Goodwill Tax Form

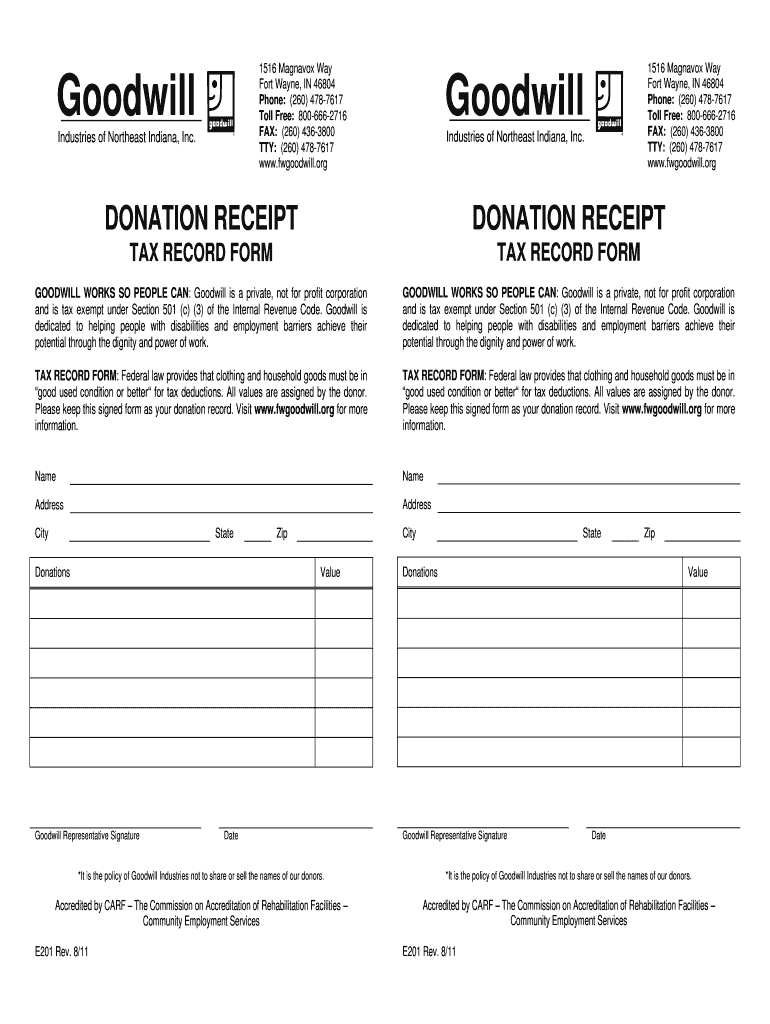

Goodwill Tax Form - To help guide you, goodwill industries. In this article, we will explain the types of contributions you can deduct and what organizations you can make deductible charitable. Donor is responsible for written verification of value for any. Web federal law provides that clothing and household goods must be in “good used condition or better” for tax deductions. If you donated to a. Web return of organization exempt from income tax omb no. Web taxes and your donations. Generally, when this occurs, each asset. We inspire you to use our advanced technologies. This type of tax record form is sufficiently straightforward and intuitive to fill out.

We inspire you to use our advanced technologies. Web tax deductions for donations if you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill cash or material donations. In this article, we will explain the types of contributions you can deduct and what organizations you can make deductible charitable. Made fillable by eforms goodwill associate record date: Generally, when this occurs, each asset. Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or. You may be able to deduct the value of your donations if you choose to itemize them on your taxes. Goodwill industries international supports a network of more than 150 local goodwill organizations. Internal revenue service (irs) requires donors to value their items. Web federal law provides that clothing and household goods must be in “good used condition or better” for tax deductions.

Goodwill spends 90¢ of every dollar on programs & services for local job seekers. Web a limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes. Generally, when this occurs, each asset. Instead, all the assets of the business are sold. Internal revenue service (irs) requires donors to value their items. Download or email form e201 & more fillable forms, register and subscribe now! Web valuation guide for goodwill donors. Web valuation guide for goodwill donors the u.s. Web so, how can you claim a goodwill tax deduction? Donor is responsible for written verification of value for any.

How to Get Tax Deductions on Goodwill Donations 15 Steps

We inspire you to use our advanced technologies. In this article, we will explain the types of contributions you can deduct and what organizations you can make deductible charitable. Web tax deductions for donations if you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill cash or material donations. Web filling.

