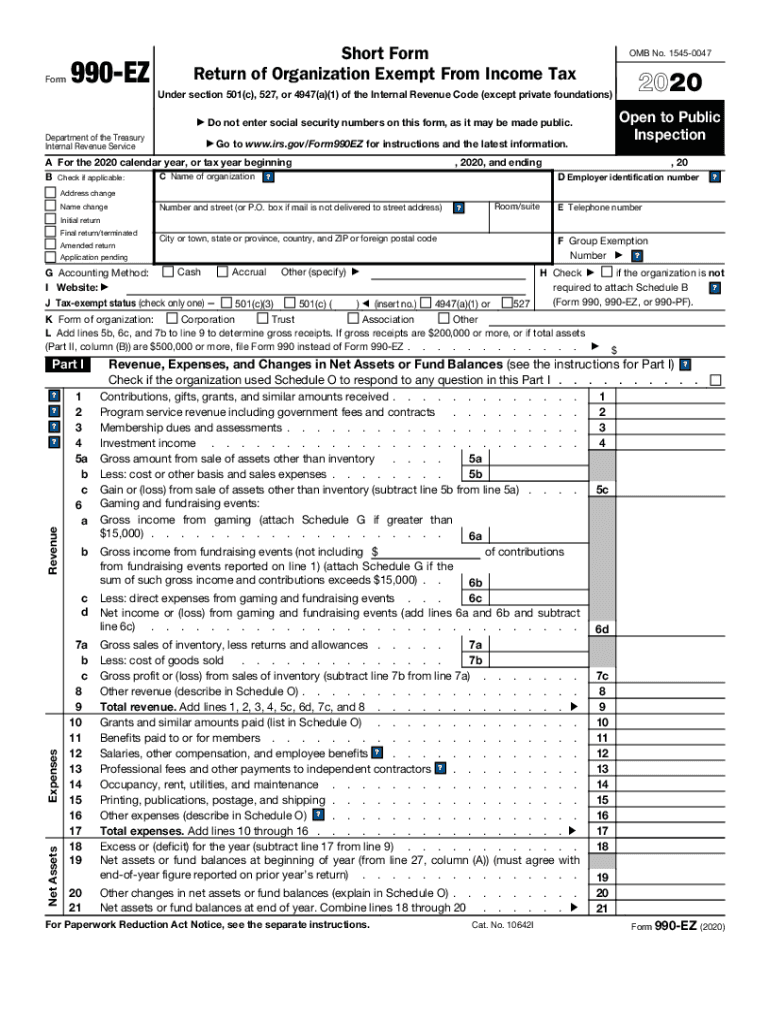

Form 990 Ez 2020

Form 990 Ez 2020 - The following are examples when form 990 return of organization exempt from income tax must be utilized: Address change name change initial return final return/terminated amended return application pending c Short form return of organization exempt from income tax. Department of the treasury internal revenue service. From part i exclusively religious, charitable, etc., contributions to organizations described in section 501(c)(7), (8), or (10) that total more than $1,000 for the year from any one contributor. Public charity status and public support. Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Web go to www.irs.gov/form990ez for instructions and the latest information. If form 990, part ix, line 2 exceeds $5,000, form 990 will be generated in the. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public.

Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Public charity status and public support. Department of the treasury internal revenue service. Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. The following are examples when form 990 return of organization exempt from income tax must be utilized: If form 990, part ix, line 2 exceeds $5,000, form 990 will be generated in the. From part i exclusively religious, charitable, etc., contributions to organizations described in section 501(c)(7), (8), or (10) that total more than $1,000 for the year from any one contributor. Web go to www.irs.gov/form990ez for instructions and the latest information. Address change name change initial return final return/terminated amended return application pending c Short form return of organization exempt from income tax.

Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. The following are examples when form 990 return of organization exempt from income tax must be utilized: Public charity status and public support. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Address change name change initial return final return/terminated amended return application pending c Web go to www.irs.gov/form990ez for instructions and the latest information. Department of the treasury internal revenue service. Short form return of organization exempt from income tax. If form 990, part ix, line 2 exceeds $5,000, form 990 will be generated in the. From part i exclusively religious, charitable, etc., contributions to organizations described in section 501(c)(7), (8), or (10) that total more than $1,000 for the year from any one contributor.

