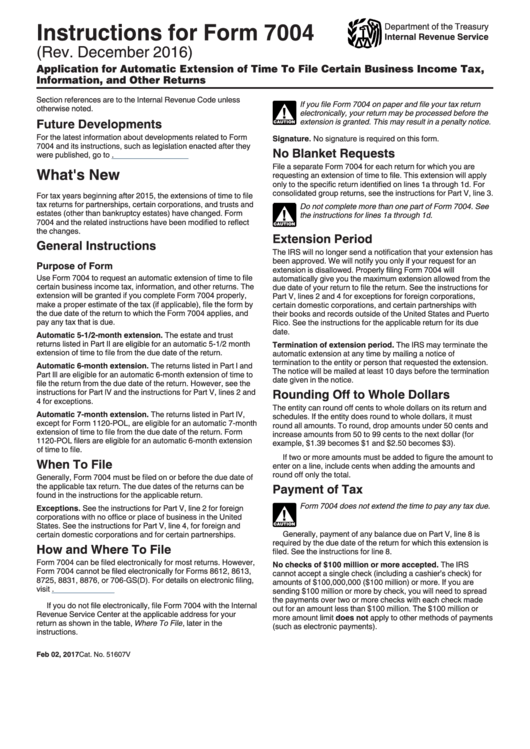

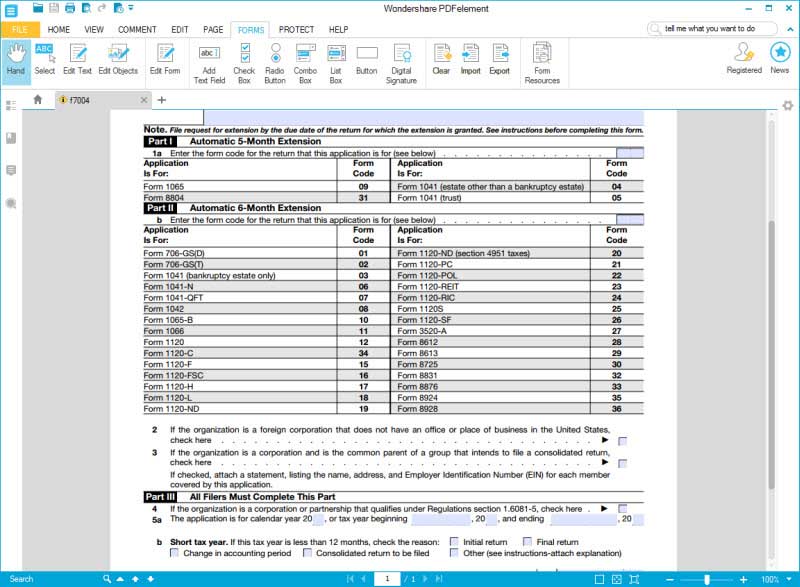

Form 7004 Instructions

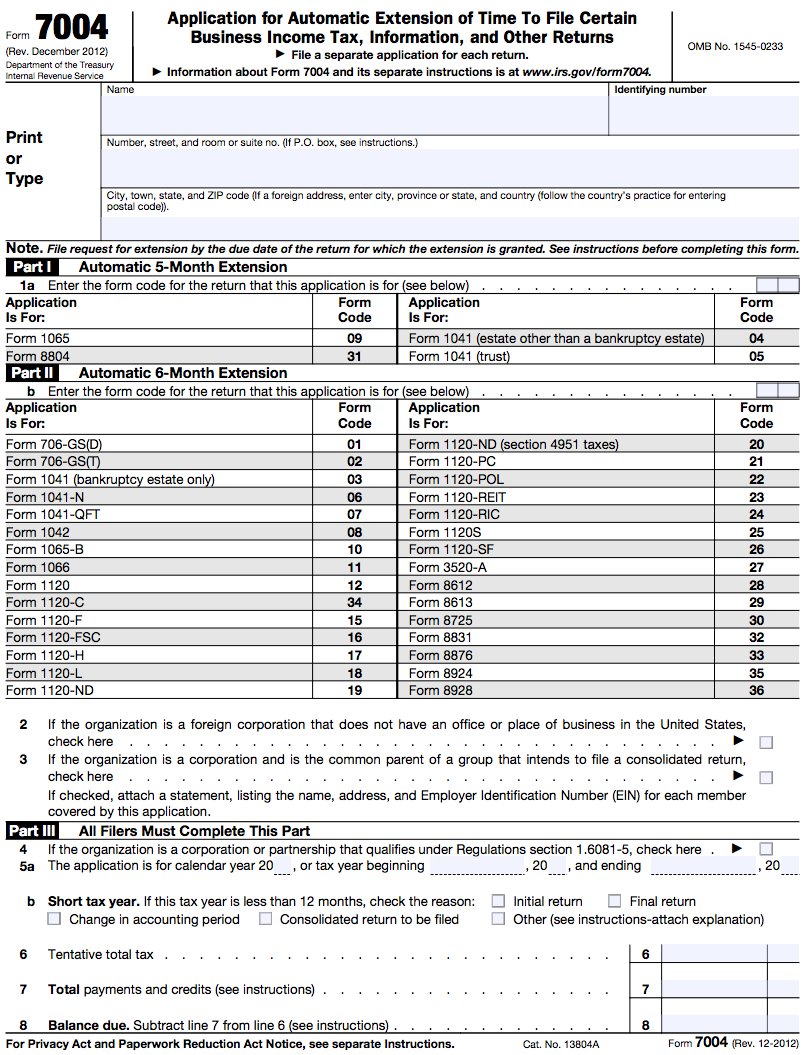

Form 7004 Instructions - Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Refer to the form 7004 instructions for additional information on payment of tax and balance due. See the form 7004 instructions for a list of the exceptions. Web purpose of form. Certain business income tax, information, and other returns. Web use form 7004 to request an automatic extension of time to file instructions for the applicable return for its due date. Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions, fully updated for tax year 2022. Select extension of time to file (form 7004) and continue; Form 7004 is used to request an automatic extension to file the certain returns. Make a proper estimate of any taxes you owe.

Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. See the form 7004 instructions for a list of the exceptions. Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Select extension of time to file (form 7004) and continue; Refer to the form 7004 instructions for additional information on payment of tax and balance due. According to the irs, however, you’re only granted this extension if you: With your return open, select search and enter extend; The extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return for which the extension is. Make a proper estimate of any taxes you owe. Web use form 7004 to request an automatic extension of time to file instructions for the applicable return for its due date.

Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. According to the irs, however, you’re only granted this extension if you: Web use form 7004 to request an automatic extension of time to file instructions for the applicable return for its due date. See the form 7004 instructions for a list of the exceptions. Web purpose of form. Web follow these steps to print a 7004 in turbotax business: Certain business income tax, information, and other returns. Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions, fully updated for tax year 2022. Web the form 7004 does not extend the time for payment of tax. We'll provide the mailing address and any payment.

