Form 8824 Instructions 2022

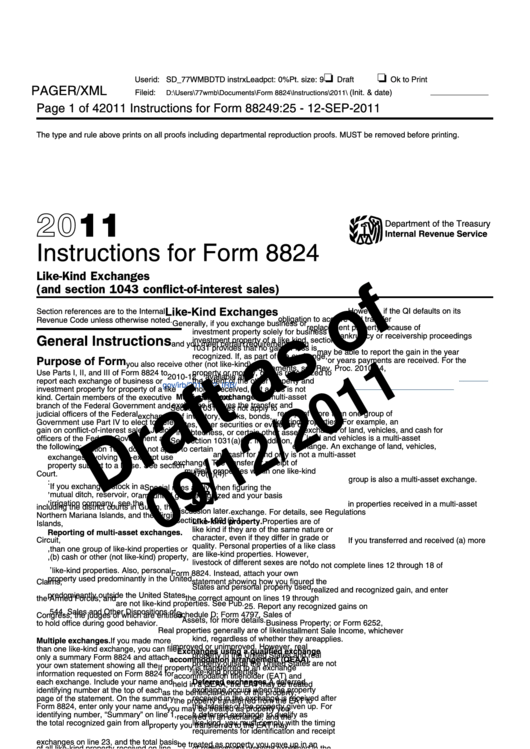

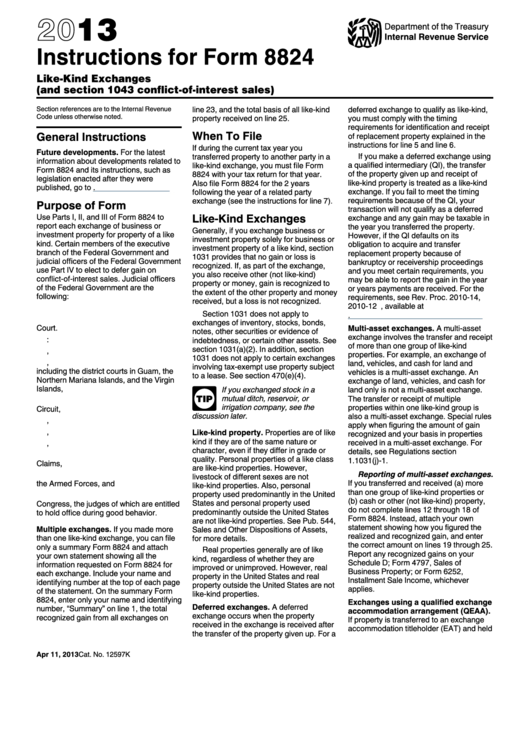

Form 8824 Instructions 2022 - The form must be filed annually no later than february 15th of the following year. This means any gain from the exchange is not recognized, and any loss cannot be deducted. Solved • by intuit • 3 • updated 1 year ago. See the instructions for exceptions. Go to www.irs.gov/form8824 for instructions and the latest information. Below are the most popular support articles associated with form 8824. Use parts i, ii, and iii of form 8824 to report each exchange of business or investment property for property of a like kind. Any other taxpayer filing an individual return with agi of $250,000 or more for the taxable year in which the exchange begins. Name(s) shown on tax return. It is also used by shareholders to report their stock and bond transactions with each other.

Go to www.irs.gov/form8824 for instructions and the latest information. It is also used by shareholders to report their stock and bond transactions with each other. The form must be filed annually no later than february 15th of the following year. Solved • by intuit • 3 • updated 1 year ago. Web common questions for form 8824 in proseries. Web form 8824, corporation exchange, is used by us corporations to report their stock and bond transactions with the sec. Below are the most popular support articles associated with form 8824. Any other taxpayer filing an individual return with agi of $250,000 or more for the taxable year in which the exchange begins. Name(s) shown on tax return. See the instructions for exceptions.

Certain exchanges of property are not taxable. Web a taxpayer who is a head of household, a surviving spouse, or spouse filing a joint return with adjusted gross income (agi) of $500,000 or more for the taxable year in which the exchange begins. Below are the most popular support articles associated with form 8824. Also file form 8824 for the 2 years following the year of a related. Completing a like kind exchange in the 1040 return. Name(s) shown on tax return. Use parts i, ii, and iii of form 8824 to report each exchange of business or investment property for property of a like kind. It is also used by shareholders to report their stock and bond transactions with each other. This means any gain from the exchange is not recognized, and any loss cannot be deducted. Any other taxpayer filing an individual return with agi of $250,000 or more for the taxable year in which the exchange begins.

