What Is An It 201 Form

What Is An It 201 Form - It is analogous to the us form 1040, but it is four pages long, instead of two pages. Web department of taxation and finance resident income tax return new york state • new york city • yonkers • mctmt for the full year january 1, 2020, through december 31,. To remove the state amended return. You may have inadvertently clicked the box to create an amended state return. This is the total of your new york state taxes.42. If you are filing state taxes for new york this year, then yes you will need this form and you want to make sure. Electronic filing is the fastest, safest way to file—but if you must file a paper resident income tax return, use our enhanced. Web resident income tax return new york state • new york city • yonkers • mctmt for the full year january 1, 2021, through december 31, 2021, or fiscal year beginning. Your ¿uvw qdph 0, <rxu odvw qdph (for a joint return, enter spouse’s name on line below) <rxu. 42 add lines 40 and 41.

You may have inadvertently clicked the box to create an amended state return. Your ¿uvw qdph 0, <rxu odvw qdph (for a joint return, enter spouse’s name on line below) <rxu. If you are filing state taxes for new york this year, then yes you will need this form and you want to make sure. Electronic filing is the fastest, safest way to file—but if you must file a paper resident income tax return, use our enhanced. This is the total of your new york state taxes.42. It is analogous to the us form 1040, but it is four pages long, instead of two pages. 42 add lines 40 and 41. To remove the state amended return. Web resident income tax return new york state • new york city • yonkers • mctmt for the full year january 1, 2021, through december 31, 2021, or fiscal year beginning. Web department of taxation and finance resident income tax return new york state • new york city • yonkers • mctmt for the full year january 1, 2020, through december 31,.

Your ¿uvw qdph 0, <rxu odvw qdph (for a joint return, enter spouse’s name on line below) <rxu. You may have inadvertently clicked the box to create an amended state return. Web department of taxation and finance resident income tax return new york state • new york city • yonkers • mctmt for the full year january 1, 2020, through december 31,. Web resident income tax return new york state • new york city • yonkers • mctmt for the full year january 1, 2021, through december 31, 2021, or fiscal year beginning. 42 add lines 40 and 41. If you are filing state taxes for new york this year, then yes you will need this form and you want to make sure. Electronic filing is the fastest, safest way to file—but if you must file a paper resident income tax return, use our enhanced. It is analogous to the us form 1040, but it is four pages long, instead of two pages. This is the total of your new york state taxes.42. To remove the state amended return.