IRS 990EZ 2020 Fill out Tax Template Online US Legal Forms

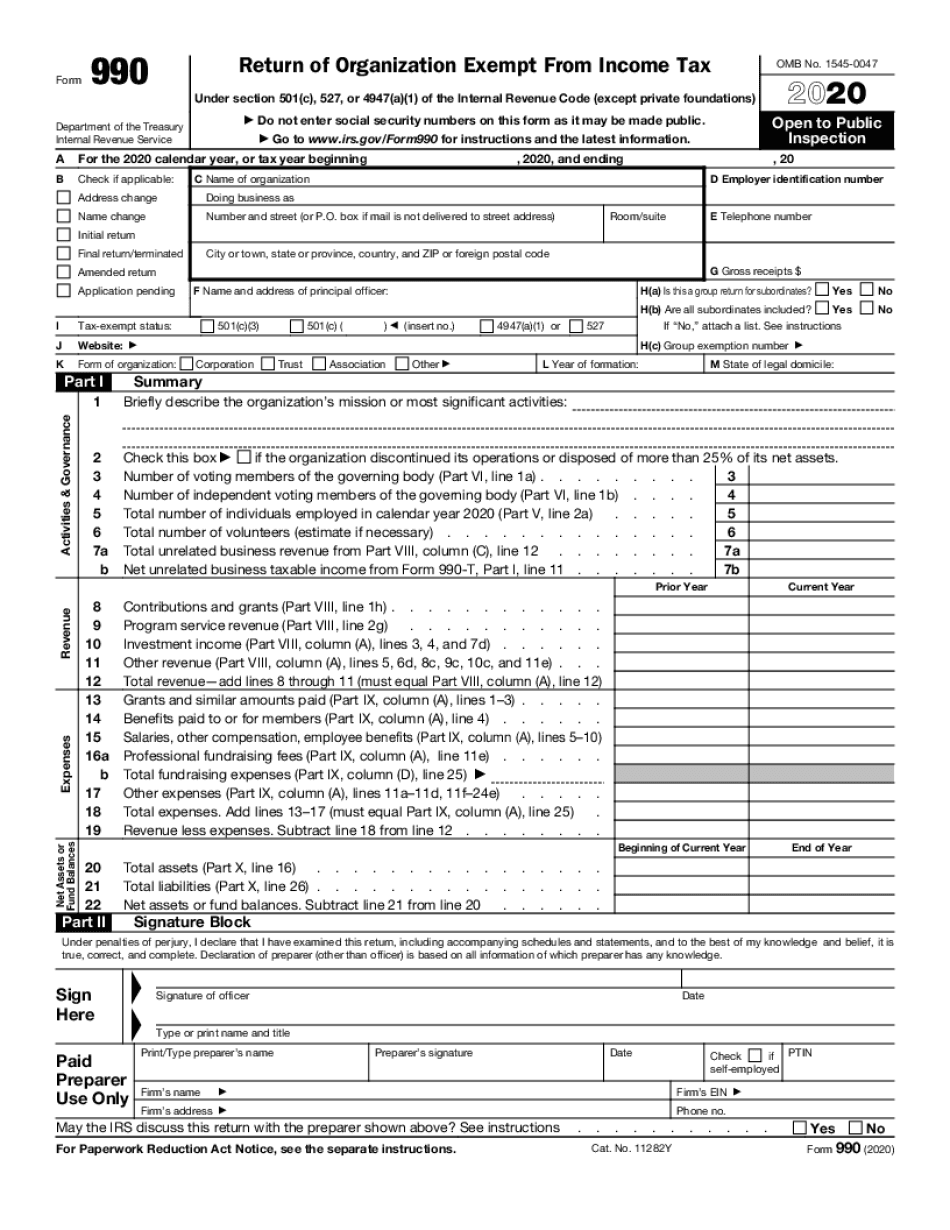

Public charity status and public support. Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Department of the treasury internal revenue service. The following are examples when form 990 return of organization exempt from income tax must be utilized: If form 990, part ix, line 2 exceeds $5,000, form 990 will be generated.

Understanding Form 990EZ Fundraising Events ExpressTaxExempt YouTube

Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Address change name change initial return final return/terminated amended return application pending c Public charity status and public support. Department of the treasury internal revenue service. From part i exclusively religious,.

Our Document Editor For 990 Form Is Your Good Luck

Address change name change initial return final return/terminated amended return application pending c If form 990, part ix, line 2 exceeds $5,000, form 990 will be generated in the. Public charity status and public support. Short form return of organization exempt from income tax. The following are examples when form 990 return of organization exempt from income tax must be.

How Do I Complete The Form 990EZ?

The following are examples when form 990 return of organization exempt from income tax must be utilized: Web go to www.irs.gov/form990ez for instructions and the latest information. Short form return of organization exempt from income tax. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as.

