Hawaii Estimated Tax Form

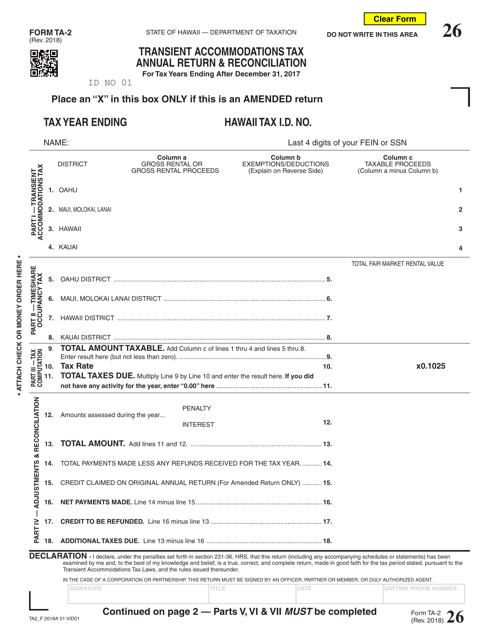

Hawaii Estimated Tax Form - † taxpayers may exclude up to $6,943 of their military reserve or. If you make $70,000 a year living in hawaii you will be taxed $12,921. Web to make a tax payment on or before april 20, you can submit an electronic payment via hawaii tax online (hitax.hawaii.gov) by selecting “make payment” under. This form should be filled out electronically. The federal or irs taxes are listed. View all 165 hawaii income tax forms disclaimer: Sba.gov's business licenses and permits search tool. Web hawaii business express is a state website that lets new businesses register with multiple agencies online. Web if you do not pay estimated taxes this year and you owe at least $500 in taxes for the year, you may incur a penalty that will be added to your tax liability. Web the hawaii tax estimator lets you calculate your state taxes for the tax year.

Do not photocop y this form. Web here's a list of some of the most commonly used hawaii tax forms: Your average tax rate is. Web the hawaii tax estimator lets you calculate your state taxes for the tax year. View all 165 hawaii income tax forms disclaimer: † taxpayers may exclude up to $6,943 of their military reserve or. Web if you do not pay estimated taxes this year and you owe at least $500 in taxes for the year, you may incur a penalty that will be added to your tax liability. If you make $70,000 a year living in hawaii you will be taxed $12,921. Sba.gov's business licenses and permits search tool. Web hawaii business express is a state website that lets new businesses register with multiple agencies online.

The federal or irs taxes are listed. Sba.gov's business licenses and permits search tool. Web here's a list of some of the most commonly used hawaii tax forms: Web hawaii business express is a state website that lets new businesses register with multiple agencies online. Your average tax rate is. This form should be filled out electronically. Do not photocop y this form. Web if you do not pay estimated taxes this year and you owe at least $500 in taxes for the year, you may incur a penalty that will be added to your tax liability. Web the hawaii tax estimator lets you calculate your state taxes for the tax year. Web to make a tax payment on or before april 20, you can submit an electronic payment via hawaii tax online (hitax.hawaii.gov) by selecting “make payment” under.

Hawaii Corporate Tax Return Extension TAXW

This form should be filled out electronically. Web here's a list of some of the most commonly used hawaii tax forms: Web hawaii business express is a state website that lets new businesses register with multiple agencies online. If you make $70,000 a year living in hawaii you will be taxed $12,921. † taxpayers may exclude up to $6,943 of.

