What Is Form 147C

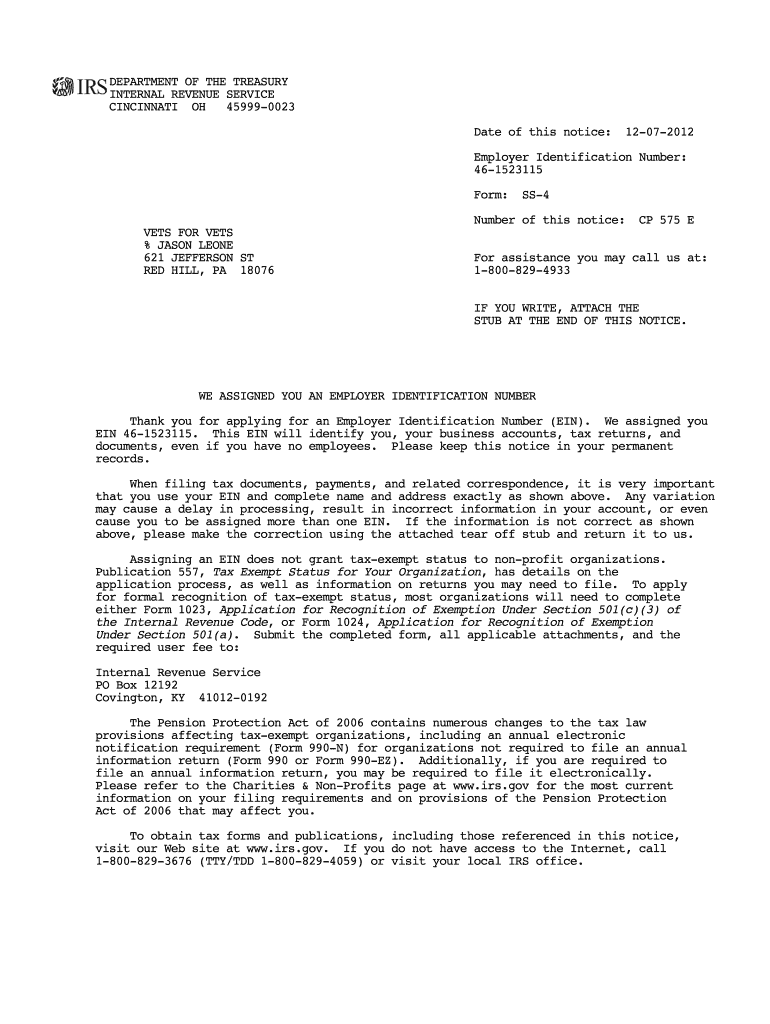

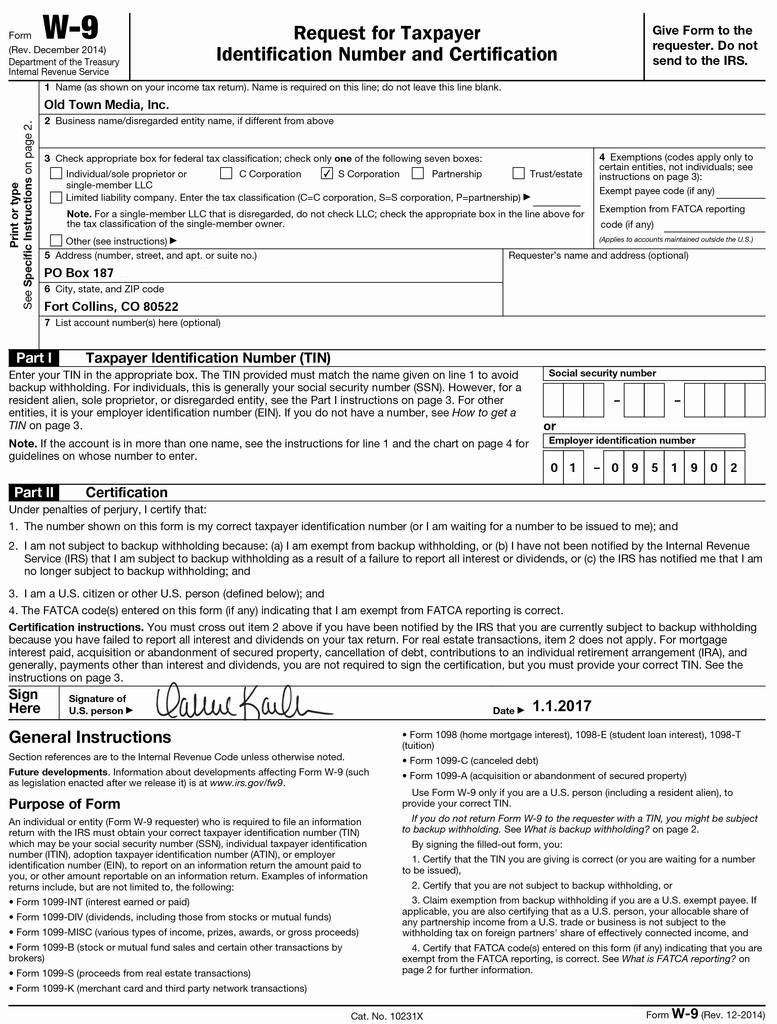

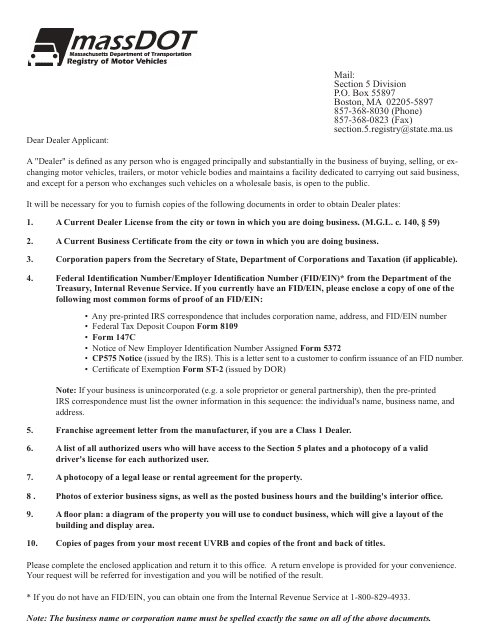

What Is Form 147C - It only provides an existing ein and does not provide a new ein. Web understanding your cp147 notice what this notice is about after previously notifying you that we couldn't apply the full amount you requested to the following year's. Web an ein verification letter (commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms. Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification. The easiest way to request your ein is to call the irs or send them a. The letter requests information about the business’s ein or employer identification number. Web what does letter 147c stand for? Web an ein verification letter (commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and. The letter will confirm the employer name and ein connected with the. Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in.

Web what does letter 147c stand for? Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification. Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in. Web form 147c is a document issued by the internal revenue service (irs) in the united states. Web the 147c letters are documents sent by the irs to businesses. Web when setting up an ein as an international founder you should get an ein verification letter (147c). Web form 147c is not an internal revenue service (irs) form you have to file, nor is it one that you will find in your mailbox unexpectedly. The company is sent a letter asking for information about its ein or employer identification. It is common that most established. Web an ein verification letter (commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and.

Web when setting up an ein as an international founder you should get an ein verification letter (147c). Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification. It is also known as the ein verification letter. The letter will confirm the employer name and ein connected with the. If you are going to apply for your ein number. Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in. Web when this happens, only you can get your “existing ein” from the irs by asking them for a “147c letter”. The easiest way to request your ein is to call the irs or send them a. Learn how to get yours. Web the 147c letter is a document that is sent to businesses by the irs.

IRS FORM 147C

Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in. Web form 147c is a document issued by the internal revenue service (irs) in the united states. Instead, this is a form that will be sent to you.