How to fill out form 8822 B 2020 YouTube

Completing a like kind exchange in the 1040 return. Web common questions for form 8824 in proseries. Any other taxpayer filing an individual return with agi of $250,000 or more for the taxable year in which the exchange begins. Certain exchanges of property are not taxable. This means any gain from the exchange is not recognized, and any loss cannot.

2020 Irs 1040 Schedule Instructions Fill Out and Sign Printable PDF

However, the property involved must be used for business or investment. Solved • by intuit • 3 • updated 1 year ago. Web a taxpayer who is a head of household, a surviving spouse, or spouse filing a joint return with adjusted gross income (agi) of $500,000 or more for the taxable year in which the exchange begins. This means.

VA Form 8824i Edit, Fill, Sign Online Handypdf

It is also used by shareholders to report their stock and bond transactions with each other. The form must be filed annually no later than february 15th of the following year. The form 8824 is due at the end of the tax year in which you began the transaction, as per the form 8824 instructions. Below are the most popular.

2002 Form 8824 (Fillin Version). LikeKind Exchanges Fill out & sign

Web common questions for form 8824 in proseries. Completing a like kind exchange in the 1040 return. The form must be filed annually no later than february 15th of the following year. Below are the most popular support articles associated with form 8824. Web form 8824, corporation exchange, is used by us corporations to report their stock and bond transactions.

How can/should I fill out Form 8824 with the following information

The form must be filed annually no later than february 15th of the following year. Solved • by intuit • 3 • updated 1 year ago. Web form 8824, corporation exchange, is used by us corporations to report their stock and bond transactions with the sec. Name(s) shown on tax return. Below are the most popular support articles associated with.

Form 8824 Do it correctly Michael Lantrip Wrote The Book

Certain exchanges of property are not taxable. Web common questions for form 8824 in proseries. It is also used by shareholders to report their stock and bond transactions with each other. Completing a like kind exchange in the 1040 return. Below are the most popular support articles associated with form 8824.

Instructions For Form 8824 LikeKind Exchanges (And Section 1043

Go to www.irs.gov/form8824 for instructions and the latest information. Web form 8824, corporation exchange, is used by us corporations to report their stock and bond transactions with the sec. The form 8824 is due at the end of the tax year in which you began the transaction, as per the form 8824 instructions. However, the property involved must be used.

Irs Form 8824 Simple Worksheet lalarextra

Solved • by intuit • 3 • updated 1 year ago. Below are the most popular support articles associated with form 8824. It is also used by shareholders to report their stock and bond transactions with each other. Web a taxpayer who is a head of household, a surviving spouse, or spouse filing a joint return with adjusted gross income.

IRS 4797 2020 Fill out Tax Template Online US Legal Forms

Web common questions for form 8824 in proseries. The form 8824 is due at the end of the tax year in which you began the transaction, as per the form 8824 instructions. Web form 8824, corporation exchange, is used by us corporations to report their stock and bond transactions with the sec. Use parts i, ii, and iii of form.

Instructions For Form 8824 LikeKind Exchanges (And Section 1043

Also file form 8824 for the 2 years following the year of a related. It is also used by shareholders to report their stock and bond transactions with each other. Completing a like kind exchange in the 1040 return. See the instructions for exceptions. This means any gain from the exchange is not recognized, and any loss cannot be deducted.

Below Are The Most Popular Support Articles Associated With Form 8824.

Web a taxpayer who is a head of household, a surviving spouse, or spouse filing a joint return with adjusted gross income (agi) of $500,000 or more for the taxable year in which the exchange begins. Certain exchanges of property are not taxable. Go to www.irs.gov/form8824 for instructions and the latest information. Web common questions for form 8824 in proseries.

Solved • By Intuit • 3 • Updated 1 Year Ago.

Web form 8824, corporation exchange, is used by us corporations to report their stock and bond transactions with the sec. This means any gain from the exchange is not recognized, and any loss cannot be deducted. However, the property involved must be used for business or investment. Completing a like kind exchange in the 1040 return.

Any Other Taxpayer Filing An Individual Return With Agi Of $250,000 Or More For The Taxable Year In Which The Exchange Begins.

The form 8824 is due at the end of the tax year in which you began the transaction, as per the form 8824 instructions. It is also used by shareholders to report their stock and bond transactions with each other. See the instructions for exceptions. Name(s) shown on tax return.

The Form Must Be Filed Annually No Later Than February 15Th Of The Following Year.

Also file form 8824 for the 2 years following the year of a related. Use parts i, ii, and iii of form 8824 to report each exchange of business or investment property for property of a like kind.