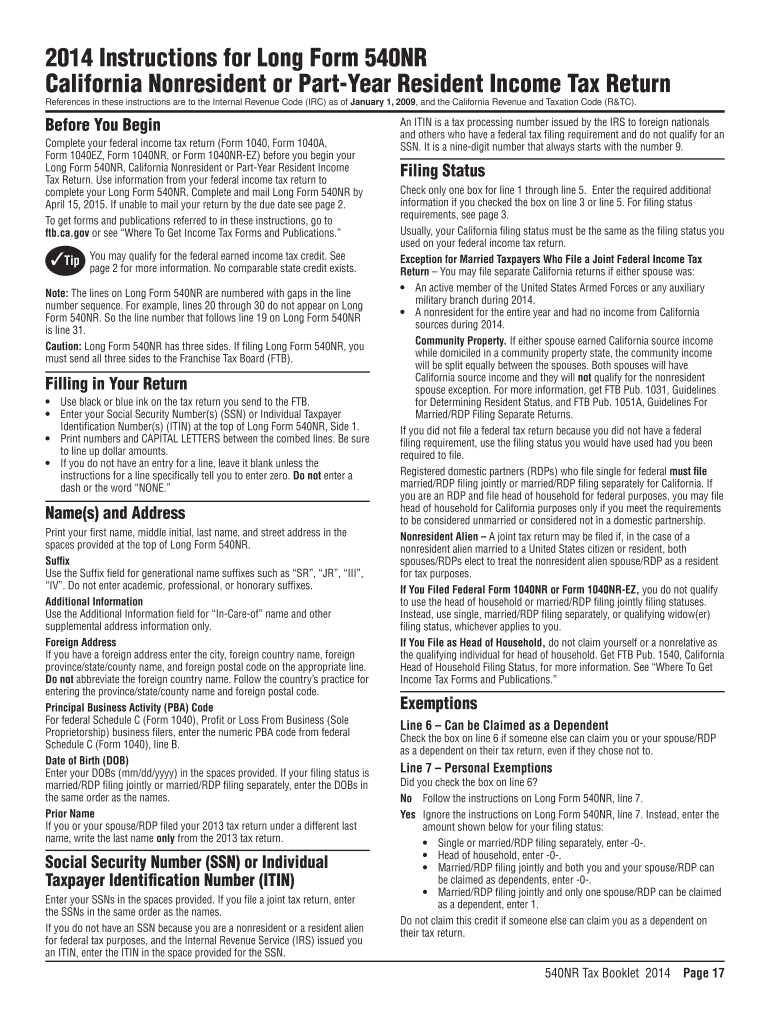

2022 Form 540Nr Instructions

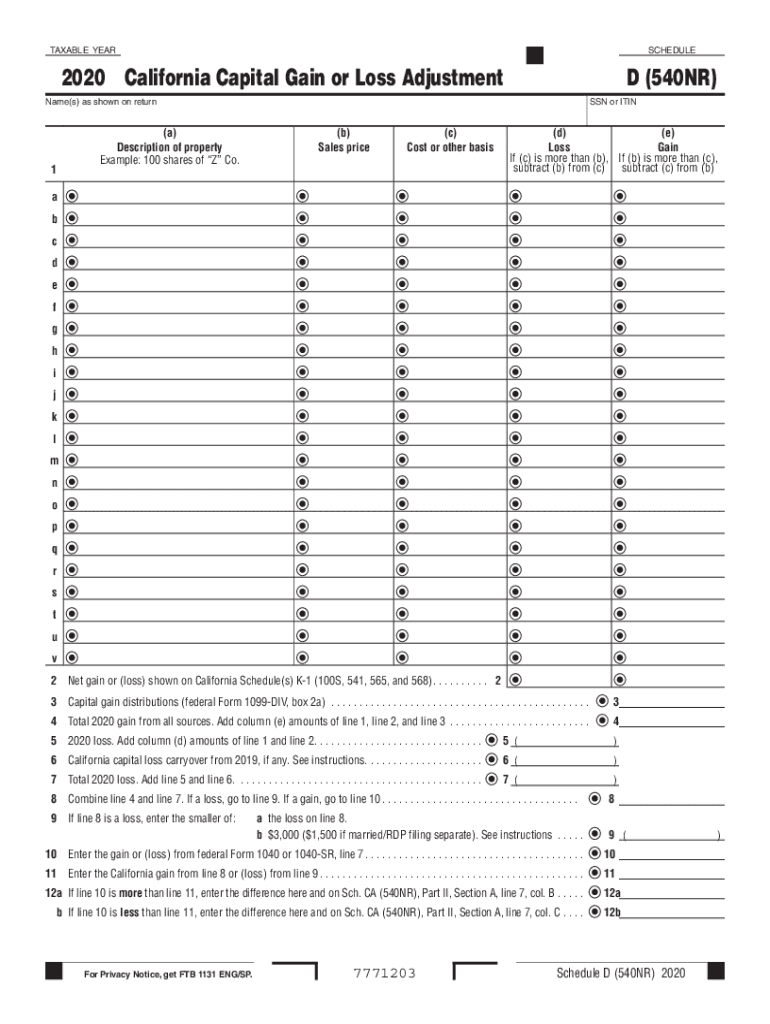

2022 Form 540Nr Instructions - Web qualifying surviving spouse/rdp with dependent child. This calculator does not figure tax for. We last updated the forms & instructions for schedule. Web (form 540nr line 17) is $42,932 or less if single or mfs. 03/2022 important dates $$$ for you earned income tax credit federal earned income. Web up to $40 cash back fill ca form 540nr instructions 2022: References in these instructions are to the internal revenue code (irc). Web what’s new and other important information for 2022 instructions for schedule ca (540nr). Web 2022 instructions for california schedule d (540nr) california capital gain or loss adjustment purpose important