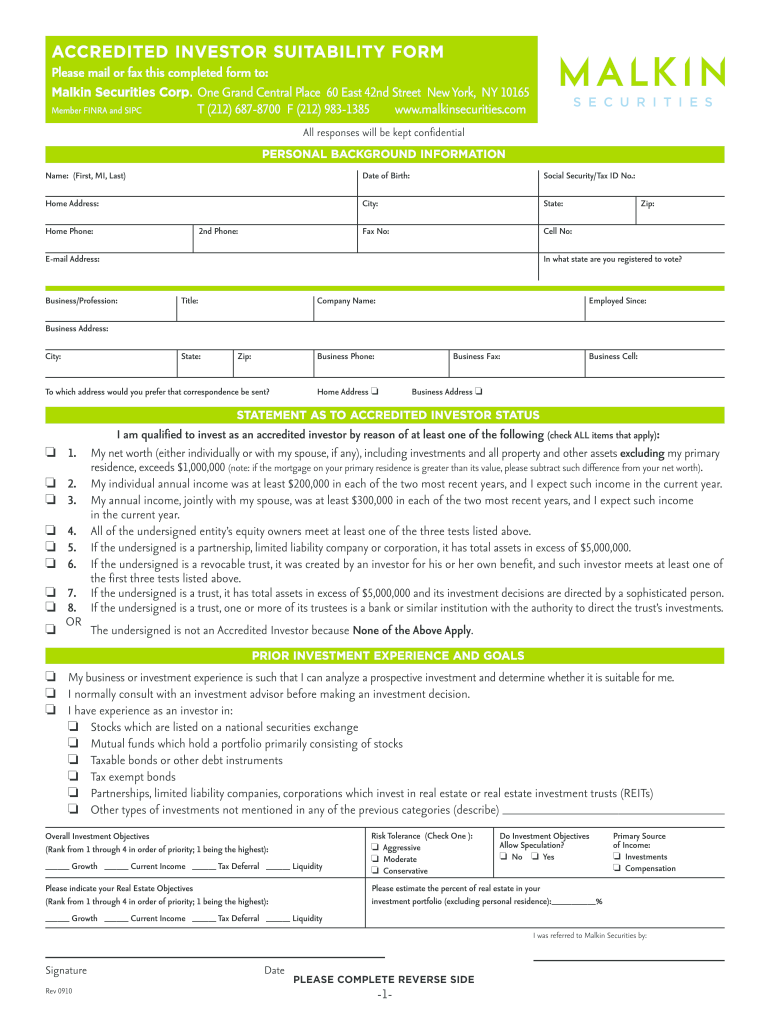

Accredited Investor Form

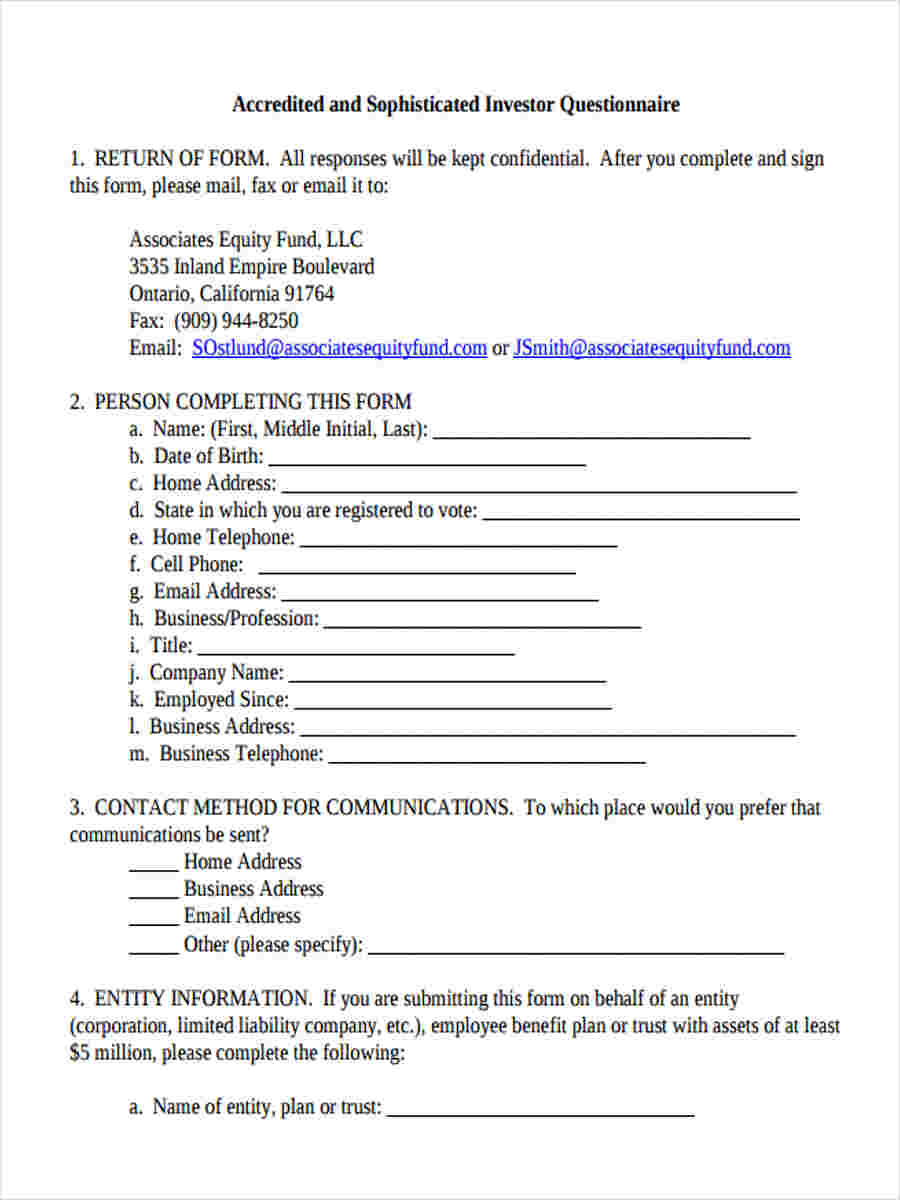

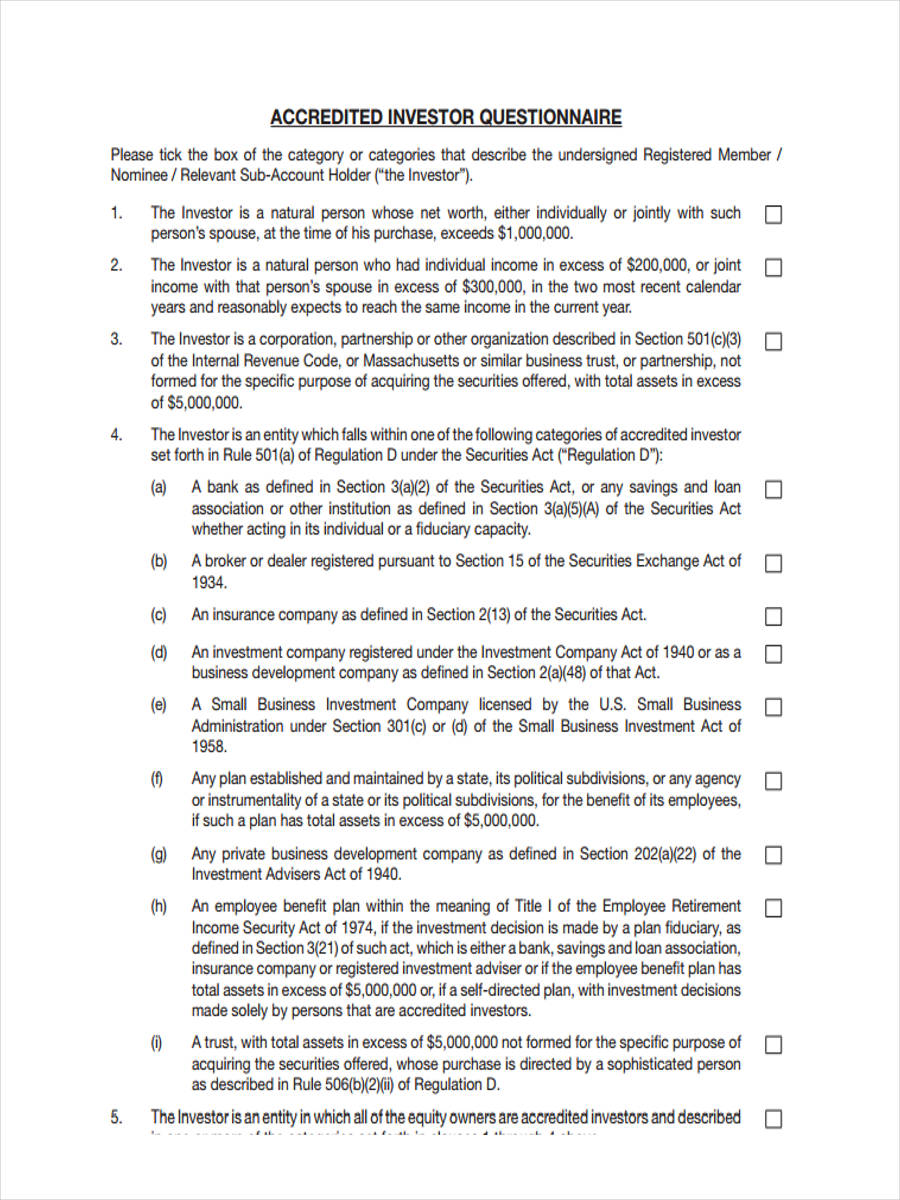

Accredited Investor Form - Web individuals who want to become accredited investors must fall into one of three categories: Web as a resource to startups seeking to raise capital, we at cooley go have made available a form of accredited investor questionnaire. The sec’s office of investor education and advocacy is issuing this investor bulletin to educate individual investors about what it means to be an “accredited investor.”. 26, 2020 — the securities and exchange commission today adopted amendments to the “accredited investor” definition, one of the principal tests for determining who is eligible to participate in our private capital markets. Web financial criteria net worth over $1 million, excluding primary residence (individually or with spouse or partner) income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year professional criteria Note that this document is intended only for us companies raising money from us investors. Web as expected, the amendment adding any form of entity with at least $5 million of investments to the list of accredited investors is beneficial to private funds and other issuers that have potential investors that are large sophisticated institutions that historically did not meet the technical requirements to qualify as accredited investors. Verifying individual or entity ( _____ ) qualifies as (check one): Web that investor is an “accredited investor” as such term is defined in rule 501 of the securities act, and hereby provides written confirmation of the following: X a copy of the trust, agency or other agreement and a document authorizing the investment signed by the requisite parties identified in the agreement, and x documentation that the trust qualifies as an accredited investor because:

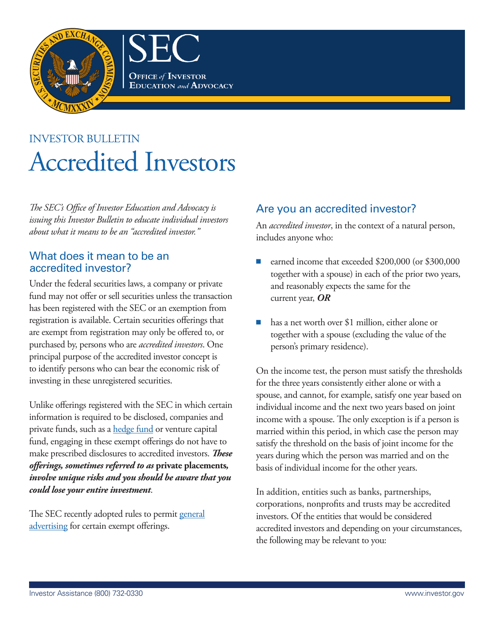

The sec’s office of investor education and advocacy is issuing this investor bulletin to educate individual investors about what it means to be an “accredited investor.”. Web as expected, the amendment adding any form of entity with at least $5 million of investments to the list of accredited investors is beneficial to private funds and other issuers that have potential investors that are large sophisticated institutions that historically did not meet the technical requirements to qualify as accredited investors. Name of verifying individual or entity Have a net worth exceeding $1 million on your own or with a spouse or its equivalent; Visit our raise guidance section for more articles on fundraising strategies. Web as a resource to startups seeking to raise capital, we at cooley go have made available a form of accredited investor questionnaire. A) it has over five million dollars ($5,000,000) in assets, and b) that it was not formed to acqu. 26, 2020 — the securities and exchange commission today adopted amendments to the “accredited investor” definition, one of the principal tests for determining who is eligible to participate in our private capital markets. Web that investor is an “accredited investor” as such term is defined in rule 501 of the securities act, and hereby provides written confirmation of the following: Web financial criteria net worth over $1 million, excluding primary residence (individually or with spouse or partner) income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year professional criteria

Visit our raise guidance section for more articles on fundraising strategies. Note that this document is intended only for us companies raising money from us investors. Web as a resource to startups seeking to raise capital, we at cooley go have made available a form of accredited investor questionnaire. Have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ability to maintain this. Web individuals who want to become accredited investors must fall into one of three categories: Web that investor is an “accredited investor” as such term is defined in rule 501 of the securities act, and hereby provides written confirmation of the following: Web timothy li an accredited investor is a person or entity that is allowed to invest in securities that are not registered with the securities and exchange commission (sec). A) it has over five million dollars ($5,000,000) in assets, and b) that it was not formed to acqu. 26, 2020 — the securities and exchange commission today adopted amendments to the “accredited investor” definition, one of the principal tests for determining who is eligible to participate in our private capital markets. Verifying individual or entity ( _____ ) qualifies as (check one):

Accredited Investor Form 2021 Fill Out and Sign Printable PDF

The sec’s office of investor education and advocacy is issuing this investor bulletin to educate individual investors about what it means to be an “accredited investor.”. Web that investor is an “accredited investor” as such term is defined in rule 501 of the securities act, and hereby provides written confirmation of the following: Web timothy li an accredited investor is.

SEC’s New Reg D Rules and Private Fund Offerings

Web that investor is an “accredited investor” as such term is defined in rule 501 of the securities act, and hereby provides written confirmation of the following: 26, 2020 — the securities and exchange commission today adopted amendments to the “accredited investor” definition, one of the principal tests for determining who is eligible to participate in our private capital markets..

Accredited Investor What Can Accredited Investors Invest In?

