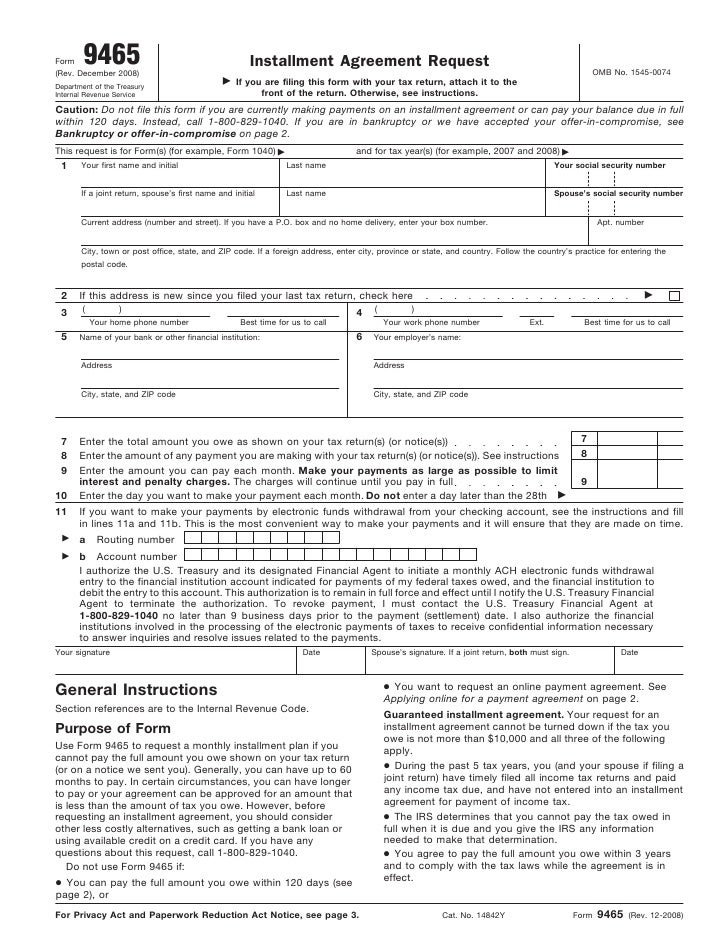

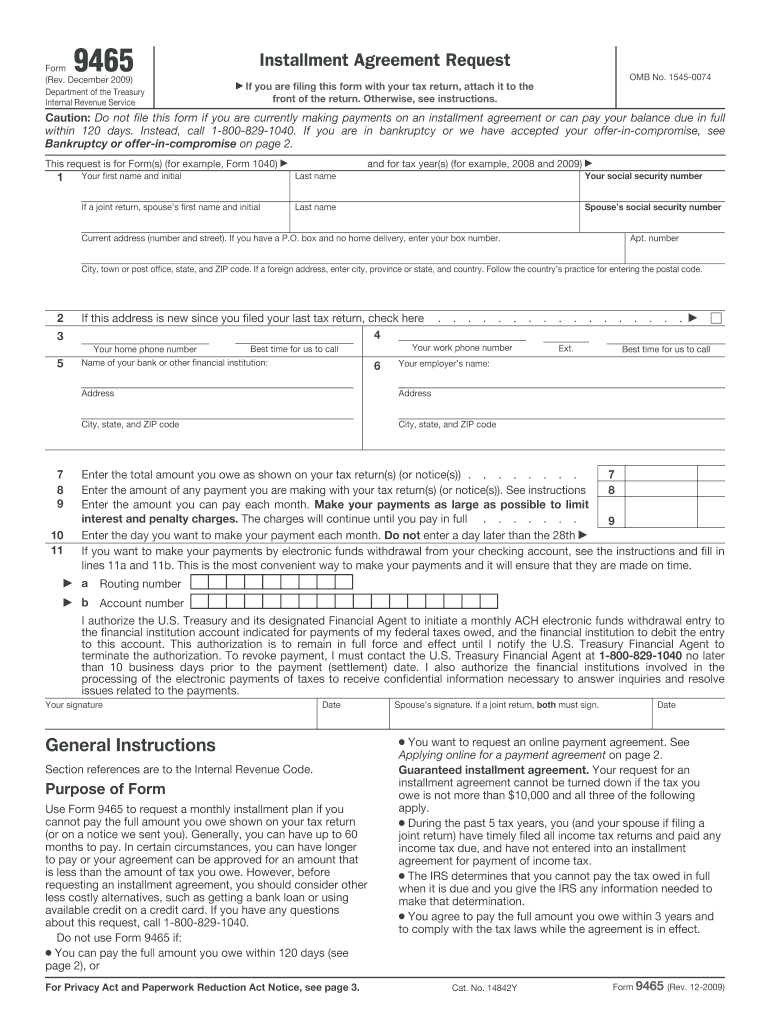

9465 Installment Agreement Request Form

9465 Installment Agreement Request Form - The irs will contact you to approve or deny your installment plan request. Applied to your balance, you are still required to make your guaranteed installment agreement. If you are filing form 9465. Web where to file your taxes for form 9465. To enter or review information for. Web the irs form 9465 is a document used to request a monthly installment plan if you cannot pay the full amount of taxes you owe by the due date. If you are filing form 9465 with your return, attach it to the front of your return when you file. You can download or print current. If you cannot use the irs’s online payment agreement or you don’t want to call the irs, you can use form 9465. Employers engaged in a trade or business who.

Web filing form 9465 does not guarantee your request for a payment plan. Employers engaged in a trade or business who. Complete, edit or print tax forms instantly. You can download or print current. Web if the taxpayer can't pay the total tax currently due but would like to pay the tax due through form 9465, installment agreement request, use the steps below to request an. If you cannot use the irs’s online payment agreement or you don’t want to call the irs, you can use form 9465. Web in order to request the installment agreement, you must be unable to pay the tax in full within 120 days of the tax return filing deadline or the date you receive an. Web irs form 9465 installment agreement request instructions. Web the irs form 9465 is a document used to request a monthly installment plan if you cannot pay the full amount of taxes you owe by the due date. If you are filing form 9465 with your return, attach it to the front of your return when you file.

Applied to your balance, you are still required to make your guaranteed installment agreement. Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice. Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice. This form is for income earned in tax year 2022, with tax returns due in april. Web form 9465 is used to request an installment agreement with the irs when you can’t pay your tax bill when due and need more time to pay. Web if you can’t or choose not to use the online system, you can complete the paper irs form 9465, installment agreement request, and submit it with all required. Employee's withholding certificate form 941; Web the irs form 9465 is a document used to request a monthly installment plan if you cannot pay the full amount of taxes you owe by the due date. Complete, edit or print tax forms instantly. To enter or review information for.