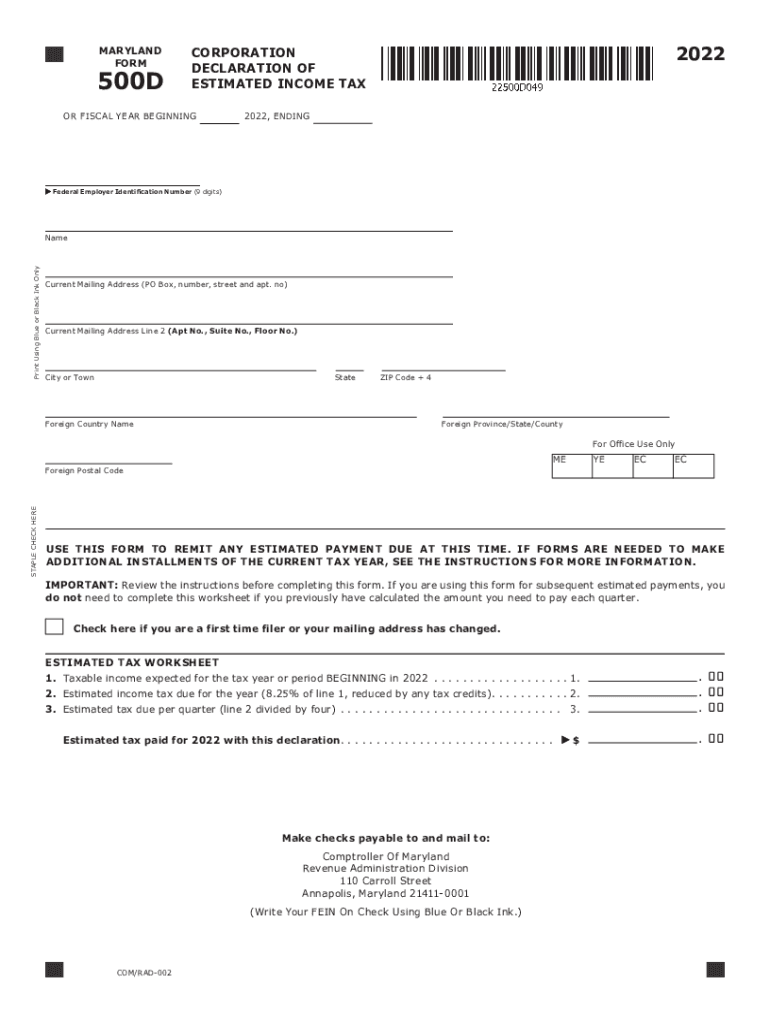

Maryland Estimated Tax Form 2020

Sba.gov's business licenses and permits search tool. This form should be filled out electronically. Web to make a tax payment on or before april 20, you can submit an electronic payment via hawaii tax online (hitax.hawaii.gov) by selecting “make payment” under. Your average tax rate is. Web here's a list of some of the most commonly used hawaii tax forms:

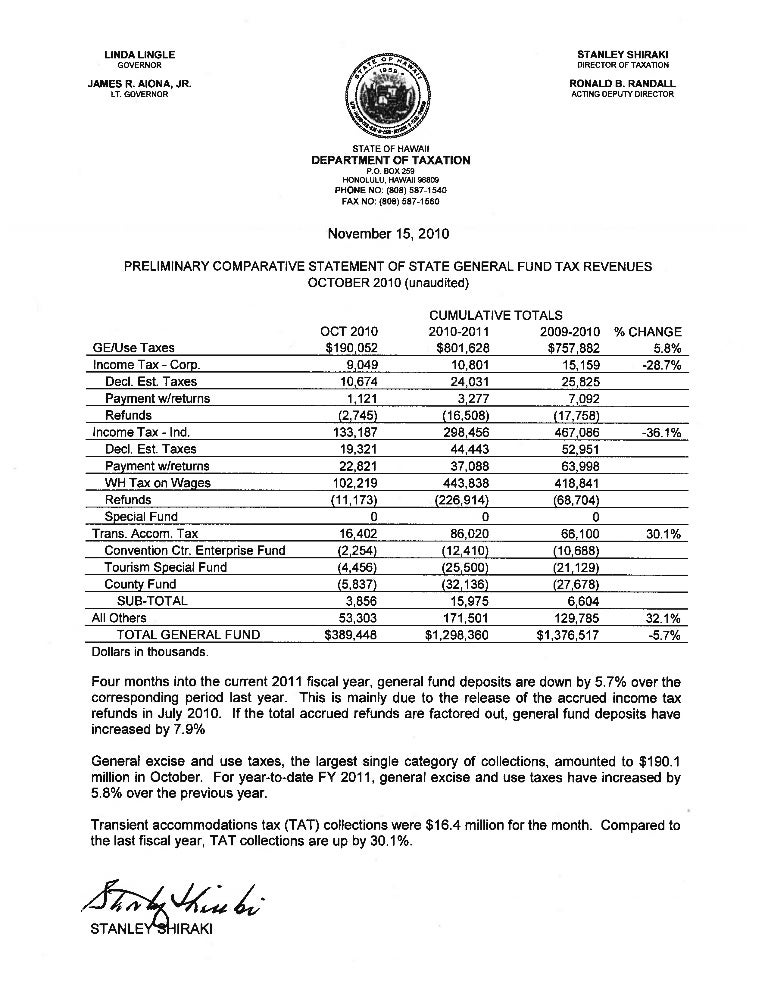

Hawaii State General Excise Tax Due Date Tax Walls

Web the hawaii tax estimator lets you calculate your state taxes for the tax year. Do not photocop y this form. Web hawaii business express is a state website that lets new businesses register with multiple agencies online. This form should be filled out electronically. The federal or irs taxes are listed.

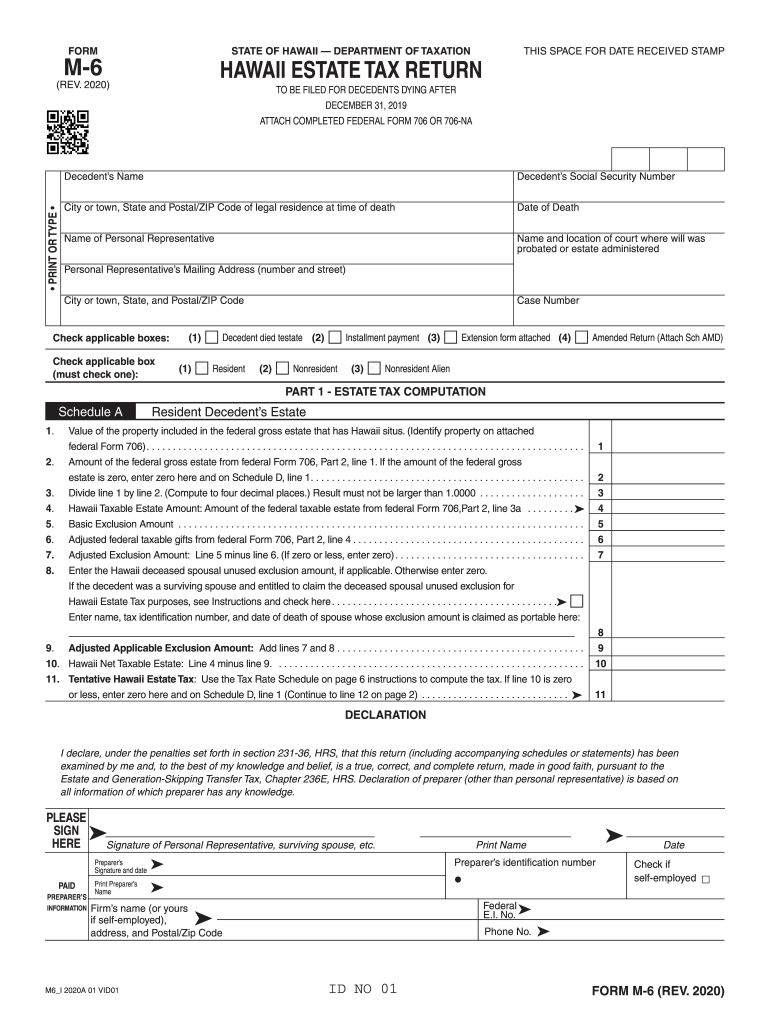

Estate And Transfer Tax Department Of Taxation Hawaii gov Fill Out

Web to make a tax payment on or before april 20, you can submit an electronic payment via hawaii tax online (hitax.hawaii.gov) by selecting “make payment” under. Web if you do not pay estimated taxes this year and you owe at least $500 in taxes for the year, you may incur a penalty that will be added to your tax.