information specific line instructions california capital. * california taxable income enter line 19 of 2022 form 540 or form 540nr.

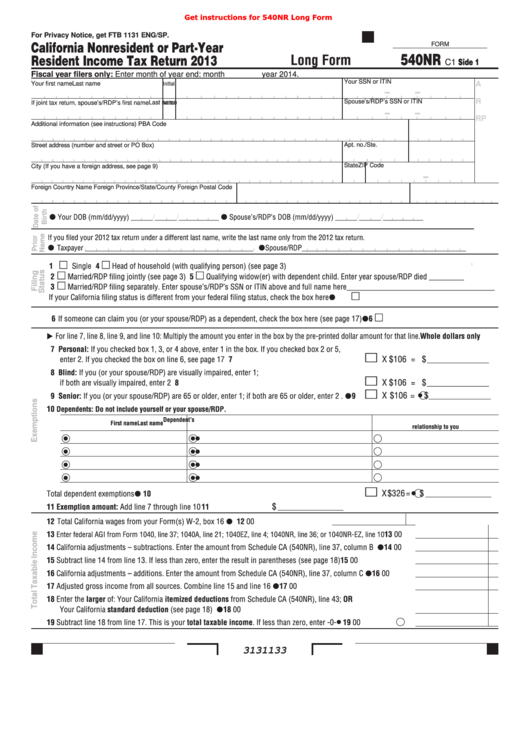

10 draft ok to print ah xsl/xmlfileid:. Taxpayers who previously filed form 540nr short will need to use. Nonresident alien income tax return. Complete a new form ca 540 or 540nr and attach a completed schedule x to the. Web what’s new and other important information for 2022 instructions for schedule ca (540nr). Web qualifying surviving spouse/rdp with dependent child. * california taxable income enter line 19 of 2022 form 540 or form 540nr. Sandy’s agi from line 17 is $58,500. Get, create, make and sign ca 540nr instructions 2022. 03/2022 important dates $$$ for you earned income tax credit federal earned income.

