What Is A 590 Form

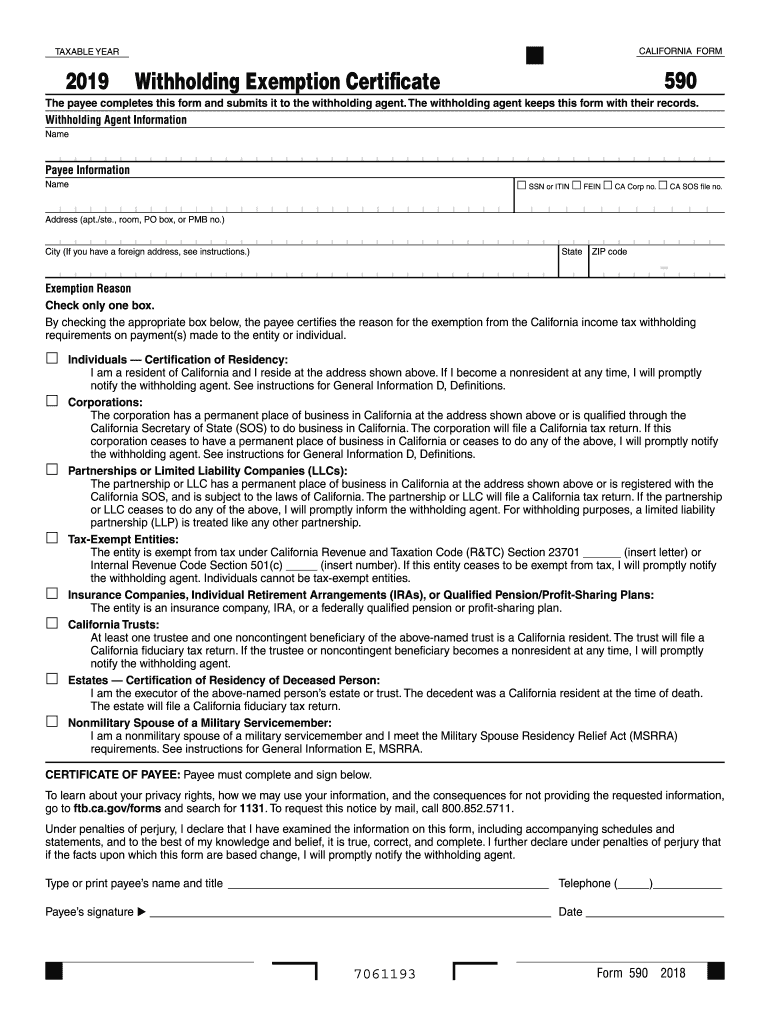

What Is A 590 Form - By checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the entity or individual. Form 590 does not apply to payments for wages to employees. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. Web exemption reason check only one box. Form 590 does not apply to payments of backup withholding. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. California residents or entities should complete and present form 590 to the withholding agent. Individuals — certification of residency: An ira is a personal savings plan that gives you tax advantages for setting aside money for retirement.

They are correctly providing this to you. Am a resident of california and i reside at the address shown above. Form 590 does not apply to payments of backup withholding. By checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the entity or individual. Web exemption reason check only one box. Form 590 does not apply to payments for wages to employees. For more information, go to ftb.ca.gov and search for backup withholding. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Form 590 does not apply to payments of backup withholding. For more information, go to ftb.ca.gov and search for backup withholding.

Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web exemption reason check only one box. An ira is a personal savings plan that gives you tax advantages for setting aside money for retirement. Form 590 does not apply to payments of backup withholding. By checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the entity or individual. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. Form 590 does not apply to payments for wages to employees. California residents or entities should complete and present form 590 to the withholding agent. For more information, go to ftb.ca.gov and search for backup withholding.

