When Is Form 944 Due

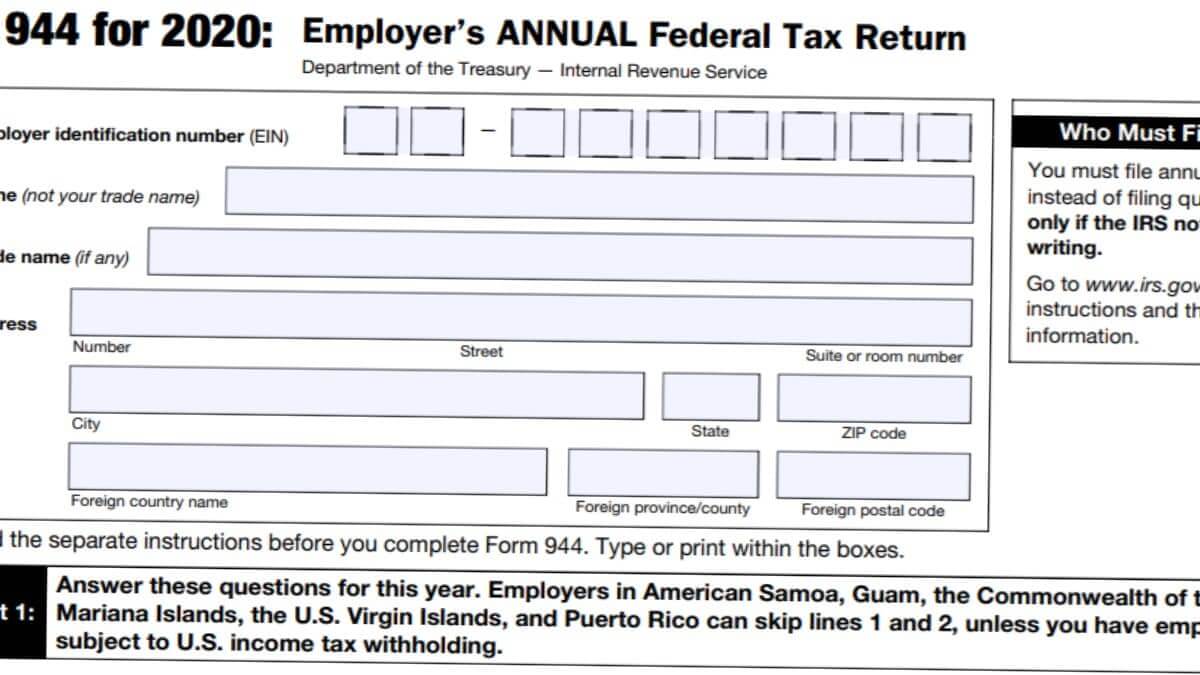

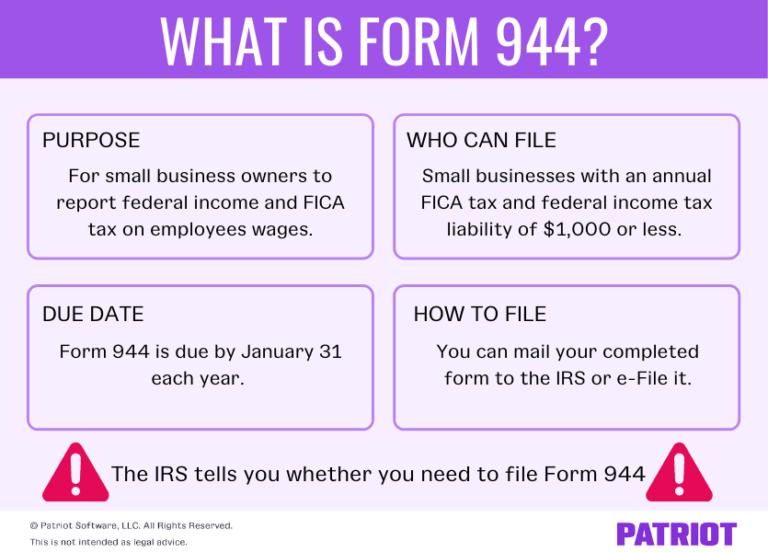

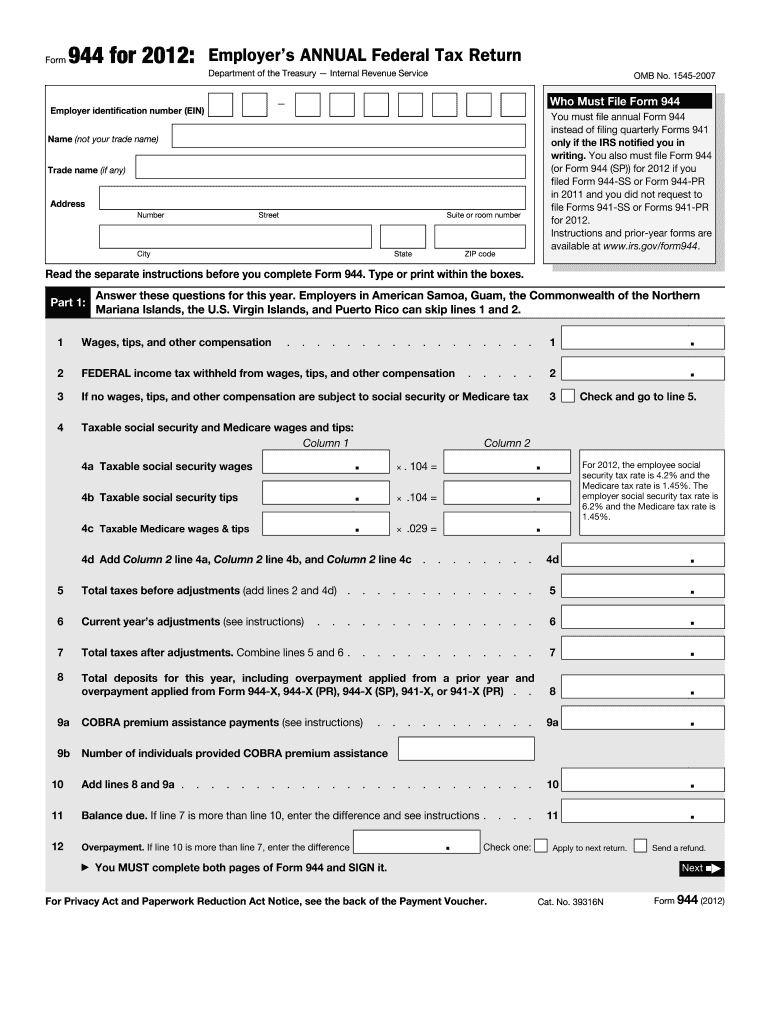

When Is Form 944 Due - This return is due once a year, by january 31, after the end of the calendar year. However, if you made deposits on time in full payment of the. Form 944 is due by january 31 st unless that day falls on a holiday or weekend; Web up to $32 cash back the deadline to file your 2022 form 944 return is january 31, 2023. January 31st, but if tax deposits are up to date, you have an additional 10 days to file. However, if you made deposits on time in full payment of the taxes due for the year, you can file the return by february 10, 2022. You can complete it online, download a copy, or you can print out a copy from the website. It is due by january 31st of each year,. For 2022, you have to file form 944 by january 31, 2023. Web generally, the credit for qualified sick and family leave wages, as enacted under the families first coronavirus response act (ffcra) and amended and extended by the covid.

However, if you made deposits on time in full payment of the taxes due for the year, you can file the return by february 10, 2022. Web when is form 944 due? For 2022, you have to file form 944 by january 31, 2023. You can complete it online, download a copy, or you can print out a copy from the website. Form 944 is designed for smaller employers who have lower tax liabilities ($1,000 or. Web form 944 is due by january 31st every year, regardless of the filing method (paper or electronic filing). If your