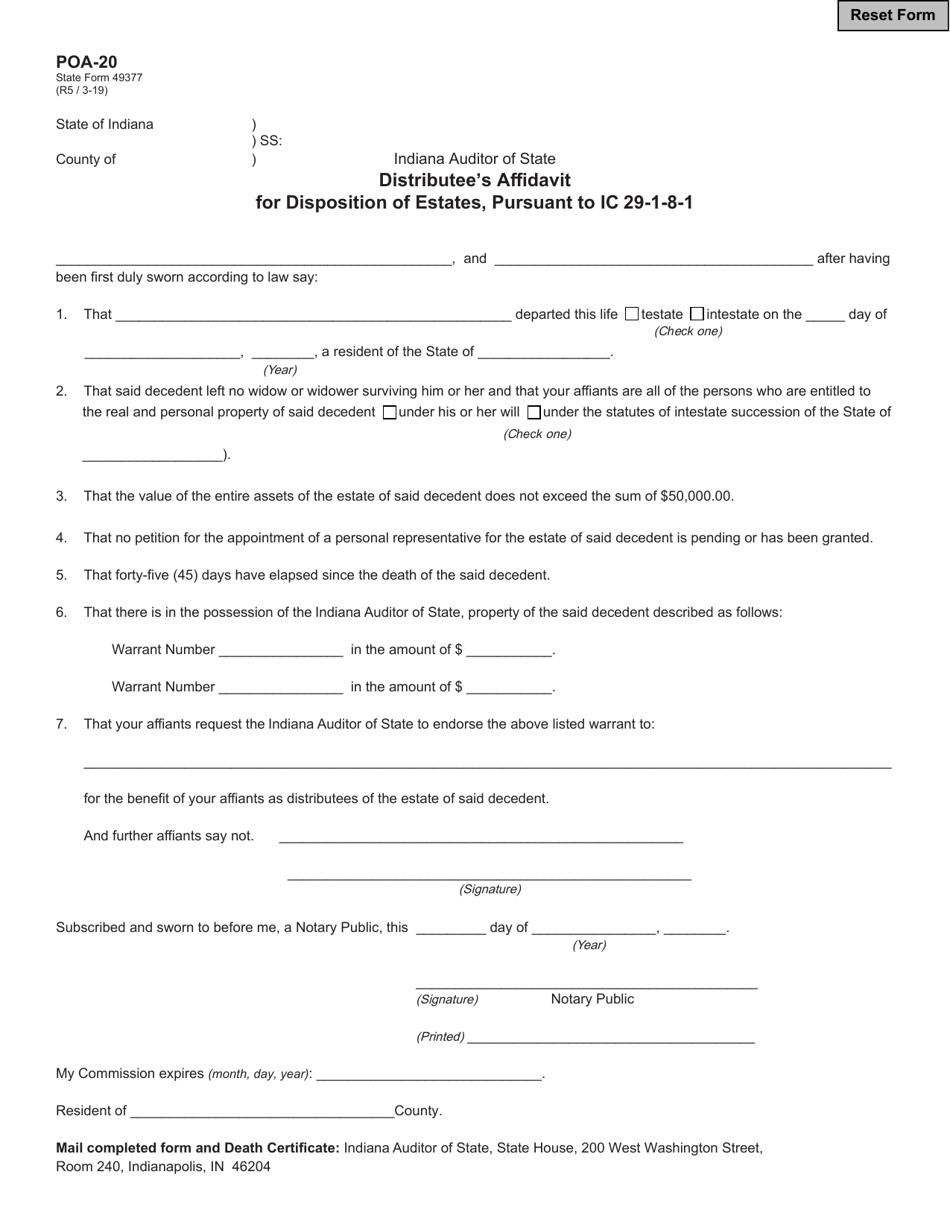

Indiana Form 49377

Indiana Form 49377 - (form 122) report of assessment for omitted or undervalued property assessment and. Web warrant (state form 42850). Complete a federal return.* state residency : The first refund ($125) resulted from indiana closing the 2021 fiscal year with $3.9 billion in reserves to. Web the state comptroller recently processed two automatic taxpayer refunds. Parking ticket / tollway vehicle. The assessed value on the. For questions about a specific form, or to determine. Web if a check is issued to a taxpayer who is deceased, the individual’s estate or surviving heir must complete a distributee’s affidavit for distribution of estates (state. Web indiana current year tax forms forms downloaded and printed from this page may be used to file taxes unless otherwise specified.

