Which 1099 Form Do I Use For Attorney Fees

Which 1099 Form Do I Use For Attorney Fees - Write “udc” and the amount of the attorney’s fees next to line 36 of form 1040. Web april 2017 issue 131 this article explains why attorneys might receive a form 1099 reporting certain amounts paid to them in the course of their practice, and why it is a “big deal.”. Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. The term “attorney” includes a law firm or other provider of legal services. Web require a defendant to issue a plaintiff a form 1099 that includes the attorneys’ fee payment whenever that payment is includible in the plaintiff’s gross income. Web this issue is particularly relevant to attorneys who earn their fees on a contingency basis and who withdraw fees and costs from a check made payable to the. Shop a wide variety of 1099 tax forms from top brands at staples®. Web ssa 1099 feds charged me attorney fees where do i enter that amount as an itemized item. Web the tax code requires the businesses making payments to attorneys and report the payments to the irs on a 1099 form. february 3, 2022 1:20 pm.

Web the instructions said: Web april 2017 issue 131 this article explains why attorneys might receive a form 1099 reporting certain amounts paid to them in the course of their practice, and why it is a “big deal.”. Web the tax code requires the businesses making payments to attorneys and report the payments to the irs on a 1099 form. Web require a defendant to issue a plaintiff a form 1099 that includes the attorneys’ fee payment whenever that payment is includible in the plaintiff’s gross income. Ad discover a wide selection of 1099 tax forms at staples®. Each person engaged in business and making a. Web ssa 1099 feds charged me attorney fees where do i enter that amount as an itemized item. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. For example, if you paid $100,000 in attorney fees, write “udc. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

Each person engaged in business and making a. Web attorney fees on ssa form 1099 i have over $20,000 in attorney fees for 2019 on my ssa 1099 which are included in box 3 & 5. Web the instructions said: Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. My case took over 4 years to win my. Web require a defendant to issue a plaintiff a form 1099 that includes the attorneys’ fee payment whenever that payment is includible in the plaintiff’s gross income. february 3, 2022 1:20 pm. Write “udc” and the amount of the attorney’s fees next to line 36 of form 1040. Shop a wide variety of 1099 tax forms from top brands at staples®. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

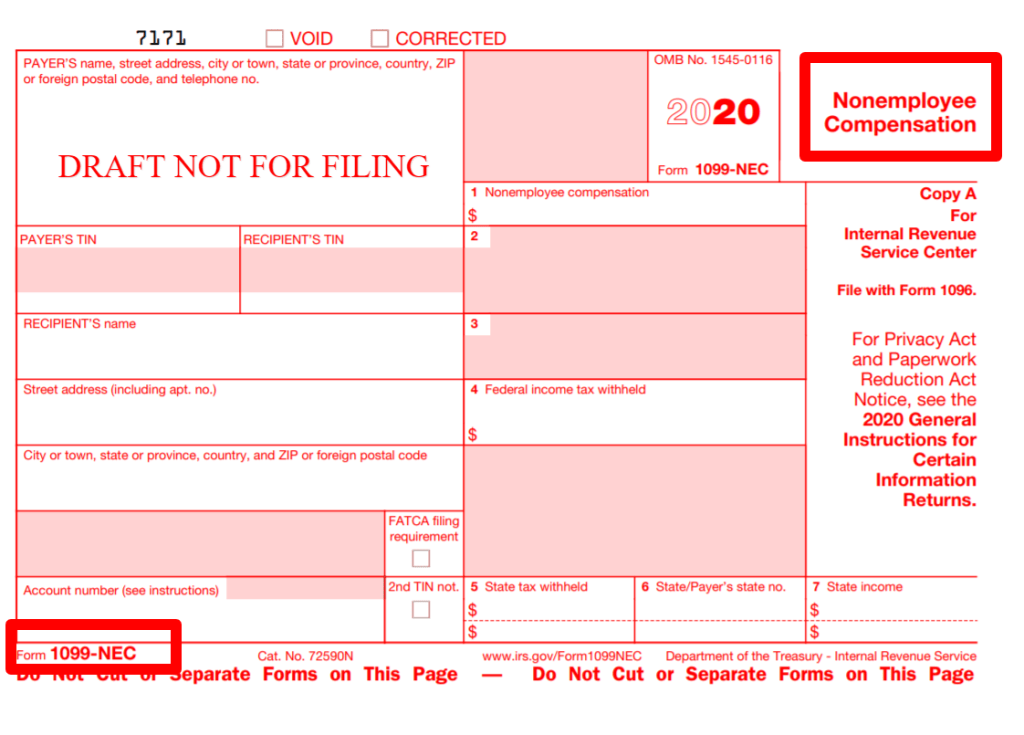

How do I Access 1099NEC form Files for Use with Sage Checks & Forms?