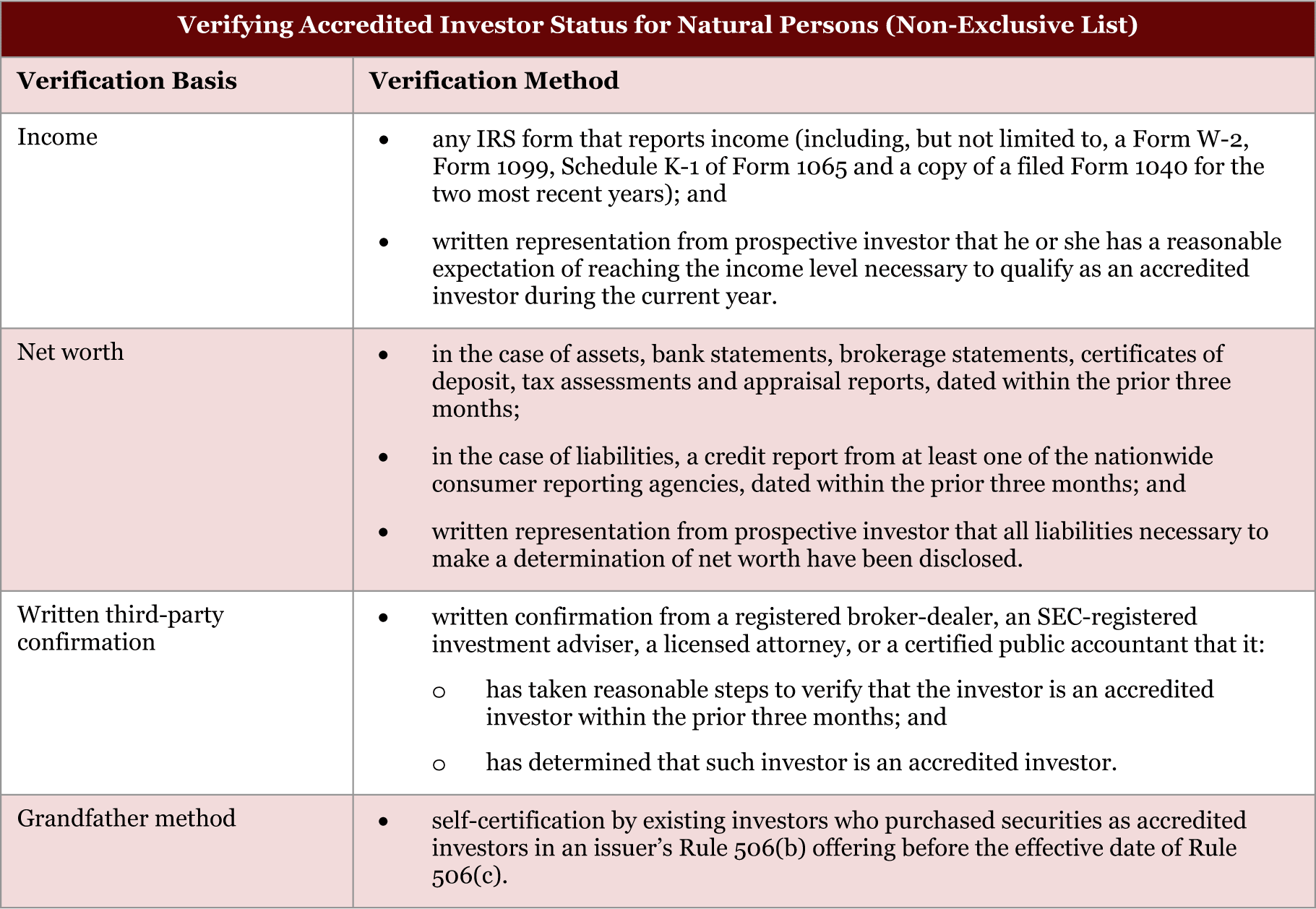

Verifying individual or entity ( _____ ) qualifies as (check one): Have a net worth exceeding $1 million on your own or with a spouse or its equivalent; 26, 2020 — the securities and exchange commission today adopted amendments to the “accredited investor” definition, one of the principal tests for determining who is eligible to participate in our private capital.

