When Is Form 5500 Due For 2022

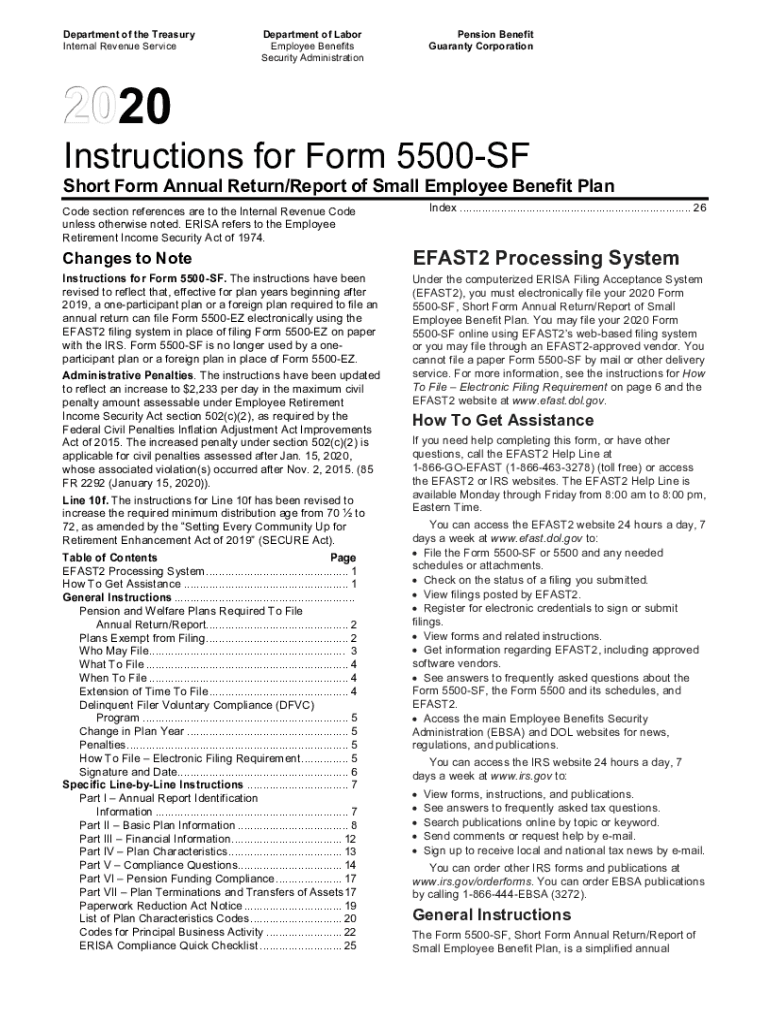

When Is Form 5500 Due For 2022 - We mail cp403 15 months after the original due. Effective march 28 2023, only the. A separate federal register notice was published in december 2021. Department of labor, internal revenue service, and pension benefit guaranty corporation to simplify and expedite the. Web january 17 // deadline for final minimum funding quarterly installment payment for defined benefit plans that had a funding shortfall in 2020 —i.e., due 15 days. Web form 5500 is due by aug. Web new and noteworthy efast2 website credentials are changing to login.gov. August 4, 2022 in this primer article we highlight who must file, the deadlines to file, and the extensions of time available to those filings. Web advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil penalties for late filings and. Web if the filing due date falls on a saturday, sunday or federal holiday, the form 5500 may be filed on the next day that is not a saturday, sunday or federal holiday.

A separate federal register notice was published in december 2021. Department of labor, internal revenuevice ser , and the pension benefit. Web if the filing due date falls on a saturday, sunday or federal holiday, the form 5500 may be filed on the next day that is not a saturday, sunday or federal holiday. Yes, form 5500 is due on july 31st for the previous year. Web form 5500 is due by aug. Web advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil penalties for late filings and. Web new and noteworthy efast2 website credentials are changing to login.gov. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. 1, 2022 for calendar year plans posted july 14, 2022 employers with employee benefit plans that operate on a calendar year basis must. August 4, 2022 in this primer article we highlight who must file, the deadlines to file, and the extensions of time available to those filings.

Web new and noteworthy efast2 website credentials are changing to login.gov. Search site you are here. We mail cp403 15 months after the original due. Effective march 28 2023, only the. Yes, form 5500 is due on july 31st for the previous year. 15th, but if the filing due date falls on a saturday, sunday or. A separate federal register notice was published in december 2021. Department of labor, internal revenue service, and pension benefit guaranty corporation to simplify and expedite the. Web if the filing due date falls on a saturday, sunday or federal holiday, the form 5500 may be filed on the next day that is not a saturday, sunday or federal holiday. 1, 2022 for calendar year plans posted july 14, 2022 employers with employee benefit plans that operate on a calendar year basis must.

