What Is Form 4797 Used For

What Is Form 4797 Used For - This might include any property used to generate rental income or even a. This may include your home that was converted into a rental property. The sale or exchange of property. In this blog post, we’ll provide insights into the best. Select take to my tax return, search for 4797, sale of business property (use this exact phrase). Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Web form 4797 is a tax form distributed with the help of the internal revenue service. Rental property, like an apartment or a house the part of your home. •the sale or exchange of: Web use form 4797 to report the following.

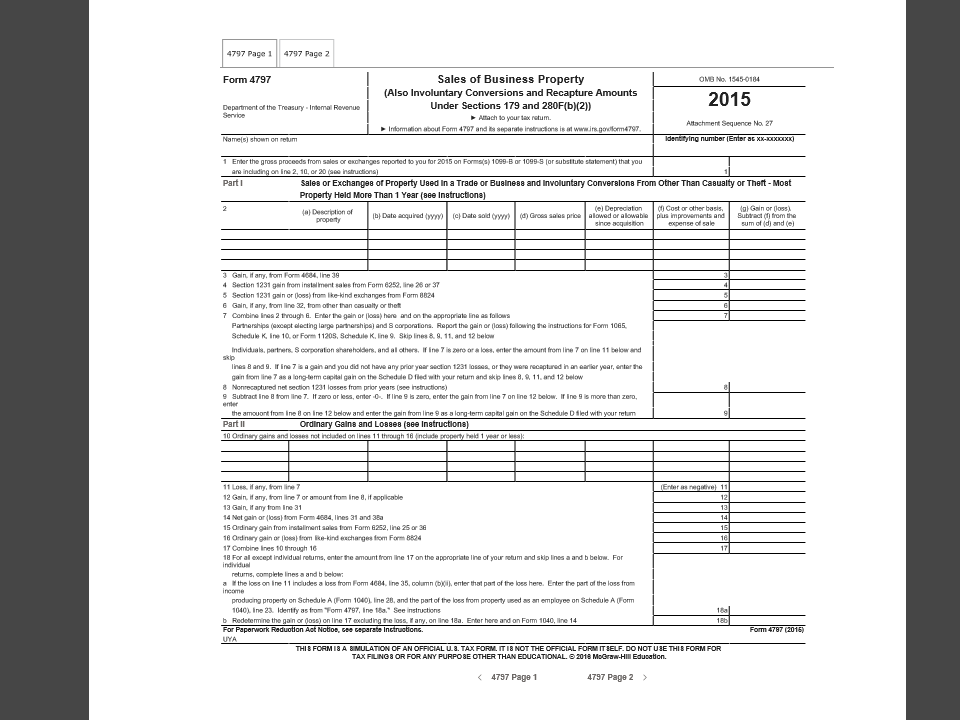

Web sale of business assets taking the mystery out of form 4797 recapture = ordinary income ordinary income 1245 1250 other recapture do not report on form 4797 sale. Web what is form 4797, sales of business property? Web form 4797 is a tax form distributed with the help of the internal revenue service. Web 1 best answer. Generally, form 4797 is used to report the sale of a business. In this blog post, we’ll provide insights into the best. Web on form 4797, line 2, enter section 1397b rollover in column (a) and enter as a (loss) in column (g) the amount of gain included on form 4797 that you are electing to postpone. Depreciable and amortizable tangible property used in your. To add form 4797 to your return: The sale or exchange of property.

The sale or exchange of property. Rental property, like an apartment or a house the part of your home. Web use form 4797 to report:the sale or exchange of: Generally, form 4797 is used to report the sale of a business. Depreciable and amortizable tangible property used in your trade or business. The involuntary conversion of property. Depreciable and amortizable tangible property used in your. Web sale of business assets taking the mystery out of form 4797 recapture = ordinary income ordinary income 1245 1250 other recapture do not report on form 4797 sale. Web form 4797 is a tax form distributed with the help of the internal revenue service. Select take to my tax return, search for 4797, sale of business property (use this exact phrase).

Form 4797 Sales of Business Property Definition

Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,. Rental property, like an apartment or a house the part of your home. In this blog post, we’ll provide insights into the best. This may include your home that was converted.

