Where To Mail Form 1310 Irs

Where To Mail Form 1310 Irs - How do i fill out form 1310? Web you'll mail form 1310 to the same internal revenue service center where the original tax return was filed. See instructions below and on back. Web line a check the box on line a if you received a refund check in your name and your deceased spouse's name. If you aren’t the surviving spouse, then you’ll mail the form to the same internal revenue service center where the original return was filed. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. Web internal revenue service p.o. If you checked the box on line b or line c, then you can either send the completed form to the irs center where you filed the original tax return, or follow the. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual is a surviving spouse filing a joint return or a court appointed personal representative. Then, yes, you will need to mail form 1310 with that court certificate to the same address where you'd mail the tax return;

Statement of person claiming refund due a deceased taxpayer. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund that was due to the taxpayer at the time of death. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. If you checked the box on line b or line c, then you can either send the completed form to the irs center where you filed the original tax return, or follow the. Use form 1310 to claim a refund on behalf of a deceased taxpayer. A new check will be issued in your name and mailed to you. Then, yes, you will need to mail form 1310 with that court certificate to the same address where you'd mail the tax return; See instructions below and on back. Web where do i mail form 1310? Tax year decedent was due a refund:

December 2021) department of the treasury internal revenue service. If you checked the box on line b or line c, then you can either send the completed form to the irs center where you filed the original tax return, or follow the. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web line a check the box on line a if you received a refund check in your name and your deceased spouse's name. Web where do i mail form 1310? Web you'll mail form 1310 to the same internal revenue service center where the original tax return was filed. Then, yes, you will need to mail form 1310 with that court certificate to the same address where you'd mail the tax return; Tax year decedent was due a refund: A new check will be issued in your name and mailed to you. If a personal representative has been appointed, they must sign the tax return.

Form 1310 Instructions 2022 2023 IRS Forms Zrivo

See instructions below and on back. December 2021) department of the treasury internal revenue service. How do i fill out form 1310? Web internal revenue service p.o. If you checked the box on line b or line c, then you can either send the completed form to the irs center where you filed the original tax return, or follow the.

IRS Form 1310 Claiming a Refund for a Deceased Person YouTube

December 2021) department of the treasury internal revenue service. Web line a check the box on line a if you received a refund check in your name and your deceased spouse's name. If you aren’t the surviving spouse, then you’ll mail the form to the same internal revenue service center where the original return was filed. Web internal revenue service.

2021 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Web line a check the box on line a if you received a refund check in your name and your deceased spouse's name. Then, yes, you will need to mail form 1310 with that court certificate to the same address where you'd mail the tax return; Tax year decedent was due a refund: Web form 1310 can be used by.

Form 1310 Instructions 2021 2022 IRS Forms Zrivo

If you checked the box on line b or line c, then you can either send the completed form to the irs center where you filed the original tax return, or follow the. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless.