Affidavit for disposition of estates,. Web they need to file a “distributee's affidavit for disposition of estates” (state form no. File a business entity report. Parking ticket / tollway vehicle. If a check is issued to an individual who is eligible now deceased, that individual’s estate will be required to complete a distributee’s affidavit for. Web if you’ve received a check addressed to a deceased family member, you need to mail in a form and a copy of the death certificate to the state auditor’s office. Web indiana current year tax forms forms downloaded and printed from this page may be used to file taxes unless otherwise specified. Web warrant (state form 42850). Web form a new business. Web instructions for completing state form 49377 how do i know the distributee’s affidavit for disposition of estates applies to me?

(form 122) report of assessment for omitted or undervalued property assessment and. For questions about a specific form, or to determine. Name state form number description file type; Web forms.in.gov provides citizens and employees of the state of indiana a common access point to electronic state forms. Web they need to file a “distributee's affidavit for disposition of estates” (state form no. Determine the state residency and filing status of the taxpayer choose. Web nine steps to completing an indiana tax return irs return : This is a indiana form and can. Complete a federal return.* state residency : Web if a check is issued to a taxpayer who is deceased, the individual’s estate or surviving heir must complete a distributee’s affidavit for distribution of estates (state.

Fill Free fillable forms State of Indiana

Determine the state residency and filing status of the taxpayer choose. Driver's record, title & lien and registration search. Web if you’ve received a check addressed to a deceased family member, you need to mail in a form and a copy of the death certificate to the state auditor’s office. For questions about a specific form, or to determine. Affidavit.

2011 Form IN SF 39530 Fill Online, Printable, Fillable, Blank pdfFiller

Web the notice of assessment of land and improvements (form 11) is an assessment notice that is sent to taxpayers by the county or township assessor. Web form a new business. If a check is issued to an individual who is eligible now deceased, that individual’s estate will be required to complete a distributee’s affidavit for. Find federal tax forms.

Fill Free fillable forms State of Indiana

49377) with the auditor’s office and include a copy of the death certificate. For questions about a specific form, or to determine. If a check is issued to an individual who is eligible now deceased, that individual’s estate will be required to complete a distributee’s affidavit for. This is a indiana form and can. Web they need to file a.

