Where To Report Form 3922 On Tax Return

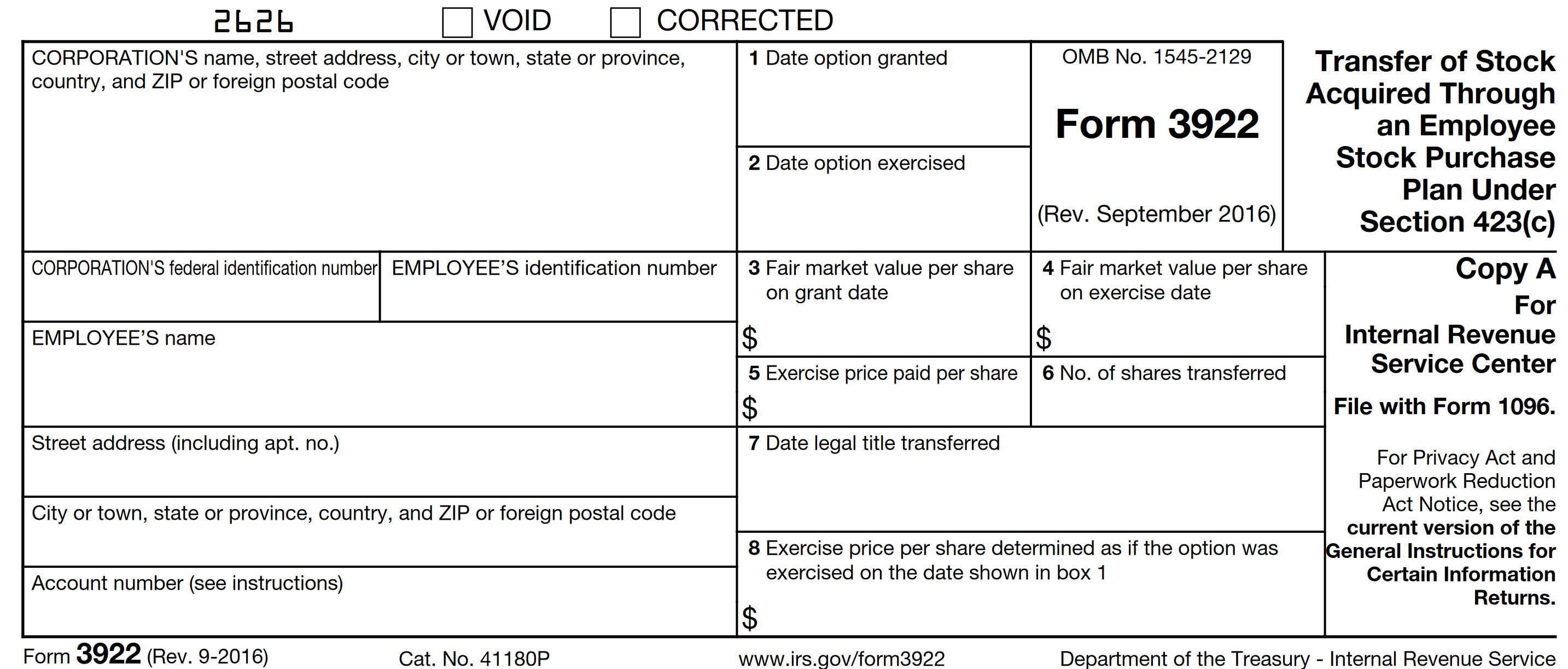

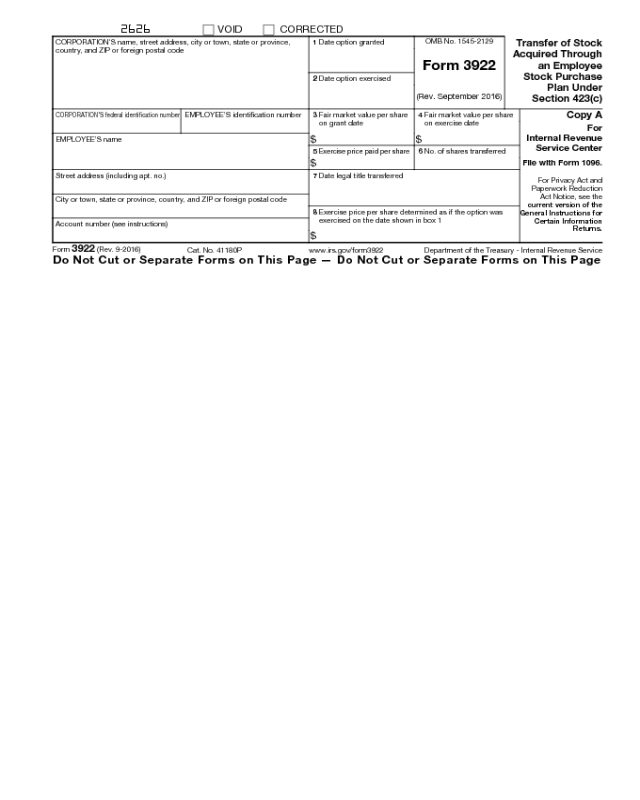

Where To Report Form 3922 On Tax Return - Web solved • by intuit • 415 • updated july 14, 2022. Click on take me to my return. Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to irs.gov/. Web this needs to be reported on your tax return. Processing, you cannot file with the irs forms 1096, 1097, 1098, 1099, 3921, 3922, or. Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to. The information on form 3922 will help determine your cost or other basis, as well as your holding period. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Web generally, form 3922 is issued for informational purposes only unless stock acquired through an employee stock purchase plan under section 423 (c) is sold or. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock.

Like form 3921, save form 3922s with your investment records. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Web form 3922 is issued to report the income on your tax return when you sell the units. For more information on the 3922 form and instructions, visit our website. Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to. Sign in or open turbotax. It is located at 7422 w 39th st tulsa, oklahoma. The information on form 3922 will help determine your cost or other basis, as well as your holding period. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Keep the form for your records because you’ll need the information when you sell, assign, or.