What Is Form 4797 Tax Guide For Real Estate Investors FortuneBuilders

Web on form 4797, line 2, enter section 1397b rollover in column (a) and enter as a (loss) in column (g) the amount of gain included on form 4797 that you are electing to postpone. In this blog post, we’ll provide insights into the best. Web what is form 4797, sales of business property? Web complete and file form 4797:.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

The involuntary conversion of property. Real property used in your trade or business; Select take to my tax return, search for 4797, sale of business property (use this exact phrase). To add form 4797 to your return: In most cases, the sale of the exchange of the business property includes the.

Solved Moab Inc. Manufactures And Distributes Hightech B...

Therefore, you will need to file this form and your standard tax return, schedule d. Real property used in your trade or business; Web complete and file form 4797: In this blog post, we’ll provide insights into the best. The involuntary conversion of property.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Web sale of business assets taking the mystery out of form 4797 recapture = ordinary income ordinary income 1245 1250 other recapture do not report on form 4797 sale. Real property used in your trade or business; Web form 4797 is a tax form distributed with the help of the internal revenue service. Web to accomplish this, businesses need to.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

In most cases, the sale of the exchange of the business property includes the. Web the irs form 4797 is a pdf form which can be filled using a pdf form filler application. Generally, form 4797 is used to report the sale of a business. Depreciable and amortizable tangible property used in your. Web what is form 4797, sales of.

Form 4797 Sales of Business Property (2014) Free Download

To add form 4797 to your return: This might include any property used to generate rental income or even a. Web complete and file form 4797: The sale or exchange of property. Real property used in your trade or business;

Form 4797 Sales of Business Property (2014) Free Download

Web complete and file form 4797: Web the purpose of irs form 4797 is to report any financial gains from your transaction to the irs. This might include any property used to generate rental income or even a. Therefore, you will need to file this form and your standard tax return, schedule d. In most cases, the sale of the.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Web what is form 4797, sales of business property? Real property used in your trade or business; Web the irs form 4797 is a pdf form which can be filled using a pdf form filler application. Web form 4797 is a tax form distributed with the help of the internal revenue service. Web form 4797 department of the treasury internal.

irs form 4797 Fill Online, Printable, Fillable Blank

Web what is form 4797, sales of business property? Web 1 best answer. Web according to the irs, you should use your 4797 form to report all of the following: •the sale or exchange of: Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or.

To Add Form 4797 To Your Return:

Generally, form 4797 is used to report the sale of a business. Web sale of business assets taking the mystery out of form 4797 recapture = ordinary income ordinary income 1245 1250 other recapture do not report on form 4797 sale. •the sale or exchange of: Web the purpose of irs form 4797 is to report any financial gains from your transaction to the irs.

Web To Accomplish This, Businesses Need To File Irs Form 4797, Sales Of Business Property, Along With Their Annual Tax Return.

Real property used in your trade or business; Select take to my tax return, search for 4797, sale of business property (use this exact phrase). Web on form 4797, line 2, enter section 1397b rollover in column (a) and enter as a (loss) in column (g) the amount of gain included on form 4797 that you are electing to postpone. Web 1 best answer.

This May Include Your Home That Was Converted Into A Rental Property.

Web the irs form 4797 is a pdf form which can be filled using a pdf form filler application. Web according to the irs, you should use your 4797 form to report all of the following: This might include any property used to generate rental income or even a. In this blog post, we’ll provide insights into the best.

Depreciable And Amortizable Tangible Property Used In Your.

Web use form 4797 to report:the sale or exchange of: Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Therefore, you will need to file this form and your standard tax return, schedule d.

:max_bytes(150000):strip_icc()/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://images.wondershare.com/pdfelement/pdfelement/guide/irs-form-4797-part2.png)

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://media.cheggcdn.com/media/498/498201e4-5770-4909-aa5b-1c142ab8249f/phptlHO4k.png)

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://media.cheggcdn.com/media/96c/s1024x708/96c0b013-86a1-4a1d-b75f-35a8de765ec8/phpsAAWmx.png)