Write “udc” and the amount of the attorney’s fees next to line 36 of form 1040. Web attorney fees on ssa form 1099 i have over $20,000 in attorney fees for 2019 on my ssa 1099 which are included in box 3 & 5. My case took over 4 years to win my. Shop a wide variety of 1099 tax.

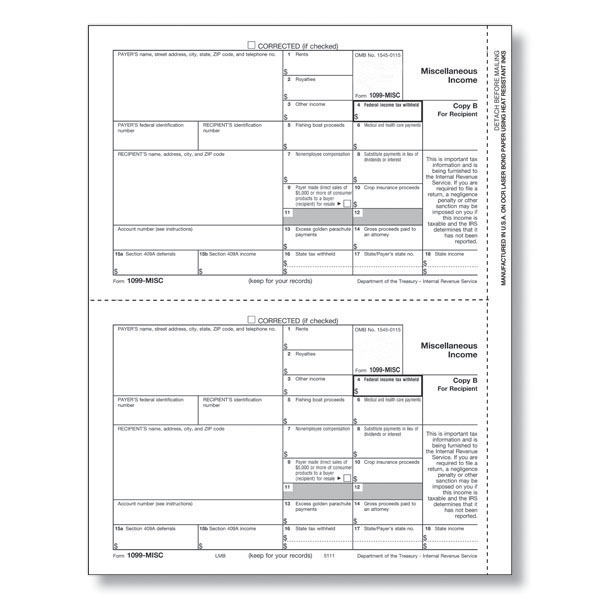

DoItYourself 1099s, Done Right Moxie Bookkeeping and Coaching Inc.

Shop a wide variety of 1099 tax forms from top brands at staples®. Ad discover a wide selection of 1099 tax forms at staples®. Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. february 3, 2022.