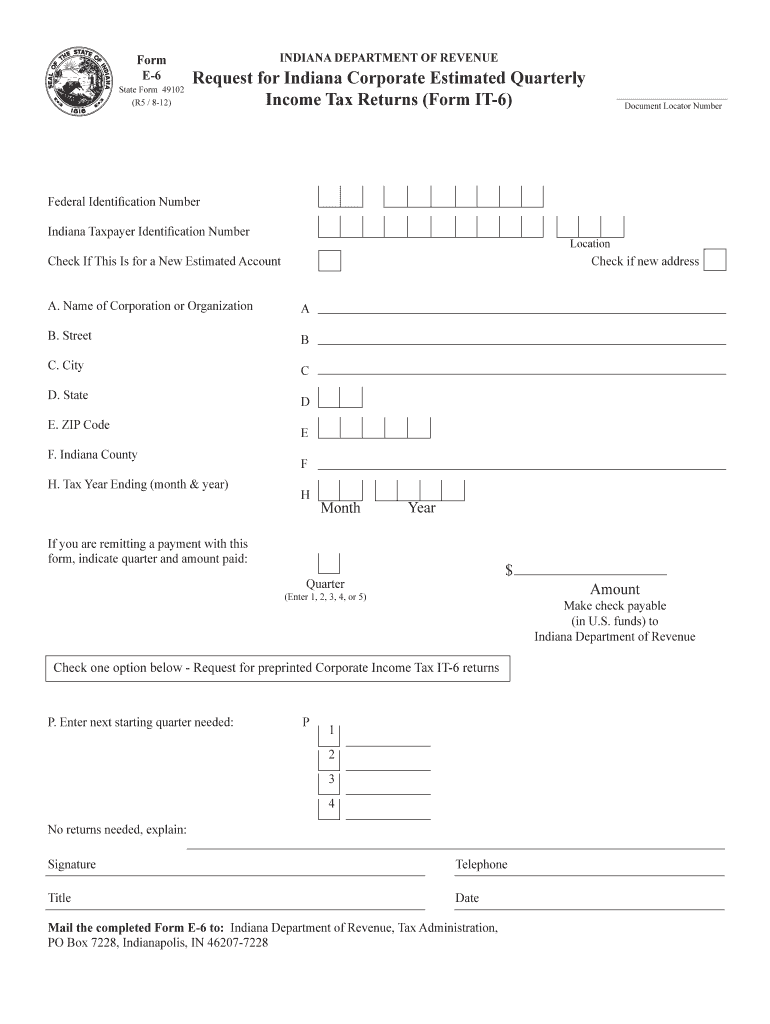

Indiana 6 Form Fill Out and Sign Printable PDF Template signNow

(form 122) report of assessment for omitted or undervalued property assessment and. Affidavit for disposition of estates,. Browse 342 indiana legal forms and. Name state form number description file type; Find federal tax forms (e.g.