147c Letter Irs Sle Bangmuin Image Josh

Web how to obtain a confirmation letter (147c letter) of the employer identification number (ein) if your clergy and/or employees are unable to e‐file their income tax returns because of. Instead, this is a form that will be sent to you if. Lost, misplaced or forgot your ein. The easiest way to request your ein is to call the irs.

Irs Form 147c Printable Printable Form, Templates and Letter

Web when setting up an ein as an international founder you should get an ein verification letter (147c). Web the 147c letter is a document that is sent to businesses by the irs. Lost, misplaced or forgot your ein. Web an ein verification letter (commonly known as a form 147c) is an official document from the internal revenue service that.

Free Printable I 9 Forms Example Calendar Printable

To request an ein verification letter (147c),. It only provides an existing ein and does not provide a new ein. Web the 147c letter is a document that is sent to businesses by the irs. The irs letter 147c is sent by individuals to request the irs give them their ein. It is common that most established.

Irs Letter 147c Sample

Web when this happens, only you can get your “existing ein” from the irs by asking them for a “147c letter”. Web you can only obtain an ein verification letter (147c) by contacting the irs directly for assistance over the phone. The irs letter 147c is sent by individuals to request the irs give them their ein. The main reason.

IRS FORM 147C

If you are going to apply for your ein number. Ein is a unique identification. Web the 147c letters are documents sent by the irs to businesses. Web irs letter 147c is an official form of verification issued by the irs (internal revenue service) that confirms the business or entity’s ein (employer identification. It is also known as the ein.

Irs Letter 147c Ein Previously Assigned

Web the 147c letters are documents sent by the irs to businesses. It is common that most established. The letter requests information about the business’s ein or employer identification number. The company is sent a letter asking for information about its ein or employer identification. Learn how to get yours.

IRS FORM 147C PDF

The company is sent a letter asking for information about its ein or employer identification. Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification. Web an ein verification letter (commonly known as a form 147c) is an official document from.

Getting 147C Online (EIN Designation Confirmation Letter) by Vadym

Learn how to get yours. The easiest way to request your ein is to call the irs or send them a. To request an ein verification letter (147c),. Web how to obtain a confirmation letter (147c letter) of the employer identification number (ein) if your clergy and/or employees are unable to e‐file their income tax returns because of. The letter.

What is the Invalid TIN or Regulatory Fee on my

The irs letter 147c is sent by individuals to request the irs give them their ein. Web understanding your cp147 notice what this notice is about after previously notifying you that we couldn't apply the full amount you requested to the following year's. Web an ein verification letter (commonly known as a form 147c) is an official document from the.

Instead, This Is A Form That Will Be Sent To You If.

If you are going to apply for your ein number. The easiest way to request your ein is to call the irs or send them a. Web when setting up an ein as an international founder you should get an ein verification letter (147c). To request an ein verification letter (147c),.

Web An Ein Verification Letter (Commonly Known As A Form 147C) Is An Official Document From The Internal Revenue Service That Lists Your Employer Identification Number And Confirms.

Web form 147c is a document issued by the internal revenue service (irs) in the united states. Web you can only obtain an ein verification letter (147c) by contacting the irs directly for assistance over the phone. Web an ein verification letter (commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and. Web the 147c letter is one of the most important details you need to know during the ein application and approval process.

Web A 147C Letter, Also Known As An Ein Verification Letter, Is A Form Sent To The Internal Revenue Service (Irs) By A Company To Request Their Employee Identification.

Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in. The main reason people send this letter is they’ve lost their ein, or it is required by a third party. Lost, misplaced or forgot your ein. Ein is a unique identification.

Web When This Happens, Only You Can Get Your “Existing Ein” From The Irs By Asking Them For A “147C Letter”.

The irs letter 147c is sent by individuals to request the irs give them their ein. It only provides an existing ein and does not provide a new ein. It is common that most established. Web what does letter 147c stand for?