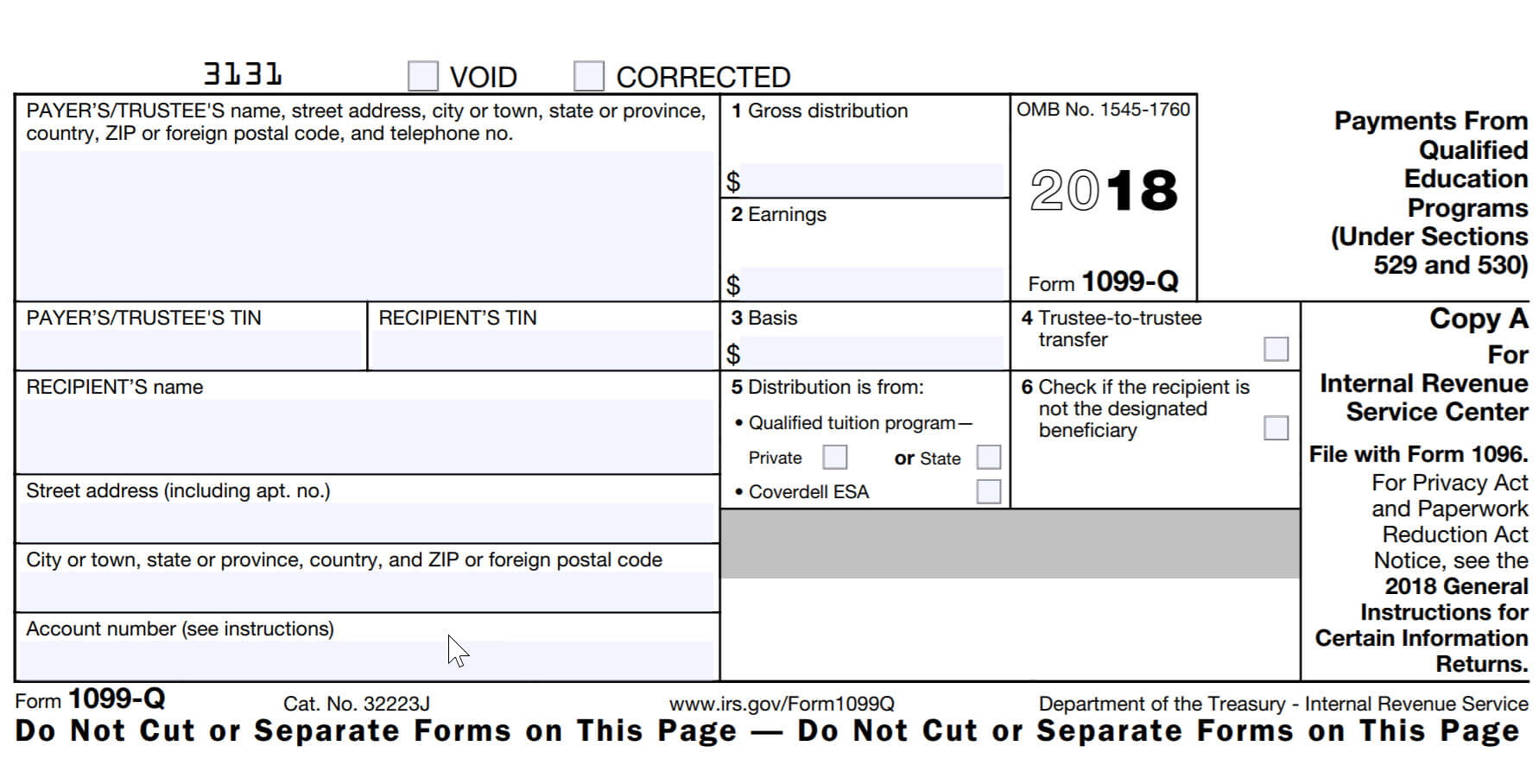

Ssa 1099 Form 2019 Pdf Fill Online, Printable, Fillable, Blank

As you mention on federal worksheet? Web the tax code requires the businesses making payments to attorneys and report the payments to the irs on a 1099 form. february 3, 2022 1:20 pm. My case took over 4 years to win my. Web attorney fees on ssa form 1099 i have over $20,000 in attorney fees for 2019 on my.