Form 5500 Due Date Avoid Serious Late Filing Penalties BASIC

Web january 17 // deadline for final minimum funding quarterly installment payment for defined benefit plans that had a funding shortfall in 2020 —i.e., due 15 days. Search site you are here. Web itr due date 2023 news updates on. Web vynm2 • 1 min. Web schedule a (form 5500) 2022 page 4 part iii welfare benefit contract information if.

Know the Considerations for Form 5500 Prenger and Profitt

Search site you are here. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. We mail cp403 15 months after the original due. Web vynm2 • 1 min. Yes, form 5500 is due on july 31st for the previous year.

Pin on calendar ideas

1, 2022 for calendar year plans posted july 14, 2022 employers with employee benefit plans that operate on a calendar year basis must. 15th, but if the filing due date falls on a saturday, sunday or. Web january 17 // deadline for final minimum funding quarterly installment payment for defined benefit plans that had a funding shortfall in 2020 —i.e.,.

Form 5500 Annual Fill Out and Sign Printable PDF Template signNow

August 4, 2022 in this primer article we highlight who must file, the deadlines to file, and the extensions of time available to those filings. Web advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil penalties for late filings and. Effective march 28 2023, only the. Web.

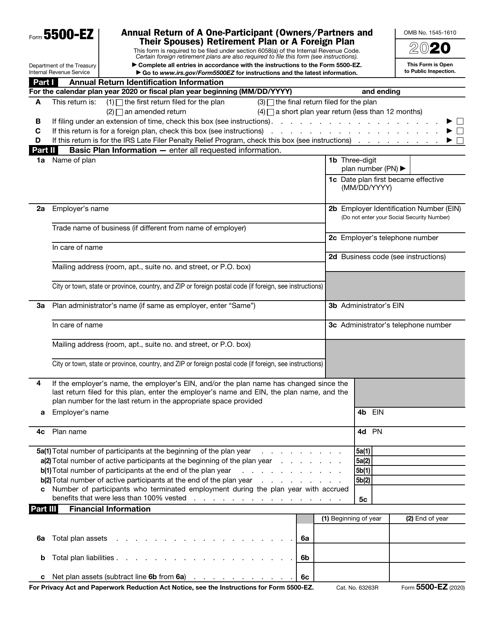

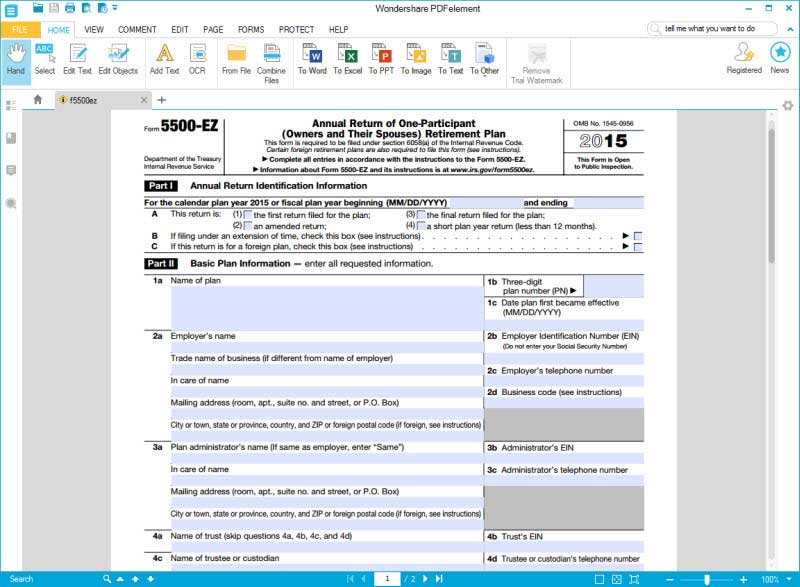

2019 Form IRS 5500EZ Fill Online, Printable, Fillable, Blank pdfFiller

Web form 5500 is due by aug. Web vynm2 • 1 min. Yes, form 5500 is due on july 31st for the previous year. Department of labor, internal revenuevice ser , and the pension benefit. Web if the filing due date falls on a saturday, sunday or federal holiday, the form 5500 may be filed on the next day that.

