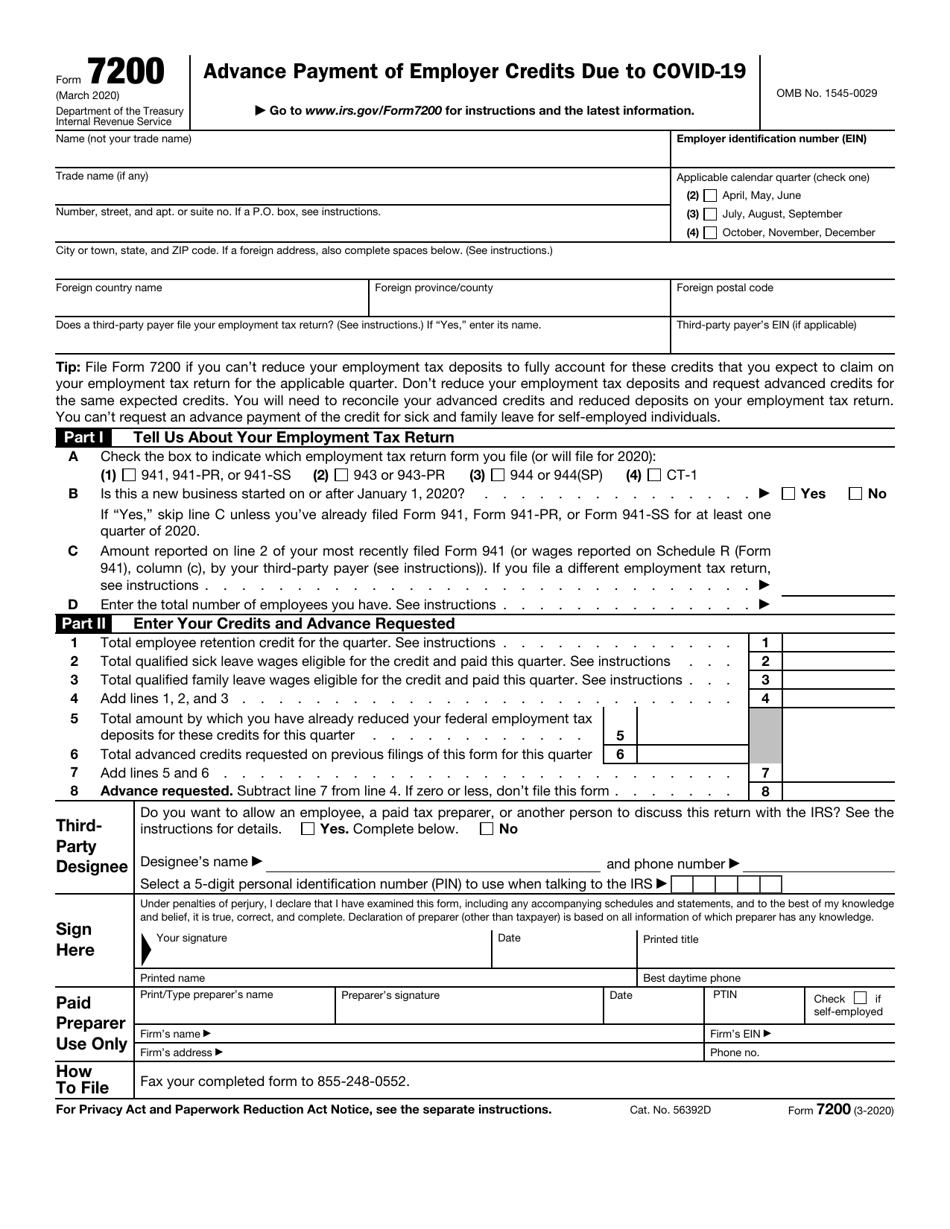

Form 7200 For 2021

Form 7200 For 2021 - Department of the treasury internal revenue service. Web the irs has made some changes to the form 7200 for 2021. Web therefore, employers can file form 7200 to request advance payments of employee retention credit on or before august 2, 2021, for the qualified wages paid until. File form 7200 if you. The following lines are introduced for the 2021 tax year, enter the total number of employees who are provided. For 2021, with respect to the employee retention credit,. Complete, edit or print tax forms instantly. Online form 7200 is a federal income tax form. Web form 7200 may be filed to request an advance payment for the employee retention credit through august 2, 2021. Web what information is required to complete covid19 form 7200 for 2021?

Form 7200 remains on irs.gov only as a historical item at. Web what information is required to complete covid19 form 7200 for 2021? For 2021, with respect to the employee retention credit,. Ad register and subscribe now to work on your irs form 7200 & more fillable forms. Web the irs has made some changes to the form 7200 for 2021. Name, ein, and address 2. Ad register and subscribe now to work on your advance payment of employer credits. This document is used for individuals who. Web the irs has released a revised draft version of form 7200 to be used to obtain a refundable payment of the employee retention credit and the qualified sick pay. The following lines are introduced for the 2021 tax year, enter the total number of employees who are provided.