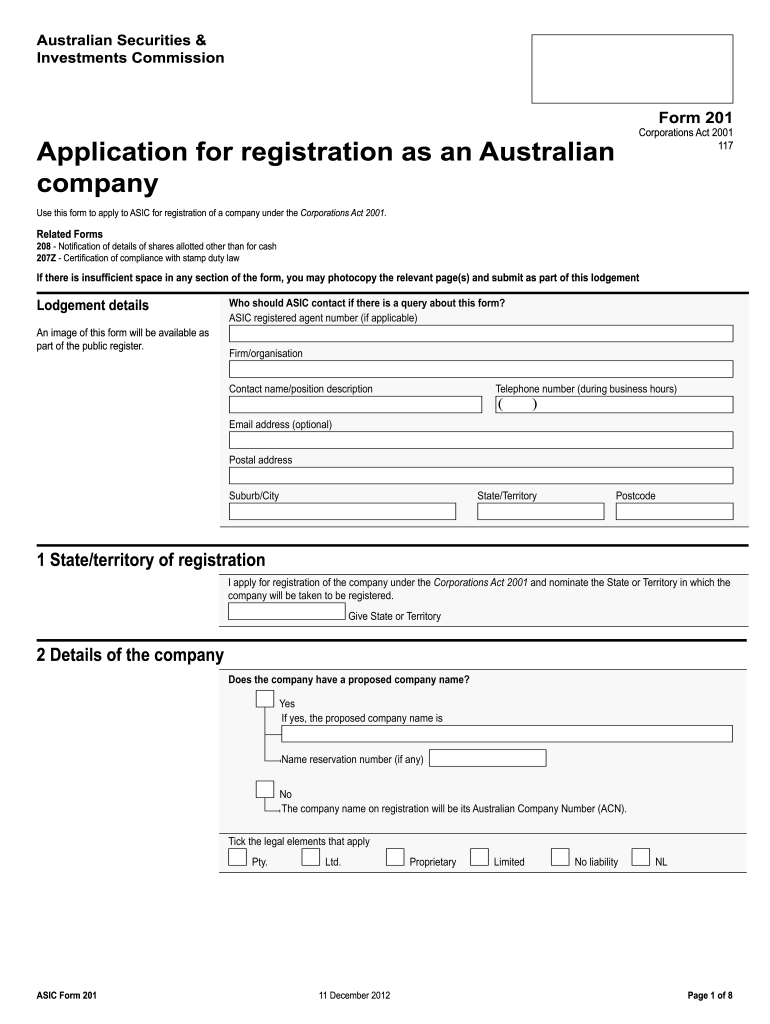

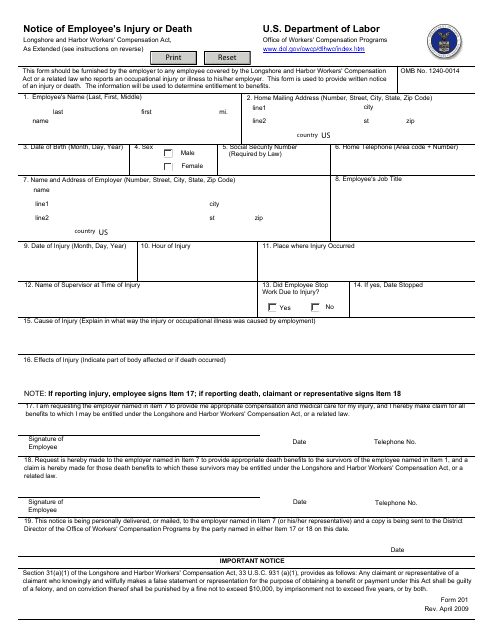

Official Form 201 Fill Online, Printable, Fillable, Blank pdfFiller

This is the total of your new york state taxes.42. If you are filing state taxes for new york this year, then yes you will need this form and you want to make sure. You may have inadvertently clicked the box to create an amended state return. Your ¿uvw qdph 0, <rxu odvw qdph (for a joint return, enter spouse’s.

