What Is A Form 2210

What Is A Form 2210 - Web form 2210 is irs form that relates to underpayment of estimated taxes. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. This is when the need of hiring an expert tax professional arises to manage things. Examine the form before completing it and use the. Web why isn't form 2210 generating for a form 1041 estate return? Your income varies during the year. Penalty for underpaying taxes while everyone living in the united states is expected to pay income taxes to the irs in some. The interest rate for underpayments, which is updated by the irs each quarter. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Web what is the underpayment of estimated tax?

Web what is irs form 2210? Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Web form 2210 is irs form that relates to underpayment of estimated taxes. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web to calculate those penalty charges, the need arises to fill out the irs form 2210. For estates and trusts, no penalty. Web personal finance back to search 2210 form 2210: The form doesn't always have to be. Web what is the underpayment of estimated tax? The quarter that you underpaid.

Underpayment of estimated tax occurs when you don’t pay enough tax during those quarterly estimated tax payments. Web to calculate those penalty charges, the need arises to fill out the irs form 2210. Web form 2210 is a federal individual income tax form. The form doesn't always have to be. Web your total underpayment amount. For estates and trusts, no penalty. Web why isn't form 2210 generating for a form 1041 estate return? This revision of the form. If you owe underpayment penalties, you may need to file form 2210, underpayment of estimated tax by individuals, estates, and trusts. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf.