We need to fill out schedule ca(540nr) before we can continue see handout schedule ca (540nr). Nonresident alien income tax return. References in these instructions are to the internal revenue code (irc). Web (form 540nr line 17) is $42,932 or less if single or mfs. Web qualifying surviving spouse/rdp with dependent child. Form popularity ca form 540nr instructions. Web what’s new and other important information for 2022 instructions for schedule ca (540nr). This calculator does not figure tax for. Web 1122 ocean drive san diego 05/22/1989 √ questions? Web 2022 instructions for california schedule d (540nr) california capital gain or loss adjustment purpose important information specific line instructions california capital.

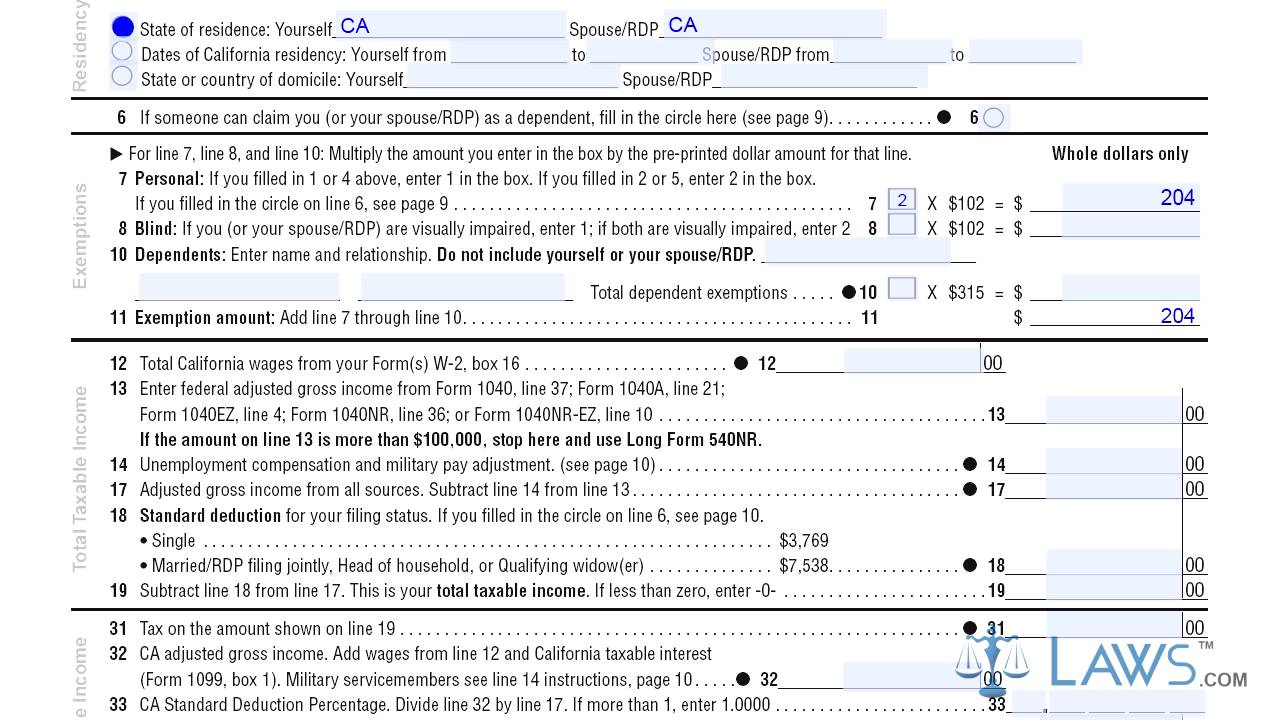

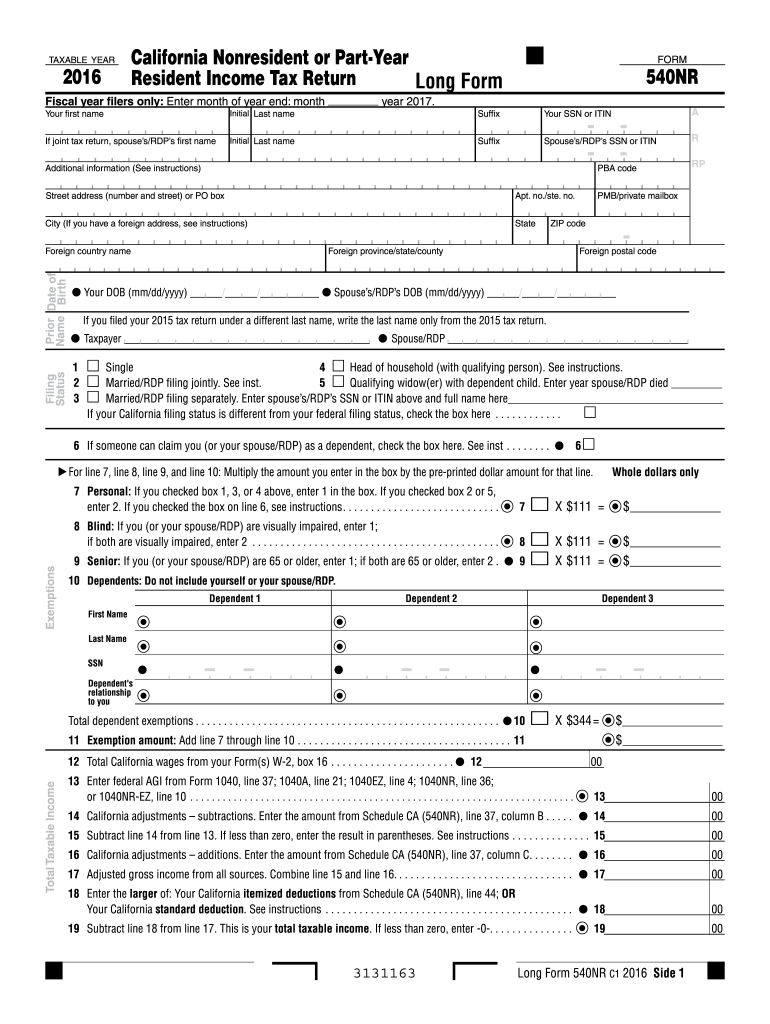

2016 Form 540 Fill Out and Sign Printable PDF Template signNow

Department of the treasury—internal revenue service. Web up to $40 cash back fill ca form 540nr instructions 2022: Web what’s new and other important information for 2022 instructions for schedule ca (540nr). 03/2022 important dates $$$ for you earned income tax credit federal earned income. Get, create, make and sign ca 540nr instructions 2022.