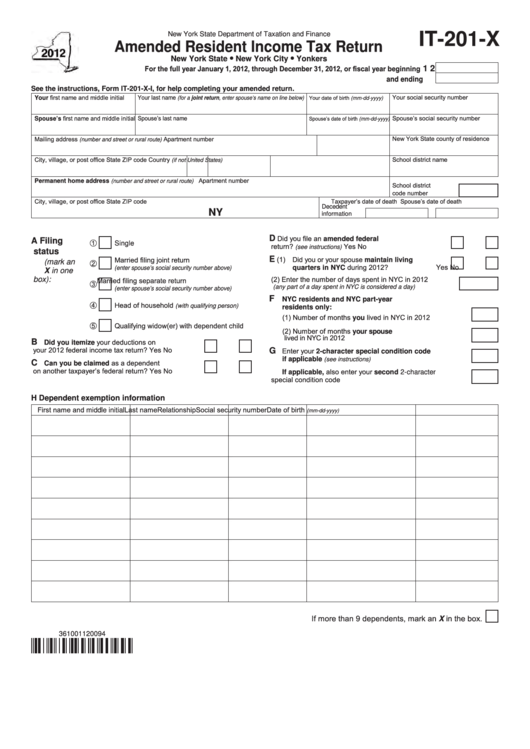

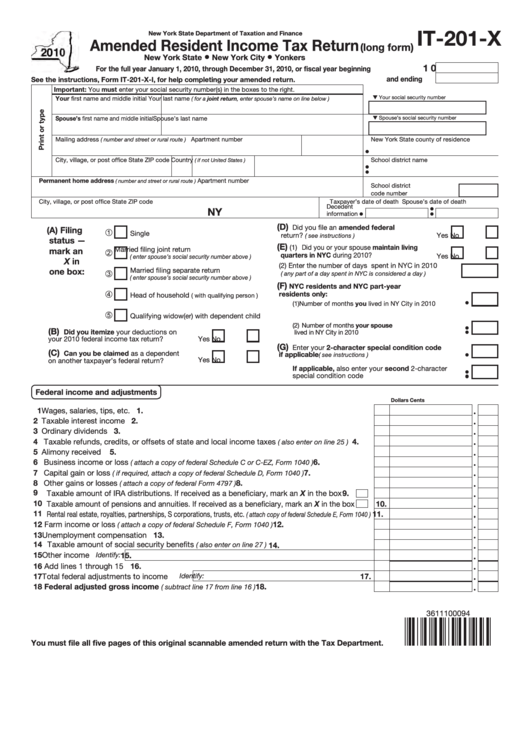

Fillable Form It201X New York Amended Resident Tax Return

42 add lines 40 and 41. If you are filing state taxes for new york this year, then yes you will need this form and you want to make sure. You may have inadvertently clicked the box to create an amended state return. Your ¿uvw qdph 0, <rxu odvw qdph (for a joint return, enter spouse’s name on line below).

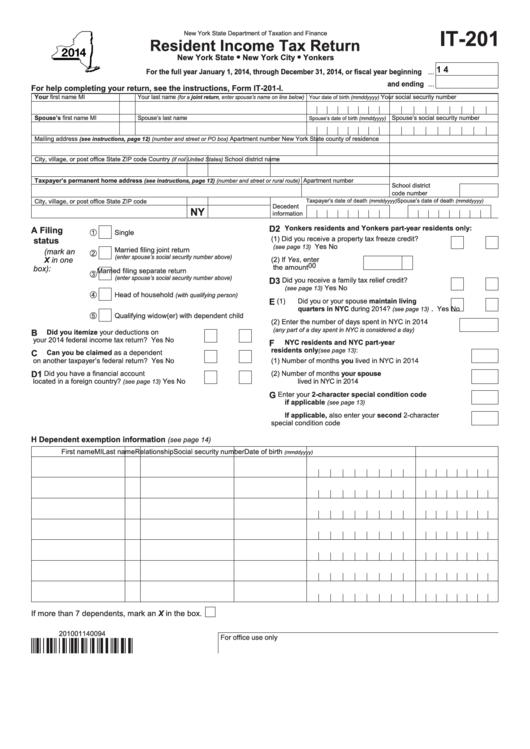

Fillable Form It201 2014 Resident Tax Return New York State

It is analogous to the us form 1040, but it is four pages long, instead of two pages. This is the total of your new york state taxes.42. 42 add lines 40 and 41. Web resident income tax return new york state • new york city • yonkers • mctmt for the full year january 1, 2021, through december 31,.