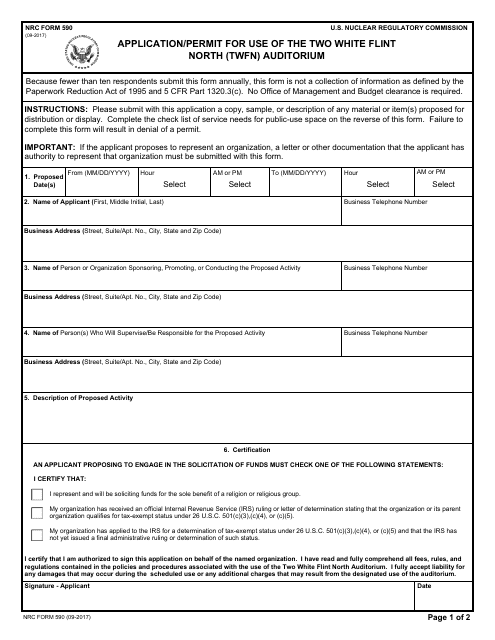

NRC Form 590 Download Fillable PDF or Fill Online Application/Permit

Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. An ira is a personal savings plan that gives you tax advantages for setting aside money for retirement. By checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the entity or.

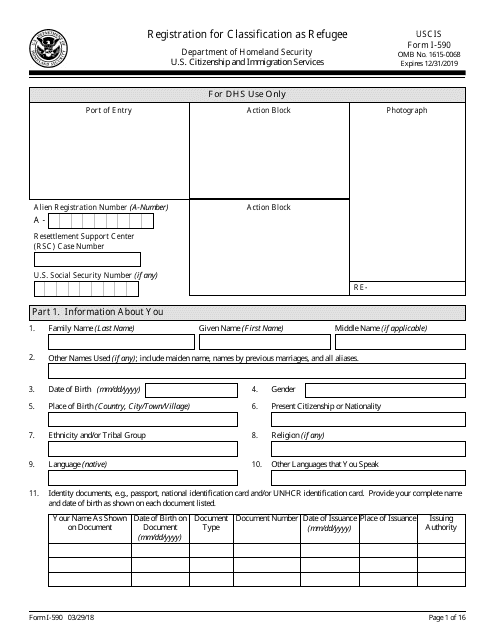

20182022 Form USCIS I590 Fill Online, Printable, Fillable, Blank

They are correctly providing this to you. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. For more information, go to ftb.ca.gov and search for backup withholding. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. Form 590 does.

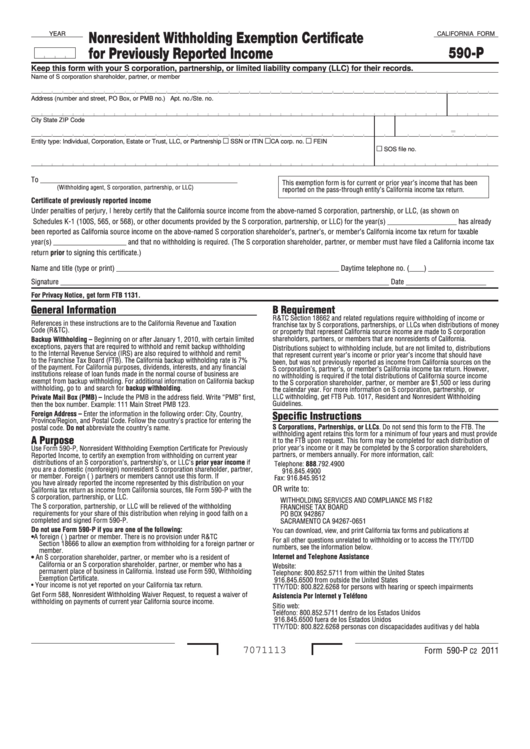

Fillable California Form 590P Nonresident Withholding Exemption

Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. The term individual retirement arrangement represents a wide variety of ira account types. Form 590 does not apply to payments for wages to employees. Web exemption reason check only one box. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding.

Fill Free fillable I590 Form I590, Registration for Classification

Individuals — certification of residency: Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. By checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the entity.