File Form 7004 Online 2021 Business Tax Extension Form

With your return open, select search and enter extend; Web use form 7004 to request an automatic extension of time to file instructions for the applicable return for its due date. See the form 7004 instructions for a list of the exceptions. Make a proper estimate of any taxes you owe. Use form 7004 to request an automatic extension of.

Form 7004 Printable PDF Sample

Web the form 7004 does not extend the time for payment of tax. The extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return for which the extension is. We'll provide the mailing address and any payment. Web you can file.

Irs Form 7004 amulette

Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions, fully updated for tax year 2022. Select extension of time to file (form 7004) and continue; File.

Instructions For Form 7004 Application For Automatic Extension Of

File form 7004 based on. Web successfully and properly filing form 7004 grants you a six month corporate tax extension to file that tax form. Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions, fully updated for tax year 2022. The rounding off to whole dollars.

Form 7004 E File Instructions Universal Network

The rounding off to whole dollars extension will be granted if. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. Web follow these steps to print a 7004 in turbotax business: Certain business income tax, information, and.

のん様ご専用 ありがとうございます♡ トートバッグ バッグ レディース 新着商品

Web you can file an irs form 7004 electronically for most returns. File form 7004 before or on the deadline of the form you need an extension on Web to file a business tax extension, use form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns.” as the name implies, irs form.