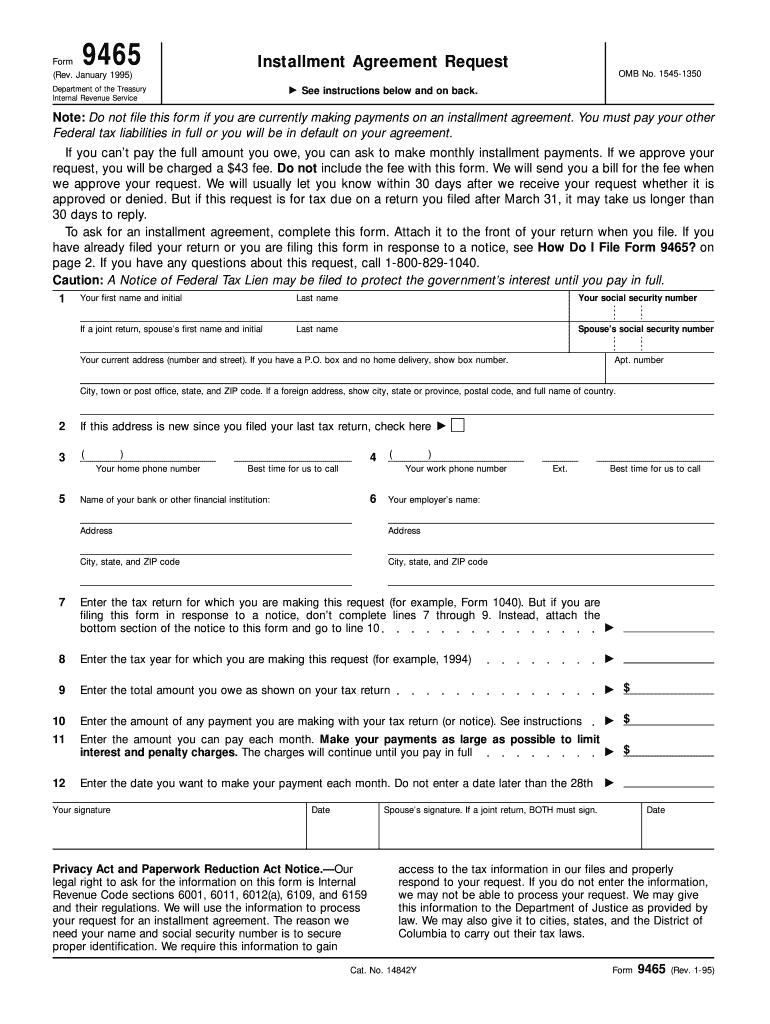

Form 9465Installment Agreement Request

Complete, edit or print tax forms instantly. Web we last updated federal form 9465 in january 2023 from the federal internal revenue service. Web in order to request the installment agreement, you must be unable to pay the tax in full within 120 days of the tax return filing deadline or the date you receive an. Web if the taxpayer.

Form 9465 Installment Agreement Request Fill Out and Sign Printable

Applied to your balance, you are still required to make your guaranteed installment agreement. The irs will contact you to approve or deny your installment plan request. If you cannot use the irs’s online payment agreement or you don’t want to call the irs, you can use form 9465. Web if the taxpayer can't pay the total tax currently due.

Irs Installment Agreement Form 9465 Instructions Erin Anderson's Template

If you do not qualify for. Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice. Employers engaged in a trade or business who. Employee's withholding certificate form 941; Web if you can’t or choose not to.