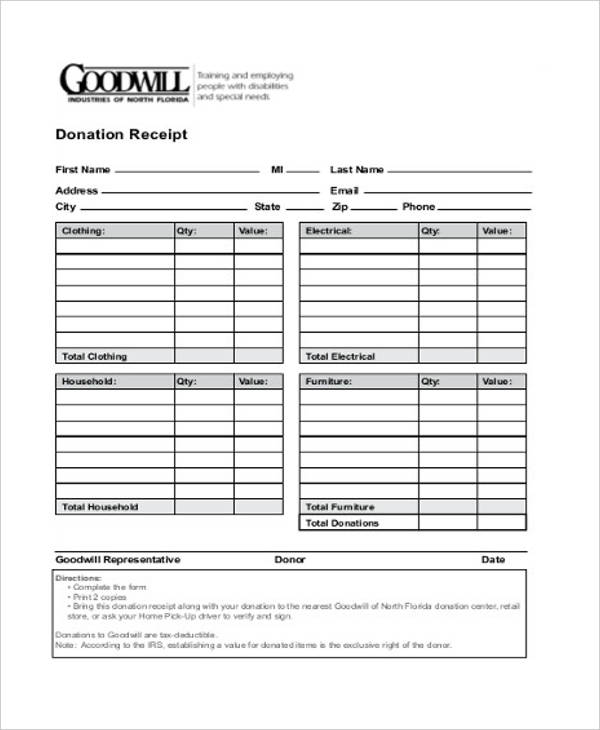

Free Goodwill Donation Receipt Template PDF eForms

Generally, when this occurs, each asset. Web sale of a business the sale of a business usually is not a sale of one asset. This type of tax record form is sufficiently straightforward and intuitive to fill out. Web valuation guide for goodwill donors. Web so, how can you claim a goodwill tax deduction?

How to fill out a Goodwill Donation Tax Receipt Goodwill NNE

Web taxes and your donations. Internal revenue service (irs) requires donors to value their items. To help guide you, goodwill industries international has. Goodwill spends 90¢ of every dollar on programs & services for local job seekers. In this article, we will explain the types of contributions you can deduct and what organizations you can make deductible charitable.

Goodwill Clothing Donation Form Template Donation form, Goodwill

Download or email form e201 & more fillable forms, register and subscribe now! Web return of organization exempt from income tax omb no. Donor is responsible for written verification of value for any. Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale.

How to Get Tax Deductions on Goodwill Donations 15 Steps

You may be able to deduct the value of your donations if you choose to itemize them on your taxes. Donors are responsible for valuing their donations. Web so, how can you claim a goodwill tax deduction? Made fillable by eforms goodwill associate record date: Instead, all the assets of the business are sold.

Donation Calculator Spreadsheet Inspirational Goodwill Values Tax

Edit, sign and save goodwill e201 form. Internal revenue service (irs) requires donors to value their items. Donor is responsible for written verification of value for any. To help guide you, goodwill industries. Generally, when this occurs, each asset.

Donation Form Template For Non Profit DocTemplates

Web about goodwill industries international. Web federal law provides that clothing and household goods must be in “good used condition or better” for tax deductions. Donors are responsible for valuing their donations. Goodwill spends 90¢ of every dollar on programs & services for local job seekers. Donor is responsible for written verification of value for any.

Goodwill Donation Receipt Fill Online Printable Fillable —

This type of tax record form is sufficiently straightforward and intuitive to fill out. Web taxes and your donations. Internal revenue service (irs) requires donors to value their items. Made fillable by eforms goodwill associate record date: In this article, we will explain the types of contributions you can deduct and what organizations you can make deductible charitable.

How to Get Tax Deductions on Goodwill Donations 15 Steps

In this article, we will explain the types of contributions you can deduct and what organizations you can make deductible charitable. Web valuation guide for goodwill donors the u.s. Web sale of a business the sale of a business usually is not a sale of one asset. Donor is responsible for written verification of value for any. Web a limited.

Did you make a tax deductible donation to Goodwill and need to fill out

Web sale of a business the sale of a business usually is not a sale of one asset. You may be able to deduct the value of your donations if you choose to itemize them on your taxes. Web so, how can you claim a goodwill tax deduction? Donors are responsible for valuing their donations. How much can you deduct.

Web Sale Of A Business The Sale Of A Business Usually Is Not A Sale Of One Asset.

Web filling out goodwill donation receipt. Web taxes and your donations. Edit, sign and save goodwill e201 form. Made fillable by eforms goodwill associate record date:

We Inspire You To Use Our Advanced Technologies.

Instead, all the assets of the business are sold. Goodwill industries international supports a network of more than 150 local goodwill organizations. Web a limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes. Web return of organization exempt from income tax omb no.

To Help Guide You, Goodwill Industries International Has.

Donors are responsible for valuing their donations. If you donated to a. Goodwill spends 90¢ of every dollar on programs & services for local job seekers. You may be able to deduct the value of your donations if you choose to itemize them on your taxes.

Internal Revenue Service (Irs) Requires Donors To Value Their Items.

Web so, how can you claim a goodwill tax deduction? To help guide you, goodwill industries. Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or. This type of tax record form is sufficiently straightforward and intuitive to fill out.