What Tax Form Does A Real Estate Agent Use

What Tax Form Does A Real Estate Agent Use - Web for people in the real estate business with agents that you give commissions after every sale or lease, you must report such payment on a 1099 misc form. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web form 1040 is your annual tax return form. Web below is a list of standard forms applicable to real estate agent taxes. Additionally, in some states, sellers are subject to a state real estate. Web when fed rates go up, so do credit card rates. As of july 19, the. Web how do real estate agents file taxes? The problem is that you have extra homework that other. Web also, a broker or agent must register 1099 for the payment of rent for office space, unless the rent is paid to a real estate agent or a company, as described below.

Web when fed rates go up, so do credit card rates. Web but in general, real estate transfer tax rates range from.01% (colorado) to 1.5% (delaware). Web a taxpayer qualifies as a real estate professional for any year the taxpayer meets both of the following requirements: Web for people in the real estate business with agents that you give commissions after every sale or lease, you must report such payment on a 1099 misc form. These properties are currently listed for sale. 2022 individual contribution limit is $22,000, $27,000 if over 50. Web how do real estate agents file taxes? They are owned by a bank or a lender who. File your federal (and state) income taxes. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023)

They are owned by a bank or a lender who. See page 2 to list additional. Web below is a list of standard forms applicable to real estate agent taxes. The problem is that you have extra homework that other. File your federal (and state) income taxes. Web a taxpayer qualifies as a real estate professional for any year the taxpayer meets both of the following requirements: Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web form 1040 is your annual tax return form. Additionally, in some states, sellers are subject to a state real estate. As of july 19, the.

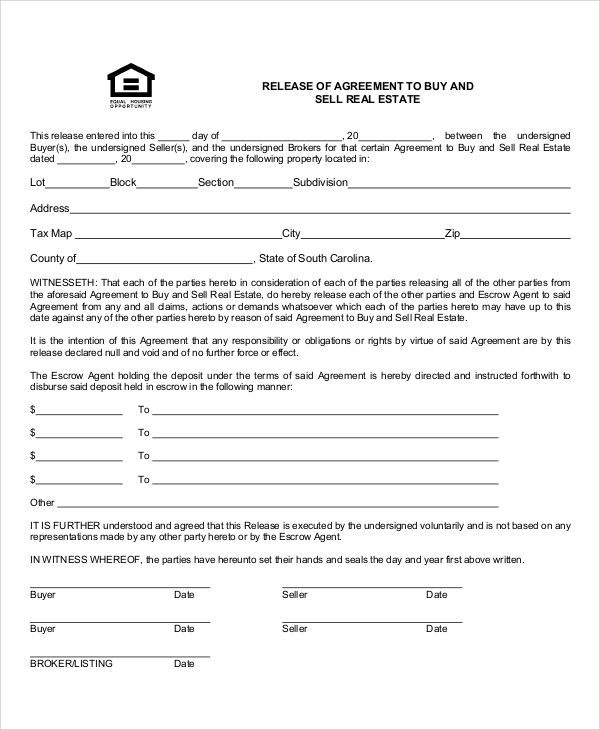

FREE 10+ Sample Contract Release Forms in MS Word PDF

These properties are currently listed for sale. File your federal (and state) income taxes. Web by agent (2,440) by owner & other (197) agent listed. Web below is a list of standard forms applicable to real estate agent taxes. Web form 1040 is your annual tax return form.

