What Is A Calendar Spread

What Is A Calendar Spread - Web what is a calendar spread? Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike price. Web calendar spreads defined. Web a calendar spread is a strategy used in options and futures trading: If you’re unfamiliar with a horizontal spread, it’s an options strategy that involves. When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration date than the. Web what are calendar spreads? A double calendar has positive vega so it is best entered in a low volatility environment. Web a calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time and price, but different expirations. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike.

Web i had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. A double calendar has positive vega so it is best entered in a low volatility environment. A calendar spread is a type of horizontal spread. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike. Traditionally calendar spreads are dealt with a price based. Web a calendar spread is a strategy used in options and futures trading: Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index. Web a calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time and price, but different expirations. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular. Web what is a calendar spread?

When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration date than the. Web what are calendar spreads? A calendar spread is a type of horizontal spread. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index. Calendar spreads are useful in any market climate. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike. Web what is a calendar spread? Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset in another month. A calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same. Web what is a calendar spread?

How to Trade Options Calendar Spreads (Visuals and Examples)

Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different expiration dates. A double calendar has positive vega so it is best entered in a low volatility environment. Web what is a calendar spread? Calendar spreads are useful in any market climate. Web a calendar spread is a.

Everything You Need to Know about Calendar Spreads

When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration date than the. Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike.

What are Calendar Spread and Double Calendar Spread Strategies

Web what is a calendar spread? Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular. A calendar spread can be constructed with either calls or puts by. Web the simple definition of a calendar spread is that it is.

How Calendar Spreads Work (Best Explanation) projectoption

Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index. A calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same. Web in finance, a calendar spread (also called a time.

What is a Calendar Spread? Finance.Gov.Capital

Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index. A double calendar has positive vega so it is best entered in a low volatility environment. Web what is a calendar spread? Traditionally calendar spreads are dealt with a price based. A calendar.

Calendar Spreads 101 Everything You Need To Know

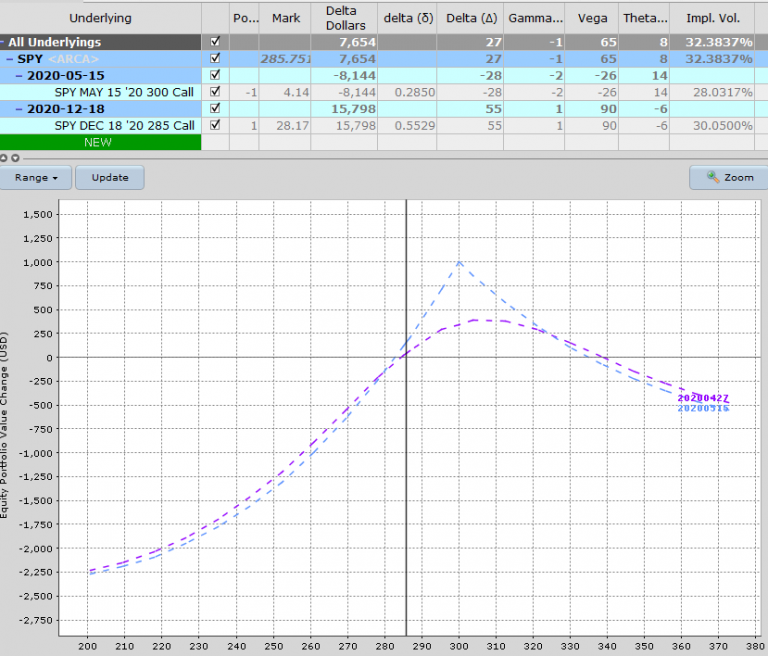

Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike price. Traders believes that volatility is likely to pick up shortly. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web.

What is Calendar Spread Options Strategy ? Different types of Calendar

A calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same. If you’re unfamiliar with a horizontal spread, it’s an options strategy that involves. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying.

Everything You Need to Know About Calendar Spreads SoFi

Web a calendar spread is a strategy used in options and futures trading: Web a calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time and price, but different expirations. Web what are calendar spreads? Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter.

Calendar Spread Options Trading Strategy In Python

Traditionally calendar spreads are dealt with a price based. Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different expiration dates. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring.

Printable Calendar Spreads on Behance

Web what is a calendar spread? Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different expiration dates. When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration date than.

Web A Calendar Spread Is A Strategy Involving Buying Longer Term Options And Selling Equal Number Of Shorter Term Options Of The Same Underlying Stock Or Index.

Web a calendar spread is a strategy used in options and futures trading: A calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same. A calendar spread can be constructed with either calls or puts by. Traders believes that volatility is likely to pick up shortly.

When Running A Calendar Spread With Calls, You’re Selling And Buying A Call With The Same Strike Price, But The Call You Buy Will Have A Later Expiration Date Than The.

Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. A calendar spread is a type of horizontal spread. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike. Web what is a calendar spread?

Traditionally Calendar Spreads Are Dealt With A Price Based.

Web what is a calendar spread? Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different expiration dates. A double calendar has positive vega so it is best entered in a low volatility environment. Web i had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module.

Web A Calendar Spread Involves Purchasing And Selling Derivatives Contracts With The Same Underlying Asset At The Same Time And Price, But Different Expirations.

If you’re unfamiliar with a horizontal spread, it’s an options strategy that involves. Web calendar spreads defined. Calendar spreads are useful in any market climate. Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike price.