2022 Form MD Comptroller 500D Fill Online, Printable, Fillable, Blank

This form should be filled out electronically. Your average tax rate is. Sba.gov's business licenses and permits search tool. Web the hawaii tax estimator lets you calculate your state taxes for the tax year. Web hawaii business express is a state website that lets new businesses register with multiple agencies online.

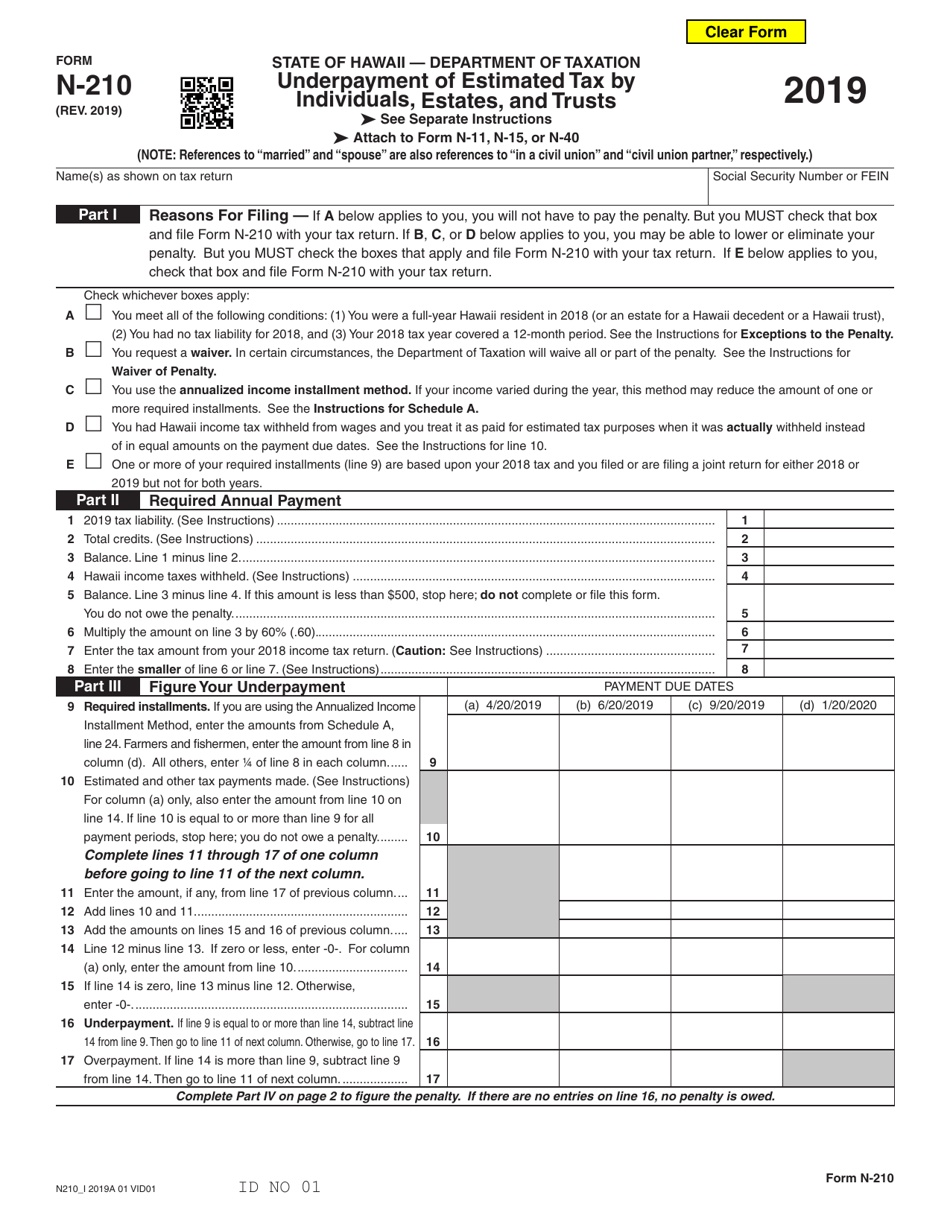

Form N210 Download Fillable PDF or Fill Online Underpayment of

View all 165 hawaii income tax forms disclaimer: Web to make a tax payment on or before april 20, you can submit an