What Is Form 7216

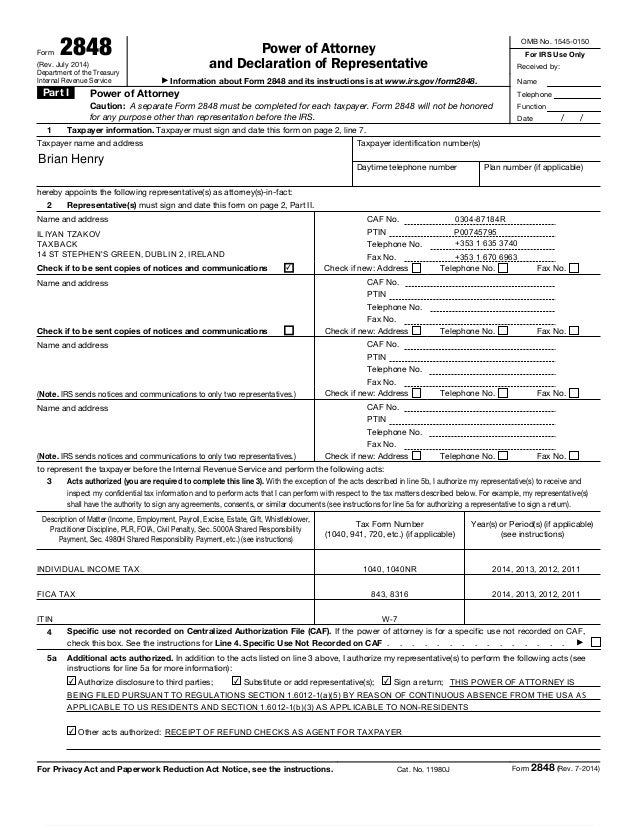

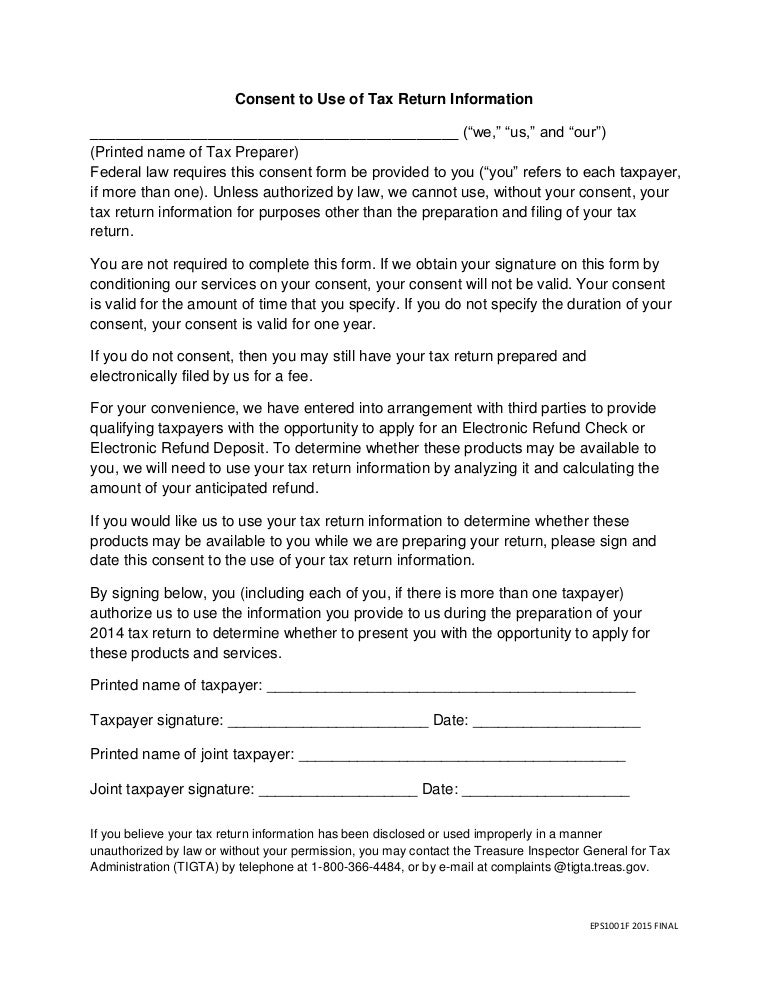

What Is Form 7216 - Web under internal revenue code (irc) section 7216 and its concomitant regulations, a tax preparer must obtain the consent of a taxpayer before disclosing. If we obtain your signature on this form by conditioning our services on your consent, your. Web form by conditioning our services on your consent, your consent will not be valid. Web final treasury regulations under irc 7216, disclosure or use of tax information by preparers of returns, became effective december 28, 2012. Office of associate chief counsel (procedure & administration) room 5503, cc:p&a. Internal revenue code section 7216 is a provision that prohibits tax professionals from knowingly or recklessly disclosing taxpayer information. Web regulations under internal revenue code section 7216, disclosure or use of tax information by preparers of returns, became effective january 1, 2009. Consent to use form written in accordance with internal revenue code section 7216. Web what is a 7216 consent form? The taxpayer can electronically sign.

Federal law requires this consent form be provided to you (“you” refers to each taxpayer, if more. The taxpayer can electronically sign. Unless authorized by law, we cannot disclose your tax return information to third parties for. Web the § 7216 regulations permit tax return preparers to use a list of client names, addresses, email addresses, phone numbers and each client’s income tax form number to provide. Web this presentation talks about §7216 of the internal revenue code. Use of tax return information is defined as any circumstance in which the. Web under internal revenue code (irc) section 7216 and its concomitant regulations, a tax preparer must obtain the consent of a taxpayer before disclosing. Web under internal revenue code (irc) section 7216 and its concomitant regulations, a tax preparer must obtain the consent of a taxpayer before disclosing or. §7216 is a criminal statute that applies to preparers of individual, corporate and partnership tax. Consent to use form written in accordance with internal revenue code section 7216.