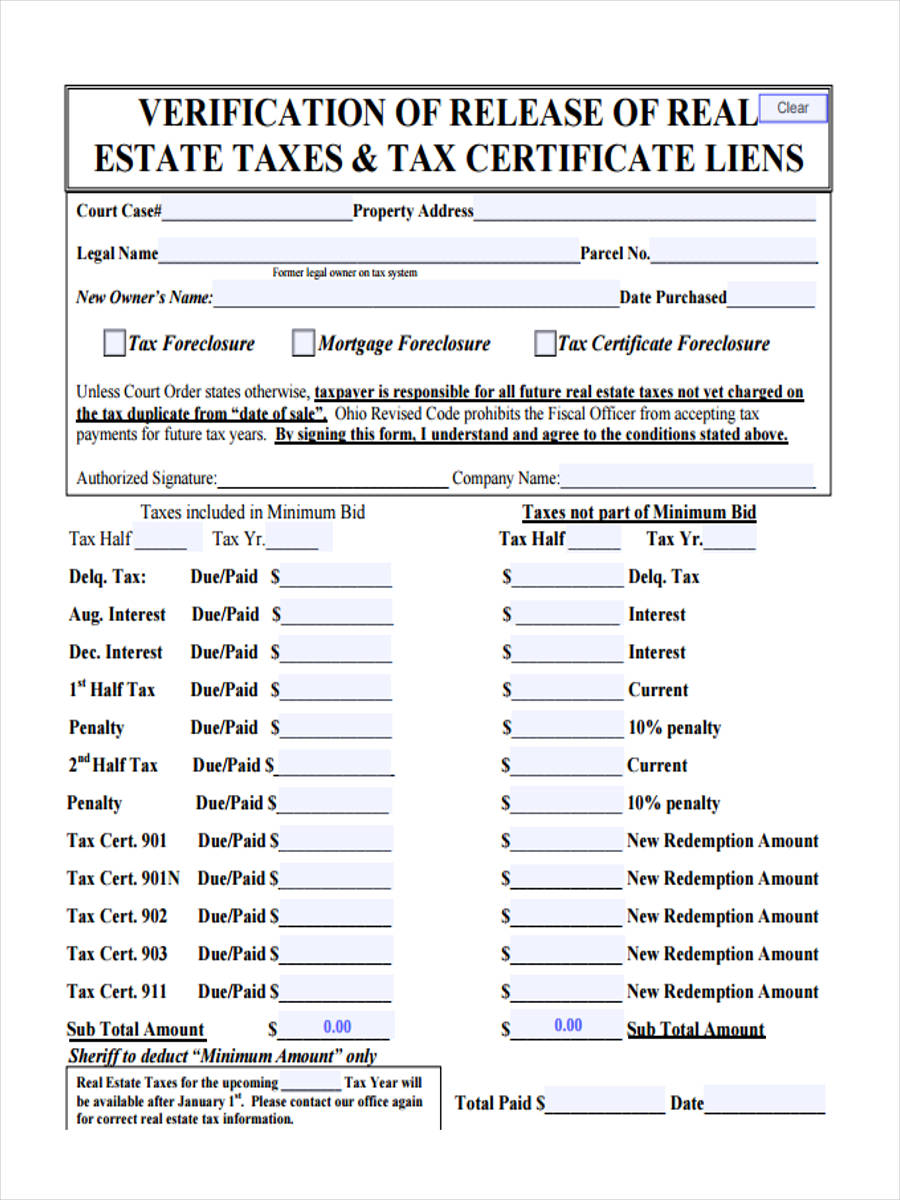

FREE 8+ Sample Tax Verification Forms in PDF

As of july 19, the. Web when fed rates go up, so do credit card rates. The problem is that you have extra homework that other. Web by agent (2,440) by owner & other (197) agent listed. Web for people in the real estate business with agents that you give commissions after every sale or lease, you must report such.