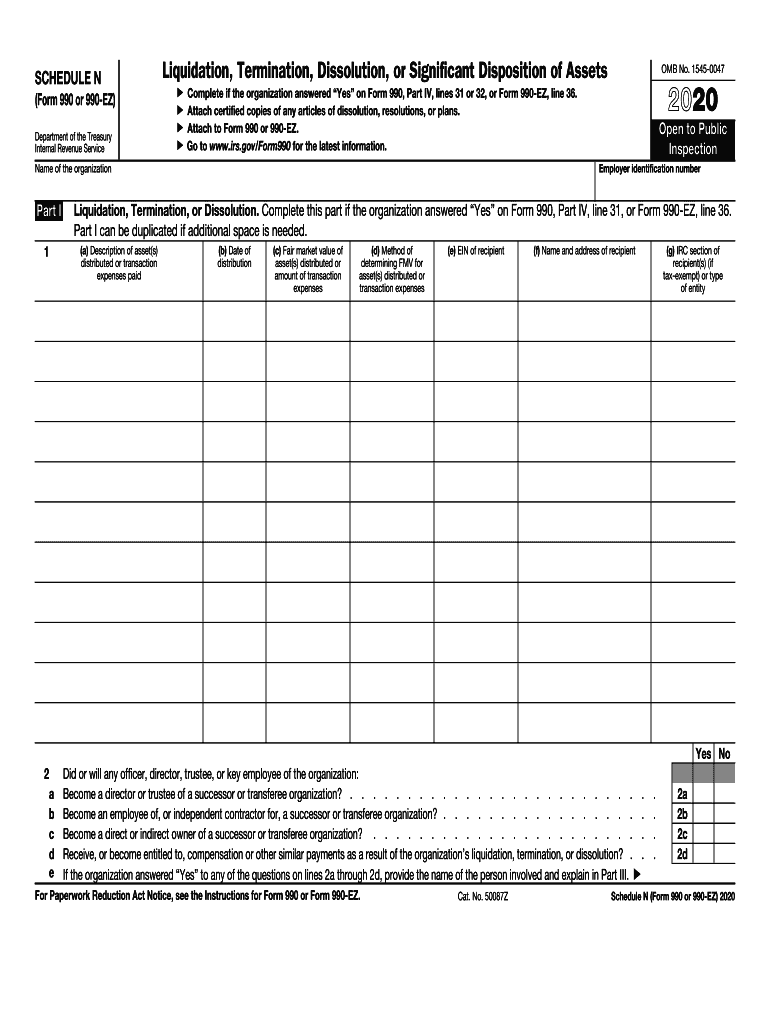

990 Schedule N Fill Out and Sign Printable PDF Template signNow

Address change name change initial return final return/terminated amended return application pending c Short form return of organization exempt from income tax. The following are examples when form 990 return of organization exempt from income tax must be utilized: From part i exclusively religious, charitable, etc., contributions to organizations described in section 501(c)(7), (8), or (10) that total more than.

Form990 (20192020) by OutreachWorks Issuu

From part i exclusively religious, charitable, etc., contributions to organizations described in section 501(c)(7), (8), or (10) that total more than $1,000 for the year from any one contributor. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Complete if.

Fillable Schedule O (Form 990 Or 990Ez) Supplemental Information To

Department of the treasury internal revenue service. The following are examples when form 990 return of organization exempt from income tax must be utilized: Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. If form 990, part ix, line 2 exceeds $5,000, form 990 will be generated in the. Under section 501(c), 527,.

Fill Free fillable Form 2020 990EZ Short Form Return of

Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. If form 990, part ix, line 2 exceeds $5,000, form 990 will be generated in the. Department of the treasury internal revenue service. Address change name change initial return final return/terminated.

Irs Form 990 Ez Instructions Form Resume Examples n49mwoeVZz

Department of the treasury internal revenue service. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. From part i exclusively religious, charitable, etc., contributions to organizations described in section 501(c)(7), (8), or (10) that total more than $1,000 for the.

IRS Form 990 Schedule O Instructions Supplemental Information

If form 990, part ix, line 2 exceeds $5,000, form 990 will be generated in the. From part i exclusively religious, charitable, etc., contributions to organizations described in section 501(c)(7), (8), or (10) that total more than $1,000 for the year from any one contributor. Web go to www.irs.gov/form990ez for instructions and the latest information. Short form return of organization.

Public Charity Status And Public Support.

From part i exclusively religious, charitable, etc., contributions to organizations described in section 501(c)(7), (8), or (10) that total more than $1,000 for the year from any one contributor. Short form return of organization exempt from income tax. The following are examples when form 990 return of organization exempt from income tax must be utilized: Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust.

Address Change Name Change Initial Return Final Return/Terminated Amended Return Application Pending C

Web go to www.irs.gov/form990ez for instructions and the latest information. If form 990, part ix, line 2 exceeds $5,000, form 990 will be generated in the. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Department of the treasury internal revenue service.