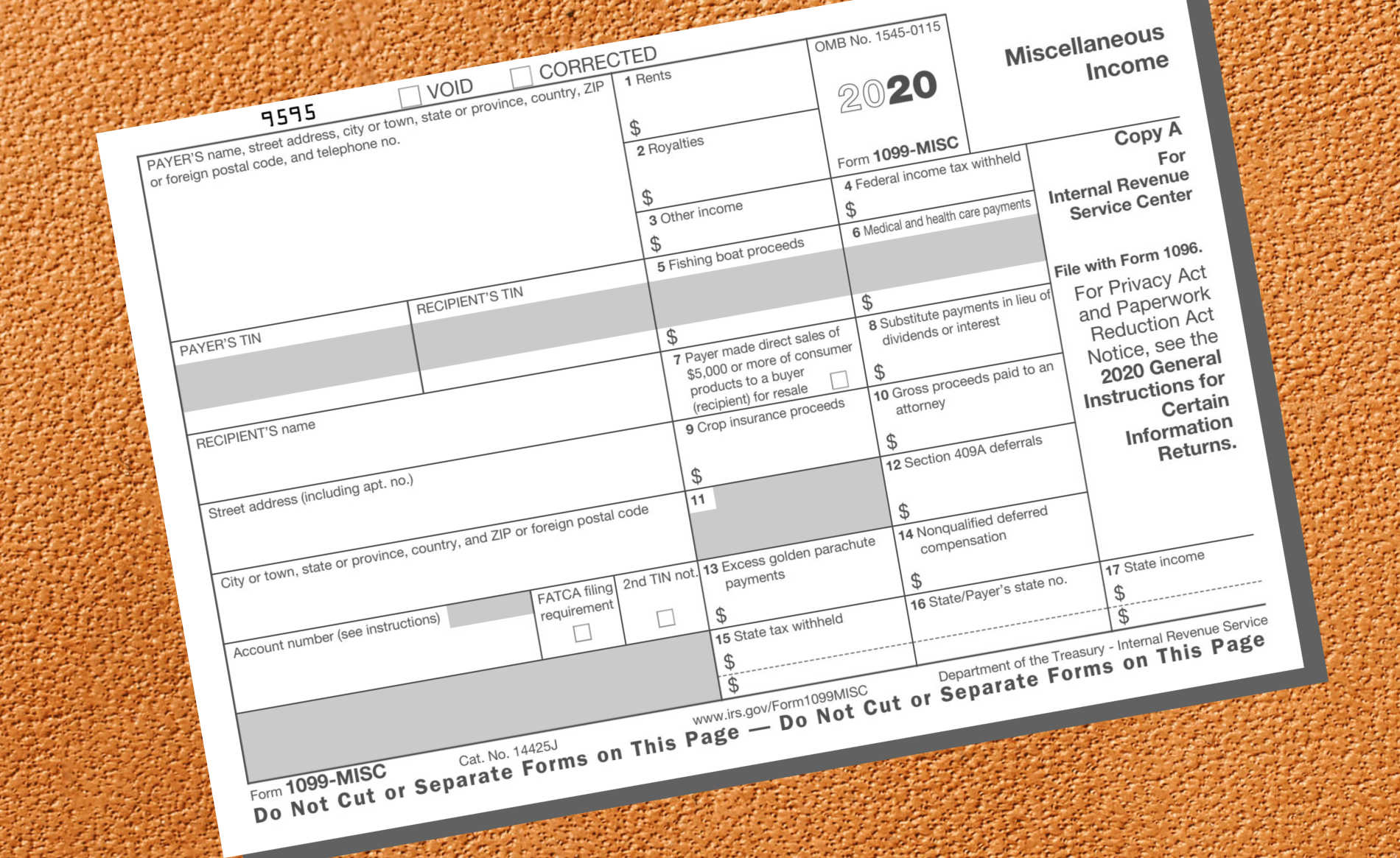

Which 1099 Form Do I Use for Rent

My case took over 4 years to win my. Web this issue is particularly relevant to attorneys who earn their fees on a contingency basis and who withdraw fees and costs from a check made payable to the. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Each person engaged in business and making.

Florida 1099 Form Online Universal Network

Web the tax code requires the businesses making payments to attorneys and report the payments to the irs on a 1099 form. Shop a wide variety of 1099 tax forms from top brands at staples®. My case took over 4 years to win my. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations..

cachodesignstudio Attorney Fees On 1099

Web this issue is particularly relevant to attorneys who earn their fees on a contingency basis and who withdraw fees and costs from a check made payable to the. For example, if you paid $100,000 in attorney fees, write “udc. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Each person.

1099 Form Printable 2018 MBM Legal

The term “attorney” includes a law firm or other provider of legal services. My case took over 4 years to win my. Each person engaged in business and making a. Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or.

1099 Miscellaneous Form For Year End Tax Reporting Universal

My case took over 4 years to win my. Web ssa 1099 feds charged me attorney fees where do i enter that amount as an itemized item. As you mention on federal worksheet? Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) The term “attorney” includes a law firm or other provider of legal services. Ad ap leaders rely on iofm’s expertise to keep them up to date on.

26 LEGAL FEES FORM 1099 PDF DOC FREE DOWNLOAD

Web this issue is particularly relevant to attorneys who earn their fees on a contingency basis and who withdraw fees and costs from a check made payable to the. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. My case took over 4 years to win my. Web april 2017 issue 131 this.

My Case Took Over 4 Years To Win My.

Attorney fees paid in the. Web the tax code requires the businesses making payments to attorneys and report the payments to the irs on a 1099 form. The term “attorney” includes a law firm or other provider of legal services. As you mention on federal worksheet?

For Example, If You Paid $100,000 In Attorney Fees, Write “Udc.

Each person engaged in business and making a. Web this issue is particularly relevant to attorneys who earn their fees on a contingency basis and who withdraw fees and costs from a check made payable to the. Web april 2017 issue 131 this article explains why attorneys might receive a form 1099 reporting certain amounts paid to them in the course of their practice, and why it is a “big deal.”. Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs.

Web Ssa 1099 Feds Charged Me Attorney Fees Where Do I Enter That Amount As An Itemized Item.

Web attorney fees on ssa form 1099 i have over $20,000 in attorney fees for 2019 on my ssa 1099 which are included in box 3 & 5. february 3, 2022 1:20 pm. Web require a defendant to issue a plaintiff a form 1099 that includes the attorneys’ fee payment whenever that payment is includible in the plaintiff’s gross income. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations.

Web Catch The Top Stories Of The Day On Anc’s ‘Top Story’ (20 July 2023)

Web the instructions said: Ad discover a wide selection of 1099 tax forms at staples®. Write “udc” and the amount of the attorney’s fees next to line 36 of form 1040. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)