Form 5500 Filing Deadline 2022

Form 5500 Filing Deadline 2022 - Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: Must file electronically through efast2. Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. 17 2022) by filing irs form 5558 by aug. Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Plan sponsors can request an. Web recent developments requesting a waiver of the electronic filing requirements: 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. In this primer article we highlight who must file, the deadlines to file, and the extensions of time available to those filings. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct.

Plan sponsors can request an. Deadlines and extensions applicable to the form 5500 series return. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Must file electronically through efast2. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day. Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. 17 2022) by filing irs form 5558 by aug. (due by the form 5500 filing deadline—usually july 31, which falls on a weekend in 2022.) Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. For information on filing a request for a hardship waiver for 2022 or 2023 plan years, see rev.

(due by the form 5500 filing deadline—usually july 31, which falls on a weekend in 2022.) Web recent developments requesting a waiver of the electronic filing requirements: Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. 17 2022) by filing irs form 5558 by aug. Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. For information on filing a request for a hardship waiver for 2022 or 2023 plan years, see rev. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Deadlines and extensions applicable to the form 5500 series return.

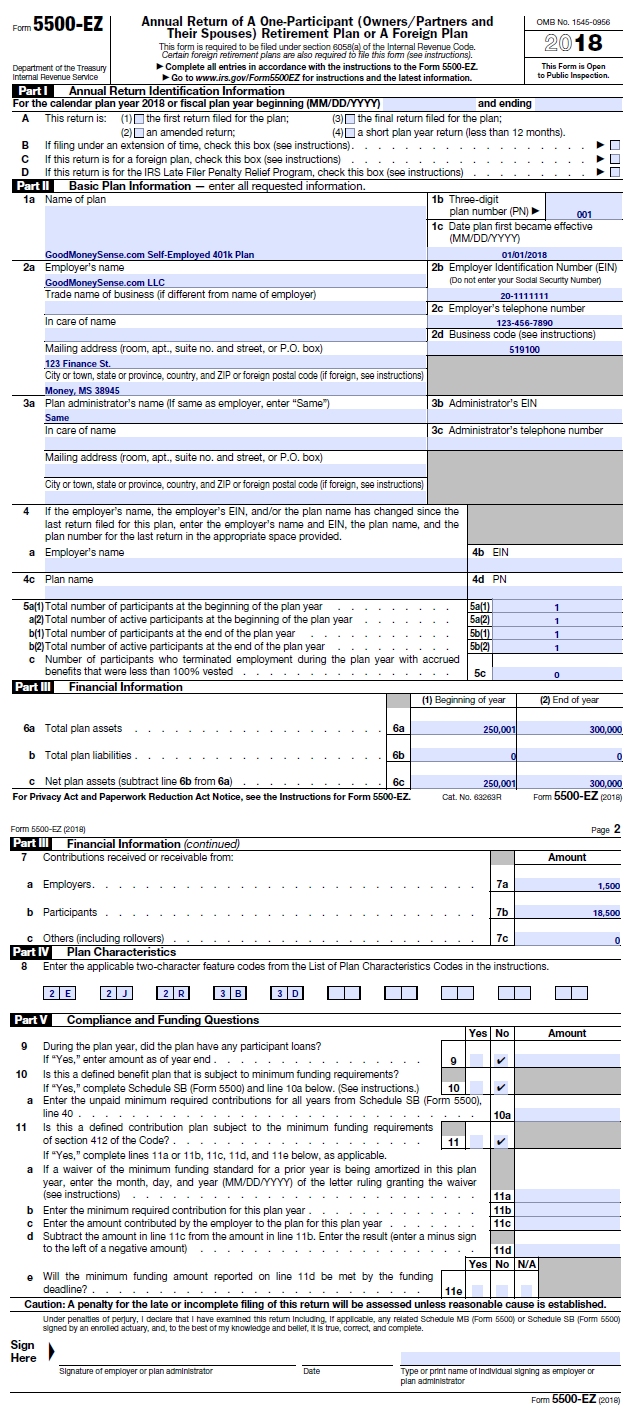

How to File Form 5500EZ Solo 401k

15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. The last day of the seventh month after the plan year ends (july 31 for a calendar year plan)..

Form 5500 Sf Instructions 2018 slidesharetrick

Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: In this primer article we highlight who must file, the deadlines to file, and the extensions of time available to those filings. 17 2022) by filing irs form 5558 by aug. For information on filing a request for a hardship waiver.

10 Common Errors in Form 5500 Preparation Outsourcing Services

Plan sponsors can request an. 17 2022) by filing irs form 5558 by aug. Web recent developments requesting a waiver of the electronic filing requirements: In this primer article we highlight who must file, the deadlines to file, and the extensions of time available to those filings. 15th, but if the filing due date falls on a saturday, sunday or.

How To File The Form 5500EZ For Your Solo 401k for 2018 Good Money Sense

For information on filing a request for a hardship waiver for 2022 or 2023 plan years, see rev. (due by the form 5500 filing deadline—usually july 31, which falls on a weekend in 2022.) Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web for the calendar plan year.

Form 5500 Instructions 5 Steps to Filing Correctly

15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day. Plan sponsors can request an. Must file electronically through efast2. (due by the form 5500 filing deadline—usually july 31, which falls on a weekend in 2022.) 17 2022) by filing irs form 5558 by aug.

Certain Form 5500 Filing Deadline Extensions Granted by IRS BASIC

Deadlines and extensions applicable to the form 5500 series return. In this primer article we highlight who must file, the deadlines to file, and the extensions of time available to those filings. Must file electronically through efast2. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. For.

Form 5500 Deadline Is it Extended Due to COVID19? Mitchell Wiggins

In this primer article we highlight who must file, the deadlines to file, and the extensions of time available to those filings. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. Web typically, the form 5500 is due by july 31st for calendar year plans, with an.

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

17 2022) by filing irs form 5558 by aug. Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: For information on filing a request for a hardship waiver for 2022 or 2023 plan years, see rev. Web file form 5500 to report information on the qualification of the plan, its.

Form 5500 Filing A Dangerous Compliance Trap BASIC

17 2022) by filing irs form 5558 by aug. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day. Must file electronically through efast2..

2019 Form IRS 5500EZ Fill Online, Printable, Fillable, Blank pdfFiller

In this primer article we highlight who must file, the deadlines to file, and the extensions of time available to those filings. (due by the form 5500 filing deadline—usually july 31, which falls on a weekend in 2022.) Must file electronically through efast2. Plan sponsors can request an. Typically, the form 5500 is due by july 31st for calendar year.

15Th, But If The Filing Due Date Falls On A Saturday, Sunday Or Federal Holiday, It May Be Filed On The Next Business Day.

Deadlines and extensions applicable to the form 5500 series return. Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. In this primer article we highlight who must file, the deadlines to file, and the extensions of time available to those filings.

(Due By The Form 5500 Filing Deadline—Usually July 31, Which Falls On A Weekend In 2022.)

For information on filing a request for a hardship waiver for 2022 or 2023 plan years, see rev. The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Web recent developments requesting a waiver of the electronic filing requirements: Plan sponsors can request an.

Web For The Calendar Plan Year 2022 Or Fiscal Plan Year Beginning (Mm/Dd/Yyyy) And Ending A This Return Is:

Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. Must file electronically through efast2. 17 2022) by filing irs form 5558 by aug.