How To File Form 8832

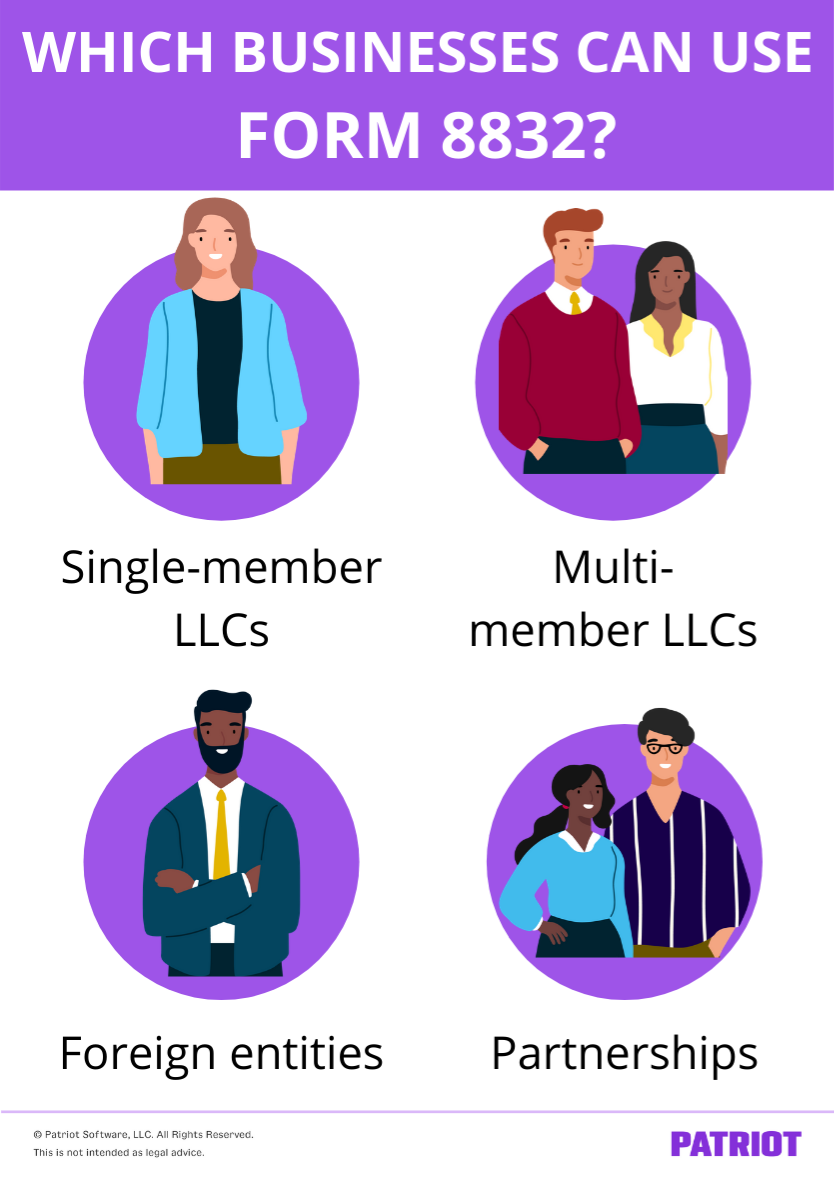

How To File Form 8832 - Pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. Part 1 of irs form 8832 asks a series of questions regarding your tax. Choose the proper type of election. Web where to file form 8832: You will receive acknowledgment and approval from the irs. Fill out your basic information. Lines 2a and 2b ask whether you’ve filed to change your status within the last 60 months (5 years). In this section, you will need to check one of two boxes. Before you rush to hand in form 8832, make sure you know about form. ~7 hours (irs estimate) turnaround:

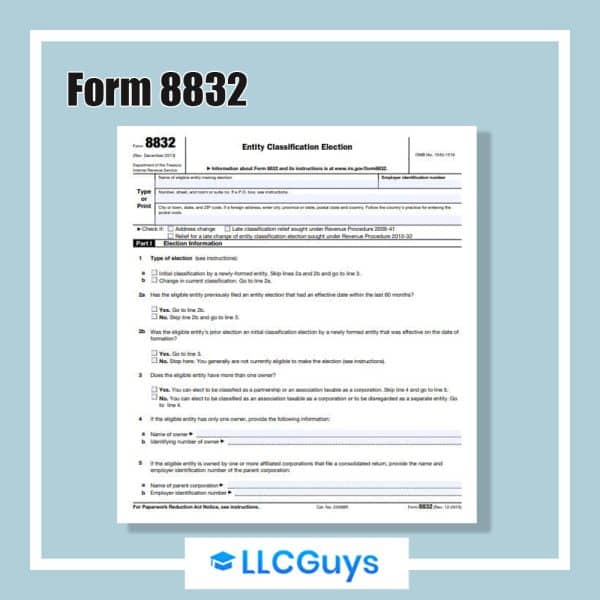

Form 8832 is divided into two parts: Depending on your financial situation, changing your tax classification could lower your total tax bill. Just as you would on any tax document, fill in your business’s name, address, and. Complete part 1, election information. Lines 2a and 2b ask whether you’ve filed to change your status within the last 60 months (5 years). Fill out your basic information. Web where to file form 8832: Web if classifying your business as a different type of entity would be advantageous, you’ll need to file form 8832 with the irs. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Other tax election forms to know about.