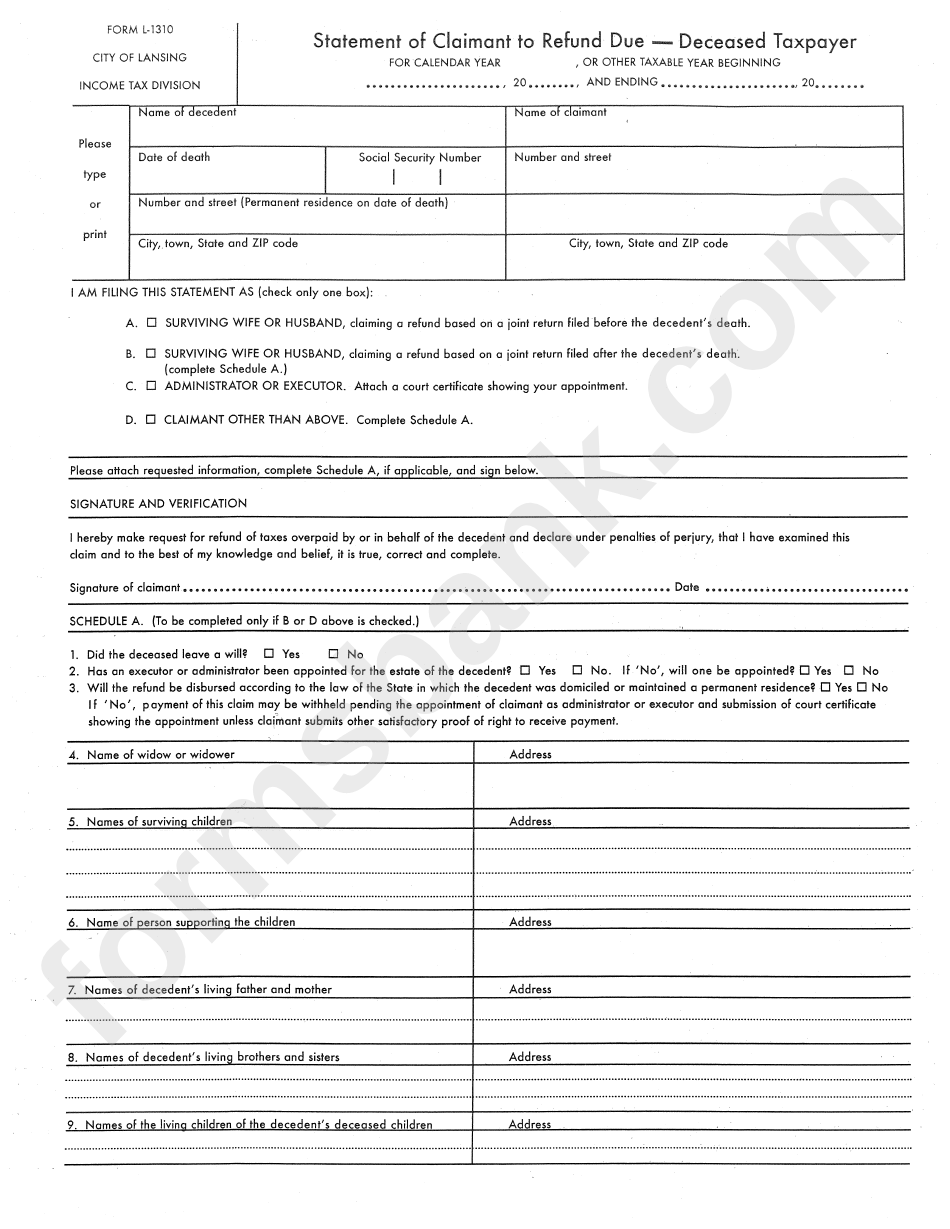

Form L1310 Statement Of Claimant To Refund Due Deceased Taxpayer

Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual is a surviving spouse filing a joint return or a court appointed personal representative. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who.

2021 Form IRS 1310 Fill Online, Printable, Fillable, Blank pdfFiller

If you had mailed it. A new check will be issued in your name and mailed to you. If you aren’t the surviving spouse, then you’ll mail the form to the same internal revenue service center where the original return was filed. Then, yes, you will need to mail form 1310 with that court certificate to the same address where.

Irs Form 1310 Printable Master of Documents

Web where do i mail form 1310? Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. If you aren’t the surviving spouse, then you’ll mail the form to the same internal revenue service center where the original return was filed. Web internal revenue service.