Web irs form 3922 is for informational purposes only and isn't entered into your return. For more information on the 3922 form and instructions, visit our website. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a form a taxpayer receives if they have. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. Web solved • by intuit • 415 • updated july 14, 2022. Web step by step guidance if you participate in an employee stock purchase plan, you probably will receive irs form 3922 from your employer at the end of the tax. Keep the form for your records because you’ll need the information when you sell, assign, or. It is located at 7422 w 39th st tulsa, oklahoma. Like form 3921, save form 3922s with your investment records.

Do You Report Form 3922 On Tax Return

Web generally, form 3922 is issued for informational purposes only unless stock acquired through an employee stock purchase plan under section 423 (c) is sold or. Keep the form for your records because you’ll need the information when you sell, assign, or. Web this needs to be reported on your tax return. Web only if you sold stock that was.

3922 2020 Public Documents 1099 Pro Wiki

Processing, you cannot file with the irs forms 1096, 1097, 1098, 1099, 3921, 3922, or. Web sps/gz’s professionals will assist you with 3922 form reporting requirements. Web irs form 3922 is for informational purposes only and isn't entered into your return. Generally, form 3922 is issued for informational. Form 3922 is an informational statement and would not be entered into.

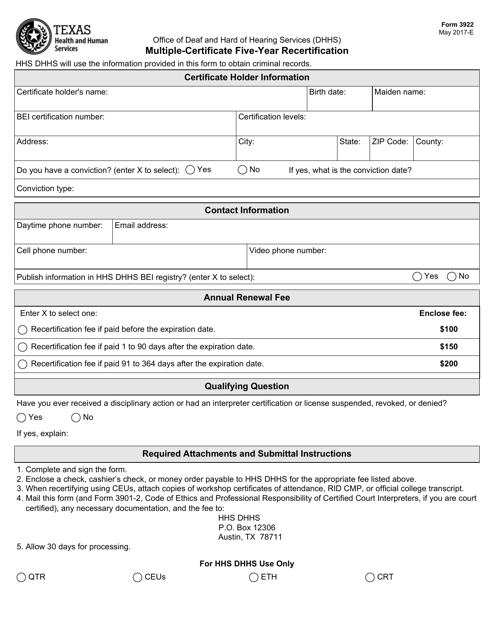

Form 3922 Download Fillable PDF or Fill Online MultipleCertificate

Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to irs.gov/. Sign in or open turbotax. Web this needs to be reported on your tax return. It is located at 7422 w 39th st tulsa, oklahoma. The information on form 3922 will help determine.

