What Is California Form 590 Used For

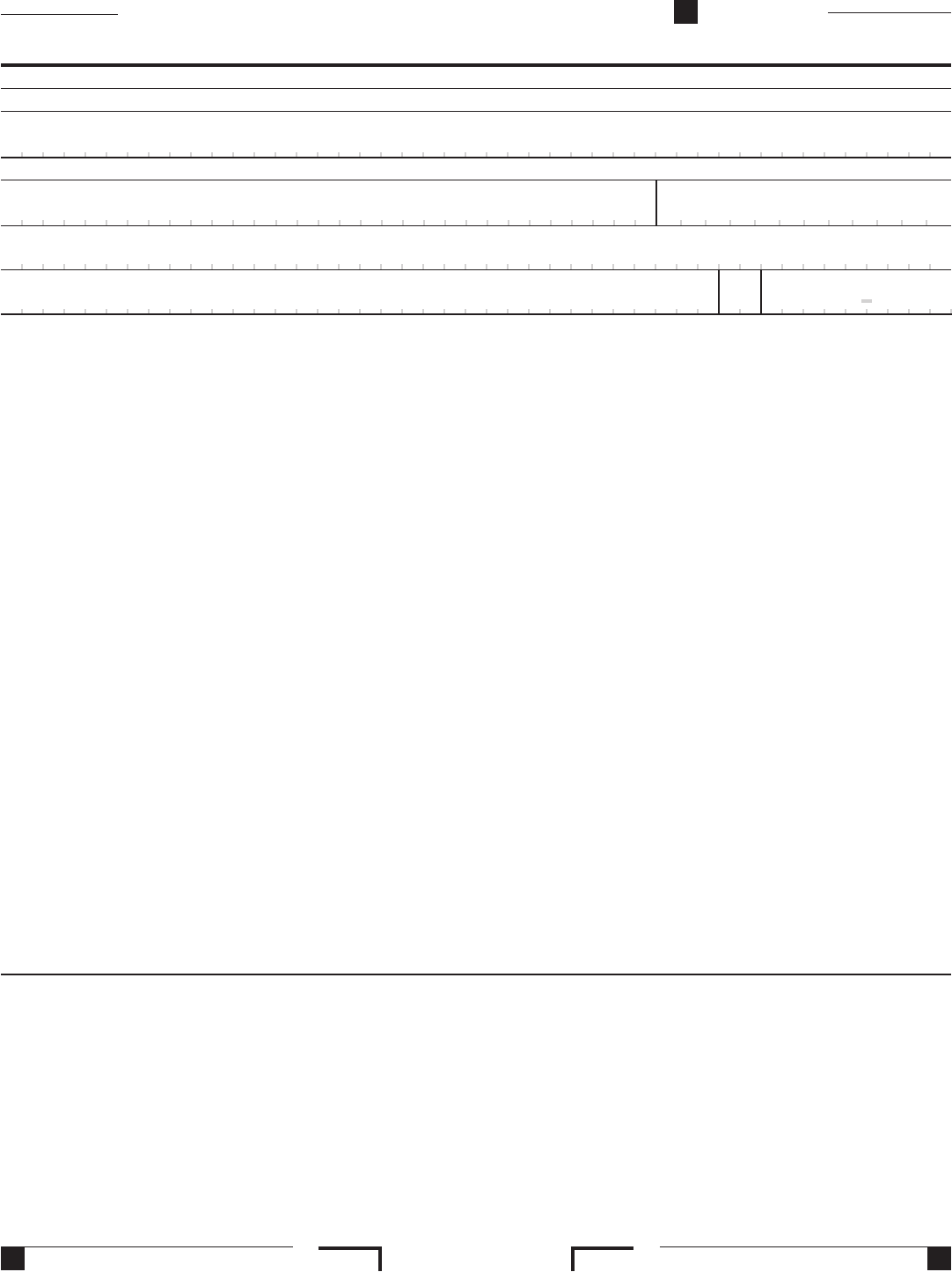

What Is California Form 590 Used For - The withholding agent keeps this form with their records. Web use form 590, withholding exemption. References in these instructions are to the california revenue and taxation. Use this form to certify exemption from withholding; Web will be used to transport passengers for hire, compensation, or profit. Form 590 does not apply to payments of backup withholding. Waived or reduced withholding some payees may. This form is for income earned in tax year 2022,. Withholding agent information name payee. Form 590 does not apply to payments of backup withholding.

Complete and presentform 590 to the withholding agent. We last updated california form 590 in february 2023 from the california franchise tax board. *this form is not required for taxicabs if the vehicle is. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. This form is for income earned in tax year 2022,. Web use form 590 to certify an exemption fromnonresident withholding. The payee is a corporation, partnership, or limited liability company (llc) that has a permanent place of business in california or. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web form 590 does not apply to payments for wages to employees. Web form 590, withholding exemption certificate (see related information) should be completed by the payee to certify exemption.

Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. The withholding agent keeps this form with their records. Form 590 does not apply to payments of backup withholding. This vehicle will not be used to transport property. The payee is a corporation, partnership, or limited liability company (llc) that has a permanent place of business in california or. Wage withholding is administered by the california employment development department (edd). Use this form to certify exemption from withholding; California residents or entities should complete and present. Withholding agent information name payee.

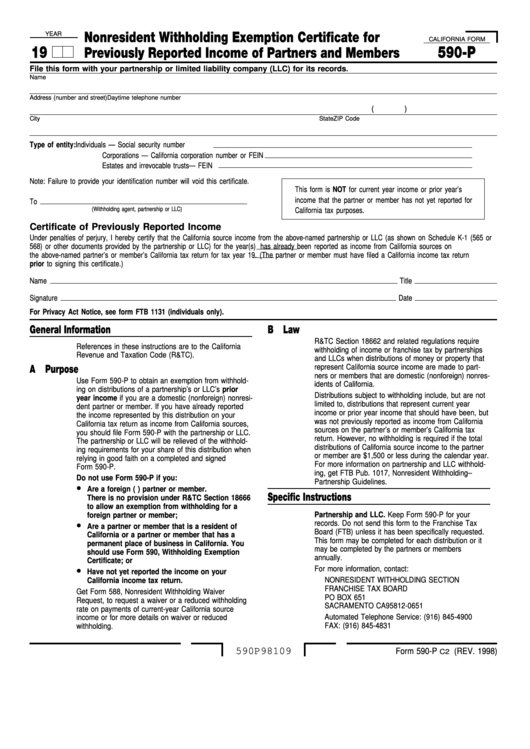

Fillable California Form 590P Nonresident Witholding Exemption

Web use form 590, withholding exemption certificate. California residents or entities should complete and present. Web more about the california form 590. The withholding agent keeps this form with their records. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments.

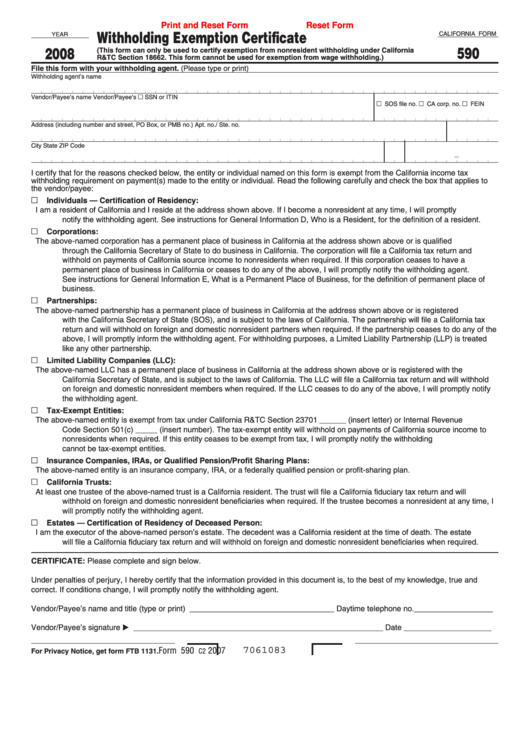

Fillable California Form 590 Withholding Exemption Certificate 2008

Web form 590 instructions 2012. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. We last updated california form 590 in february 2023 from.

2010 Form USCIS I590 Fill Online, Printable, Fillable, Blank pdfFiller

Web will be used to transport passengers for hire, compensation, or profit. Web 590 the payee completes this form and submits it to the withholding agent. Web use form 590 to certify an exemption fromnonresident withholding. Web more about the california form 590. Web form 590, withholding exemption certificate (see related information) should be completed by the payee to certify.

Hot 10+ California Franchise Tax Board, Model Dresses Paling Dicari!

Form 590 does not apply to payments of backup withholding. Web form 590, withholding exemption certificate (see related information) should be completed by the payee to certify exemption. Withholding agent information name payee. We last updated california form 590 in february 2023 from the california franchise tax board. Web use form 590, withholding exemption certificate, to certify an exemption from.

