What Is A W9 Form For Landlord

What Is A W9 Form For Landlord - To utilize in verifying their social security or tax identification number to other entities. Name (as shown on your income tax return). Individual property owner = social security number Get everything done in minutes. It allows them to accurately report. Person (including a resident alien), to provide your correct tin. One of the most common situations is when someone works as an independent contractor for a business. Web guidelines on whose number to enter. If a business deducts rent as a business expense, they may need to issue a 1099 form to the landlord. Name address tax identification number the type of entity that they are not subject to backup withholding the recipient will need to certify the information listed above is correct.

The business needs pertinent information from. The income paid to you by your landlord is. The form helps businesses obtain important information from payees to prepare information returns for the irs. One of the most common situations is when someone works as an independent contractor for a business. Person (including a resident alien) and to request certain certifications and claims for exemption. When a business pays more than $600 to a single taxpayer during the year, it must submit an informational return to the internal revenue (irs) to disclose the payments. A 1099 is the form that independent contractors and others may. The form also provides other personally identifying information like your name and address. Employers use this form to get the taxpayer identification number (tin) from contractors, freelancers and vendors. To utilize in verifying their social security or tax identification number to other entities.

Contributions you made to an ira. It allows them to accurately report. Do not leave this line blank. Acquisition or abandonment of secured property. A 1099 is the form that independent contractors and others may. Part ii certification under penalties of perjury, i certify that: Web the w9 is a standard tax form landlords need in order to properly deal with your security deposit, though many of them don't bother with it, says sam himmelstein, a lawyer who represents residential and commercial tenants and tenant associations. Employers use this form to get the taxpayer identification number (tin) from contractors, freelancers and vendors. Web guidelines on whose number to enter. The number shown on this form is my correct taxpayer identification number (or i am waiting for a number to be issued to me);