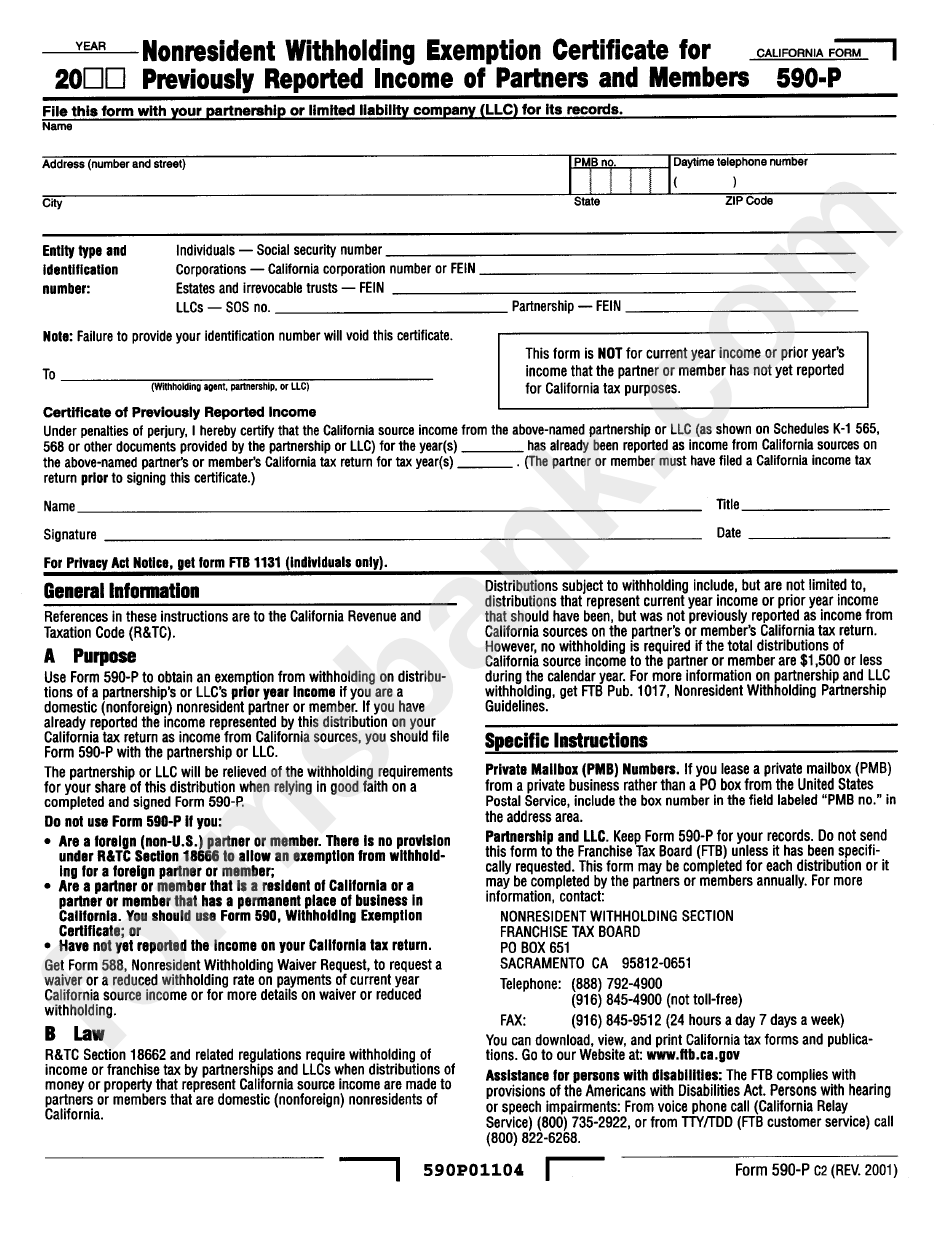

Form 590P Nonresident Withholding Exemption Certificate For

Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. An ira is a personal savings plan that gives you tax advantages for setting aside money for retirement. Web exemption reason check only one box. Form 590 does not apply to payments for wages to.

Ca 590 form 2018 Lovely San Bernardino County Ficial Website

For more information, go to ftb.ca.gov and search for backup withholding. They are correctly providing this to you. Form 590 does not apply to payments of backup withholding. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. For more information, go to ftb.ca.gov and search for backup withholding.

2019 Form CA FTB 590 Fill Online, Printable, Fillable, Blank PDFfiller

Form 590 does not apply to payments for wages to employees. Form 590 does not apply to payments of backup withholding. California residents or entities should complete and present form 590 to the withholding agent. Form 590 does not apply to payments of backup withholding. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding.