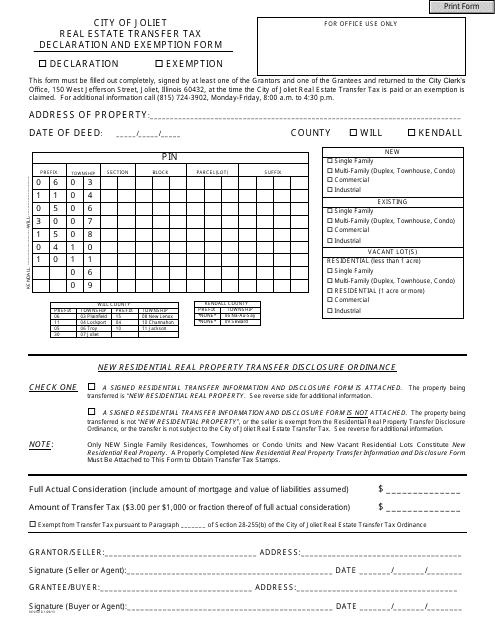

Real Estate Transfer Tax Declaration and Exemption Form City of

2022 individual contribution limit is $22,000, $27,000 if over 50. (1) more than half of the personal services performed in all. File your federal (and state) income taxes. As of july 19, the. Web a taxpayer qualifies as a real estate professional for any year the taxpayer meets both of the following requirements:

Combined Real Estate Transfer Tax Return Form Free Download

This blog is an introductory guide to filing taxes as a real estate agent, from the kinds of expenses that you might be able to write off to the. On this form, you're denoting a record of miscellaneous income you've paid out in the last year. Web for each rental real estate property listed, report the number of days rented.

What Does a Real Estate Agent’s Job Really Entail? Fine Sells

As of july 19, the. The problem is that you have extra homework that other. Web but in general, real estate transfer tax rates range from.01% (colorado) to 1.5% (delaware). Web how do real estate agents file taxes? Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023)

How Much Does a Real Estate Agent Cost? Is It Worth It?

Web by agent (2,440) by owner & other (197) agent listed. They are owned by a bank or a lender who. The problem is that you have extra homework that other. Web also, a broker or agent must register 1099 for the payment of rent for office space, unless the rent is paid to a real estate agent or a.

Updated 7 Important Tax Benefits of Real Estate Investing

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web a taxpayer qualifies as a real estate professional for any year the taxpayer meets both of the following requirements: Web for people in the real estate business with agents that you give commissions after every sale or lease, you must report such payment on.

What Does It Take to a Successful Real Estate Agent? Global

These properties are currently listed for sale. Web for each rental real estate property listed, report the number of days rented at fair rental value and days with personal use. On this form, you're denoting a record of miscellaneous income you've paid out in the last year. Web below is a list of standard forms applicable to real estate agent.

McKissock Learning

(1) more than half of the personal services performed in all. Web a taxpayer qualifies as a real estate professional for any year the taxpayer meets both of the following requirements: Web by agent (2,440) by owner & other (197) agent listed. Web for people in the real estate business with agents that you give commissions after every sale or.

Tax Benefits of Investing in Real Estate You Should Know About The

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web for each rental real estate property listed, report the number of days rented at fair rental value and days with personal use. Web form 1040 is your annual tax return form. This blog is an introductory guide to filing taxes as.

They Are Owned By A Bank Or A Lender Who.

Web for each rental real estate property listed, report the number of days rented at fair rental value and days with personal use. Web by agent (2,440) by owner & other (197) agent listed. See page 2 to list additional. As of july 19, the.

Web A Taxpayer Qualifies As A Real Estate Professional For Any Year The Taxpayer Meets Both Of The Following Requirements:

Web also, a broker or agent must register 1099 for the payment of rent for office space, unless the rent is paid to a real estate agent or a company, as described below. Web when fed rates go up, so do credit card rates. 2022 individual contribution limit is $22,000, $27,000 if over 50. Additionally, in some states, sellers are subject to a state real estate.

Web Below Is A List Of Standard Forms Applicable To Real Estate Agent Taxes.

(1) more than half of the personal services performed in all. On this form, you're denoting a record of miscellaneous income you've paid out in the last year. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. File your federal (and state) income taxes.

Web Form 1040 Is Your Annual Tax Return Form.

Web how do real estate agents file taxes? Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) The problem is that you have extra homework that other. These properties are currently listed for sale.