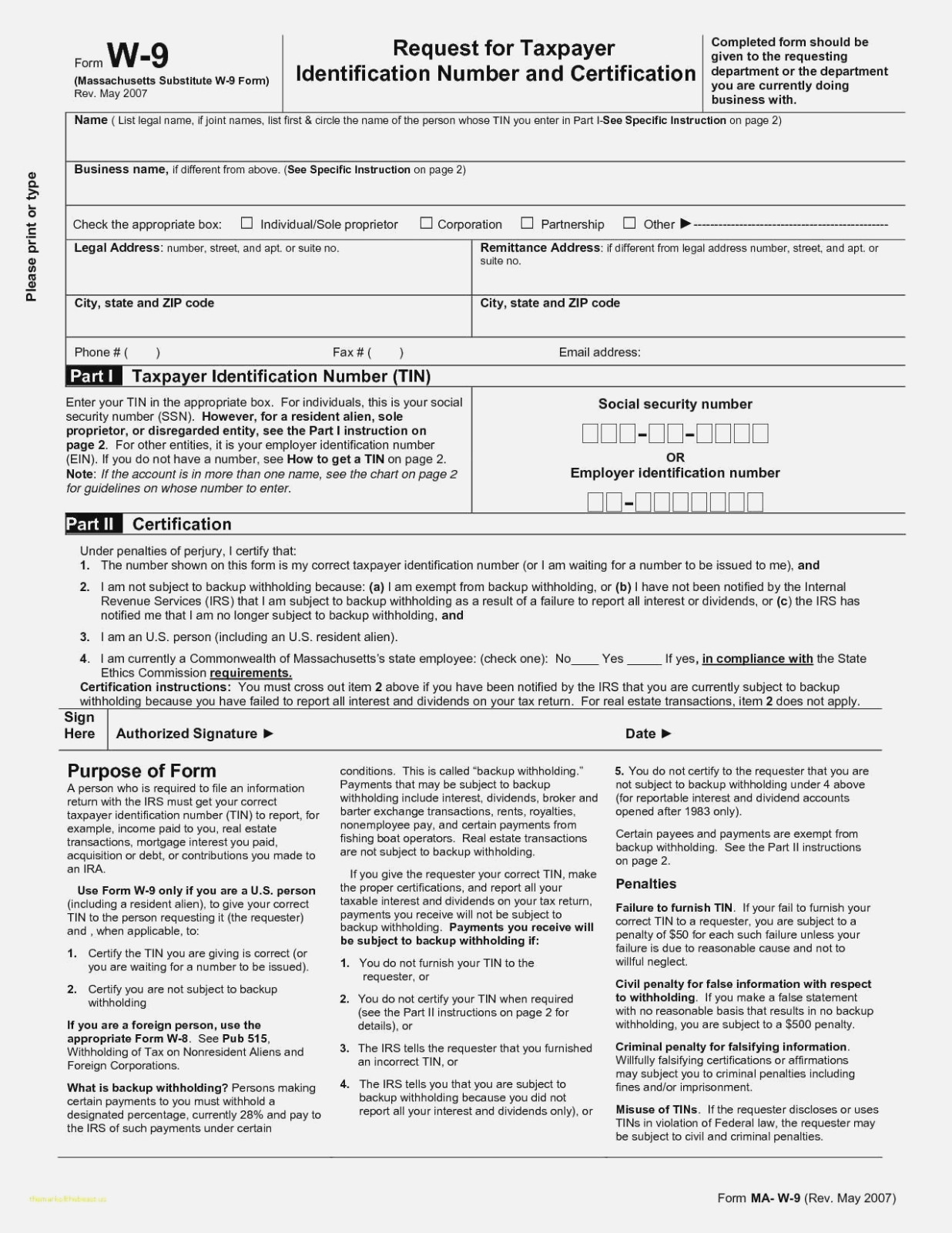

W9 forms Free Download Free W9 form Download Free for Free W9 form Free

Part ii certification under penalties of perjury, i certify that: Individual property owner = social security number Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Why do you need my information if it is the tenant who is applying for assistance? Do not leave this line blank.

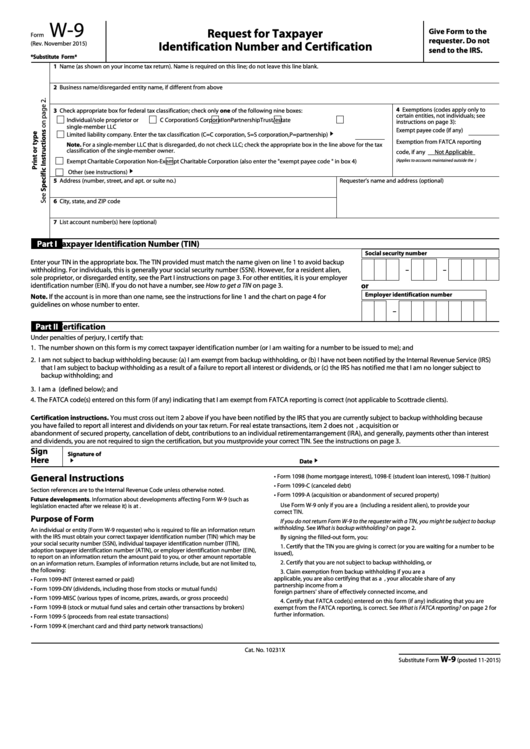

W 9 Form 2020 Printable Free Blank Example Calendar Printable

Web the w9 is a standard tax form landlords need in order to properly deal with your security deposit, though many of them don't bother with it, says sam himmelstein, a lawyer who represents residential and commercial tenants and tenant associations. What is backup withholding, later. When a business pays more than $600 to a single taxpayer during the year,.