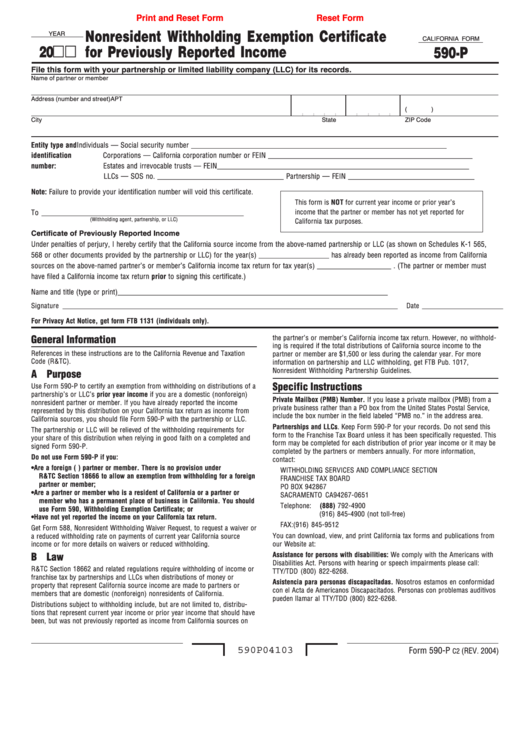

Fillable California Form 590P Nonresident Withholding Exemption

*this form is not required for taxicabs if the vehicle is. Web will be used to transport passengers for hire, compensation, or profit. Web form 590, withholding exemption certificate (see related information) should be completed by the payee to certify exemption. Thewithholding agent will then be relieved of. The payee is a corporation, partnership, or limited liability company (llc) that.

Vintage ProForm 590 Space Saver Treadmill

This form is for income earned in tax year 2022,. Web will be used to transport passengers for hire, compensation, or profit. Use this form to certify exemption from withholding; Web by checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the. Web most taxpayers.

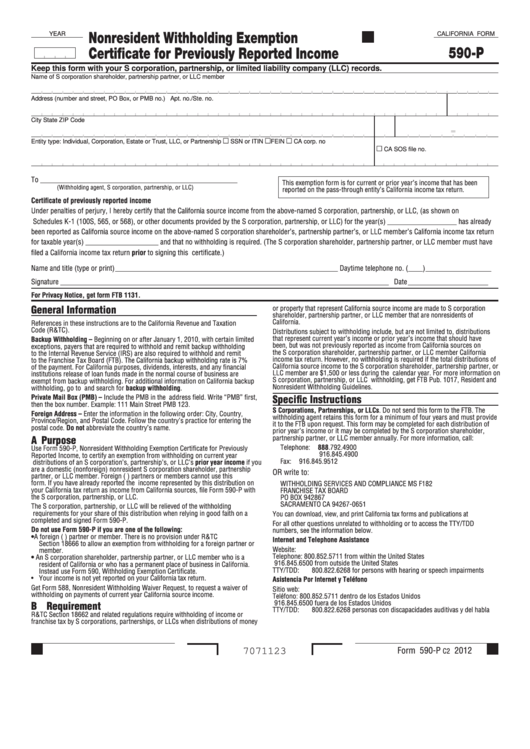

Fillable California Form 590P Nonresident Withholding Exemption

Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Complete and presentform 590 to the withholding agent. We last updated california form 590 in february 2023 from the california franchise tax board. Wage withholding is administered by the california employment development department (edd). Web form 590, withholding exemption certificate (see related information) should be completed.

2016 Form 590 Withholding Exemption Certificate Edit, Fill, Sign

Form 590 does not apply to payments of backup withholding. Web more about the california form 590. The payee is a corporation, partnership, or limited liability company (llc) that has a permanent place of business in california or. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold.

Ca590 Fill Out and Sign Printable PDF Template signNow

Web by checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. *this form is not required for taxicabs if the vehicle is. Web use form 590, withholding exemption certificate. Web.

California Form 587 2019 Fillable Fill Online, Printable, Fillable

This vehicle will not be used to transport property. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. Use this form to certify exemption from withholding; Form 590 does not apply to payments of backup withholding. Web use form 590 to certify an exemption.

Web Use Form 590, Withholding Exemption Certificate, To Certify An Exemption From Nonresident Withholding.

Form 590 does not apply to payments of backup withholding. *this form is not required for taxicabs if the vehicle is. The payee is a corporation, partnership, or limited liability company (llc) that has a permanent place of business in california or. The withholding agent keeps this form with their records.

This Form Is For Income Earned In Tax Year 2022,.

Web use form 590 to certify an exemption fromnonresident withholding. California residents or entities should complete and present. Wage withholding is administered by the california employment development department (edd). We last updated california form 590 in february 2023 from the california franchise tax board.

References In These Instructions Are To The California Revenue And Taxation.

Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Waived or reduced withholding some payees may. Web use form 590, withholding exemption certificate.

Web Withholding Exemption Certificate (Form 590) Submit Form 590 To Your Withholding Agent;

Complete and presentform 590 to the withholding agent. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. Web form 590, withholding exemption certificate (see related information) should be completed by the payee to certify exemption. Form 590 does not apply to payments of backup withholding.