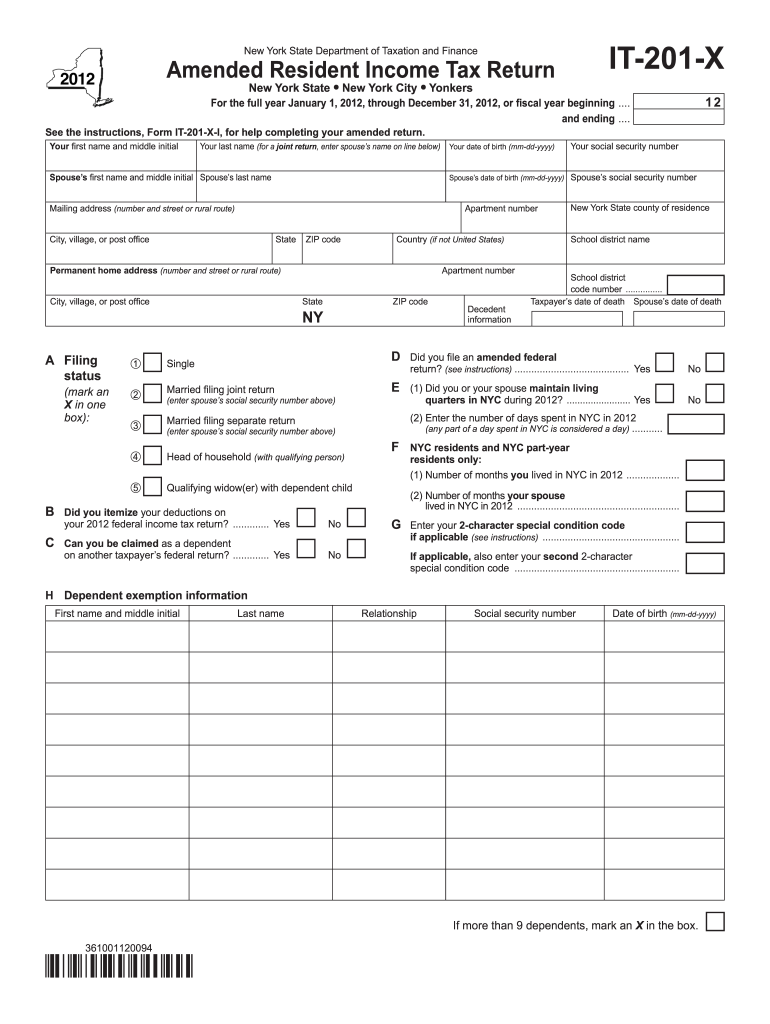

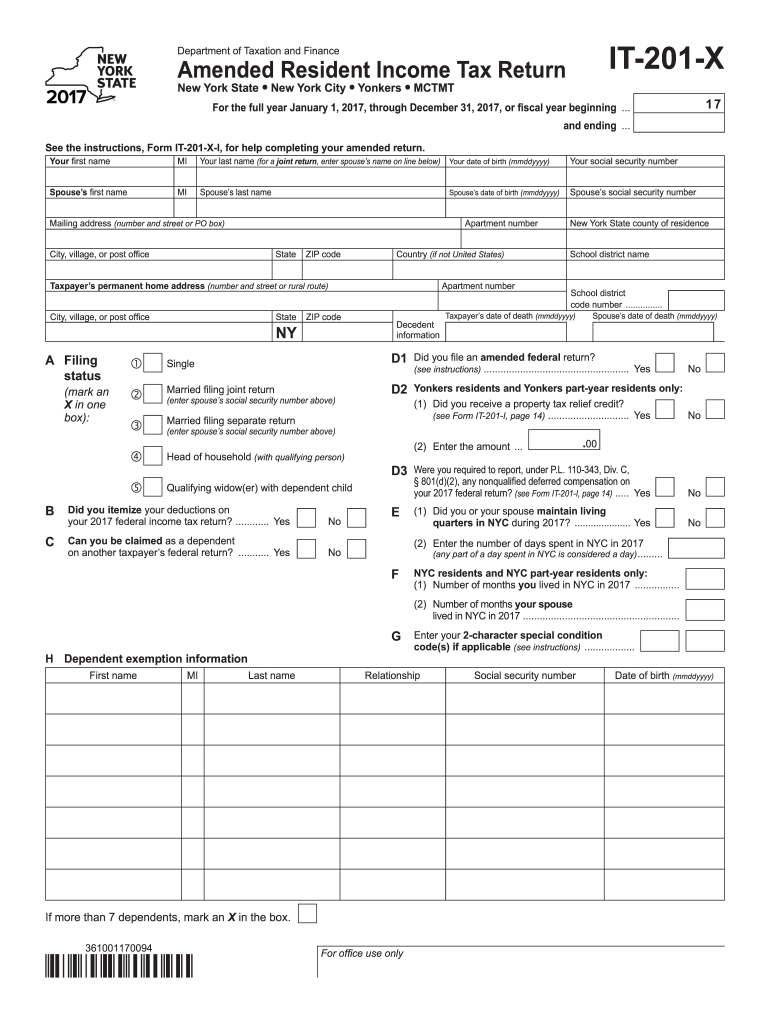

Form it 201 X Fill Out and Sign Printable PDF Template signNow

Web resident income tax return new york state • new york city • yonkers • mctmt for the full year january 1, 2021, through december 31, 2021, or fiscal year beginning. 42 add lines 40 and 41. If you are filing state taxes for new york this year, then yes you will need this form and you want to make.