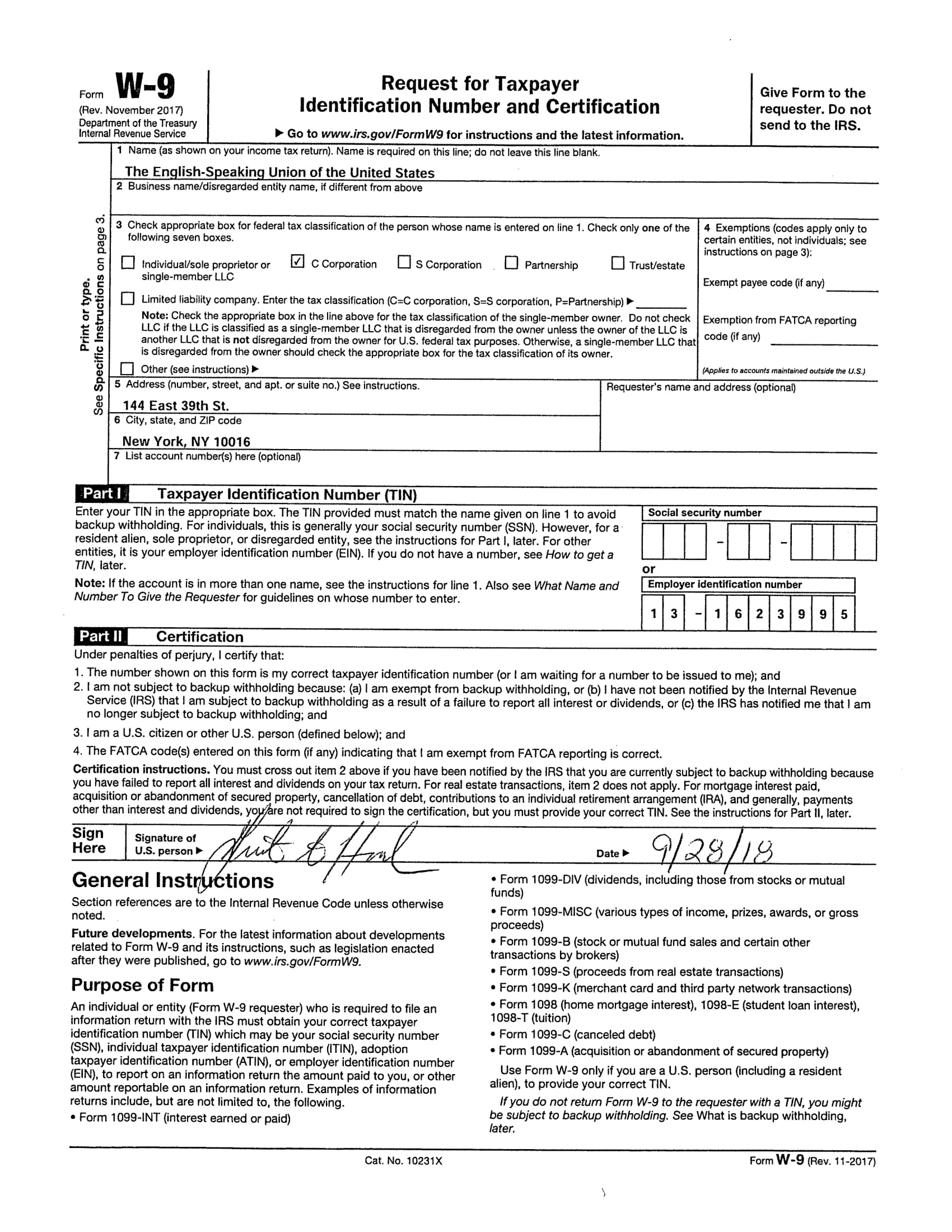

Fillable Form W9 Request For Taxpayer Identification Number And

Part ii certification under penalties of perjury, i certify that: Person (including a resident alien) and to request certain certifications and claims for exemption. Get everything done in minutes. The number shown on this form is my correct taxpayer identification number (or i am waiting for a number to be issued to me); When a business pays more than $600.

How To Prepare A W9 Tax Form YouTube

Name address tax identification number the type of entity that they are not subject to backup withholding the recipient will need to certify the information listed above is correct. Person (including a resident alien) and to request certain certifications and claims for exemption. Check out how easy it is to complete and esign documents online using fillable templates and a.

Fillable Form W9 Request For Taxpayer Identification with Blank W 9

Employers use this form to get the taxpayer identification number (tin) from contractors, freelancers and vendors. It allows them to accurately report. If a business deducts rent as a business expense, they may need to issue a 1099 form to the landlord. Contributions you made to an ira. The income paid to you by your landlord is.

Get W9 Form 2020 Calendar Printables Free Blank

Individual property owner = social security number Exempt recipients to overcome a presumption of foreign status. Name address tax identification number the type of entity that they are not subject to backup withholding the recipient will need to certify the information listed above is correct. A 1099 is the form that independent contractors and others may. Person (including a resident.