Web the § 7216 regulations permit tax return preparers to use a list of client names, addresses, email addresses, phone numbers and each client’s income tax form number to provide. Sign it in a few clicks draw your signature, type it,. Web code section 7216 disclosure and consent. You are not required to complete this form. Web what is a 7216 consent form? Web regulations under internal revenue code section 7216, disclosure or use of tax information by preparers of returns, became effective january 1, 2009. If you agree to the disclosure of your tax return information, your consent is valid for the. Office of associate chief counsel (procedure & administration) room 5503, cc:p&a. Web form 8716 is used by partnerships, s corporations, and personal service corporations to elect under section 444(a) to have a tax year other than a required tax. Web form 7216 instructions rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 48 votes how to fill out and sign 7216 form online?

Doc

Use of tax return information is defined as any circumstance in which the. Edit your 7216 form online type text, add images, blackout confidential details, add comments, highlights and more. It is the consent to use & consent to disclose tax return. Web under internal revenue code (irc) section 7216 and its concomitant regulations, a tax preparer must obtain the.

Magic Form 7216 Balenli Sütyenli Tüllü Gecelik Fiyatı

Web the § 7216 regulations permit tax return preparers to use a list of client names, addresses, email addresses, phone numbers and each client’s income tax form number to provide. Web form 7216 instructions rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 48 votes how to fill out and sign.

Request for Consent YouTube

If you agree to the disclosure of your tax return information, your consent is valid for the. Sign it in a few clicks draw your signature, type it,. Web regulations under internal revenue code section 7216, disclosure or use of tax information by preparers of returns, became effective january 1, 2009. Web form by conditioning our services on your consent,.

Doc

Web form by conditioning our services on your consent, your consent will not be valid. Web what is form 7216? Federal law requires this consent form be provided to you (“you” refers to each taxpayer, if more. It is the consent to use & consent to disclose tax return. Consent to use form written in accordance with internal revenue code.

Pin on mlsplan

Web what is a 7216 consent form? If you agree to the disclosure of your tax return information, your consent is valid for the. Unless authorized by law, we cannot disclose your tax return information to third parties for. Consent to use form written in accordance with internal revenue code section 7216. Web code section 7216 disclosure and consent.

Form 7216 Fill Online, Printable, Fillable, Blank pdfFiller

Federal law requires this consent form be provided to you (“you” refers to each taxpayer, if more. Edit your 7216 form online type text, add images, blackout confidential details, add comments, highlights and more. §7216 is a criminal statute that applies to preparers of individual, corporate and partnership tax. Use of tax return information is defined as any circumstance in.

1.7216 DIN/EN Steel Material Sheet

Web (we, us and our) federal law requires this consent form be provided to you. Sign it in a few clicks draw your signature, type it,. If you agree to the disclosure of your tax return information, your consent is valid for the. Web what is form 7216? Edit your 7216 form online type text, add images, blackout confidential details,.

Form 7216 Consent Pdf Consent Form

Web the § 7216 regulations permit tax return preparers to use a list of client names, addresses, email addresses, phone numbers and each client’s income tax form number to provide. Unless authorized by law, we cannot disclose your tax return information to third parties for. Consent to use form written in accordance with internal revenue code section 7216. Office of.

Magic Form 7216 Balenli Sütyenli Tüllü GecelikEkru Fiyatı

Internal revenue code section 7216 is a provision that prohibits tax professionals from knowingly or recklessly disclosing taxpayer information. You are not required to complete this form. Office of associate chief counsel (procedure & administration) room 5503, cc:p&a. Federal law requires this consent form be provided to you (“you” refers to each taxpayer, if more. Web code section 7216 disclosure.

Form 7216 Sample Fill And Sign Printable Template Online Gambaran

Web what is a 7216 consent form? Web what is form 7216? The taxpayer can electronically sign. Web form 8716 is used by partnerships, s corporations, and personal service corporations to elect under section 444(a) to have a tax year other than a required tax. §7216 is a criminal statute that applies to preparers of individual, corporate and partnership tax.

Office Of Associate Chief Counsel (Procedure & Administration) Room 5503, Cc:p&A.

Use of tax return information is defined as any circumstance in which the. Internal revenue code section 7216 is a provision that prohibits tax professionals from knowingly or recklessly disclosing. Web what is form 7216? Consent to use form written in accordance with internal revenue code section 7216.

It Is The Consent To Use & Consent To Disclose Tax Return.

Web (we, us and our) federal law requires this consent form be provided to you. Web regulations under internal revenue code section 7216, disclosure or use of tax information by preparers of returns, became effective january 1, 2009. Unless authorized by law, we cannot disclose your tax return information to third parties for. Sign it in a few clicks draw your signature, type it,.

Web What Is A 7216 Consent Form?

Web code section 7216 disclosure and consent. Get your online template and fill it in. If we obtain your signature on this form by conditioning our services on your consent, your. Web what is a 7216 consent form?

Web Form 8716 Is Used By Partnerships, S Corporations, And Personal Service Corporations To Elect Under Section 444(A) To Have A Tax Year Other Than A Required Tax.

Federal law requires this consent form be provided to you (“you” refers to each taxpayer, if more. Web this presentation talks about §7216 of the internal revenue code. Web the § 7216 regulations permit tax return preparers to use a list of client names, addresses, email addresses, phone numbers and each client’s income tax form number to provide. Web final treasury regulations under irc 7216, disclosure or use of tax information by preparers of returns, became effective december 28, 2012.