Form 1095-C Line 14 Code 1E

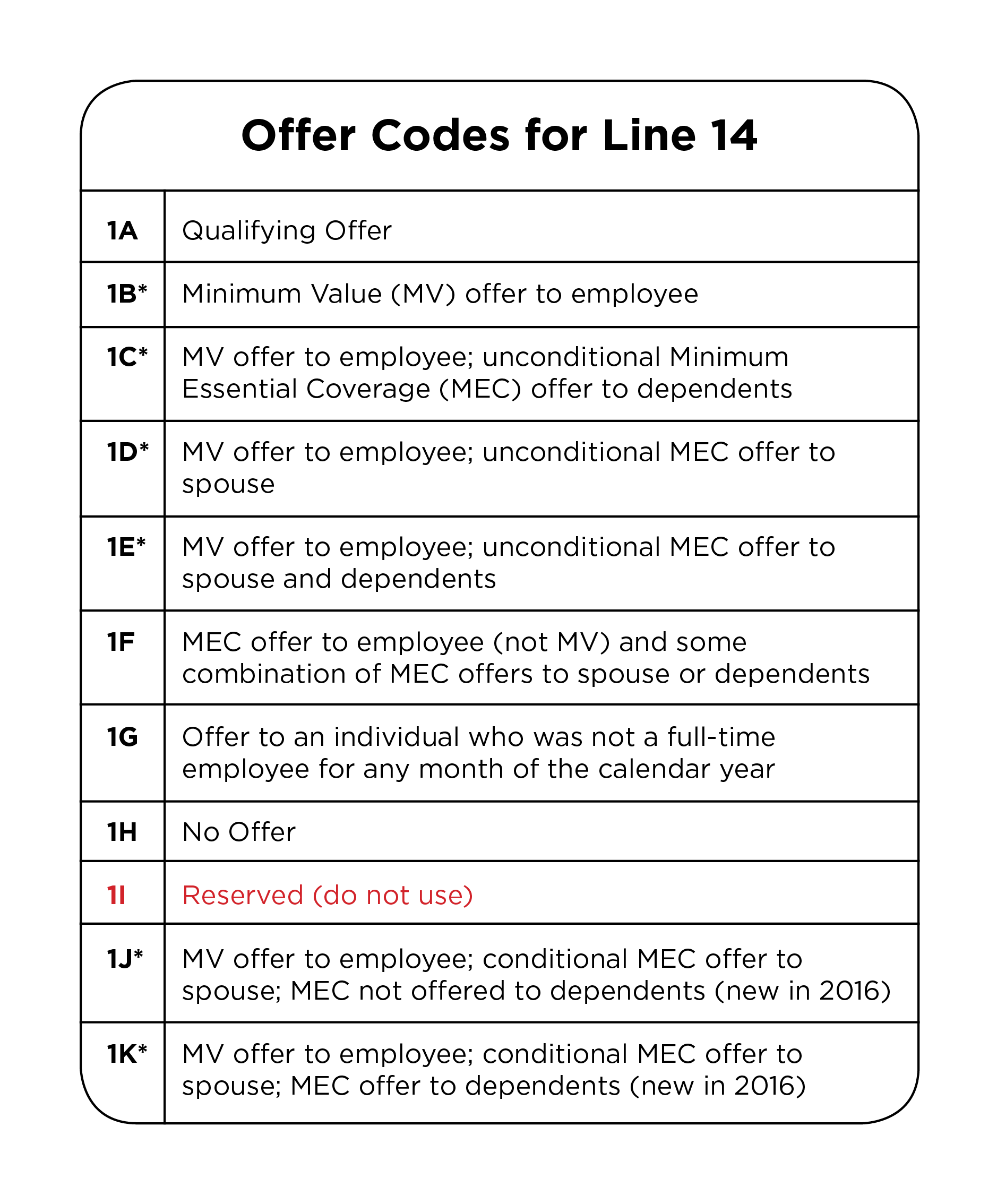

Form 1095-C Line 14 Code 1E - Complete line 15 only if code 1b, 1c, 1d, 1e, 1j, 1k, 1l, 1m, 1n, 1o, 1p, 1q, 1t, or 1u is entered on line. The irs provides two sets of codes, one for line 14 and one for line 16 that employers will need to. (if you received an offer of coverage through. If you were offered coverage. Web the codes on line 14 are used to describe the offer of coverage. Web if you are an employer, you must include the employees personal details and health coverage details on line 14, 15, & 16 by using various codes. Web the codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and dependent(s), if any. The codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and dependent(s), if any. Schedule c (form 1065 ) (rev. The 1a code communicates that the individual received a qualifying offer, which is.

The irs provides two sets of codes, one for line 14 and one for line 16 that employers will need to. Line 15 will show an amount only if code 1b, 1c, 1d, or 1e is entered on line 14. The codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and dependent(s), if any. The 1a code communicates that the individual received a qualifying offer, which is. Web the codes on line 14 are used to describe the offer of coverage. Web the codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and dependent(s), if any. Schedule c (form 1065 ) (rev. Complete line 15 only if code 1b, 1c, 1d, 1e, 1j, 1k, 1l, 1m, 1n, 1o, 1p, 1q, 1t, or 1u is entered on line. (if you received an offer of coverage through. Web chose to enroll in more expensive coverage such as family coverage.

The 1a code communicates that the individual received a qualifying offer, which is. (if you received an offer of coverage through. Web chose to enroll in more expensive coverage such as family coverage. Schedule c (form 1065 ) (rev. Web the codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and dependent(s), if any. Complete line 15 only if code 1b, 1c, 1d, 1e, 1j, 1k, 1l, 1m, 1n, 1o, 1p, 1q, 1t, or 1u is entered on line. Web if you are an employer, you must include the employees personal details and health coverage details on line 14, 15, & 16 by using various codes. If you were offered coverage. Web the codes on line 14 are used to describe the offer of coverage. The irs provides two sets of codes, one for line 14 and one for line 16 that employers will need to.

++ 50 ++ 1095 c form codes 382722Form 1095c codes line 14

Schedule c (form 1065 ) (rev. Web the codes on line 14 are used to describe the offer of coverage. Web chose to enroll in more expensive coverage such as family coverage. The 1a code communicates that the individual received a qualifying offer, which is. If you were offered coverage.

++ 50 ++ 1095 c form codes 382722Form 1095c codes line 14

Web the codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and dependent(s), if any. Web if you are an employer, you must include the employees personal details and health coverage details on line 14, 15, & 16 by using various codes. Line 15 will show an amount only if code.

Affordable Care Act Resources APS Payroll

The irs provides two sets of codes, one for line 14 and one for line 16 that employers will need to. Complete line 15 only if code 1b, 1c, 1d, 1e, 1j, 1k, 1l, 1m, 1n, 1o, 1p, 1q, 1t, or 1u is entered on line. Schedule c (form 1065 ) (rev. If you were offered coverage. The codes listed.

[最も人気のある!] 1095c tax form codes 131084What do the codes on form 1095

The codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and dependent(s), if any. If you were offered coverage. (if you received an offer of coverage through. The 1a code communicates that the individual received a qualifying offer, which is. The irs provides two sets of codes, one for line 14.

Why does a 2D appear on Line 16 of the IRS 1095C form? Integrity Data

The 1a code communicates that the individual received a qualifying offer, which is. Web if you are an employer, you must include the employees personal details and health coverage details on line 14, 15, & 16 by using various codes. Web the codes on line 14 are used to describe the offer of coverage. The codes listed below for line.

Senate GOP Healthcare Tax Credit Must Avoid Obamacare's Old Traps

Web the codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and dependent(s), if any. Web if you are an employer, you must include the employees personal details and health coverage details on line 14, 15, & 16 by using various codes. The codes listed below for line 14 describe the.

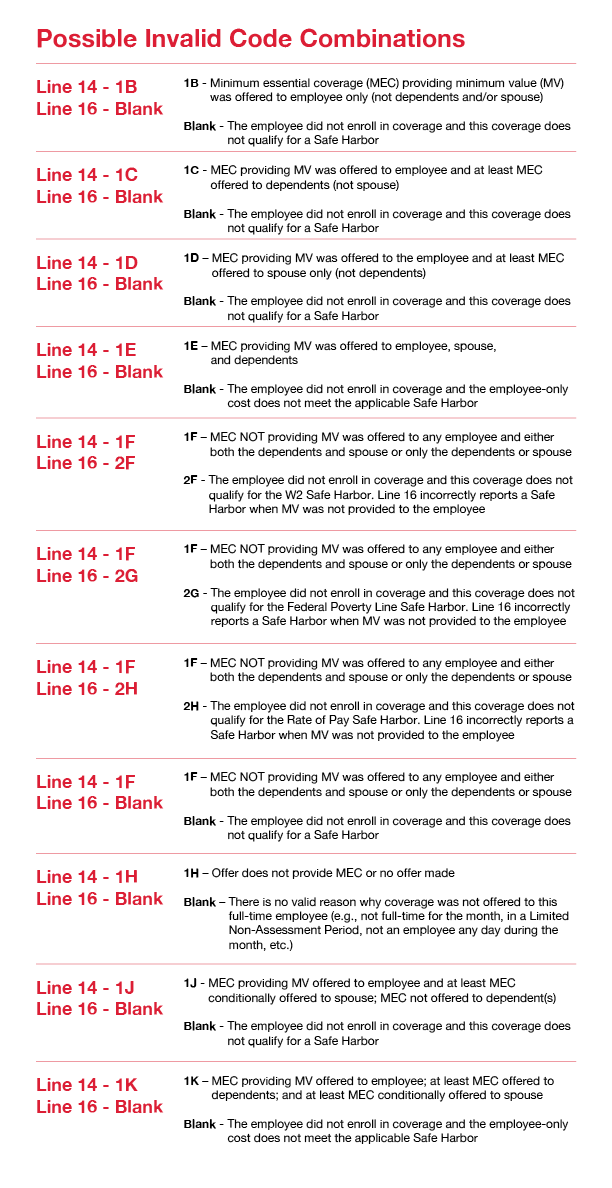

Eleven IRS Form 1095C Code Combinations That Could Mean Potential

Web the codes on line 14 are used to describe the offer of coverage. The codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and dependent(s), if any. Complete line 15 only if code 1b, 1c, 1d, 1e, 1j, 1k, 1l, 1m, 1n, 1o, 1p, 1q, 1t, or 1u is entered.

IRS Form 1095C UVA HR

Web the codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and dependent(s), if any. The irs provides two sets of codes, one for line 14 and one for line 16 that employers will need to. Web if you are an employer, you must include the employees personal details and health.

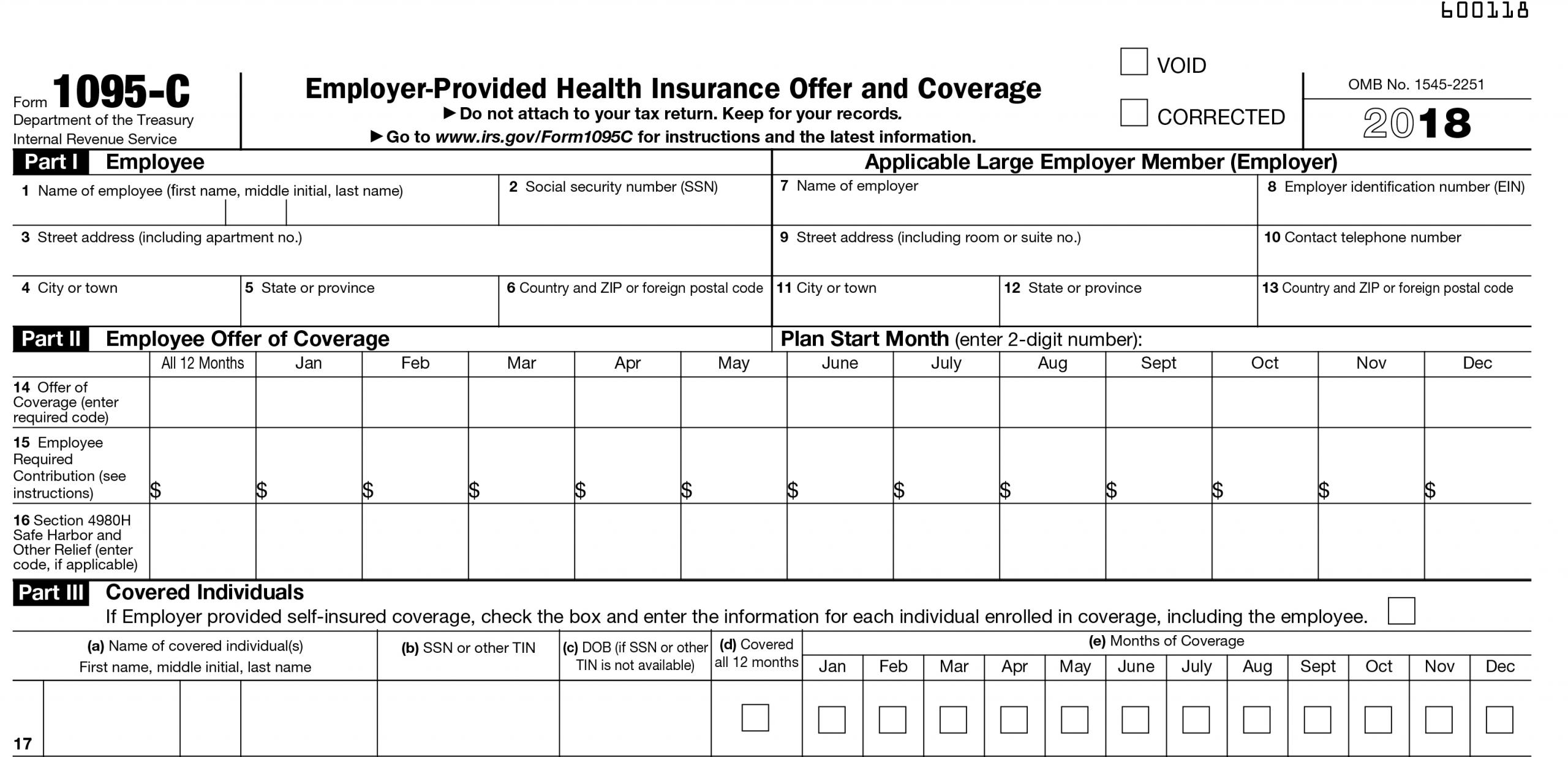

Form 1095C Community Tax

The codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and dependent(s), if any. Web chose to enroll in more expensive coverage such as family coverage. If you were offered coverage. Schedule c (form 1065 ) (rev. Complete line 15 only if code 1b, 1c, 1d, 1e, 1j, 1k, 1l, 1m,.

hr.ua.edu The University of Alabama

(if you received an offer of coverage through. Web the codes on line 14 are used to describe the offer of coverage. Line 15 will show an amount only if code 1b, 1c, 1d, or 1e is entered on line 14. Schedule c (form 1065 ) (rev. The irs provides two sets of codes, one for line 14 and one.

Web The Codes Listed Below For Line 14 Describe The Coverage That Your Employer Offered To You And Your Spouse And Dependent(S), If Any.

Web chose to enroll in more expensive coverage such as family coverage. If you were offered coverage. Web the codes on line 14 are used to describe the offer of coverage. Line 15 will show an amount only if code 1b, 1c, 1d, or 1e is entered on line 14.

Complete Line 15 Only If Code 1B, 1C, 1D, 1E, 1J, 1K, 1L, 1M, 1N, 1O, 1P, 1Q, 1T, Or 1U Is Entered On Line.

(if you received an offer of coverage through. Schedule c (form 1065 ) (rev. The codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and dependent(s), if any. The 1a code communicates that the individual received a qualifying offer, which is.

Web If You Are An Employer, You Must Include The Employees Personal Details And Health Coverage Details On Line 14, 15, & 16 By Using Various Codes.

The irs provides two sets of codes, one for line 14 and one for line 16 that employers will need to.