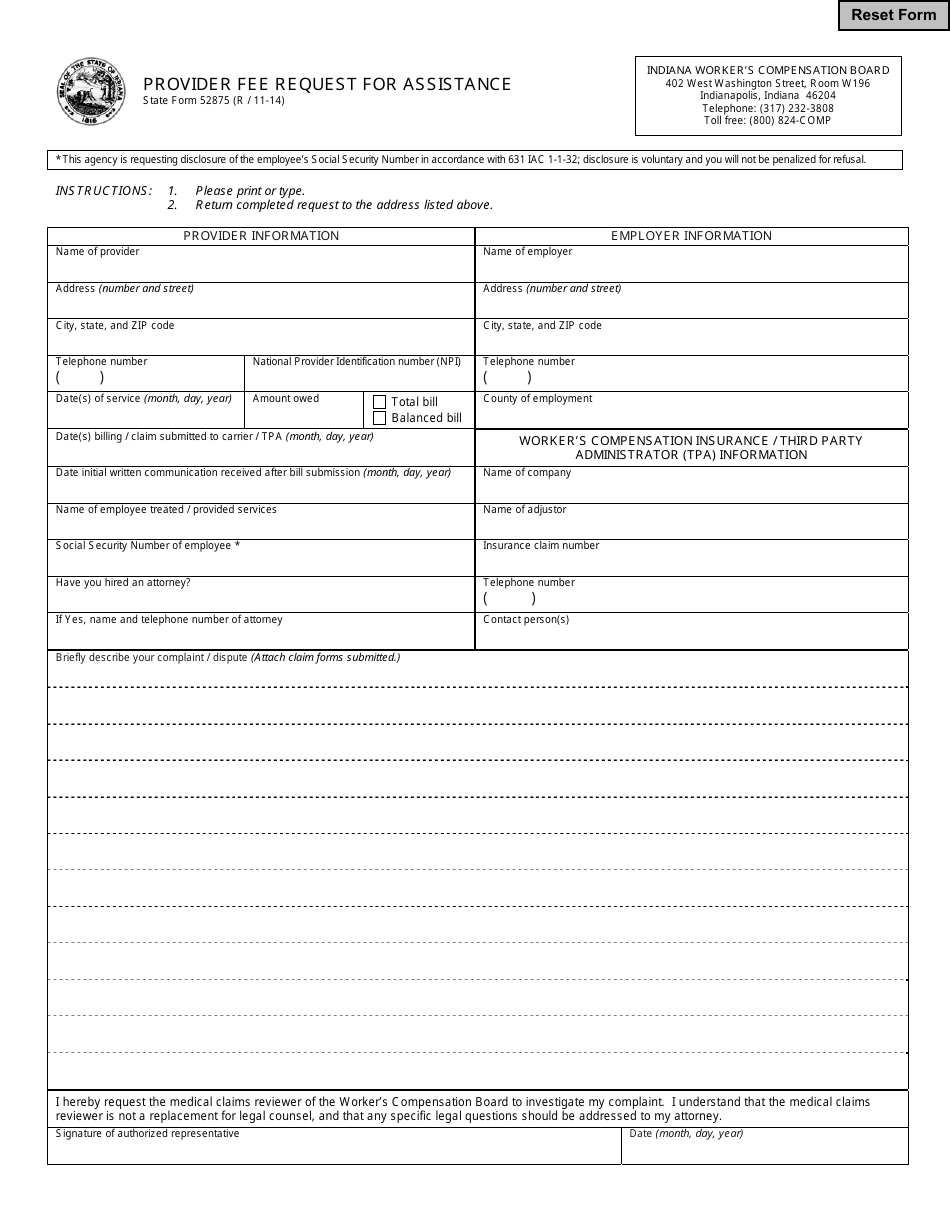

State Form 52875 Download Fillable PDF or Fill Online Provider Fee

Web if you do not find a direct link to the form you need, check the state forms online catalog provided by the indiana archives and records administration (iara). If a check is issued to an individual who is eligible now deceased, that individual’s estate will be required to complete a distributee’s affidavit for. (form 122) report of assessment for.