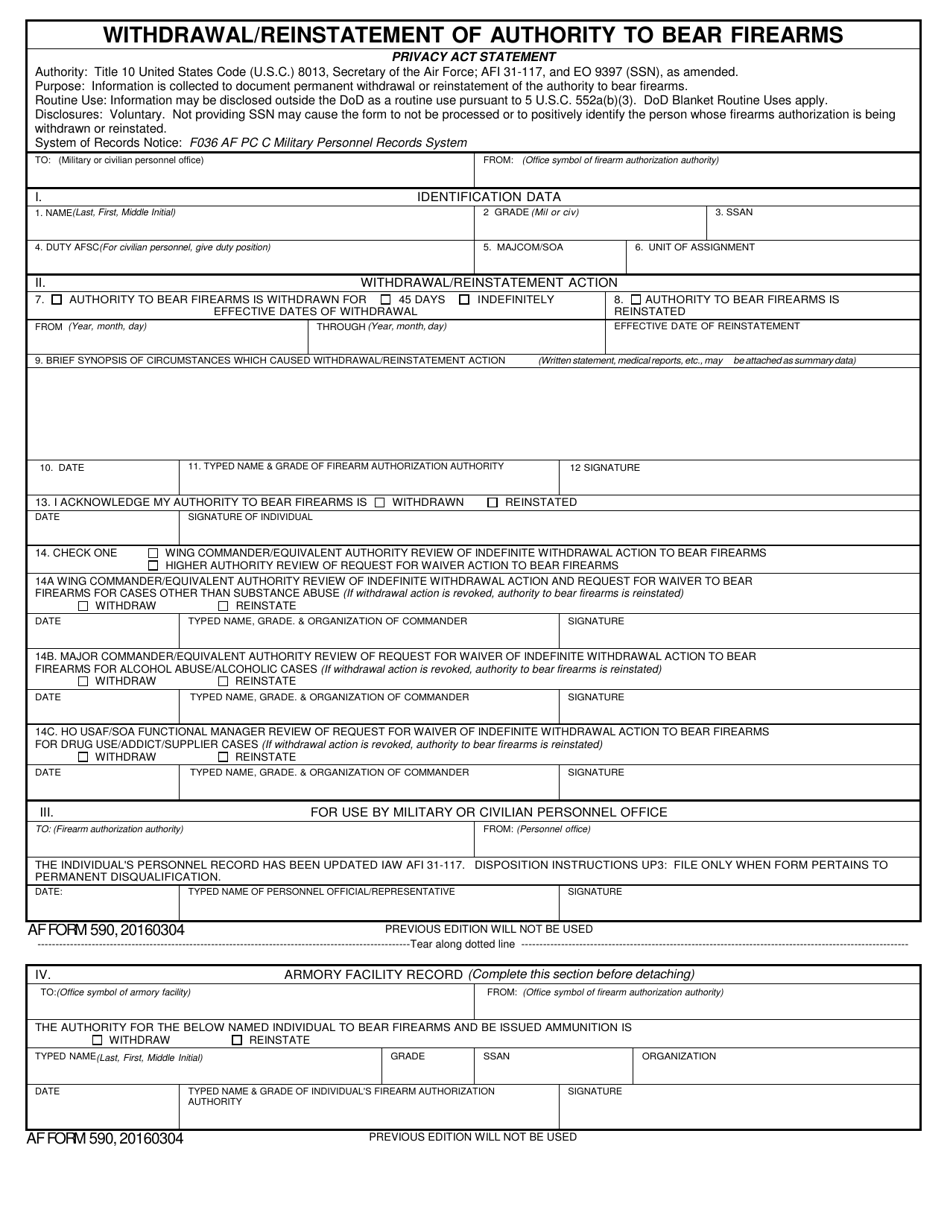

AF Form 590 Download Fillable PDF or Fill Online Withdrawal

They are correctly providing this to you. Form 590 does not apply to payments of backup withholding. For more information, go to ftb.ca.gov and search for backup withholding. Am a resident of california and i reside at the address shown above. For more information, go to ftb.ca.gov and search for backup withholding.