form_9465_Installment_Agreement_Request Stop My IRS Bill

Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice. If you do not qualify for. Applied to your balance, you are still required to make your guaranteed installment agreement. Web use irs form 9465 installment agreement.

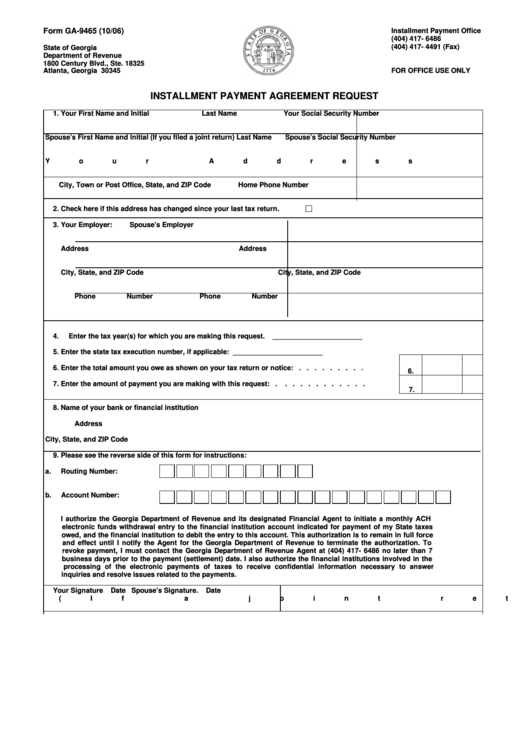

Form Ga9465 Installment Payment Agreement Request printable pdf download

Ad access irs tax forms. Complete, edit or print tax forms instantly. Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice. To enter or review information for. Employee's withholding certificate form 941;

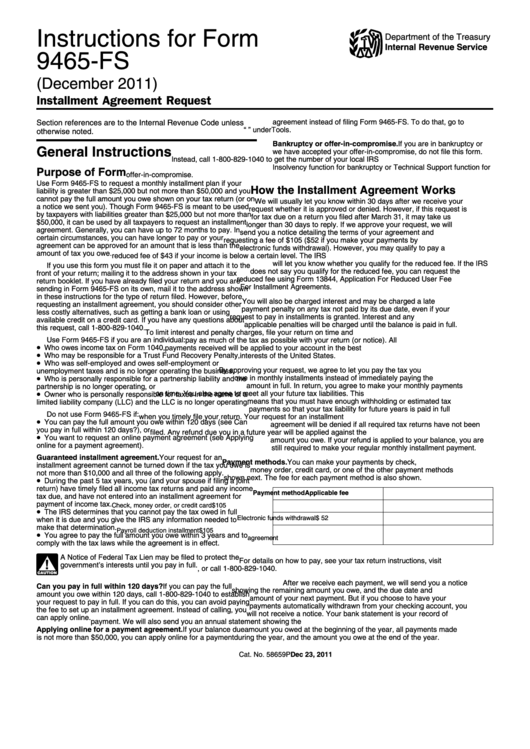

Instructions For Form 9465Fs Installment Agreement Request printable

Applied to your balance, you are still required to make your guaranteed installment agreement. Complete, edit or print tax forms instantly. Web form 9465 is used to request an installment agreement with the irs when you can’t pay your tax bill when due and need more time to pay. This form is for income earned in tax year 2022, with.