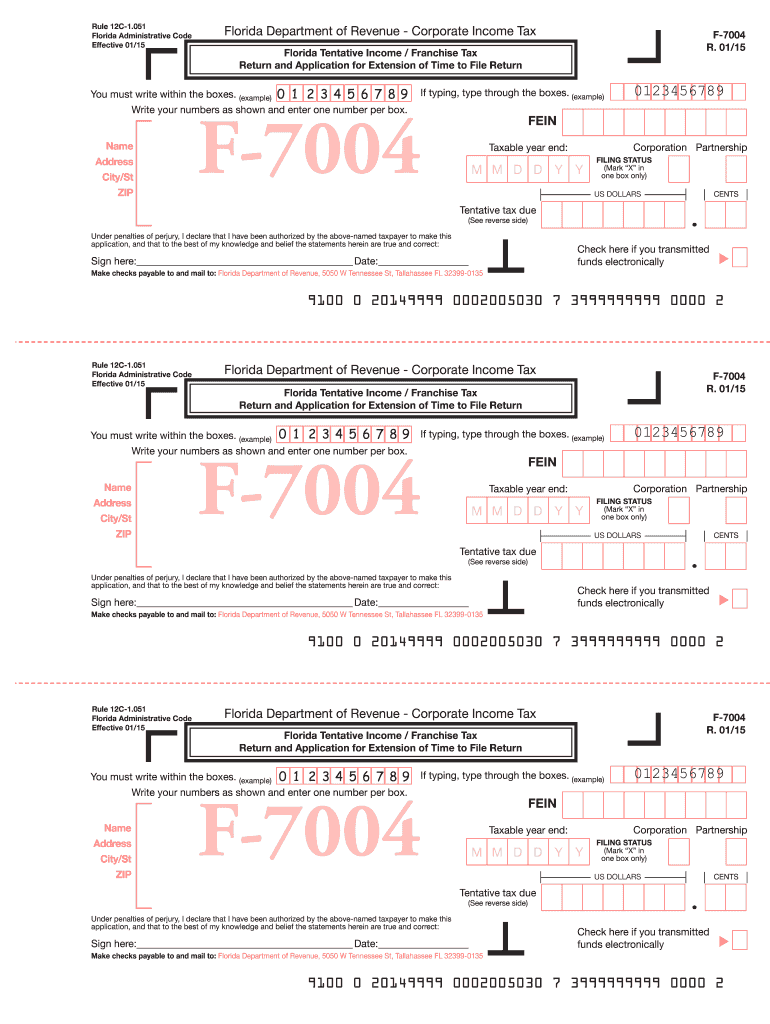

Form F 7004 Fill Out and Sign Printable PDF Template signNow

File form 7004 based on. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. File form 7004 before or on the deadline of the form you need an extension on The rounding off to whole dollars extension.

Instructions For Form 7004 Application For Automatic Extension Of

Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Certain business income tax, information, and other.

Instructions for How to Fill in IRS Form 7004

Web follow these steps to print a 7004 in turbotax business: Certain business income tax, information, and other returns. Web use form 7004 to request an automatic extension of time to file instructions for the applicable return for its due date. The rounding off to whole dollars extension will be granted if. Form 7004 is used to request an automatic.

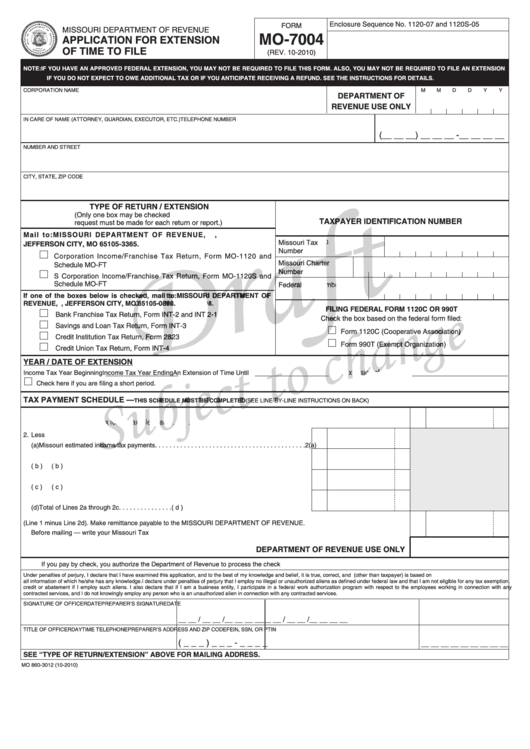

Form Mo7004 Draft Application For Extension Of Time To File 2010

Select extension of time to file (form 7004) and continue; Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. According to the irs, however, you’re only granted this extension if you: File form 7004 based on..

Web We Last Updated The Irs Automatic Business Extension Instructions In February 2023, So This Is The Latest Version Of Form 7004 Instructions, Fully Updated For Tax Year 2022.

Web you can file an irs form 7004 electronically for most returns. Refer to the form 7004 instructions for additional information on payment of tax and balance due. Select extension of time to file (form 7004) and continue; Web use form 7004 to request an automatic extension of time to file instructions for the applicable return for its due date.

File Form 7004 Based On.

According to the irs, however, you’re only granted this extension if you: Certain business income tax, information, and other returns. Form 7004 is used to request an automatic extension to file the certain returns. Follow the instructions to prepare and print your 7004 form.

We'll Provide The Mailing Address And Any Payment.

Web follow these steps to print a 7004 in turbotax business: File form 7004 before or on the deadline of the form you need an extension on With your return open, select search and enter extend; Web successfully and properly filing form 7004 grants you a six month corporate tax extension to file that tax form.

Web Information About Form 7004, Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns, Including Recent Updates, Related Forms, And Instructions On How To File.

Web the form 7004 does not extend the time for payment of tax. The extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return for which the extension is. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web to file a business tax extension, use form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns.” as the name implies, irs form 7004 is used by various types of businesses to extend the filing deadline on their taxes.