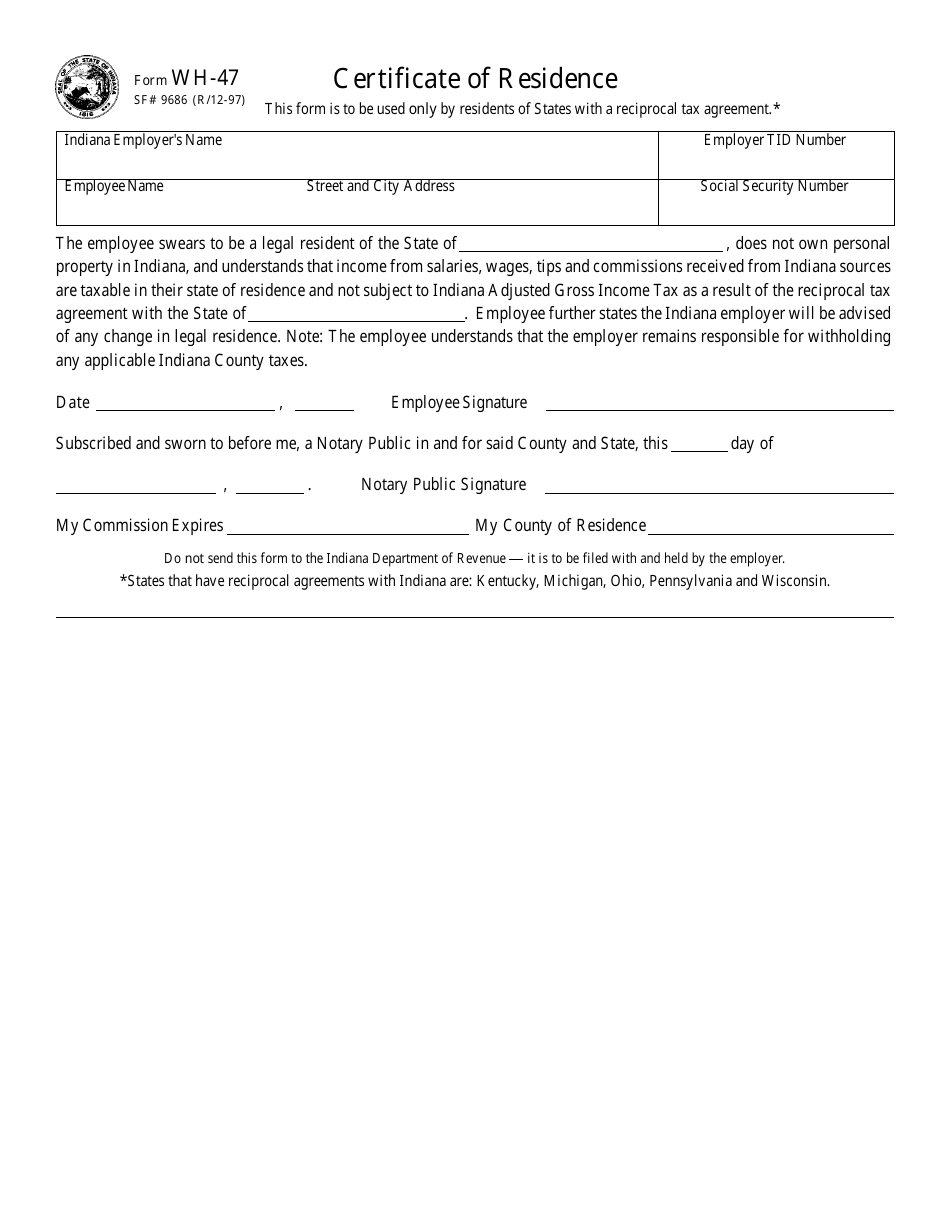

Form SF9686 (WH47) Download Printable PDF or Fill Online Certificate

49377) with the auditor’s office and include a copy of the death certificate. Affidavit for disposition of estates,. The assessed value on the. Web instructions for completing state form 49377 how do i know the distributee’s affidavit for disposition of estates applies to me? Parking ticket / tollway vehicle.

Free Indiana Do Not Resuscitate (DNR) Order Form PDF eForms

Web warrant (state form 42850). 49377) with the auditor’s office and include a copy of the death certificate. Web if you do not have an account with the indiana department of revenue, you need to complete your business registration. Web the state comptroller recently processed two automatic taxpayer refunds. Web they need to file a “distributee's affidavit for disposition of.

1996 IN Form 46800 Fill Online, Printable, Fillable, Blank pdfFiller

Name state form number description file type; Web if a check is issued to a taxpayer who is deceased, the individual’s estate or surviving heir must complete a distributee’s affidavit for distribution of estates (state. Find federal tax forms (e.g. Web indiana current year tax forms forms downloaded and printed from this page may be used to file taxes unless.

Form POA20 (State Form 49377) Download Fillable PDF or Fill Online

Web if a check is issued to a taxpayer who is deceased, the individual’s estate or surviving heir must complete a distributee’s affidavit for distribution of estates (state. If a check is issued to an individual who is eligible now deceased, that individual’s estate will be required to complete a distributee’s affidavit for. This is a indiana form and can..

If A Check Is Issued To An Individual Who Is Eligible Now Deceased, That Individual’s Estate Will Be Required To Complete A Distributee’s Affidavit For.

The assessed value on the. Web warrant (state form 42850). Web if a check is issued to a taxpayer who is deceased, the individual’s estate or surviving heir must complete a distributee’s affidavit for distribution of estates (state. Name state form number description file type;

Affidavit For Disposition Of Estates,.

Web if you’ve received a check addressed to a deceased family member, you need to mail in a form and a copy of the death certificate to the state auditor’s office. Web nine steps to completing an indiana tax return irs return : The first refund ($125) resulted from indiana closing the 2021 fiscal year with $3.9 billion in reserves to. Find federal tax forms (e.g.

Web Instructions For Completing State Form 49377 How Do I Know The Distributee’s Affidavit For Disposition Of Estates Applies To Me?

Web they need to file a “distributee's affidavit for disposition of estates” (state form no. Driver's record, title & lien and registration search. 49377) with the auditor’s office and include a copy of the death certificate. Web forms.in.gov provides citizens and employees of the state of indiana a common access point to electronic state forms.

(Form 122) Report Of Assessment For Omitted Or Undervalued Property Assessment And.

Distributees affidavit for disposition of estates form. Determine the state residency and filing status of the taxpayer choose. Parking ticket / tollway vehicle. Web the notice of assessment of land and improvements (form 11) is an assessment notice that is sent to taxpayers by the county or township assessor.