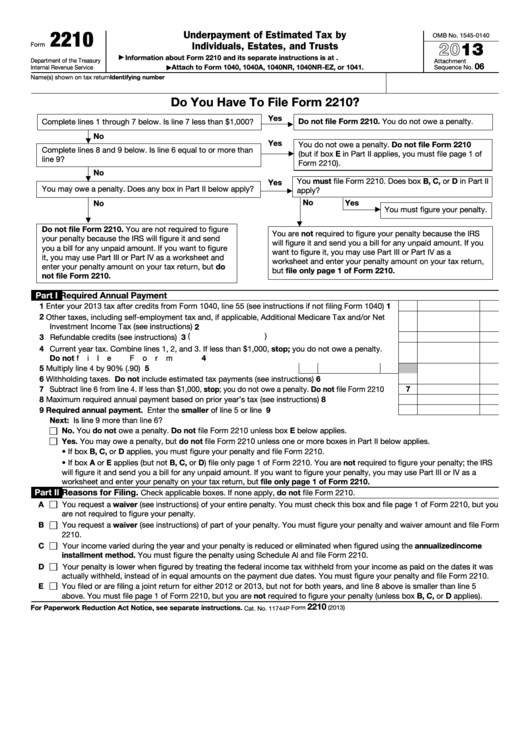

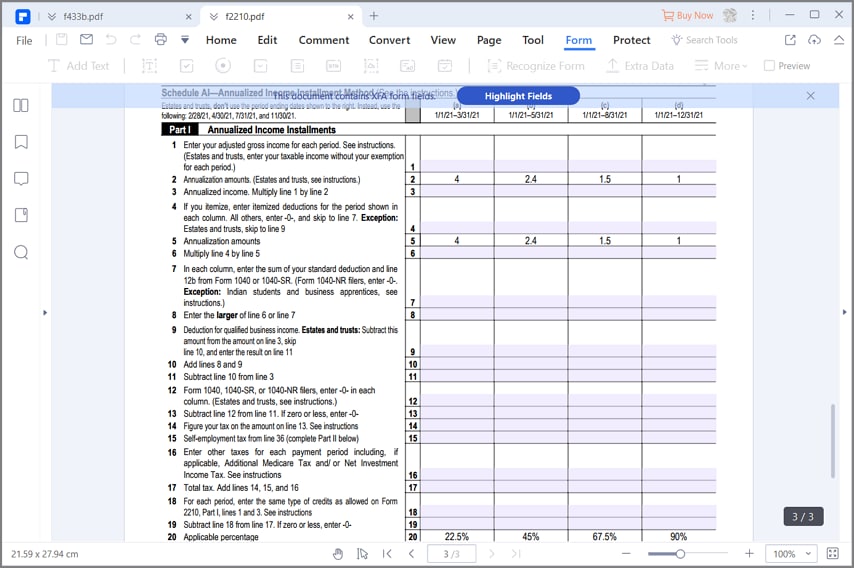

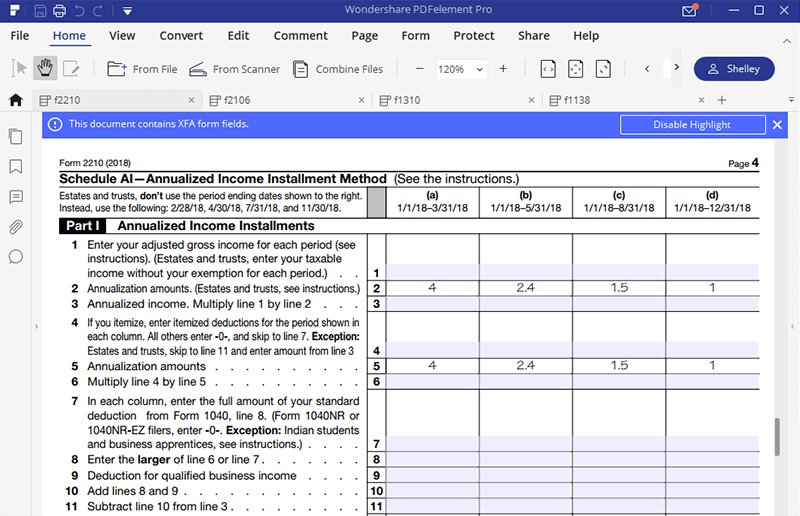

Fillable Form 2210 Fill Online, Printable, Fillable, Blank pdfFiller

Web to request a waiver when you file, complete irs form 2210 and submit it with your tax return. Underpayment of estimated tax occurs when you don’t pay enough tax during those quarterly estimated tax payments. The quarter that you underpaid. Web personal finance back to search 2210 form 2210: Web for the latest information about developments related to form.