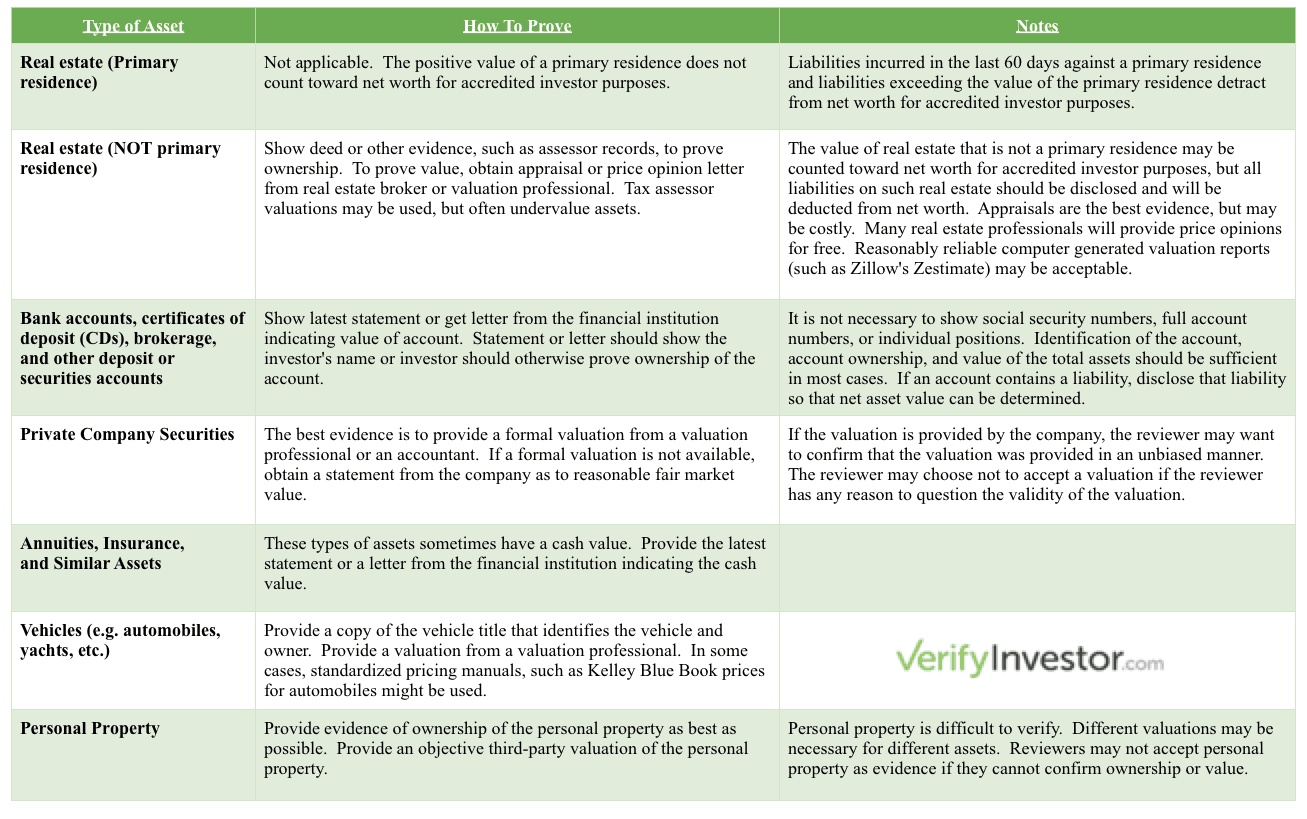

Everything You Need To Know About Accredited Investor Verification

Web financial criteria net worth over $1 million, excluding primary residence (individually or with spouse or partner) income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year professional criteria Have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent).

FREE 7+ Sample Investor Questionnaire Forms in MS Word PDF

Web individuals who want to become accredited investors must fall into one of three categories: Web financial criteria net worth over $1 million, excluding primary residence (individually or with spouse or partner) income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year professional criteria.

Investor Bulletin Accredited Investors Download Printable PDF

Web as a resource to startups seeking to raise capital, we at cooley go have made available a form of accredited investor questionnaire. Have a net worth exceeding $1 million on your own or with a spouse or its equivalent; Visit our raise guidance section for more articles on fundraising strategies. X a copy of the trust, agency or other.

FREE 43+ Sample Questionnaire Forms in PDF MS Word Excel

Web in the u.s., the term accredited investor is used by the securities and exchange commission (sec) under regulation d to refer to investors who are financially sophisticated and have a reduced. Web individuals who want to become accredited investors must fall into one of three categories: Have a net worth exceeding $1 million on your own or with a.

Accredited Investor Western Alliance Group

Web financial criteria net worth over $1 million, excluding primary residence (individually or with spouse or partner) income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year professional criteria Verifying individual or entity ( _____ ) qualifies as (check one): Web that investor is.

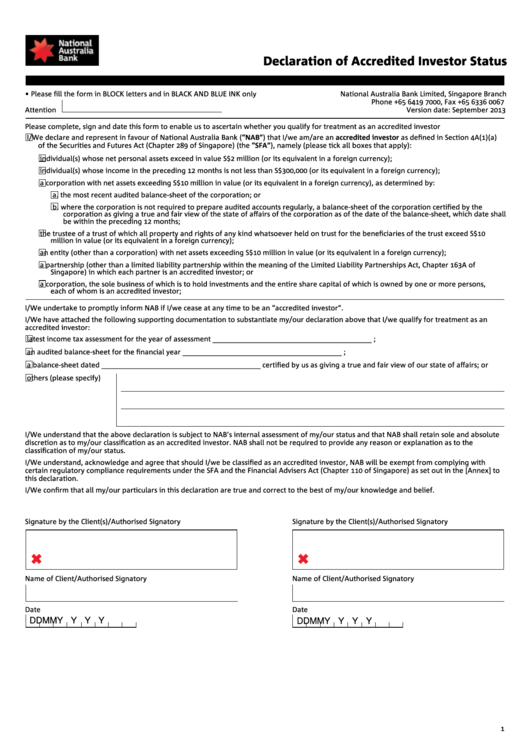

Fillable Declaration Of Accredited Investor Status printable pdf download

Visit our raise guidance section for more articles on fundraising strategies. Web as expected, the amendment adding any form of entity with at least $5 million of investments to the list of accredited investors is beneficial to private funds and other issuers that have potential investors that are large sophisticated institutions that historically did not meet the technical requirements to.

Understanding The Difference Between Accredited vs Nonaccredited

Web as expected, the amendment adding any form of entity with at least $5 million of investments to the list of accredited investors is beneficial to private funds and other issuers that have potential investors that are large sophisticated institutions that historically did not meet the technical requirements to qualify as accredited investors. 26, 2020 — the securities and exchange.

Web As A Resource To Startups Seeking To Raise Capital, We At Cooley Go Have Made Available A Form Of Accredited Investor Questionnaire.

Web as expected, the amendment adding any form of entity with at least $5 million of investments to the list of accredited investors is beneficial to private funds and other issuers that have potential investors that are large sophisticated institutions that historically did not meet the technical requirements to qualify as accredited investors. Web that investor is an “accredited investor” as such term is defined in rule 501 of the securities act, and hereby provides written confirmation of the following: Web financial criteria net worth over $1 million, excluding primary residence (individually or with spouse or partner) income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year professional criteria Name of verifying individual or entity

Web In The U.s., The Term Accredited Investor Is Used By The Securities And Exchange Commission (Sec) Under Regulation D To Refer To Investors Who Are Financially Sophisticated And Have A Reduced.

Web timothy li an accredited investor is a person or entity that is allowed to invest in securities that are not registered with the securities and exchange commission (sec). Web individuals who want to become accredited investors must fall into one of three categories: Have a net worth exceeding $1 million on your own or with a spouse or its equivalent; Visit our raise guidance section for more articles on fundraising strategies.

The Sec’s Office Of Investor Education And Advocacy Is Issuing This Investor Bulletin To Educate Individual Investors About What It Means To Be An “Accredited Investor.”.

A) it has over five million dollars ($5,000,000) in assets, and b) that it was not formed to acqu. 26, 2020 — the securities and exchange commission today adopted amendments to the “accredited investor” definition, one of the principal tests for determining who is eligible to participate in our private capital markets. Have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ability to maintain this. Note that this document is intended only for us companies raising money from us investors.

X A Copy Of The Trust, Agency Or Other Agreement And A Document Authorizing The Investment Signed By The Requisite Parties Identified In The Agreement, And X Documentation That The Trust Qualifies As An Accredited Investor Because:

Verifying individual or entity ( _____ ) qualifies as (check one):