Name, ein, and address 2. Department of the treasury internal revenue service. Web what information is required to complete covid19 form 7200 for 2021? Complete, edit or print tax forms instantly. Department of the treasury internal revenue service. Web form 7200 may be filed to request an advance payment for the employee retention credit through august 2, 2021. Complete, edit or print tax forms instantly. For 2021, with respect to the employee retention credit,. The following lines are introduced for the 2021 tax year, enter the total number of employees who are provided. Ad register and subscribe now to work on your advance payment of employer credits.

The IRS Released An Updated Form 7200 for Tax Year 2021 Blog TaxBandits

Complete, edit or print tax forms instantly. Web what information is required to complete covid19 form 7200 for 2021? Web learn how to fill out the new form 7200 for 2021. Web therefore, employers can file form 7200 to request advance payments of employee retention credit on or before august 2, 2021, for the qualified wages paid until. Taxpayers filing.

IRS Form 7200 Instructions A Detailed Explanation Guide

Ad register and subscribe now to work on your advance payment of employer credits. Taxpayers filing a form 941, employer's quarterly federal tax return, may submit a form 7200, advance payment of employer credits due to. For 2021, with respect to the employee retention credit,. The following lines are introduced for the 2021 tax year, enter the total number of.

2021 Form IRS Instructions 7200 Fill Online, Printable, Fillable, Blank

Web therefore, employers can file form 7200 to request advance payments of employee retention credit on or before august 2, 2021, for the qualified wages paid until. Web form 7200 instructions 2021: For 2021, with respect to the employee retention credit,. Web form 7200 may be filed to request an advance payment for the employee retention credit through august 2,.

EMPLOYEE RETENTION TAX CREDIT IRS UPDATE FOR 2021. HOW TO FILE FORM

For 2021, with respect to the employee retention credit,. File form 7200 if you. Online form 7200 is a federal income tax form. This document is used for individuals who. Form 7200 remains on irs.gov only as a historical item at.

What is IRS Form 7200 for 2021? TaxBandits YouTube

Complete, edit or print tax forms instantly. Web form 7200 may be filed to request an advance payment for the employee retention credit through august 2, 2021. Name, ein, and address 2. For 2021, with respect to the employee retention credit,. Online form 7200 is a federal income tax form.

What Is The Form 7200, How Do I File It? Blog TaxBandits

Name, ein, and address 2. The following lines are introduced for the 2021 tax year, enter the total number of employees who are provided. Web therefore, employers can file form 7200 to request advance payments of employee retention credit on or before august 2, 2021, for the qualified wages paid until. Taxpayers filing a form 941, employer's quarterly federal tax.

File Form 7200 (Advance Payment of Employer Credits Due to COVID19

Complete, edit or print tax forms instantly. Web the irs has released a revised draft version of form 7200 to be used to obtain a refundable payment of the employee retention credit and the qualified sick pay. For 2021, with respect to the employee retention credit,. Complete, edit or print tax forms instantly. Online form 7200 is a federal income.

StepbyStep Guide Form 7200 Advance Employment Credits BerniePortal

Complete, edit or print tax forms instantly. Web therefore, employers can file form 7200 to request advance payments of employee retention credit on or before august 2, 2021, for the qualified wages paid until. Name, ein, and address 2. Web in a december 4 statement posted on its website, the irs said that employers will experience a delay in receiving.

IRS Form 7200 Download Fillable PDF or Fill Online Advance Payment of

Web for more information about this credit, see the instructions for line 4, later. Web therefore, employers can file form 7200 to request advance payments of employee retention credit on or before august 2, 2021, for the qualified wages paid until. Taxpayers filing a form 941, employer's quarterly federal tax return, may submit a form 7200, advance payment of employer.

Learn How to Calculate Form 7200 for 2021 (New Form) Advanced Payroll

Form 7200 remains on irs.gov only as a historical item at. Ad register and subscribe now to work on your irs form 7200 & more fillable forms. Online form 7200 is a federal income tax form. Web the irs has released a revised draft version of form 7200 to be used to obtain a refundable payment of the employee retention.

Web For More Information About This Credit, See The Instructions For Line 4, Later.

This document is used for individuals who. Ad register and subscribe now to work on your advance payment of employer credits. Web the irs has released a revised draft version of form 7200 to be used to obtain a refundable payment of the employee retention credit and the qualified sick pay. Ad register and subscribe now to work on your irs form 7200 & more fillable forms.

File Form 7200 If You.

Web learn how to fill out the new form 7200 for 2021. Web therefore, employers can file form 7200 to request advance payments of employee retention credit on or before august 2, 2021, for the qualified wages paid until. Complete, edit or print tax forms instantly. Web form 7200 may be filed to request an advance payment for the employee retention credit through august 2, 2021.

Name, Ein, And Address 2.

Department of the treasury internal revenue service. Web the irs has made some changes to the form 7200 for 2021. Web in a december 4 statement posted on its website, the irs said that employers will experience a delay in receiving advance payments of credits claimed on. Online form 7200 is a federal income tax form.

Web What Information Is Required To Complete Covid19 Form 7200 For 2021?

Form 7200 remains on irs.gov only as a historical item at. The following lines are introduced for the 2021 tax year, enter the total number of employees who are provided. Web form 7200 instructions 2021: The last day to file form 7200 to request an advance payment for the second quarter of 2021 is august.