quarterly fica tax withholding is $1,000 or less, you must file form 944 with the irs every year by january 31 of the. Web when is form 944 due? If you made timely deposits in full payment of your. Employer’s annual federal tax return department of the treasury — internal revenue service.

If you haven’t received your ein by. Web generally, the credit for qualified sick and family leave wages, as enacted under the families first coronavirus response act (ffcra) and amended and extended by the covid. However, if you made deposits on time in full payment of the. You can complete it online, download a copy, or you can print out a copy from the website. If your quarterly fica tax withholding is $1,000 or less, you must file form 944 with the irs every year by january 31 of the. Web form 944 is due by january 31st every year, regardless of the filing method (paper or electronic filing). However, if you made deposits on time in full payment of the taxes due for the year, you can file the return by february 10, 2022. Unlike quarterly payments due throughout the year, this annual form needs to be filed only once. Web when is form 944 due? Form 944 is due by january 31 st unless that day falls on a holiday or weekend;

Fillable IRS Form 944 Printable, Blank PDF and Instructions in

Web when is form 944 due? Web up to $32 cash back the deadline to file your 2022 form 944 return is january 31, 2023. If you haven’t received your ein by. If your quarterly fica tax withholding is $1,000 or less, you must file form 944 with the irs every year by january 31 of the. 31 for the.