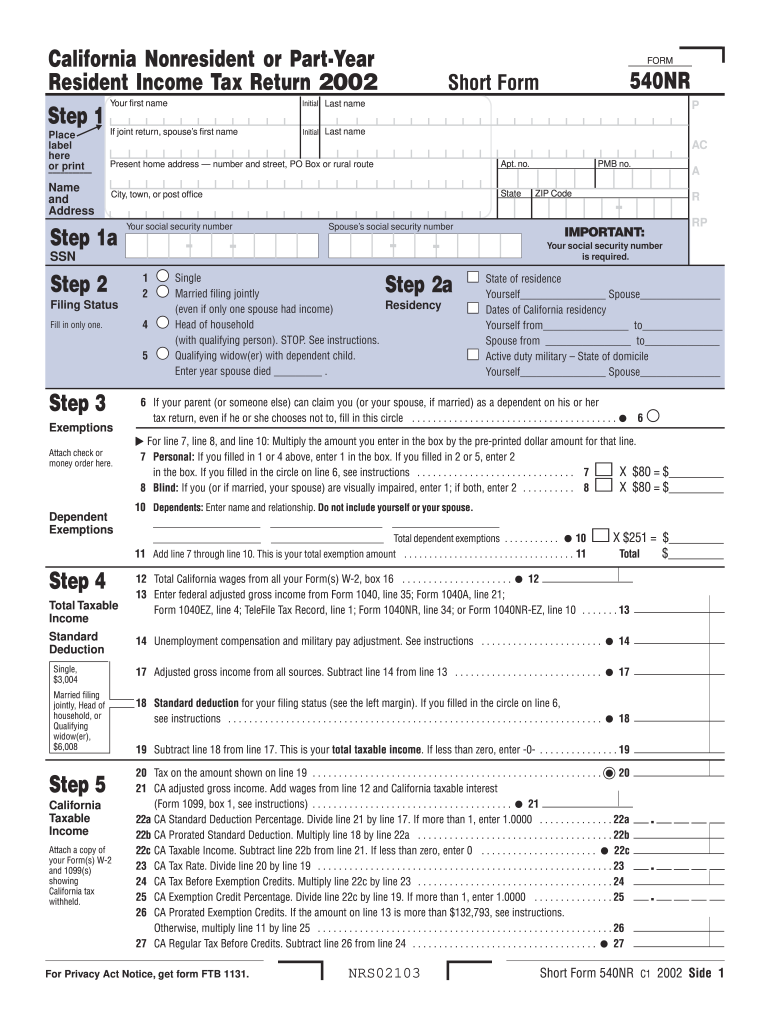

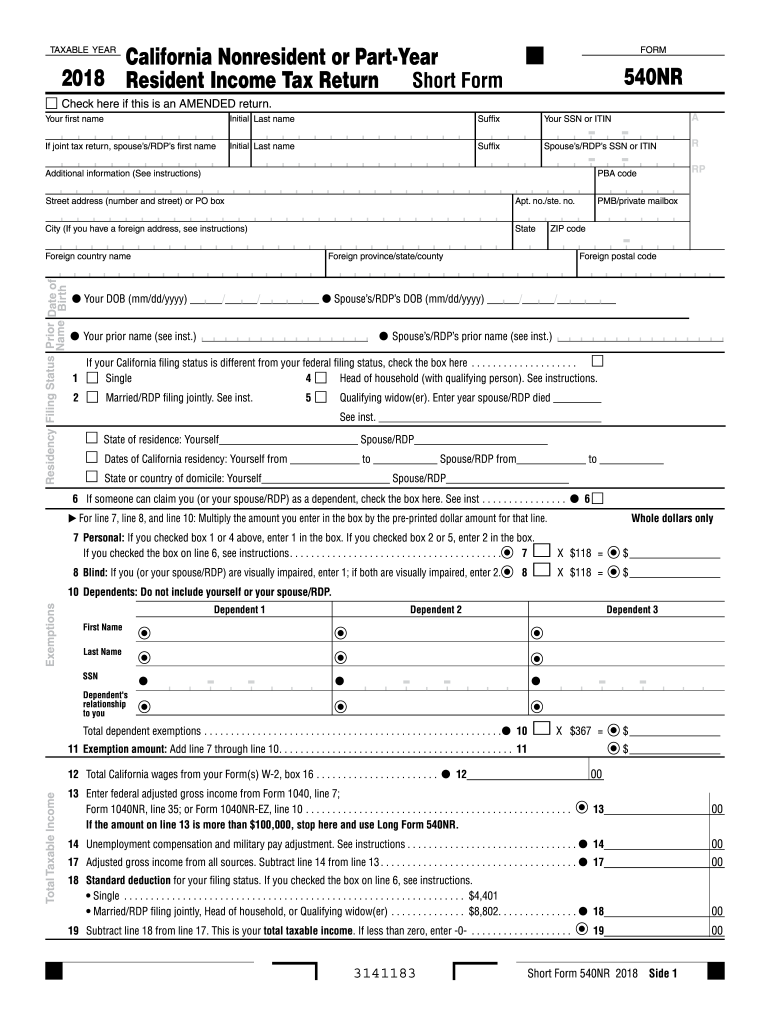

Form 540NR California Nonresident or Part Year Resident Tax

* california taxable income enter line 19 of 2022 form 540 or form 540nr. Income tax return, tax amendment, change of address. Nonresident alien income tax return. Department of the treasury—internal revenue service. 10 draft ok to print ah xsl/xmlfileid:.