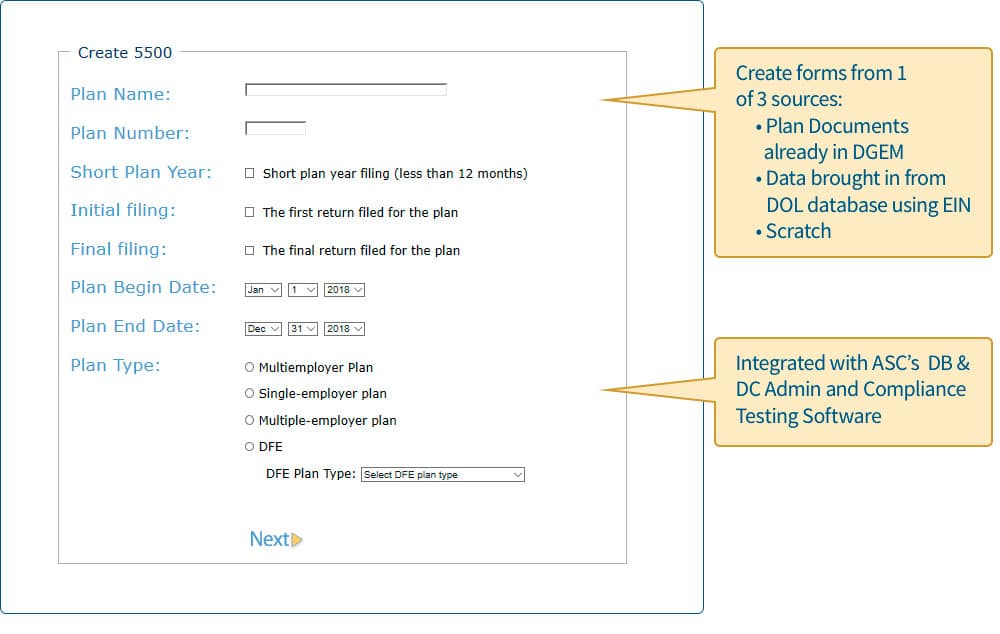

5500 Forms for Qualified Retirement Plans

Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. August 4, 2022 in this primer article we highlight who must file, the deadlines to file, and the extensions of time available to those filings. So, if you didn't open your 401k until sometime in 2023, you won't need to.

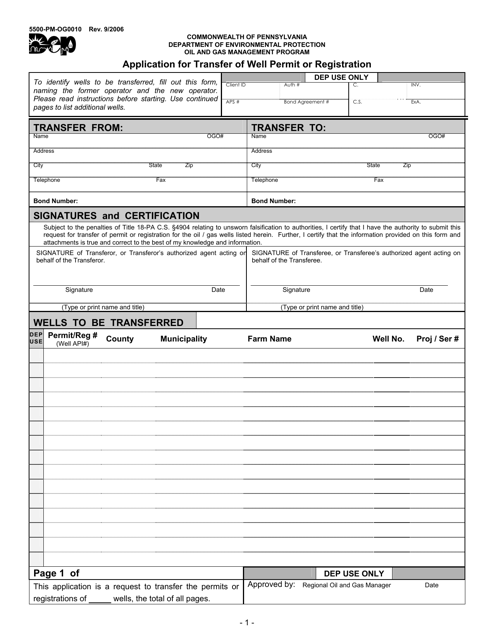

Form 5500PMOG0010 Download Printable PDF or Fill Online Application

Effective march 28 2023, only the. Department of labor, internal revenuevice ser , and the pension benefit. Web advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil penalties for late filings and. This does not change efast2 signature credentials. August 4, 2022 in this primer article we.

IRS Form 5500EZ Download Fillable PDF or Fill Online Annual Return of

So, if you didn't open your 401k until sometime in 2023, you won't need to file form 5500 until 2024. A separate federal register notice was published in december 2021. Web new and noteworthy efast2 website credentials are changing to login.gov. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of.

Retirement plan 5500 due date Early Retirement

Search site you are here. Web schedule a (form 5500) 2022 page 4 part iii welfare benefit contract information if more than one contract covers the same group of employees of the same. (1) the first return filed for the plan (3) the final return filed for the plan (2). We mail cp403 15 months after the original due. Web.

So, If You Didn't Open Your 401K Until Sometime In 2023, You Won't Need To File Form 5500 Until 2024.

Department of labor, internal revenuevice ser , and the pension benefit. Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: (1) the first return filed for the plan (3) the final return filed for the plan (2). Web vynm2 • 1 min.

Effective March 28 2023, Only The.

Web advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil penalties for late filings and. Yes, form 5500 is due on july 31st for the previous year. 15th, but if the filing due date falls on a saturday, sunday or. Web itr due date 2023 news updates on.

Department Of Labor, Internal Revenue Service, And Pension Benefit Guaranty Corporation To Simplify And Expedite The.

A separate federal register notice was published in december 2021. Web new and noteworthy efast2 website credentials are changing to login.gov. Search site you are here. August 4, 2022 in this primer article we highlight who must file, the deadlines to file, and the extensions of time available to those filings.

Web Form 5500 Is Due By Aug.

Web schedule a (form 5500) 2022 page 4 part iii welfare benefit contract information if more than one contract covers the same group of employees of the same. This does not change efast2 signature credentials. We mail cp403 15 months after the original due. 1, 2022 for calendar year plans posted july 14, 2022 employers with employee benefit plans that operate on a calendar year basis must.