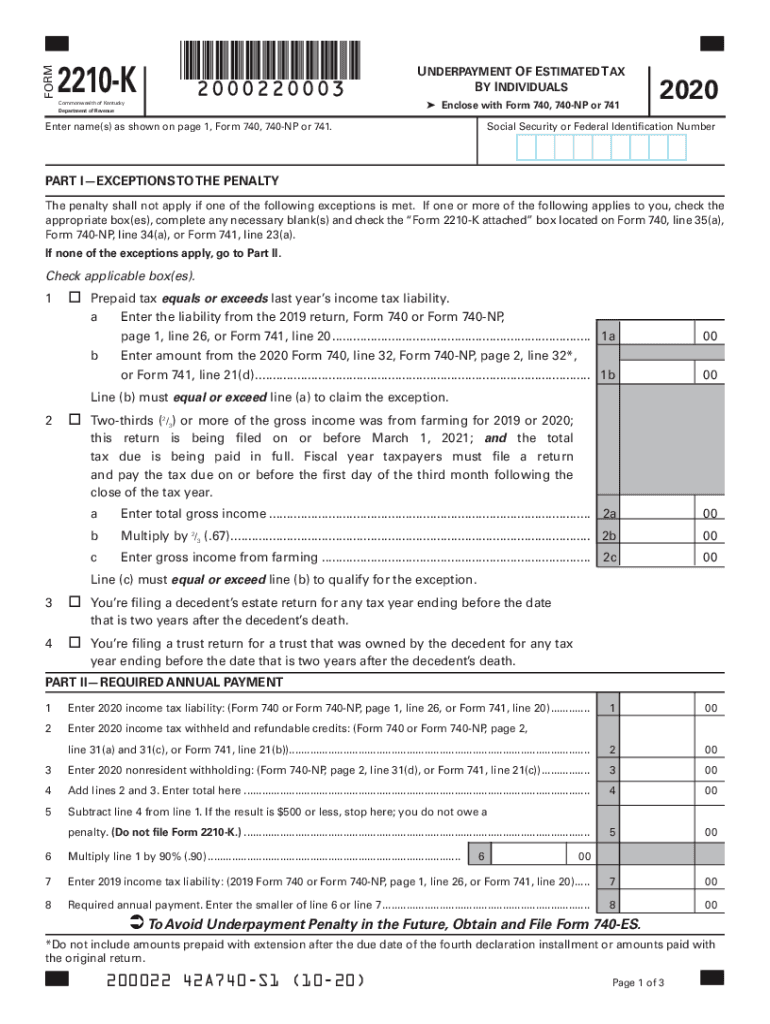

Form 2210 K Fill Out and Sign Printable PDF Template signNow

The interest rate for underpayments, which is updated by the irs each quarter. This revision of the form. Complete, edit or print tax forms instantly. Web department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts go to www.irs.gov/form2210 for instructions and the. Web form 2210 is used to determine how much you owe.

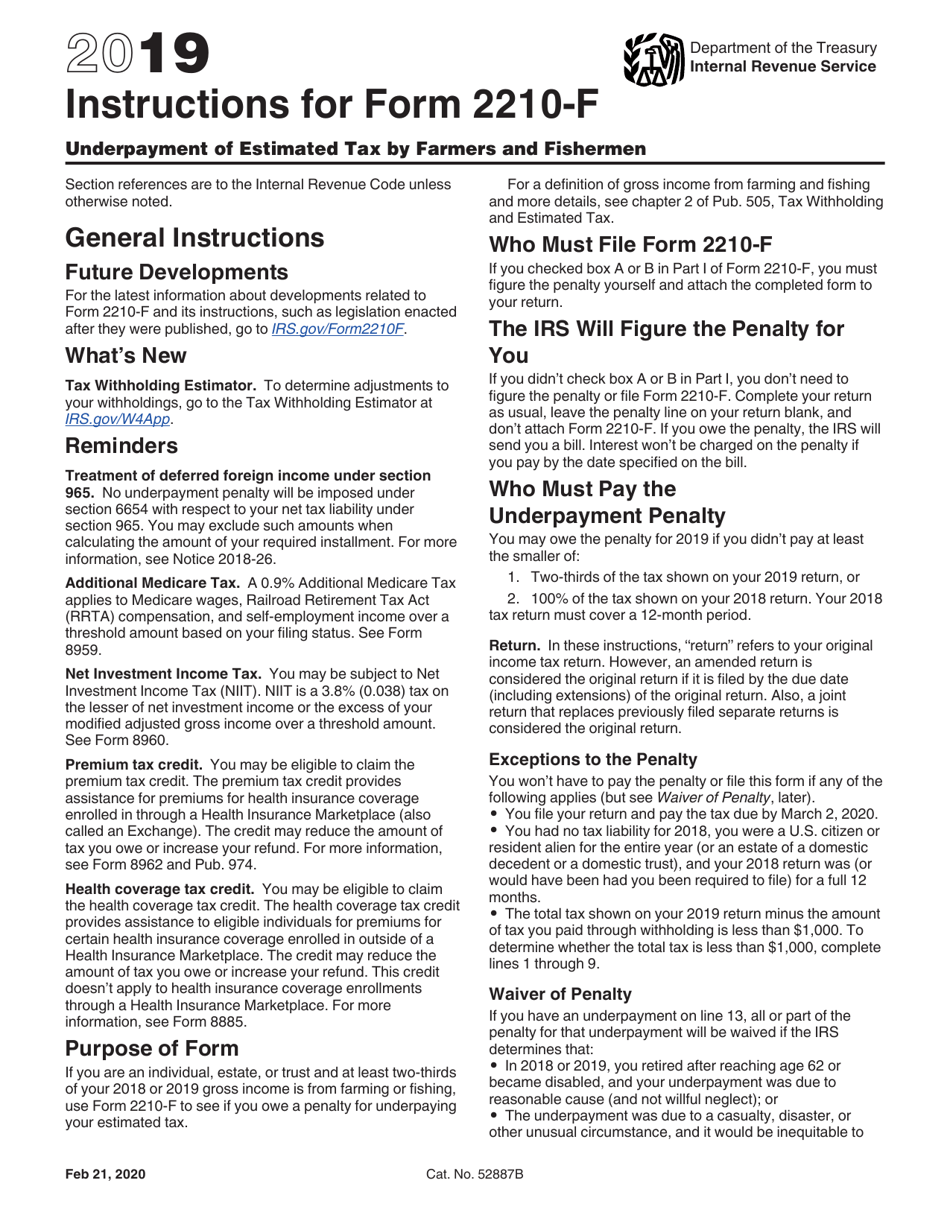

Download Instructions for IRS Form 2210F Underpayment of Estimated Tax

Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. For estates and trusts, no penalty. Web department of the treasury internal revenue service underpayment of estimated tax by.