Documents to Bring To Tax Preparer Tax Documents Checklist

It is located at 7422 w 39th st tulsa, oklahoma. Keep the form for your records because you’ll need the information when you sell, assign, or. Web irs form 3922 is for informational purposes only and isn't entered into your return. The information on form 3922 will help determine your cost or other basis, as well as your holding period..

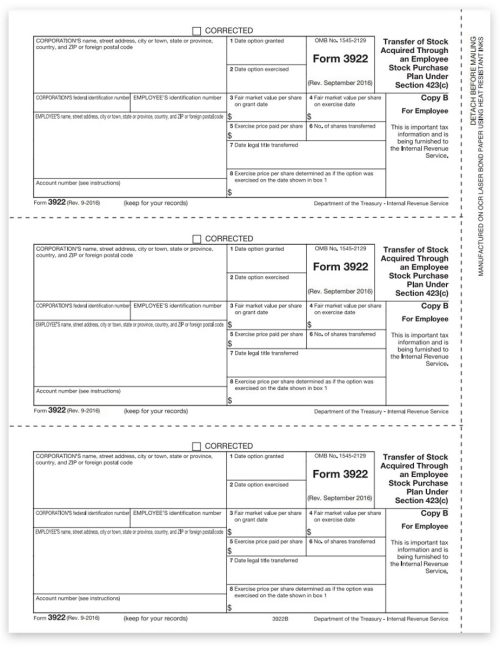

3922 Forms, Employee Stock Purchase, Employee Copy B DiscountTaxForms

Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Like form 3921, save form 3922s with your investment records. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web step by step guidance if.

IRS Form 3922

Keep the form for your records because you’ll need the information when you sell, assign, or. Form 3922 is an informational statement and would not be entered into the tax return. Web form 3922 is issued to report the income on your tax return when you sell the units. Web irs form 3922 transfer of stock acquired through an employee.

Form 3922 Edit, Fill, Sign Online Handypdf

For more information on the 3922 form and instructions, visit our website. Web step by step guidance if you participate in an employee stock purchase plan, you probably will receive irs form 3922 from your employer at the end of the tax. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Web this needs to.