electronic payment via hawaii tax online (hitax.hawaii.gov) by selecting “make payment” under. If you make $70,000 a year living in hawaii you will be taxed $12,921. Your average tax rate is. † taxpayers may exclude up to.

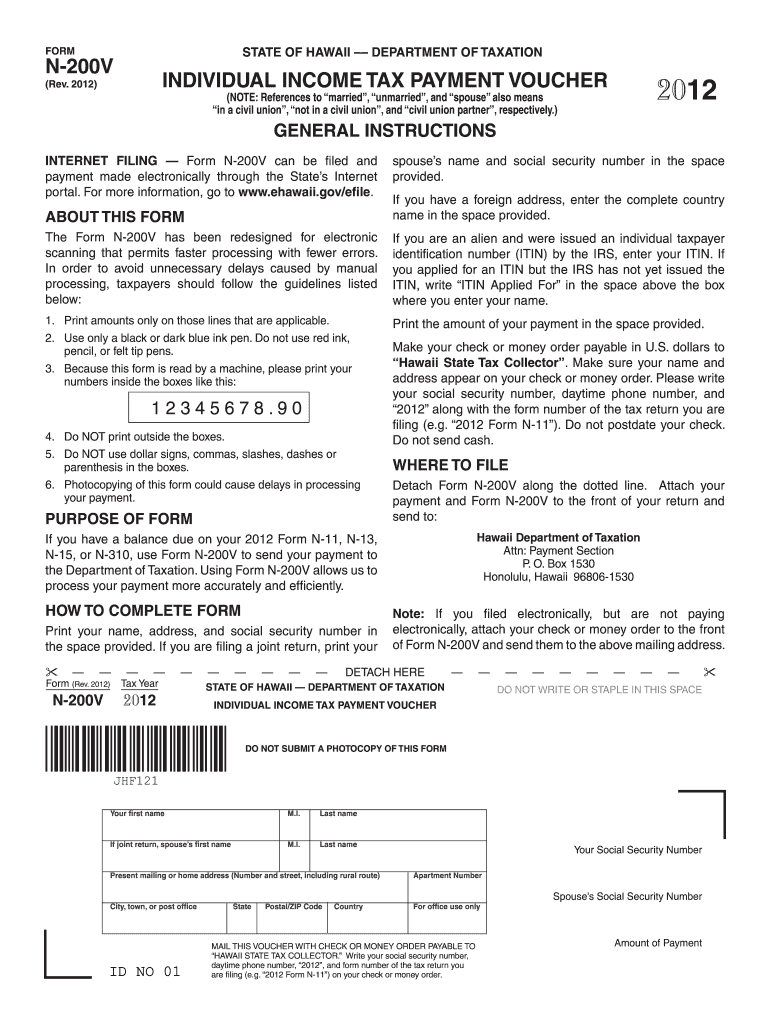

Hawaii Form N 200v 2021 Fill Out and Sign Printable PDF Template

† taxpayers may exclude up to $6,943 of their military reserve or. Do not photocop y this form. Sba.gov's business licenses and permits search tool. If you make $70,000 a year living in hawaii you will be taxed $12,921. Web here's a list of some of the most commonly used hawaii tax forms:

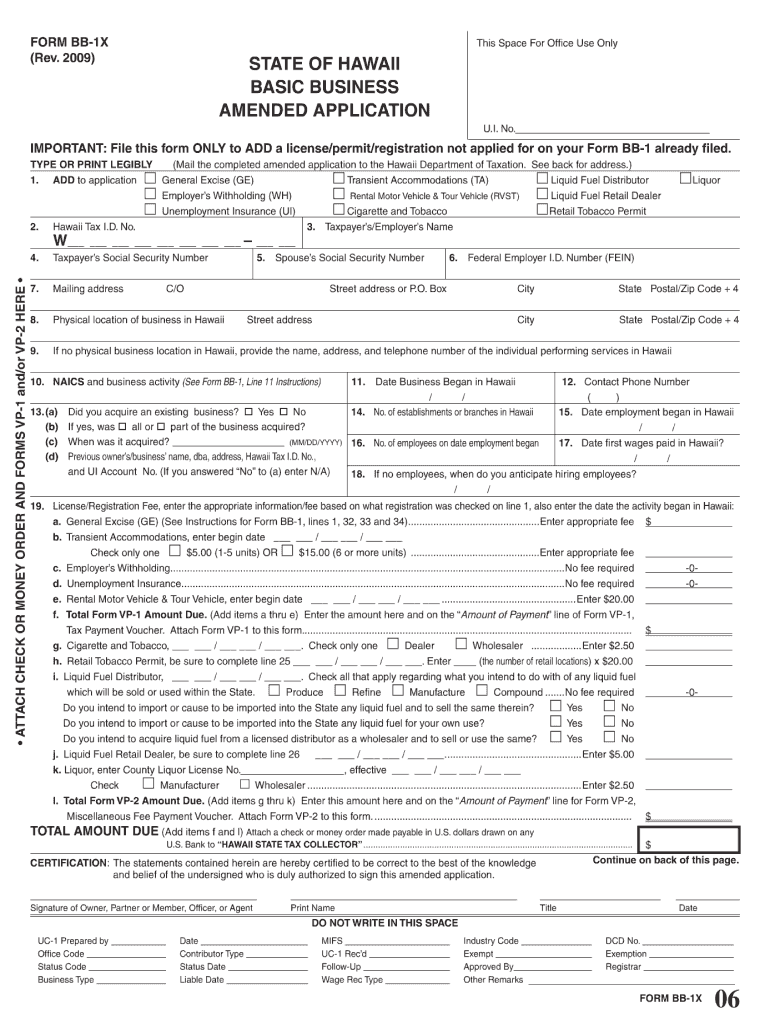

Hawaii tax forms Fill Out and Sign Printable PDF Template signNow

Web to make a tax payment on or before april 20, you can submit an electronic payment via hawaii tax online (hitax.hawaii.gov) by selecting “make payment” under. Sba.gov's business licenses and permits search tool. Web hawaii business express is a state website that lets new businesses register with multiple agencies online. If you make $70,000 a year living in hawaii.

General Excise And Use Tax Department Of Taxation Hawaii gov Fill Out

The federal or irs taxes are listed. † taxpayers may exclude up to $6,943 of their military reserve or. Web hawaii business express is a state website that lets new businesses register with multiple agencies online. Do not photocop y this form. Web the hawaii tax estimator lets you calculate your state taxes for the tax year.

† Taxpayers May Exclude Up To $6,943 Of Their Military Reserve Or.

Web to make a tax payment on or before april 20, you can submit an electronic payment via hawaii tax online (hitax.hawaii.gov) by selecting “make payment” under. This form should be filled out electronically. Your average tax rate is. Do not photocop y this form.

If You Make $70,000 A Year Living In Hawaii You Will Be Taxed $12,921.

View all 165 hawaii income tax forms disclaimer: Web if you do not pay estimated taxes this year and you owe at least $500 in taxes for the year, you may incur a penalty that will be added to your tax liability. Web here's a list of some of the most commonly used hawaii tax forms: Web the hawaii tax estimator lets you calculate your state taxes for the tax year.

Sba.gov's Business Licenses And Permits Search Tool.

The federal or irs taxes are listed. Web hawaii business express is a state website that lets new businesses register with multiple agencies online.