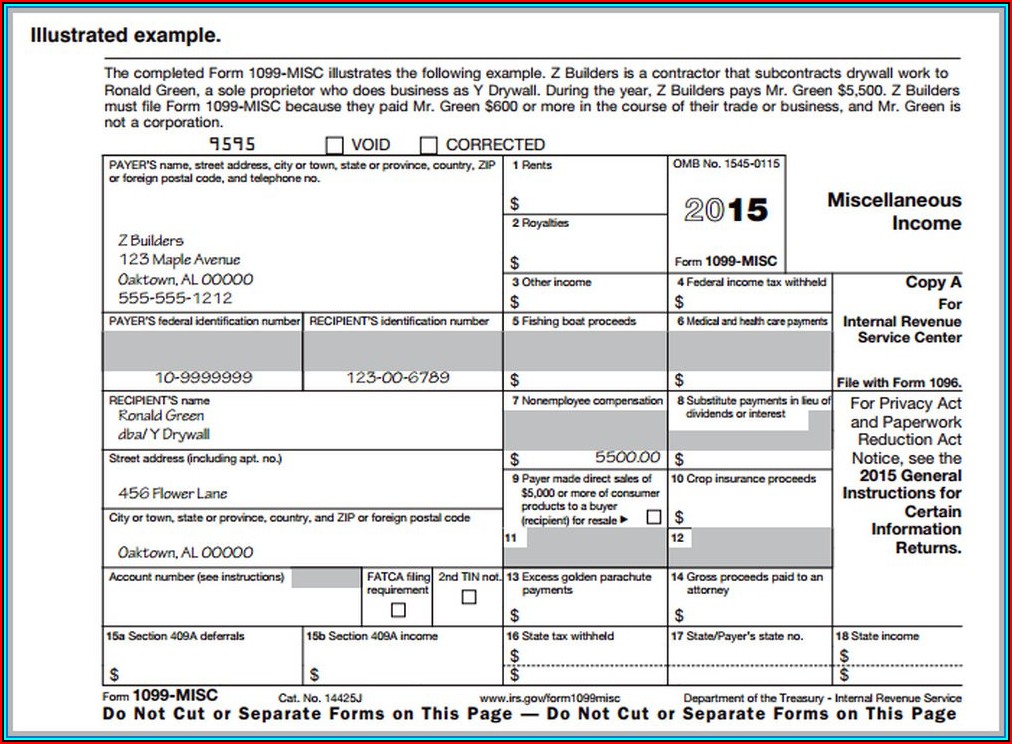

Wages From Form 8919 - Web form 8919, uncollected social security and medicare tax on wages ines zemelman, ea 22 march 2023 as a seasoned tax expert with years of experience, i've. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. Attach to your tax return. Meet irs form 8919 jim buttonow, cpa, citp. Web workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes withheld from their. Web about form 8919, uncollected social security and medicare tax on wages. Combine lines 1 through 5 in column (f). Web 1 best answer anthonyc level 7 this information is entered in a different area of the program then regular w2s. Per irs form 8919, you must file this form if all of the following apply. You must file form 8919 if.