Before you rush to hand in form 8832, make sure you know about form. Pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. You will receive acknowledgment and approval from the irs. Form 8832 is divided into two parts: Just as you would on any tax document, fill in your business’s name, address, and. Web the entity failed to qualify as a corporation solely because form 8832 was not timely filed; The location you send the form depends on the state or country your business calls home. Web llcs can file form 8832, entity classification election to elect their business entity classification. Lines 2a and 2b ask whether you’ve filed to change your status within the last 60 months (5 years). Choose the proper type of election.

What Is IRS Form 8832? Definition, Deadline, & More

And the entity timely filed all required federal tax returns consistent with its requested classification as an s corporation. In this section, you will need to check one of two boxes. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. That’s because different entities are taxed in different ways. Form.

What is Form 8832 and How Do I File it?

Other tax election forms to know about. Pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. Web how to fill out form 8832 in 9 steps 1. Just as you would on any tax document, fill in your business’s name, address, and. And the entity timely filed all required.

IRS Form 8832 Instructions and FAQs for Business Owners NerdWallet

Web irs form 8832 instructions: Web llcs can file form 8832, entity classification election to elect their business entity classification. You will receive acknowledgment and approval from the irs. Web if classifying your business as a different type of entity would be advantageous, you’ll need to file form 8832 with the irs. And the entity timely filed all required federal.

What Is Form 8832 and How Do I Fill It Out? Ask Gusto

Web how do i fill out form 8832? In our simple guide, we’ll walk you through form 8832 instructions. Form 8832 is not available for submission through efile. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Part 1 of irs form 8832 asks a series of questions regarding your.

Do I Need to File IRS Form 8832 for My Business? The Handy Tax Guy

If the entity qualifies and files timely in accordance with rev. In this section, you will need to check one of two boxes. The location you send the form depends on the state or country your business calls home. Lines 2a and 2b ask whether you’ve filed to change your status within the last 60 months (5 years). In our.

Irs Form 8832 Fillable Pdf Printable Forms Free Online

Web if classifying your business as a different type of entity would be advantageous, you’ll need to file form 8832 with the irs. Web irs form 8832 instructions: Pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. Web information about form 8832, entity classification election, including recent updates, related.

Using Form 8832 to Change Your LLC’s Tax Classification

In this section, you will need to check one of two boxes. Lines 2a and 2b ask whether you’ve filed to change your status within the last 60 months (5 years). The irs form lists two addresses to mail in your form. Complete part 1, election information. In our simple guide, we’ll walk you through form 8832 instructions.

Form 8832 and Changing Your LLC Tax Status Bench Accounting

Web the entity failed to qualify as a corporation solely because form 8832 was not timely filed; Form 8832 is divided into two parts: Choose the proper type of election. Web the first page looks like this: Why would i change my tax classification?

Form 8832 All About It and How to File It?

You can find irs form 8832 on the irs website the first page of the form has. Pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. And the entity timely filed all required federal tax returns consistent with its requested classification as an s corporation. Complete part 1, election.

Form 8832 All About It and How to File It?

Web how to fill out form 8832 in 9 steps 1. ~7 hours (irs estimate) turnaround: Web how do i fill out form 8832? Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Part 1 of irs form 8832 asks a series of questions regarding your tax.

Web If Classifying Your Business As A Different Type Of Entity Would Be Advantageous, You’ll Need To File Form 8832 With The Irs.

Part 1 of irs form 8832 asks a series of questions regarding your tax. Web irs form 8832 instructions: Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Web where to file form 8832:

Form 8832 Is Divided Into Two Parts:

Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Web how do i fill out form 8832? That’s because different entities are taxed in different ways. Web the entity failed to qualify as a corporation solely because form 8832 was not timely filed;

Before You Rush To Hand In Form 8832, Make Sure You Know About Form.

Fill out your basic information. Just as you would on any tax document, fill in your business’s name, address, and. In this section, you will need to check one of two boxes. Pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership.

The Irs Form Lists Two Addresses To Mail In Your Form.

Depending on your financial situation, changing your tax classification could lower your total tax bill. If the entity qualifies and files timely in accordance with rev. And the entity timely filed all required federal tax returns consistent with its requested classification as an s corporation. Web how to fill out form 8832 in 9 steps 1.