Who is Required to File Form I944 for a Green Card? CitizenPath

This return is due once a year, by january 31, after the end of the calendar year. In those cases, it is due on the following normal business day. January 31st, but if tax deposits are up to date, you have an additional 10 days to file. If your quarterly fica tax withholding is $1,000 or less, you must file.

944 Form 2021 2022 IRS Forms Zrivo

31 for the previous tax year — the return covering the 2021 year, therefore, would be due jan. Web for 2022, the due date for filing form 944 is january 31, 2023. Form 1040, federal income tax return, schedule c: If the deposits are made on time in full payment of the taxes, the return can be filed by february.

Form 944 YouTube

Web when is the due date to file 944 tax form? Web for 2022, the due date for filing form 944 is january 31, 2023. This return is due once a year, by january 31, after the end of the calendar year. If you haven’t received your ein by. Unlike those filing a 941, small business owners have the option.

944 Form 2021 2022 IRS Forms Zrivo

Web when is form 944 due? If you made timely deposits in full payment of your. Web up to $32 cash back see more about form 944. If you haven’t received your ein by. Web when is the due date to file 944 tax form?

2016 Form IRS 944 Fill Online, Printable, Fillable, Blank PDFfiller

Web up to $32 cash back see more about form 944. Form 944 is due by january 31 st unless that day falls on a holiday or weekend; Form 1040, federal income tax return, schedule c: You can complete it online, download a copy, or you can print out a copy from the website. Web up to $32 cash back.

Sweet Beginning USA Form I944 Declaration of SelfSufficiency In the

If you made timely deposits in full payment of your. Web when is form 944 due? Web up to $32 cash back see more about form 944. Form 944 is designed for smaller employers who have lower tax liabilities ($1,000 or. Web form 944 is due by january 31st every year, regardless of the filing method (paper or electronic filing).

What is Form 944? Reporting Federal & FICA Taxes

Web new employers may request to file form 944 when applying for an employer identification number (ein). A line on the application form allows employers to indicate. If you made timely deposits in full payment of your. Web when is the due date for form 944? For 2022, you have to file form 944 by january 31, 2023.

944 d4

January 31st, but if tax deposits are up to date, you have an additional 10 days to file. Web when will i file form 944? Web up to $32 cash back the deadline to file your 2022 form 944 return is january 31, 2023. However, if you made deposits on time in full payment of the. Web where to.

2012 Form IRS 944 Fill Online, Printable, Fillable, Blank PDFfiller

A line on the application form allows employers to indicate. However, if you made deposits on time in full payment of the taxes due for the year, you can file the return by february 10, 2022. Web form 944 for 2022: If you made timely deposits in full payment of your. Web for 2022, the due date for filing form.

Form 944 Is Due By January 31 St Unless That Day Falls On A Holiday Or Weekend;

If the deposits are made on time in full payment of the taxes, the return can be filed by february 10,. Web when is form 944 due? Employer’s annual federal tax return department of the treasury — internal revenue service. However, if you made deposits on time in full payment of the taxes due for the year, you can file the return by february 10, 2022.

However, If You Made Deposits On Time In Full Payment Of The.

Web form 944 for 2022: Form 1040, federal income tax return, schedule c: However, if you made deposits on time in full payment of the. Web when is the due date for form 944?

Web When Will I File Form 944?

Web when is form 944 due? Web when is the due date to file 944 tax form? Web up to $32 cash back the deadline to file your 2022 form 944 return is january 31, 2023. It is due by january 31st of each year,.

31 For The Previous Tax Year — The Return Covering The 2021 Year, Therefore, Would Be Due Jan.

Web where to get form 944 form 944 is available on the irs website. Form 944 is designed for smaller employers who have lower tax liabilities ($1,000 or. Unlike those filing a 941, small business owners have the option to pay taxes when. January 31st, but if tax deposits are up to date, you have an additional 10 days to file.