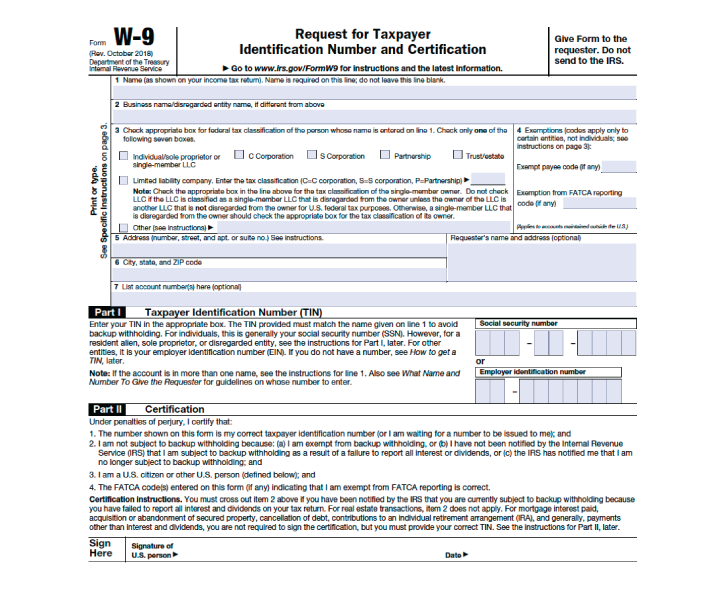

W9 Form for Landlord 2023 W9 Form 2023

Person (including a resident alien) and to request certain certifications and claims for exemption. The number shown on this form is my correct taxpayer identification number (or i am waiting for a number to be issued to me); One of the most common situations is when someone works as an independent contractor for a business. Exempt recipients to overcome a.

Blank W9 Tax Form W9 Form Printable, Fillable 2021 throughout W 9

To utilize in verifying their social security or tax identification number to other entities. Exempt recipients to overcome a presumption of foreign status. Do not leave this line blank. When a business pays more than $600 to a single taxpayer during the year, it must submit an informational return to the internal revenue (irs) to disclose the payments. Why do.

Blank W9 Form Fill Online, Printable, Fillable, Blank with regard to

It allows them to accurately report. To utilize in verifying their social security or tax identification number to other entities. A 1099 is the form that independent contractors and others may. Web landlord w9 form 2022. Web guidelines on whose number to enter.

W9 What Is It and How Do You Fill It Out? SmartAsset

To utilize in verifying their social security or tax identification number to other entities. One of the most common situations is when someone works as an independent contractor for a business. Name address tax identification number the type of entity that they are not subject to backup withholding the recipient will need to certify the information listed above is correct..

Person (Including A Resident Alien) And To Request Certain Certifications And Claims For Exemption.

The number shown on this form is my correct taxpayer identification number (or i am waiting for a number to be issued to me); Get everything done in minutes. Part ii certification under penalties of perjury, i certify that: The income paid to you by your landlord is.

It Allows Them To Accurately Report.

When a business pays more than $600 to a single taxpayer during the year, it must submit an informational return to the internal revenue (irs) to disclose the payments. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web the w9 is a standard tax form landlords need in order to properly deal with your security deposit, though many of them don't bother with it, says sam himmelstein, a lawyer who represents residential and commercial tenants and tenant associations. Exempt recipients to overcome a presumption of foreign status.

It Is Filled Out By You Or Your Representative.

The form helps businesses obtain important information from payees to prepare information returns for the irs. Why do you need my information if it is the tenant who is applying for assistance? One of the most common situations is when someone works as an independent contractor for a business. Person (including a resident alien), to provide your correct tin.

October 2018) Department Of The Treasury Internal Revenue Service Request For Taxpayer Identification Number And Certification Go To Www.irs.gov/Formw9 For Instructions And The Latest Information.

Do not leave this line blank. Individual property owner = social security number Employers use this form to get the taxpayer identification number (tin) from contractors, freelancers and vendors. Exempt recipients to overcome a presumption of foreign status.