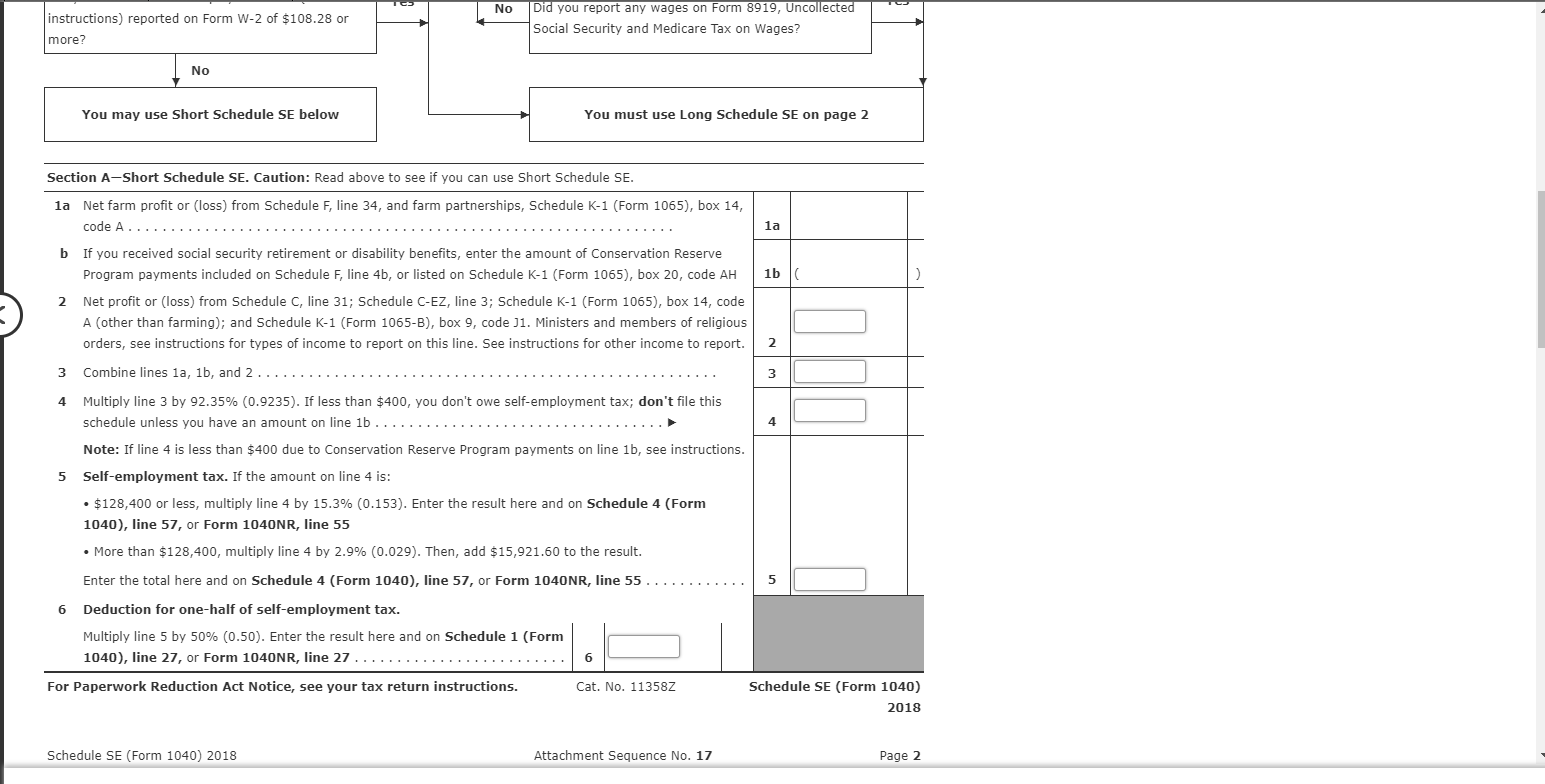

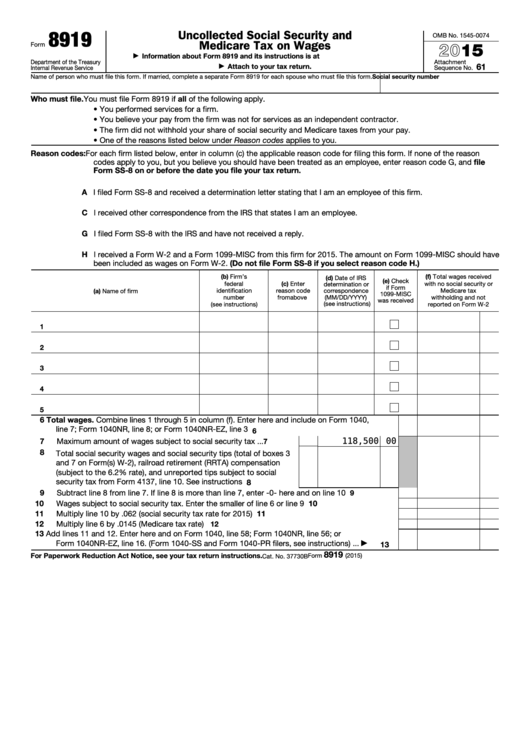

Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. Web workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes withheld from their. Web form 8919, uncollected social security and medicare tax on wages ines zemelman, ea 22 march 2023 as a seasoned tax expert with years of experience, i've. Ss8 has been submitted but without an irs answer yet. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Web after confirming your employment status, they must file form 8919 to report uncollected social security and medicare tax on wages. Web if married, complete a separate form 8919 for each spouse who must file this form. Use form 8919 to figure and report your share of the uncollected social. You performed services for a.

You must file form 8919 if. The taxpayer performed services for an individual or a firm. Web medicare tax on wages information about form 8919 and its instructions is at www.irs.gov/form8919. Attach to your tax return. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by. Web after confirming your employment status, they must file form 8919 to report uncollected social security and medicare tax on wages. Per irs form 8919, you must file this form if all of the following apply. Web form 8919, uncollected social security and medicare tax on wages ines zemelman, ea 22 march 2023 as a seasoned tax expert with years of experience, i've. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Combine lines 1 through 5 in column (f).

IRS Form 8919 Uncollected Social Security & Medicare Taxes

Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. You performed services for a. You must file form 8919 if. Attach to your tax return. Web medicare tax on wages information about form 8919 and its instructions is at www.irs.gov/form8919.

Lost wages/earnings claim form in Word and Pdf formats page 4 of 4

Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Web medicare tax on wages information about form 8919 and its instructions is at www.irs.gov/form8919. Web form 8919, uncollected social security and medicare tax on wages, will need to.