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals

Penalty for underpaying taxes while everyone living in the united states is expected to pay income taxes to the irs in some. Web form 2210 is a federal individual income tax form. The quarter that you underpaid. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Complete, edit or print tax forms instantly.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Your income varies during the year. Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough taxes. The quarter that you underpaid. Web the form instructions say not to file form 2210.

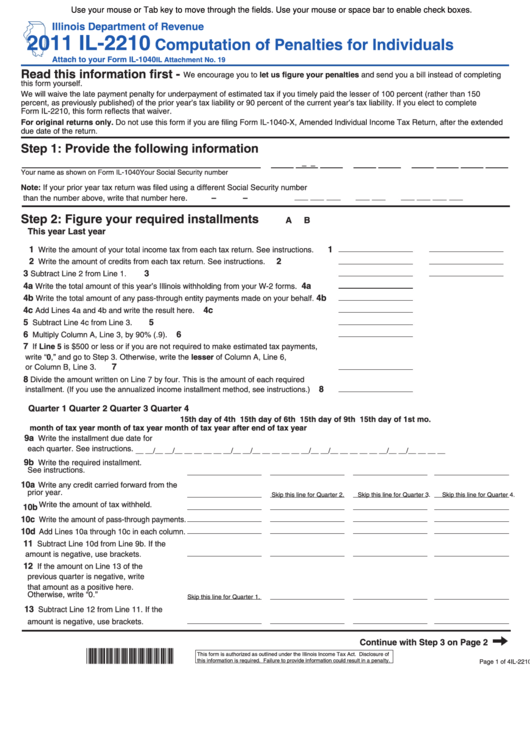

Fillable Form Il2210 Computation Of Penalties For Individuals 2011

Web what is the underpayment of estimated tax? Web form 2210 is a federal individual income tax form. For estates and trusts, no penalty. Web your total underpayment amount. With the form, attach an explanation for why you didn’t pay estimated taxes in the.

IRS Form 2210Fill it with the Best Form Filler

With the form, attach an explanation for why you didn’t pay estimated taxes in the. The quarter that you underpaid. Complete, edit or print tax forms instantly. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Web personal finance back to search.

Instructions for IRS Form 2210 Underpayment of Estimated Tax by

Complete, edit or print tax forms instantly. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Web department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts go to www.irs.gov/form2210 for instructions and the. The irs will generally figure your penalty for you and you should.

IRS Form 2210Fill it with the Best Form Filler

Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough taxes. With the form, attach an explanation for why you didn’t pay estimated taxes in the. Web personal.