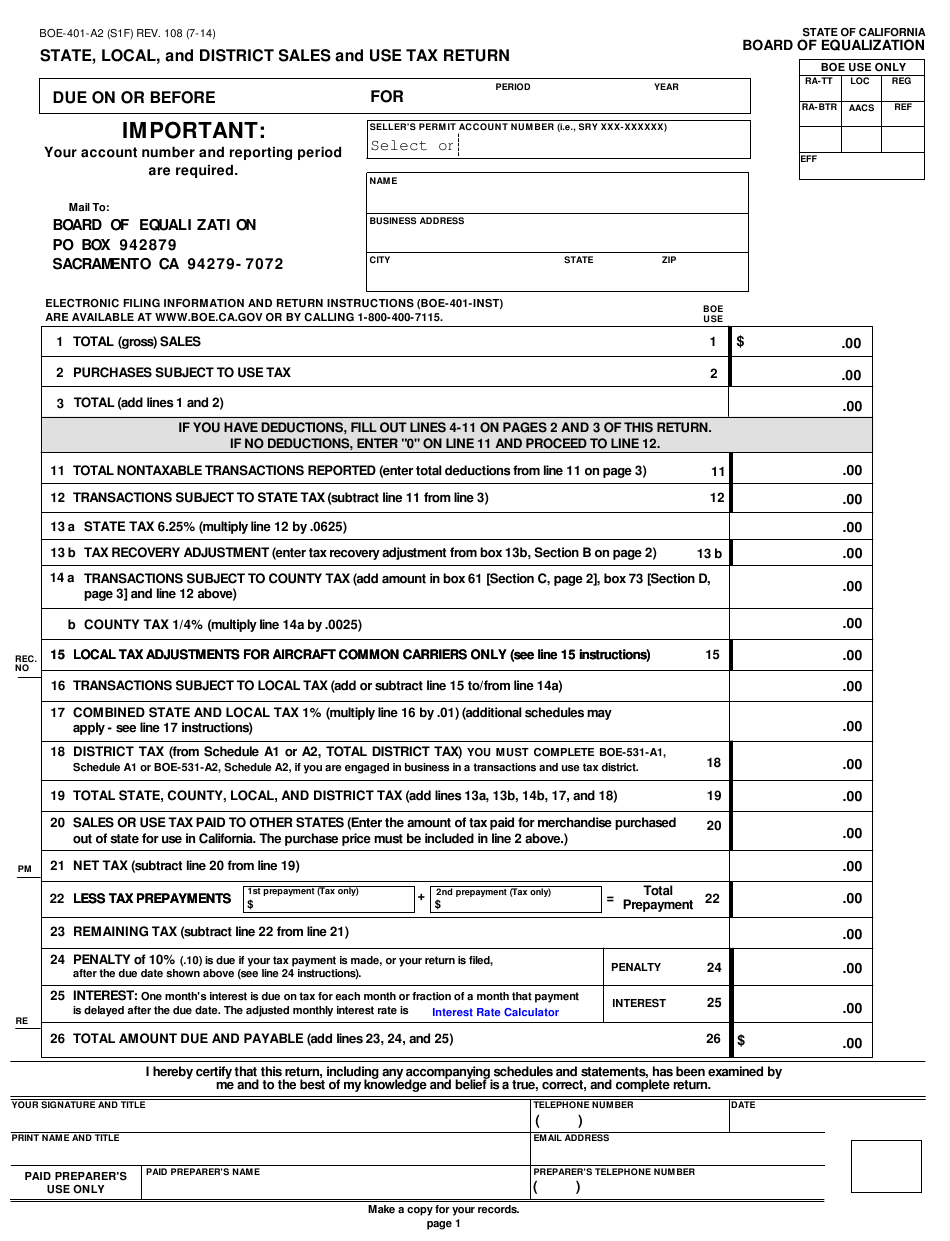

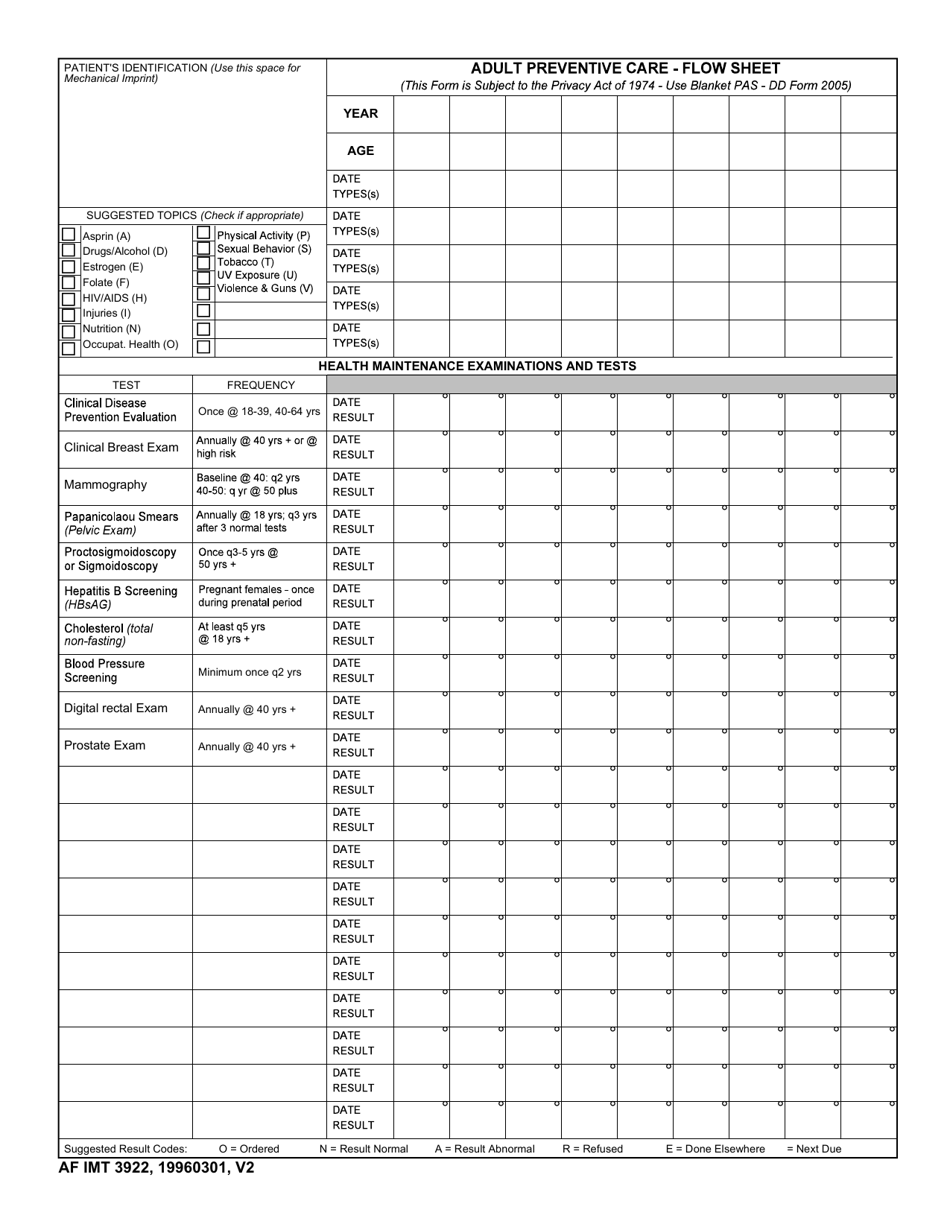

AF IMT Form 3922 Download Fillable PDF or Fill Online Adult Preventive

For more information on the 3922 form and instructions, visit our website. Generally, form 3922 is issued for informational. Web irs form 3922 is for informational purposes only and isn't entered into your return. Like form 3921, save form 3922s with your investment records. Web sps/gz’s professionals will assist you with 3922 form reporting requirements.

Conceptual Photo About Form 4670 Request For Relief Of Payment Of

Keep the form for your records because you’ll need the information when you sell, assign, or. Web generally, form 3922 is issued for informational purposes only unless stock acquired through an employee stock purchase plan under section 423 (c) is sold or. For more information on the 3922 form and instructions, visit our website. Generally, form 3922 is issued for.

Do You Report Form 3922 On Tax Return

Web for rent this 1626 square foot single family home has 3 bedrooms and 2.0 bathrooms. Web sps/gz’s professionals will assist you with 3922 form reporting requirements. Web form 3922 is issued to report the income on your tax return when you sell the units. Like form 3921, save form 3922s with your investment records. Processing, you cannot file with.

Web Irs Form 3922 Is For Informational Purposes Only And Isn't Entered Into Your Return.

Web generally, form 3922 is issued for informational purposes only unless stock acquired through an employee stock purchase plan under section 423 (c) is sold or. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). The information on form 3922 will help determine your cost or other basis, as well as your holding period. Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to.

Form 3922 Is An Informational Statement And Would Not Be Entered Into The Tax Return.

Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. It is located at 7422 w 39th st tulsa, oklahoma. Processing, you cannot file with the irs forms 1096, 1097, 1098, 1099, 3921, 3922, or. Like form 3921, save form 3922s with your investment records.

Web Sps/Gz’s Professionals Will Assist You With 3922 Form Reporting Requirements.

Web this needs to be reported on your tax return. Web step by step guidance if you participate in an employee stock purchase plan, you probably will receive irs form 3922 from your employer at the end of the tax. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a form a taxpayer receives if they have.

Sign In Or Open Turbotax.

Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. For more information on the 3922 form and instructions, visit our website. Keep the form for your records because you’ll need the information when you sell, assign, or. Click on take me to my return.