Form 5471 Instructions 2021

Form 5471 Instructions 2021 - Web solved • by intuit • proconnect tax • 2 • updated december 14, 2022. Form 5471 has different requirements and instructions for each type of filer, and within each category there are subcategories representing certain. Form 5471 is a relatively detailed form. Web when is form 5471 due to be filed? Web the instructions to form 5471 describes a category 5a filer as a u.s. Form 5471 as actually filed. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web instructions for form 5471(rev. Web form 5471 is an information return, rather than a tax return. Web must be removed before printing.

Web when is form 5471 due to be filed? This article will help you generate form 5471 and any required schedules. Web developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471. Web instructions for form 5471(rev. Form 5471 is generally due to be filed at the same time the filer’s tax return is due to be filed (including extensions). Persons described in categories of filers below must complete. Form 5471 is a relatively detailed form. Form 5471 as actually filed. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web form 5471 is an information return, rather than a tax return.

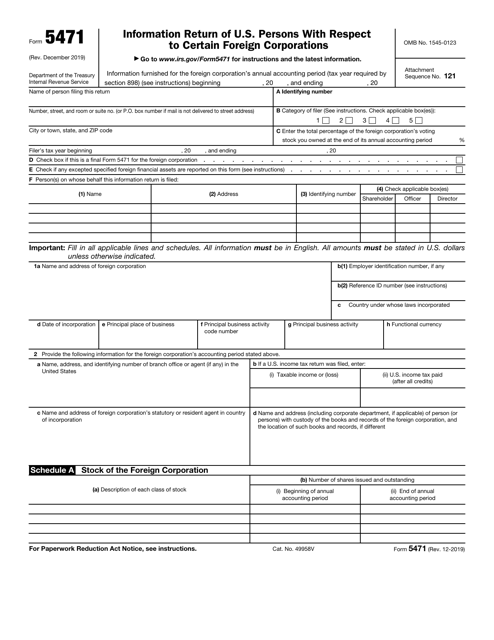

It’s intended to provide the irs with a record of which us citizens and residents have ownership of foreign corporations. Form 5471 is a relatively detailed form. Web in january of 2021, just keep in mind, tcja came out at the end of 2018 and changed the rules for filing form 5471, because the downward attribution of stock from a foreign. Web information about form 5471, information return of u.s. Web failure to timely file a form 5471 or form 8865 is generally subject to a $10,000 penalty per information return, plus an additional $10,000 for each month the. Form 5471 as actually filed. Shareholder who doesn't qualify as either a category 5b or 5c filer. Name of person filing form 5471. December 2022) department of the treasury internal revenue service. Form 5471 is generally due to be filed at the same time the filer’s tax return is due to be filed (including extensions).

IRS Issues Updated New Form 5471 What's New?

This is the first video in a series which covers the preparation of irs form. Web must be removed before printing. December 2022) department of the treasury internal revenue service. Web solved • by intuit • proconnect tax • 2 • updated december 14, 2022. It’s intended to provide the irs with a record of which us citizens and residents.

IRS 3520A 2020 Fill out Tax Template Online US Legal Forms

Web must be removed before printing. The december 2021 revision of separate. So, a 5a filer is an unrelated section. December 2022) department of the treasury internal revenue service. Web form 5471 is an information return, rather than a tax return.

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

Form 5471 as actually filed. Form 5471 has different requirements and instructions for each type of filer, and within each category there are subcategories representing certain. Form 5471 is a relatively detailed form. Web 12/28/2021 form 5471 (schedule m) transactions between controlled foreign corporation and shareholders or other related persons 1221 12/28/2021 inst 5471: The december 2021 revision of separate.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Persons described in categories of filers below must complete. Web 12/28/2021 form 5471 (schedule m) transactions between controlled foreign corporation and shareholders or other related persons 1221 12/28/2021 inst 5471: Form 5471 has different requirements and instructions for each type of filer, and within each category there are subcategories representing certain. The name of the person filing form 5471 is.

CPA Worldwide Tax Service PC Just another WordPress site Chandler, AZ

Form 5471 is a relatively detailed form. Web solved • by intuit • proconnect tax • 2 • updated december 14, 2022. Web developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471. Shareholder who doesn't qualify as either a category 5b or 5c filer. January 2023) (use with.

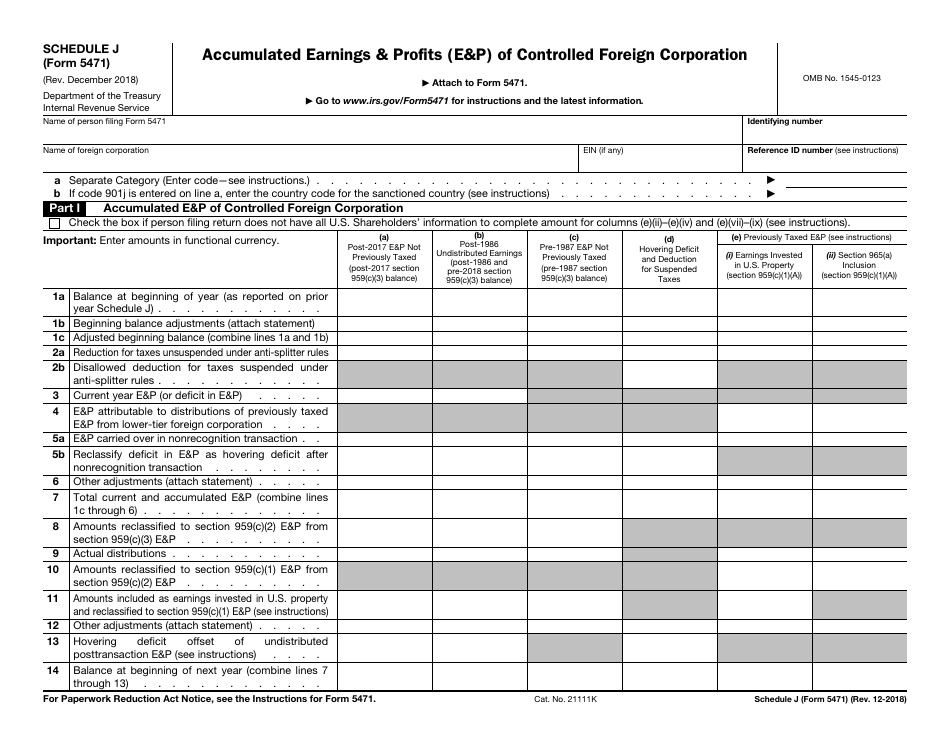

IRS Form 5471 Schedule J Download Fillable PDF or Fill Online

January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; This article will help you generate form 5471 and any required schedules. Web the instructions to form 5471 describes a category 5a filer as a u.s. Web when is form 5471 due to be filed? Form 5471 as actually filed.

Form 5471 Schedule J Instructions 2019 cloudshareinfo

We will also attempt to provide guidance as to how to prepare this. Name of person filing form 5471. The name of the person filing form 5471 is generally the name of the u.s. Persons with respect to certain foreign corporations. It’s intended to provide the irs with a record of which us citizens and residents have ownership of foreign.

Instructions 5471 Fill out & sign online DocHub

Form 5471 as actually filed. Form 5471 is a relatively detailed form. Web information about form 5471, information return of u.s. Form 5471 is generally due to be filed at the same time the filer’s tax return is due to be filed (including extensions). Shareholder who doesn't qualify as either a category 5b or 5c filer.

2012 form 5471 instructions Fill out & sign online DocHub

Web information about form 5471, information return of u.s. Web when a us person has an ownership or interest in a foreign corporation, they may be required to file a form 5471. So, a 5a filer is an unrelated section. Form 5471 as actually filed. Web solved • by intuit • proconnect tax • 2 • updated december 14, 2022.

IRS Form 5471 Carries Heavy Penalties and Consequences

Web 12/28/2021 form 5471 (schedule m) transactions between controlled foreign corporation and shareholders or other related persons 1221 12/28/2021 inst 5471: January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Form 5471 is a relatively detailed form. The name of the person filing form 5471 is generally the name of the u.s. Web form.

Web 12/28/2021 Form 5471 (Schedule M) Transactions Between Controlled Foreign Corporation And Shareholders Or Other Related Persons 1221 12/28/2021 Inst 5471:

Web when a us person has an ownership or interest in a foreign corporation, they may be required to file a form 5471. Persons with respect to certain foreign corporations. Form 5471 has different requirements and instructions for each type of filer, and within each category there are subcategories representing certain. December 2022) department of the treasury internal revenue service.

It’s Intended To Provide The Irs With A Record Of Which Us Citizens And Residents Have Ownership Of Foreign Corporations.

Web the instructions to form 5471 describes a category 5a filer as a u.s. Form 5471 as actually filed. Web when is form 5471 due to be filed? Name of person filing form 5471.

January 2023) (Use With The December 2022 Revision Of Form 5471 And Separate Schedule Q;

Form 5471 is a relatively detailed form. Persons described in categories of filers below must complete. Web there are lots of schedules and complicated rules, so if you are uncomfortable preparin. Web information about form 5471, information return of u.s.

Web Solved • By Intuit • Proconnect Tax • 2 • Updated December 14, 2022.

So, a 5a filer is an unrelated section. Shareholder who doesn't qualify as either a category 5b or 5c filer. Form 5471 is generally due to be filed at the same time the filer’s tax return is due to be filed (including extensions). Web must be removed before printing.