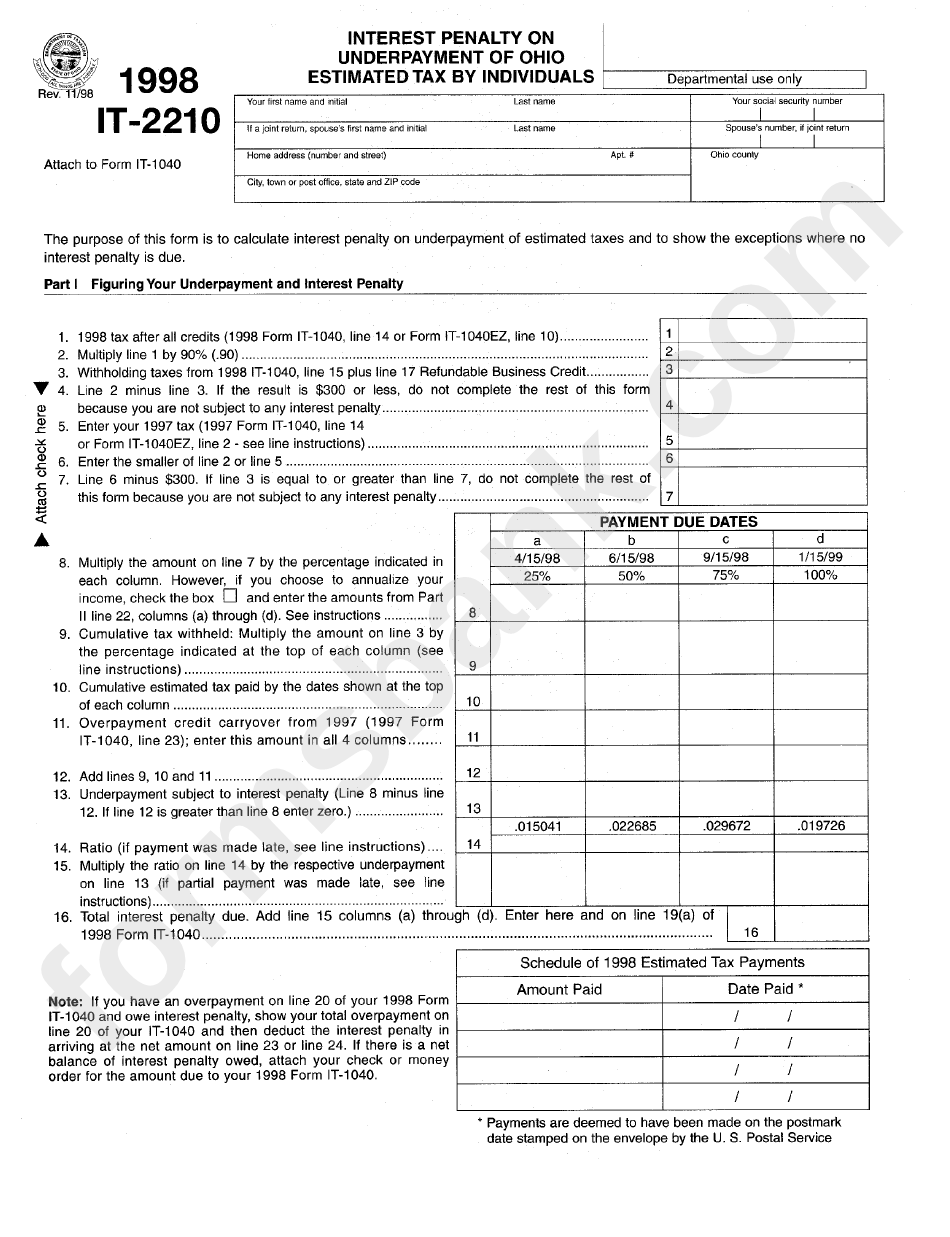

Fillable Form It2210 Interest Penalty On Underpayment Of Ohio

Web to request a waiver when you file, complete irs form 2210 and submit it with your tax return. Web to calculate those penalty charges, the need arises to fill out the irs form 2210. Underpayment of estimated tax occurs when you don’t pay enough tax during those quarterly estimated tax payments. Examine the form before completing it and use.

The Form Doesn't Always Have To Be.

This is when the need of hiring an expert tax professional arises to manage things. If you owe underpayment penalties, you may need to file form 2210, underpayment of estimated tax by individuals, estates, and trusts. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. Proconnect won't generate form 2210 if an exception to the penalty is met.

Web To Complete Form 2210 Within The Program, Please Follow The Steps Listed Below.

Web what is irs form 2210? Web the form instructions say not to file form 2210 for the sole purpose of including and calculating the penalty. The irs will generally figure your penalty for you and you should not file form 2210. Web department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts go to www.irs.gov/form2210 for instructions and the.

The Interest Rate For Underpayments, Which Is Updated By The Irs Each Quarter.

Web form 2210 is a federal individual income tax form. Penalty for underpaying taxes while everyone living in the united states is expected to pay income taxes to the irs in some. Examine the form before completing it and use the. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn.

Web Form 2210 Is Used To Determine How Much You Owe In Underpayment Penalties On Your Balance Due.

Your income varies during the year. Web to calculate those penalty charges, the need arises to fill out the irs form 2210. Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough taxes. Web form 2210 is irs form that relates to underpayment of estimated taxes.