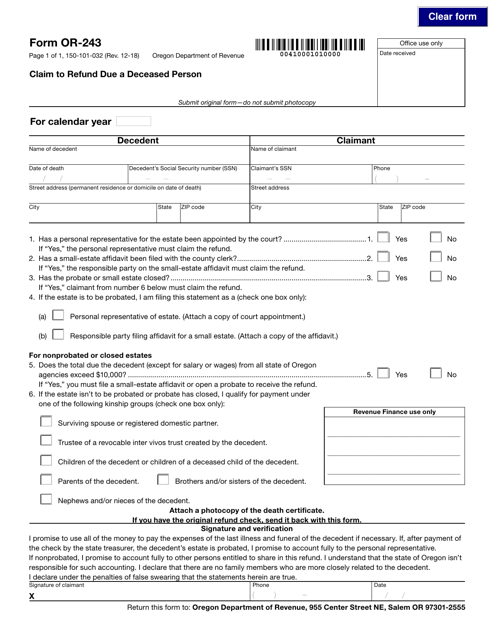

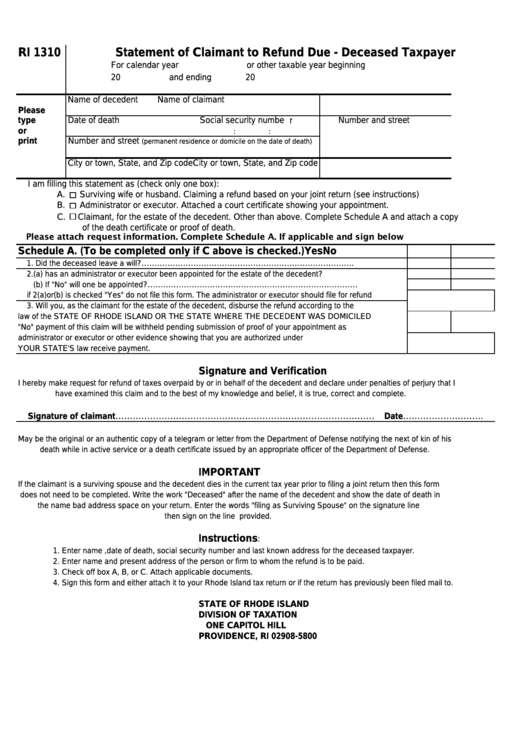

Form Ri 1310 Statement Of Claimant To Refund DueDeceased Taxpayer

See instructions below and on back. If a personal representative has been appointed, they must sign the tax return. Web where do i mail form 1310? Web line a check the box on line a if you received a refund check in your name and your deceased spouse's name. If you checked the box on line b or line c,.

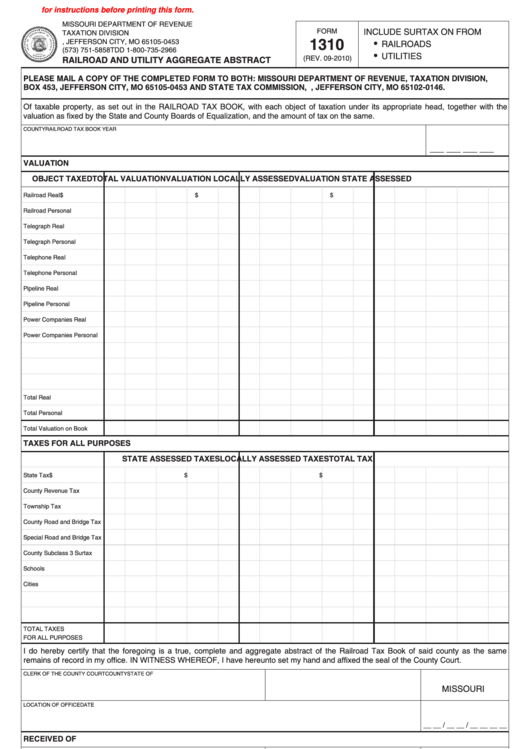

Fillable Form 1310 Railroad And Utility Aggregate Abstract 2010

Web where do i mail form 1310? December 2021) department of the treasury internal revenue service. See instructions below and on back. Web internal revenue service p.o. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual is a surviving spouse.

Breanna Form 2848 Irsgov

Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web you'll mail form 1310 to the same internal revenue service center where the original tax return was filed. If you had mailed it. Then, yes, you will need to mail form 1310 with that court certificate to the same address where you'd mail the tax return;.

See Instructions Below And On Back.

If a personal representative has been appointed, they must sign the tax return. If you aren’t the surviving spouse, then you’ll mail the form to the same internal revenue service center where the original return was filed. Web where do i mail form 1310? Web internal revenue service p.o.

Web If A Tax Refund Is Due, The Person Claiming The Refund Must Fill Out Form 1310 (Statement Of Person Claiming Refund Due To Deceased Taxpayer) Unless The Individual Is A Surviving Spouse Filing A Joint Return Or A Court Appointed Personal Representative.

If you checked the box on line b or line c, then you can either send the completed form to the irs center where you filed the original tax return, or follow the. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. December 2021) department of the treasury internal revenue service. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund that was due to the taxpayer at the time of death.

Web Line A Check The Box On Line A If You Received A Refund Check In Your Name And Your Deceased Spouse's Name.

Then, yes, you will need to mail form 1310 with that court certificate to the same address where you'd mail the tax return; Use form 1310 to claim a refund on behalf of a deceased taxpayer. If you had mailed it. Statement of person claiming refund due a deceased taxpayer.

Tax Year Decedent Was Due A Refund:

How do i fill out form 1310? A new check will be issued in your name and mailed to you. If you’re a surviving spouse, you’ll mail form 1310 to the same internal revenue service center where you filed your return. Web you'll mail form 1310 to the same internal revenue service center where the original tax return was filed.

/1310-RefundClaimDuetoDeceasedTaxpayer-1-292bd14843c94bf4abf09ea5d6eb9a4b.png)