Financial Concept about Form 8919 Uncollected Social Security and

Use form 8919 to figure and report your share of the uncollected social. How do i change the reason. Web if married, complete a separate form 8919 for each spouse who must file this form. Meet irs form 8919 jim buttonow, cpa, citp. Web medicare tax on wages information about form 8919 and its instructions is at www.irs.gov/form8919.

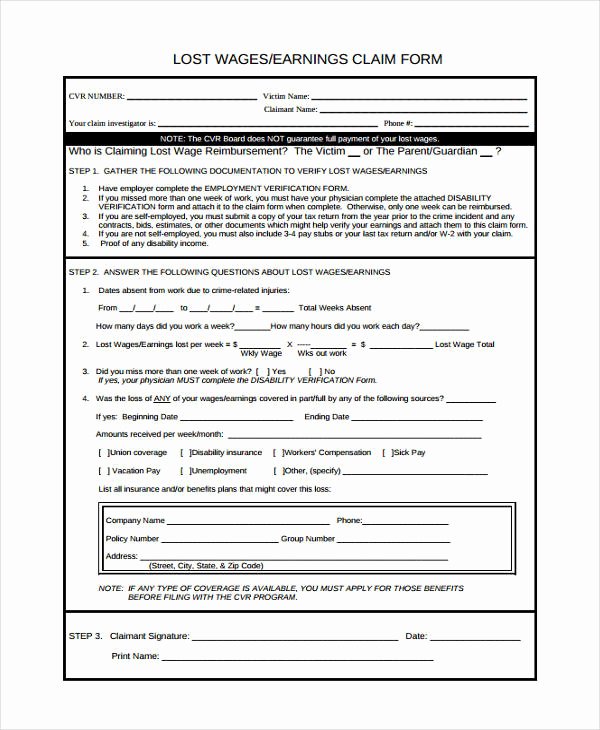

Solved Problem 616 (Algorithmic) SelfEmployment Tax (LO...

Meet irs form 8919 jim buttonow, cpa, citp. Web about form 8919, uncollected social security and medicare tax on wages. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Ss8 has been submitted but without an irs answer yet. Web workers must file form 8919,.

Fillable Form 8919 Uncollected Social Security And Medicare Tax On

Attach to your tax return. Use form 8919 to figure and report your share of the uncollected social. You performed services for a. Web workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes withheld from their. Web department of the treasury internal revenue service uncollected social.

US Internal Revenue Service f8888 Tax Refund Individual Retirement

Attach to your tax return. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. You performed services for a. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Per irs form.

Fill Form 8919 Uncollected Social Security and Medicare Tax

Web medicare tax on wages information about form 8919 and its instructions is at www.irs.gov/form8919. Ss8 has been submitted but without an irs answer yet. Web workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes withheld from their. Web department of the treasury internal revenue service.

Lost wages/earnings claim form in Word and Pdf formats page 3 of 4

Web workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes withheld from their. Use form 8919 to figure and report your share of the uncollected social. Attach to your tax return. Web department of the treasury internal revenue service uncollected social security and medicare tax on.

Lost Wages Form Car Accident Form Resume Examples l6YN6AlY3z

Web about form 8919, uncollected social security and medicare tax on wages. Meet irs form 8919 jim buttonow, cpa, citp. Web 1 best answer anthonyc level 7 this information is entered in a different area of the program then regular w2s. Web after confirming your employment status, they must file form 8919 to report uncollected social security and medicare tax.

√ 20 Lost Wages form ™ Dannybarrantes Template

Web about form 8919, uncollected social security and medicare tax on wages. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your.

Web Form 8919, Uncollected Social Security And Medicare Tax On Wages, Will Need To Be Filed If All Of The Following Are True:

The taxpayer performed services for an individual or a firm. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. You must file form 8919 if. You performed services for a.

Web Use Form 8919 To Figure And Report Your Share Of The Uncollected Social Security And Medicare Taxes Due On Your Compensation If You Were An Employee But Were Treated As.

How do i change the reason. Web after confirming your employment status, they must file form 8919 to report uncollected social security and medicare tax on wages. Web workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes withheld from their. Enter here and include on form.

Web 1 Best Answer Anthonyc Level 7 This Information Is Entered In A Different Area Of The Program Then Regular W2S.

Combine lines 1 through 5 in column (f). Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Meet irs form 8919 jim buttonow, cpa, citp.

Per Irs Form 8919, You Must File This Form If All Of The Following Apply.

Ss8 has been submitted but without an irs answer yet. Web form 8919, uncollected social security and medicare tax on wages ines zemelman, ea 22 march 2023 as a seasoned tax expert with years of experience, i've. Web if married, complete a separate form 8919 for each spouse who must file this form. Attach to your tax return.