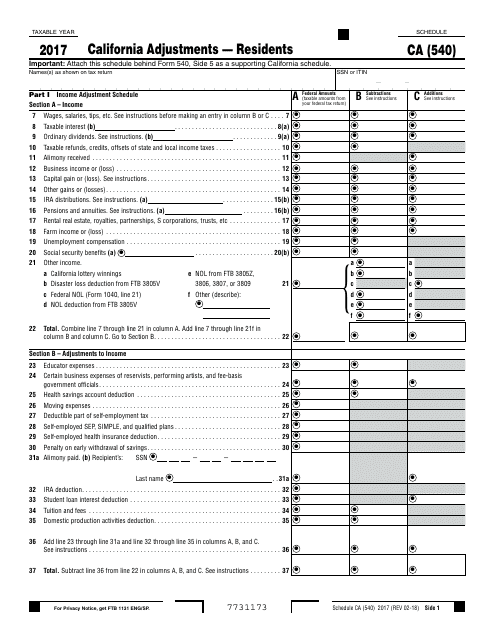

Form 540 Download Fillable PDF 2017, Schedule Ca California

This form is for income earned in. Web 2022 instructions for california schedule d (540nr) california capital gain or loss adjustment purpose important information specific line instructions california capital. Nonresident alien income tax return. Taxpayers who previously filed form 540nr short will need to use. * california taxable income enter line 19 of 2022 form 540 or form 540nr.

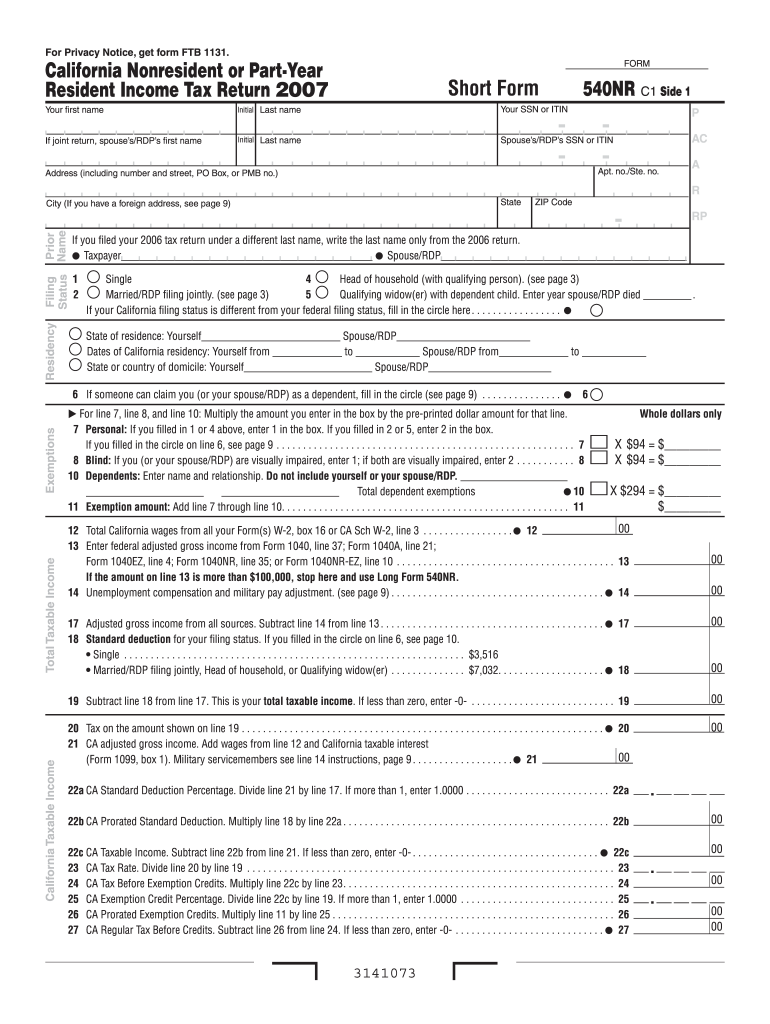

2007 540nr fillable form Fill out & sign online DocHub

Sandy’s agi from line 17 is $58,500. X $433 = $ qualifying surviving spouse/rdp. We need to fill out schedule ca(540nr) before we can continue see handout schedule ca (540nr). Web this form can be used to file an: Nonresident alien income tax return.