USCIS Form I590 Download Fillable PDF or Fill Online Registration for

Am a resident of california and i reside at the address shown above. Web exemption reason check only one box. Form 590 does not apply to payments of backup withholding. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. California residents or entities should.

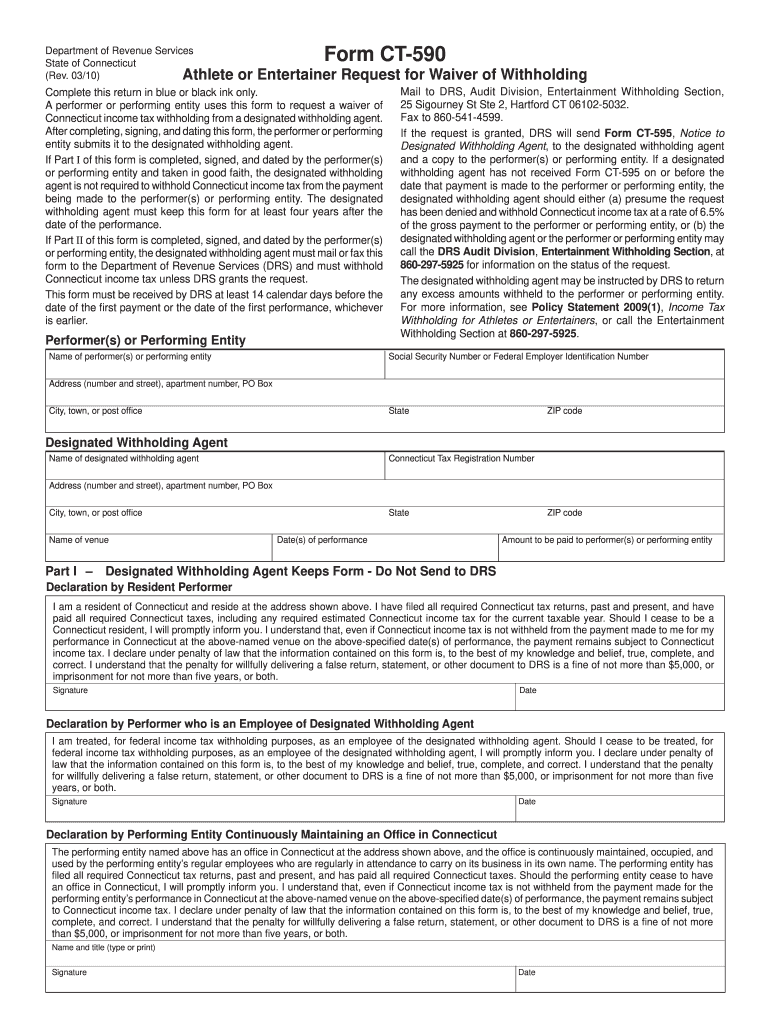

Ct 590 Fill Out and Sign Printable PDF Template signNow

Form 590 does not apply to payments of backup withholding. Form 590 does not apply to payments for wages to employees. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. An ira is a personal savings plan that gives you tax advantages for setting aside money for retirement. For more information, go to ftb.ca.gov and.

By Checking The Appropriate Box Below, The Payee Certifies The Reason For The Exemption From The California Income Tax Withholding Requirements On Payment(S) Made To The Entity Or Individual.

Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Am a resident of california and i reside at the address shown above. An ira is a personal savings plan that gives you tax advantages for setting aside money for retirement. Form 590 does not apply to payments of backup withholding.

California Residents Or Entities Should Complete And Present Form 590 To The Withholding Agent.

The term individual retirement arrangement represents a wide variety of ira account types. Individuals — certification of residency: Form 590 does not apply to payments for wages to employees. Web exemption reason check only one box.

Web Use Form 590, Withholding Exemption Certificate, To Certify An Exemption From Nonresident Withholding.

For more information, go to ftb.ca.gov and search for backup withholding. For more information, go to ftb.ca.gov and search for backup withholding. Form 590 does not apply to payments for wages to employees. Form 590 does not apply to payments of backup withholding.

Web Use Form 590, Withholding Exemption Certificate, To Certify An Exemption From Nonresident Withholding.

They are correctly providing this to you. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments.