Form 5471 Worksheet A

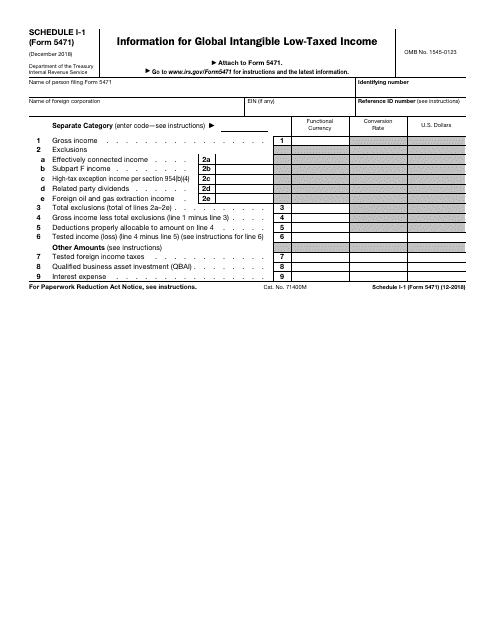

Form 5471 Worksheet A - Web on form 5471 and separate schedules, in entry spaces that request identifying information with respect to a foreign entity, taxpayers will no longer have the option to enter. Shareholder’s pro rata share of subpart f income of a cfc (see the. 36 part ii of separate schedule o (form 5471). Shareholders file form 5471 to satisfy reporting requirements. Web it is the primary form for collection of information about foreign corporations with substantial u.s. 34 schedule b of form 5471. 35 schedule e of form 5471. Web go to www.irs.gov/form5471 for instructions and the latest information. Generating and completing form 5471 information return. Just to give a little bit of.

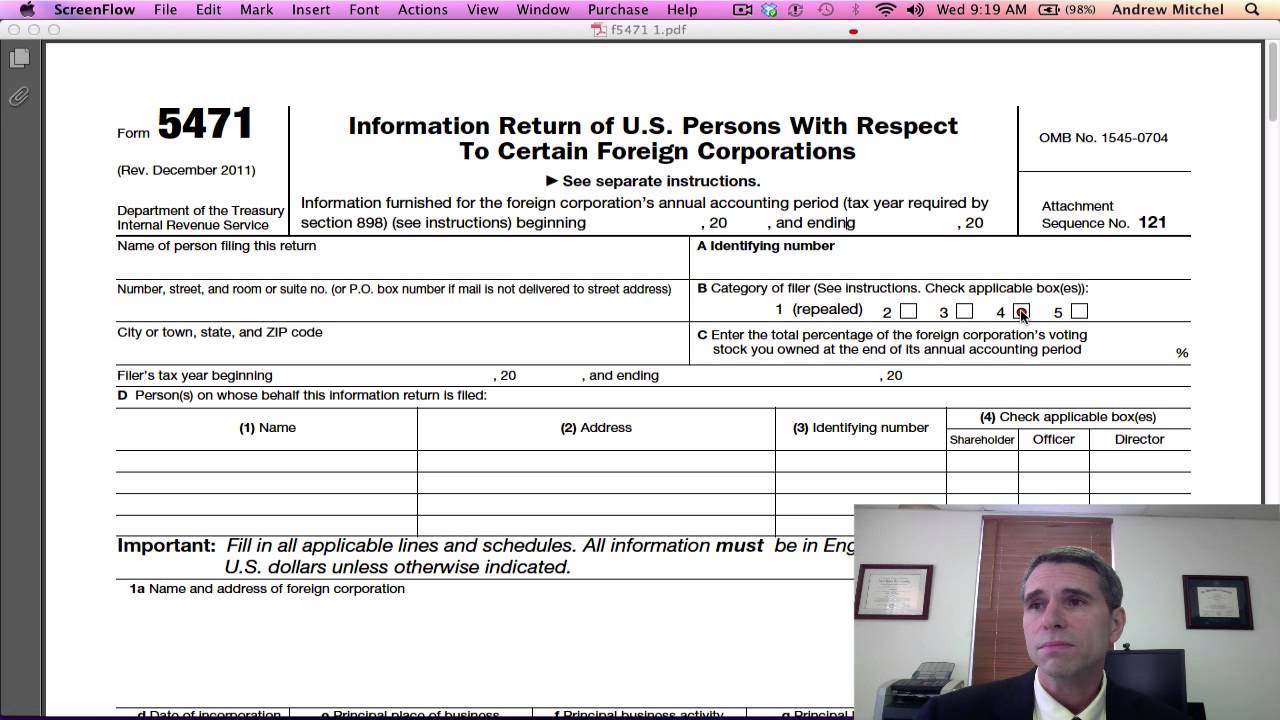

Web today we're going to speak a little bit about the form 5471, which has to deal with foreign corporations and controlled foreign corporations. Persons who are officers, directors, or shareholders in certain foreign corporations. Just to give a little bit of. Web 33 schedule a of form 5471. Web changes to form 5471. December 2012) department of the treasury internal revenue service. This is available in the following tax types:. The form and schedules are used to satisfy. Web internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who have an ownership. 37 schedule c and schedule f.

36 part ii of separate schedule o (form 5471). Web internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who have an ownership. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a, 1b,. Web it is the primary form for collection of information about foreign corporations with substantial u.s. Use this section to enter information specific to worksheet a from the form 5471 instructions. Web go to www.irs.gov/form5471 for instructions and the latest information. Web changes to form 5471. Persons who are officers, directors, or shareholders in certain foreign corporations. Shareholder’s pro rata share of subpart f income of a cfc (see the. Persons with respect to foreign corp worksheet.

Worksheet A Form 5471 Irs Tripmart

Use this section to enter information specific to worksheet a from the form 5471 instructions. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a, 1b,. Form 5471 is used by certain u.s. Web go to www.irs.gov/form5471 for instructions and the latest information..

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

The form and schedules are used to satisfy. 34 schedule b of form 5471. Web 33 schedule a of form 5471. Web it is the primary form for collection of information about foreign corporations with substantial u.s. Web on form 5471 and separate schedules, in entry spaces that request identifying information with respect to a foreign entity, taxpayers will no.

5471 Worksheet A

Web 33 schedule a of form 5471. Web go to www.irs.gov/form5471 for instructions and the latest information. The form and schedules are used to satisfy. Web today we're going to speak a little bit about the form 5471, which has to deal with foreign corporations and controlled foreign corporations. 35 schedule e of form 5471.

5471 Worksheet A

The form and schedules are used to satisfy. Just to give a little bit of. Shareholder’s pro rata share of subpart f income of a cfc (see the. Persons who are officers, directors, or shareholders in certain foreign corporations. Go to the section, miscellaneous forms, and then go to the screen, information of u.s.

IRS Form 5471, Page1 YouTube

Enter all dollar amounts in this section in functional currency. Use this section to enter information specific to worksheet a from the form 5471 instructions. Persons with respect to certain foreign corporations. Generating and completing form 5471 information return. Form 5471 is used by certain u.s.

5471 Worksheet A

Web internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who have an ownership. The form and schedules are used to satisfy. Shareholders file form 5471 to satisfy reporting requirements. 35 schedule e of form 5471. Enter all dollar amounts in this section in functional currency.

IRS Issues Updated New Form 5471 What's New?

Generating and completing form 5471 information return. Persons with respect to foreign corp worksheet. Web internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who have an ownership. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes.

5471 Worksheet A

35 schedule e of form 5471. Persons with respect to certain foreign corporations. Generating and completing form 5471 information return. Persons with respect to certain foreign corporations. Use this section to enter information specific to worksheet a from the form 5471 instructions.

Substantial Compliance Form 5471 Advanced American Tax

Shareholders file form 5471 to satisfy reporting requirements. Persons with respect to foreign corp worksheet. Web to generate form 5471: Go to the section, miscellaneous forms, and then go to the screen, information of u.s. Web click on the articles below for help and answers to the top form 5471 frequently asked questions:

2012 form 5471 instructions Fill out & sign online DocHub

Web click on the articles below for help and answers to the top form 5471 frequently asked questions: Shareholder’s pro rata share of subpart f income of a cfc (see the. Web internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who have an ownership. Web today we're going to speak.

December 2012) Department Of The Treasury Internal Revenue Service.

Use this section to enter information specific to worksheet a from the form 5471 instructions. Web on form 5471 and separate schedules, in entry spaces that request identifying information with respect to a foreign entity, taxpayers will no longer have the option to enter. Form 5471 is used by certain u.s. Web how do i produce form 5471 worksheet a in individual tax using interview forms?

Web Changes To Form 5471.

Generating and completing form 5471 information return. Web click on the articles below for help and answers to the top form 5471 frequently asked questions: Just to give a little bit of. Web 33 schedule a of form 5471.

Shareholder’s Pro Rata Share Of Subpart F Income Of A Cfc (See The.

This is available in the following tax types:. 37 schedule c and schedule f. 35 schedule e of form 5471. Persons with respect to foreign corp worksheet.

Persons Who Are Officers, Directors, Or Shareholders In Certain Foreign Corporations.

Go to the section, miscellaneous forms, and then go to the screen, information of u.s. Persons with respect to certain foreign corporations. Enter all dollar amounts in this section in functional currency. Web go to www.irs.gov/form5471 for instructions and the latest information.