540Nr Instructions Fill Out and Sign Printable PDF Template signNow

Income tax return, tax amendment, change of address. Irs use only—do not write or staple in. Web up to $40 cash back fill ca form 540nr instructions 2022: 03/2022 important dates $$$ for you earned income tax credit federal earned income. X $433 = $ qualifying surviving spouse/rdp.

Form540Nr Short Fill Out and Sign Printable PDF Template signNow

Web this form can be used to file an: We need to fill out schedule ca(540nr) before we can continue see handout schedule ca (540nr). References in these instructions are to the internal revenue code (irc). Web 1122 ocean drive san diego 05/22/1989 √ questions? 03/2022 important dates $$$ for you earned income tax credit federal earned income.

CA 540NR Schedule D 20202022 Fill and Sign Printable Template Online

Web qualifying surviving spouse/rdp with dependent child. Complete a new form ca 540 or 540nr and attach a completed schedule x to the. Department of the treasury—internal revenue service. Sandy eggo 123456789 0 1,787 0 1,787. X $433 = $ qualifying surviving spouse/rdp.

Fillable Form 540nr California Nonresident Or PartYear Resident

Get, create, make and sign ca 540nr instructions 2022. Taxpayers who previously filed form 540nr short will need to use. Web up to $40 cash back fill ca form 540nr instructions 2022: Web (form 540nr line 17) is $42,932 or less if single or mfs. This form is for income earned in.

2016 form 540nr Fill out & sign online DocHub

Sandy eggo 123456789 0 1,787 0 1,787. 03/2022 important dates $$$ for you earned income tax credit federal earned income. This calculator does not figure tax for. Web 1122 ocean drive san diego 05/22/1989 √ questions? We need to fill out schedule ca(540nr) before we can continue see handout schedule ca (540nr).

California Nonresident Tax Fill Out and Sign Printable PDF Template

Web qualifying surviving spouse/rdp with dependent child. Web (form 540nr line 17) is $42,932 or less if single or mfs. Irs use only—do not write or staple in. Department of the treasury—internal revenue service. Web what’s new and other important information for 2022 instructions for schedule ca (540nr).

X $433 = $ Qualifying Surviving Spouse/Rdp.

Complete a new form ca 540 or 540nr and attach a completed schedule x to the. 03/2022 important dates $$$ for you earned income tax credit federal earned income. Web 2022 instructions for california schedule d (540nr) california capital gain or loss adjustment purpose important information specific line instructions california capital. Get, create, make and sign ca 540nr instructions 2022.

Taxpayers Who Previously Filed Form 540Nr Short Will Need To Use.

Form popularity ca form 540nr instructions. Web 1122 ocean drive san diego 05/22/1989 √ questions? * california taxable income enter line 19 of 2022 form 540 or form 540nr. References in these instructions are to the internal revenue code (irc).

Web This Form Can Be Used To File An:

Sandy eggo 123456789 0 1,787 0 1,787. We need to fill out schedule ca(540nr) before we can continue see handout schedule ca (540nr). Irs use only—do not write or staple in. Nonresident alien income tax return.

Department Of The Treasury—Internal Revenue Service.

Sandy’s agi from line 17 is $58,500. Web up to $40 cash back fill ca form 540nr instructions 2022: Web what’s new and other important information for 2022 instructions for schedule ca (540nr). 10 draft ok to print ah xsl/xmlfileid:.