Form 201 Files PDF

You may have inadvertently clicked the box to create an amended state return. It is analogous to the us form 1040, but it is four pages long, instead of two pages. If you are filing state taxes for new york this year, then yes you will need this form and you want to make sure. Web resident income tax return.

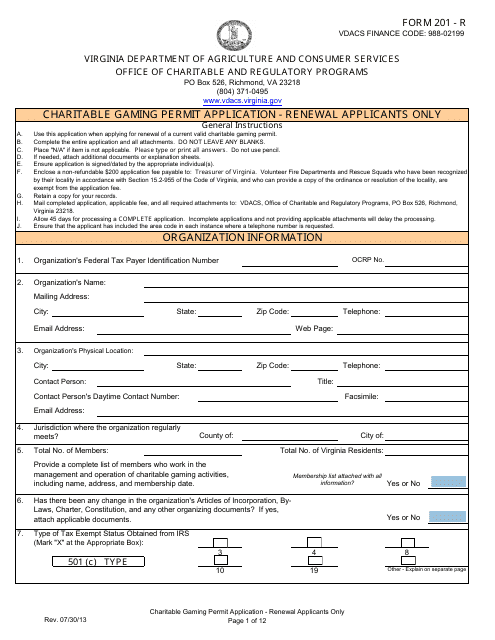

Form 201 Fill Out and Sign Printable PDF Template signNow

42 add lines 40 and 41. If you are filing state taxes for new york this year, then yes you will need this form and you want to make sure. Your ¿uvw qdph 0, <rxu odvw qdph (for a joint return, enter spouse’s name on line below) <rxu. This is the total of your new york state taxes.42. To remove.

Fillable Form It201X Amended Resident Tax Return (Long Form

If you are filing state taxes for new york this year, then yes you will need this form and you want to make sure. Your ¿uvw qdph 0, <rxu odvw qdph (for a joint return, enter spouse’s name on line below) <rxu. Web department of taxation and finance resident income tax return new york state • new york city •.

Form 201 Download Fillable PDF or Fill Online Notice of Employee's

To remove the state amended return. It is analogous to the us form 1040, but it is four pages long, instead of two pages. Web department of taxation and finance resident income tax return new york state • new york city • yonkers • mctmt for the full year january 1, 2020, through december 31,. Web resident income tax return.

Form 201 Fill Out and Sign Printable PDF Template signNow

To remove the state amended return. Web resident income tax return new york state • new york city • yonkers • mctmt for the full year january 1, 2021, through december 31, 2021, or fiscal year beginning. You may have inadvertently clicked the box to create an amended state return. If you are filing state taxes for new york this.

Form 201R Download Fillable PDF or Fill Online Charitable Gaming

You may have inadvertently clicked the box to create an amended state return. Web department of taxation and finance resident income tax return new york state • new york city • yonkers • mctmt for the full year january 1, 2020, through december 31,. It is analogous to the us form 1040, but it is four pages long, instead of.

Electronic Filing Is The Fastest, Safest Way To File—But If You Must File A Paper Resident Income Tax Return, Use Our Enhanced.

To remove the state amended return. If you are filing state taxes for new york this year, then yes you will need this form and you want to make sure. It is analogous to the us form 1040, but it is four pages long, instead of two pages. Web resident income tax return new york state • new york city • yonkers • mctmt for the full year january 1, 2021, through december 31, 2021, or fiscal year beginning.

This Is The Total Of Your New York State Taxes.42.

Your ¿uvw qdph 0,