Form 9465 Installment Agreement Request Fill and Sign Printable

Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice. Ad fill your 9465 installment agreement request online, download & print. Web where to file your taxes for form 9465. If you cannot use the irs’s online.

Tax Hacks 2017 Can’t Pay Your Taxes? Here’s What to Do ‒ Money Talks News

Your request for an regular monthly. Ad fill your 9465 installment agreement request online, download & print. If you do not qualify for. This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated federal form 9465 in january 2023 from the federal internal revenue service.

Quick Tips Filling Out IRS Form 9465 Installment Agreement Request

Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice. If you are filing form 9465 with your return, attach it to the front of your return when you file. Applied to your balance, you are still.

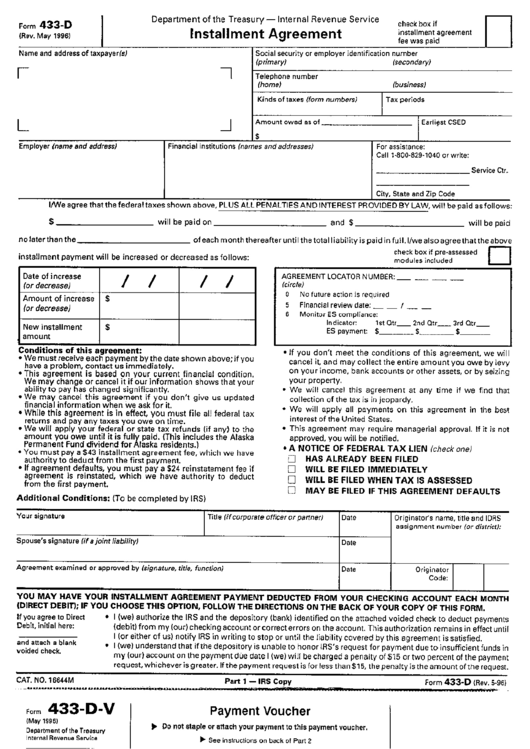

Form 433D Installment Agreement printable pdf download

The irs will contact you to approve or deny your installment plan request. Employers engaged in a trade or business who. If you are filing form 9465 with your return, attach it to the front of your return when you file. Ad access irs tax forms. Web the irs form 9465 is a document used to request a monthly installment.

Web Where To File Your Taxes For Form 9465.

Web irs form 9465 installment agreement request instructions. If you cannot use the irs’s online payment agreement or you don’t want to call the irs, you can use form 9465. Employee's withholding certificate form 941; If you are filing form 9465 with your return, attach it to the front of your return when you file.

Web Purpose Of Form Use Form 9465 To Request A Monthly Installment Agreement (Payment Plan) If You Can’t Pay The Full Amount You Owe Shown On Your Tax Return (Or On A Notice.

If you do not qualify for. Web we last updated federal form 9465 in january 2023 from the federal internal revenue service. Complete, edit or print tax forms instantly. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount.

Web The Irs Form 9465 Is A Document Used To Request A Monthly Installment Plan If You Cannot Pay The Full Amount Of Taxes You Owe By The Due Date.

Web if you can’t or choose not to use the online system, you can complete the paper irs form 9465, installment agreement request, and submit it with all required. Web form 9465 is used to request an installment agreement with the irs when you can’t pay your tax bill when due and need more time to pay. Web in order to request the installment agreement, you must be unable to pay the tax in full within 120 days of the tax return filing deadline or the date you receive an. The irs will contact you to approve or deny your installment plan request.

Applied To Your Balance, You Are Still Required To Make Your Guaranteed Installment Agreement.

The irs encourages you to pay a portion. Web filing form 9465 does not guarantee your request for a payment plan. If you are filing form 9465. Ad access irs tax forms.